We have one of the highest death taxes in the world here in Ireland.

It’s more commonly known as inheritance tax.

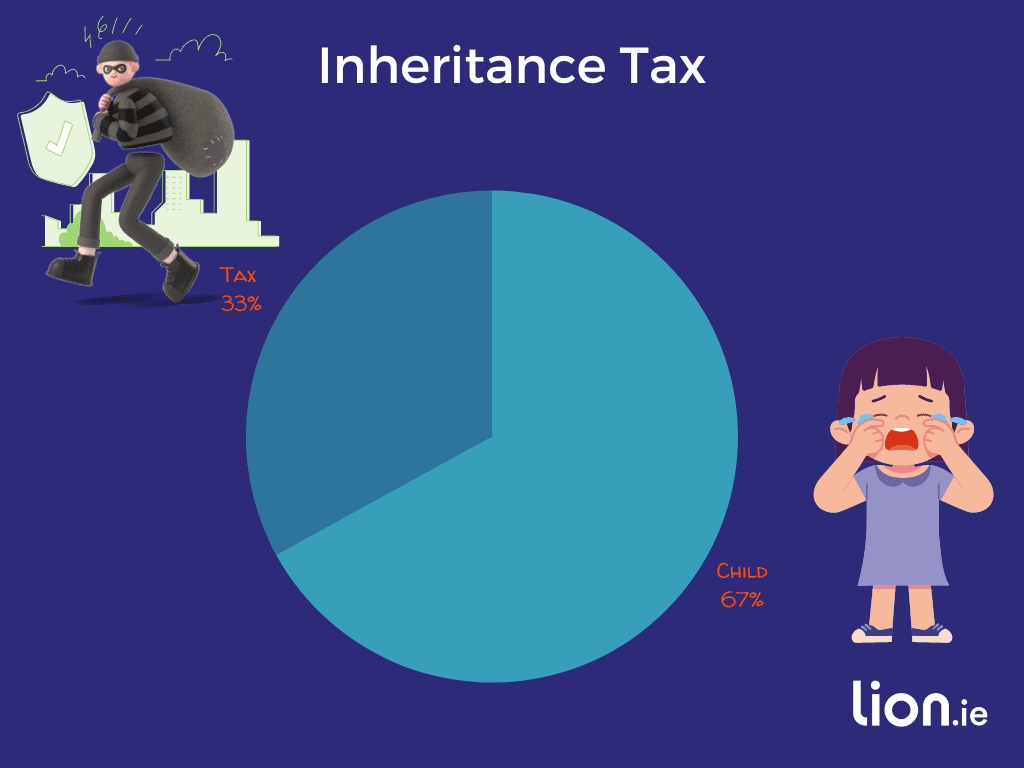

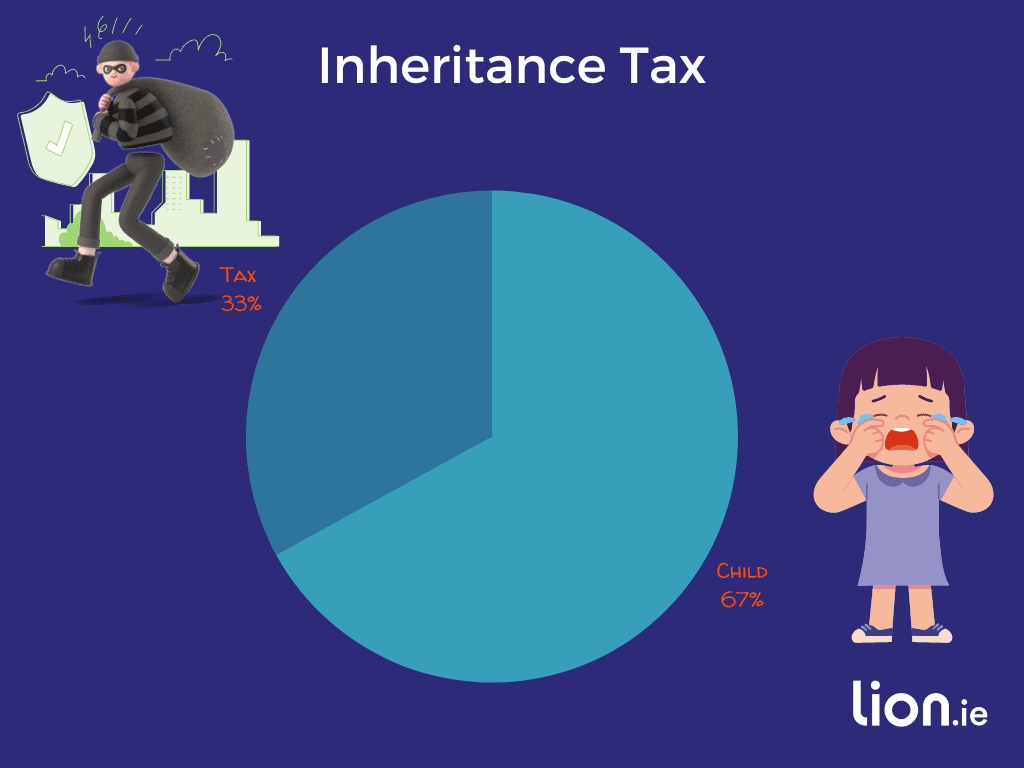

Revenue will take a 33% shaped slice out of what you intended to leave to your kids unless you put a plan in place to pay their inheritance tax when you exit stage left.

When you die and leave something nice behind, the person receiving the gift may have to pay tax on it.

Why – because the government are cruel bastards and want to tax you out the wazoo when you’re alive and also when you’re 6 feet under/buried at sea/up in smoke.

Regardless of the size of the inheritance, there is no inheritance tax if you leave money to your spouse. And this right here folks is the real reason to get married. ?

But your children could be hit with a massive tax bill.

The first €335,000 your kids receive in their lifetime is tax-free.

Anything above €335,000 is taxed at a whopping 33%.

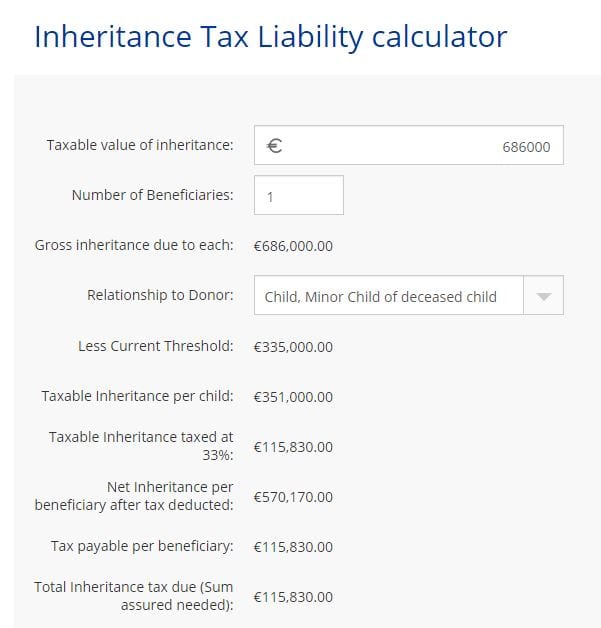

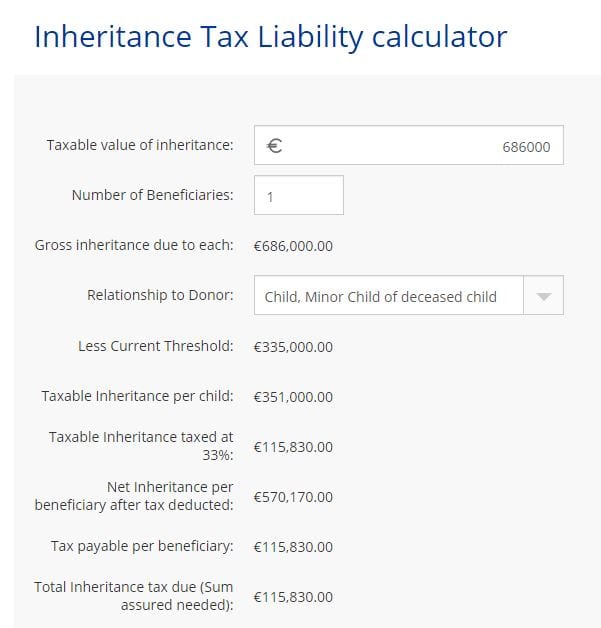

Let’s say you have one child, Pixiebelle Moonface, who receives a house worth €600,000 and is also lucky enough to inherit shares valued at €86,000.

She will have an inheritance tax bill of €115,830

What if little Pixiebelle Moonface doesn’t have that sort of cash?

She’ll have to sell the family home to pay the tax bill.

A home that could have been in your family for generations.

You probably want to avoid seeing young Pixie homeless, and you can with some careful forward planning

Inheritance tax life assurance is a special type of whole of life insurance, the proceeds of which are tax-free if used to pay an inheritance tax bill.

It’s also known as Section 72 Life Insurance.

In the example above, you could take out a Section 72 life insurance policy for €115,830 on youself.

When you head off, the policy would pay Pixiebelle’s tax bill so she would get the property and shares tax-free.

Well, that depends on how much of an inheritance you plan to leave.

If you’d like an estimate, complete this questionnaire and I’ll be right back with some options.

However, if your personal situation is complex, you should take independent tax advice before proceeding with a S72 life insurance policy.

Like all life insurance policies, it depends on:

It’s underwritten in the same way as a normal life insurance policy.

As a rule of thumb, S72 life assurance premiums are 15x the price of term life insurance.

How much do you love your kids? ?

Is Tax Liable on Life Insurance Payouts in Ireland?

Unfortunately, we can’t quote online for inheritance tax life assurance but give me a call on 05793 20836, and I’d be happy to help. If you prefer a quote over, just complete this short form.

Nick McGowan

lion.ie | making life insurance easier

As Ireland's leading life insurance broker, we specialise in comparing the rates and policies from the top five Irish life insurance providers and offering the very best value quotes to suit the individual needs of our clients. Our expertise lies in finding a suitable insurance plan for those with specific needs, be it a particular illness, occupation or claim history, we've got you covered in every sense!

Watch our video