Complete this questionnaire and I’ll send you a quote taking your back pain into account

Dear Nick, My husband has scoliosis, can he still get life cover? What about serious illness cover and income protection? Any pointers you can give us? Kindest regards, Anne

Looking into life insurance can be overwhelming. I mean, all that jargon is enough to have you running for the hills howling like a loon.

Chronic illnesses can bump up your premium but what if you suffer from something simple like on and off back pain?

Surely this will be grand thinks you as you close your eyes and wince, in the hope that I’ll agree with you.

You’re right though, back pain won’t increase the cost of mortgage protection or life insurance, but it can affect serious illness cover and income protection.

Okay, so let’s get into the nitty-gritty.

We’ll start with the type of back pain you experience.

If it’s back pain that’s caused by, let’s say, shitty form at the gym, then your insurance provider isn’t going to charge you extra or refuse to cover you at all.

Although they may have a little giggle at your expense and maybe direct you to a Youtube video or two comme ci:

Back pain is a pretty common condition that most of us will experience at least once in our lifetime and depending on the insurer, you may not even have to disclose it on your application form.

Understood, awesome. So let’s move on to the next category of back pain sufferers.

The chronic back pain sufferer.

Unfortunately, some back issues are long term, like scoliosis (curvature of the spine), osteoporosis (brittle bones), and arthritis can all cause pretty nasty back pain and your insurance provider will need more details on these conditions.

But, Nick what I want to know is whether I will have to pay more because of my back pain?

You’re right, I probably went off on a little tangent there considering, if you’re reading this you just want to know if you’re going to have to pay more.

For life insurance and critical illness cover, back pain is generally viewed as a common ailment so you shouldn’t have to pay any extra for the back pain alone. The exception is where the back pain is severe and is being medicated.

So, now you can breathe a little sigh of relief, let’s get into what information your insurer may need.

The insurer you go with will ask you to complete a life insurance back disorders questionnaire.

I know what you’re thinking, if I don’t tell them about my back pain, I won’t have to fill in the questionnaire, and then I won’t have to worry about anything anyways. Whoop, I’m a Big Brain.

I strongly advise against this – no seriously, this is a massive no, no.

Say you had to claim on your insurance down the line and had the insurer known about your back issues, they would have made a different decision. Well, this will end up invalidating your insurance altogether. That smaller premia you got through your BIG FAT LIE has become multiple years’ worth of wasted payments.

So, just like your mother warned you, no one likes a liar and yes, an omission is still a fib.

That concludes the ethical part of this blog.

Back to our questionnaire.

This list of questions will cover everything from the cause and duration of your back issues, to any treatments you may have had to alleviate your back pain and if you’ve had to take any time off work.

This is where your insurer will also take your occupation into consideration.

Because more physically demanding jobs can be far more damaging for people who experience chronic back pain.

Although the insurer asks for all these tidbits of info, it still shouldn’t cause an issue when it comes to your final premium.

Well, well, well, someone has been doing their homework.

Back pain is one of the largest causes of income protection claims so the insurer treads cautiously when underwriting income protection for someone with a history of back pain.

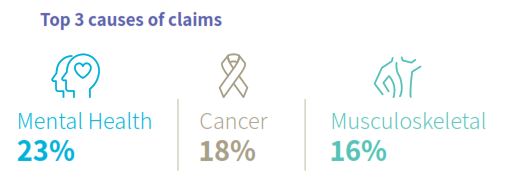

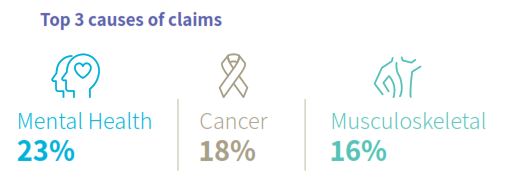

Here are the top three causes of claims at Irish Life last year:

As you can see musculoskeletal (back, neck, hip, knee etc) is the third biggest source of claims.

In short, that means that in most cases, back pain will trigger an income protection exclusion.

So if you find yourself unable to do your job thanks to a tricky back your income protection won’t payout.

Don’t worry, your insurer will make it abundantly clear before they issue your policy if they’re not going to cover you for a back issue.

If you have had symptoms or treatment in the last five years, you’re likely to face exclusion of

any disease or disorder of, or any injury to, the spine, its intervertebral discs, joints, nerve roots, spinal cord or supporting musculature and ligaments and any neurological complications including any treatment and/or complications thereof.

I know it can feel like insurance providers are working against you instead of for you but the last thing they want is an issue at the claim stage.

It’s preferable to know exactly what you’re covered for before you take out your policy so you can make an informed decision. Are you concerned that a bad back is going to stop you from working for longer than your deferred period. Or are you more worried about everything else that will be covered by your policy like cancer, mental health issues, heart attack, MS, a stroke? All the really bad shit.

Generally, yes, especially for something like a slipped disc – all the insurers will add an exclusion.

However if your back pain was a one-off, caused by lifting too heavy and it has never returned, we might be able to great you cover without an exclusion even if this happened in the last five years.

The insurers may exclude Permanent Total Disablement or Loss of Independent Existence from your policy depending on how severe your back pain.

The jargon, the different exclusions, the exceptions, the questionnaires, and the wide variety of quotes you may receive can put you into a bit of a tailspin.

If you’re starting the journey that is ‘finding insurance while having back pain” please use a specialist protection advisor (not a mortgage broker, not a pensions guy, not a financial planner).

A specialist will focus on how each individual insurer underwrites your specific medical issue, they won’t just give you an application form and say “well this is the cheapest price, have at it“.

If you don’t know any of these legends ?

We’re here to help you wade through all the insurance providers swiping until you find your perfect match.

Think of us as the Tinder of the insurance world.

No matter your personal circumstances, we want to see you get the best deal for the cover that you need. Back pain and all.

Complete this questionnaire and I’ll check if your back issue is a concern for the insurers.

Just having a nose at this page, even though you don’t have back pain, but you would now like a recommendation – very good – complete this questionnaire and I’ll be right back.

Thanks for reading

Nick

As Ireland's leading life insurance broker, we specialise in comparing the rates and policies from the top five Irish life insurance providers and offering the very best value quotes to suit the individual needs of our clients. Our expertise lies in finding a suitable insurance plan for those with specific needs, be it a particular illness, occupation or claim history, we've got you covered in every sense!

Watch our video