Can I be honest with you?

If you haven’t insured your income, you’re a lunatic.

And as long as you ignore income protection as part of a solid financial plan while you waste your money on bright, shiny but useless things; a lunatic, you shall remain.

Illness, the bastard, can blindside you at any time, be it physical illness like a heart attack, cancer or a stroke, or a mental illness like anxiety, stress or depression.

He will creep up when you least expect it.

And even if you think you’re incredibly healthy, almost invincible:

sure didn’t both my grandparents live until they were 136

you can’t prevent day to day accidents, be they car, sports or falling off something high (remember that scare putting up the Christmas lights)

All of these could force you to miss work for a long period.

What happens then?

You’ve worked damn hard to get where you are today. Do you want to be reliant on state handouts if a catastrophe strikes and you find ourself unable to work for a time?

Insurance is all about risk, well, the transfer of risk.

Every day, the risk you face is an injury or illness that keeps you out of work.

You can shoulder this risk yourself, cross your fingers, say a little prayer, rub a rabbit’s foot and hope illness or injury never strikes.

Or you can pay an insurance company a few quid per month to take away this risk. When illness or injury strikes, the insurer ponies up and pays you a replacement income until you get back to work. Recovering from a major illness isn’t easy. Recovering from a major illness while dealing with money worries makes it even harder.

I can only assume that as of today, you’re taking all that risk personally – very brave but you must be worried, otherwise, you wouldn’t be here.

Personal story:

It used to gnaw me like a fox chewing a bone whenever someone we knew got sick. I’d swear I’d put income protection in place but then life happened and it went on the long finger. It took a young client to get diagnosed with prostate cancer for me to take out income protection. His cancer, unfortunately, led to depression, and he hasn’t worked since. His family is struggling financially. I vowed that would never be me, so I put income protection in place and haven’t worried since. It’s just a great relief to know your family is safe should shit hit the fan.

Sure, it costs a few quid every month, the money I’d rather spend on my kids, but my kids won’t keep a roof over my head if I can’t work.

Those little feckers won’t even clear the table, let alone pay the mortgage. Leeches the lot of them!

By the way, taking the risk yourself is perfectly normal, especially if you haven’t heard of income protection. We all feel invincible, and we don’t like to think about getting sick, let alone prepare for it – that’s just human nature. It’s only when it happens to someone close to us that we realise how financially exposed we would be if we were in their shoes.

Some questions for you:

Please investigate further if you don’t know the answers to a) and b).

If you don’t know the answer to c), keep reading.

We all have expenses out the wazoo

– the reality is that all of these will fall by the wayside if you don’t have an income because you simply won’t be able to pay them.

Your income pays for everything, so protecting it should be your priority.

It’s more important than the mortgage, because, and sorry for repeating myself…if you don’t have an income, you won’t be able to pay the damn mortgage.

So if you have pet insurance but no income insurance, you’re doing it wrong.

And if you think about it, you’re showing even more love for Fido by protecting your income first because if you don’t have an income…yep, you’ve guessed it, you won’t be able to pay for his pooch insurance.

Income protection “keeping pets happy since 2022”.

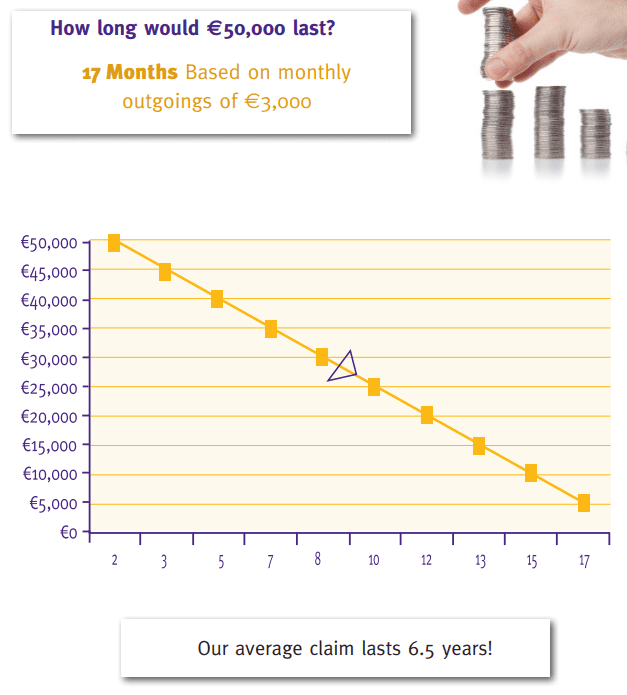

Let’s say you’re squirrelling away €400 per month, and you have a savings fund of €50,000.

Well done, fair play, good hustle.

But take a step back and think about what you’re saving for?

If it’s for your kid’s education, excellent, that makes sense because you can’t buy “college fund” insurance.

Again, saving makes sense if it’s for a new car or holiday because you can’t buy “replacement car or luxury holiday” insurance.

But if you’re saving up for that “rainy day”, the godforsaken day when you get sick and can’t work?

Well, then we have a problem because there’s a much cleverer and more cost-efficient way to do this.

Any idea?

Let’s take a look at self-insuring using a rainy day fund

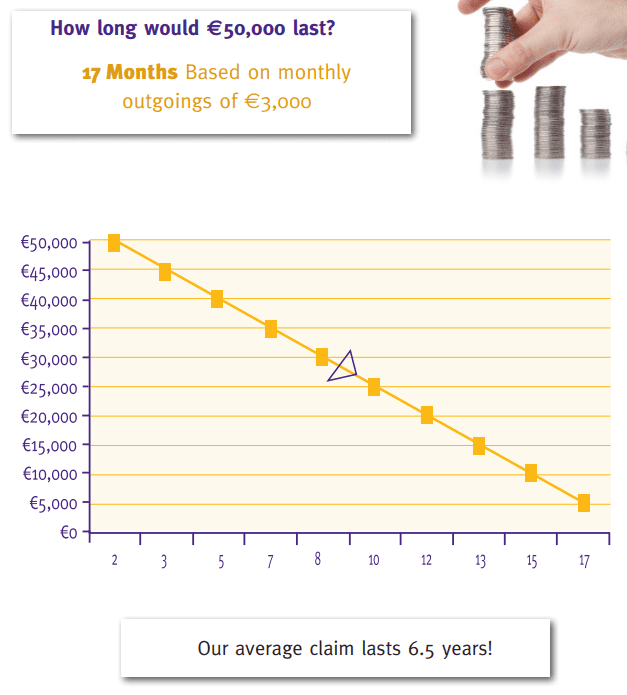

Guess how long that €50,000 will last if you can’t work.

G’wan.

Three years?

Two years?

How’s about seventeen months:

Seventeen months – less than a year and a half! (Yeah, I know I’m a maths whizz)

What happens when the €50,000 runs out, and you’re not ready or can’t get back to work?

After all the years of hard slog to get where you are, think about that. You could end up with no income. It’s a frightening thought.

Saving to protect yourself against a long term inability to work doesn’t work.

Instead of saving €400 per month, you should use a portion of those savings to protect your income and put the rest of the money in a “sunshine fund”, saving up for things you’ll actually look forward to.

Insure against the rainy days, save for the sunny days.

Let’s take a 40-year-old non-smoker earning €60,000 who has insured their maximum replacement income of €34,184.

If they can’t work for longer than their waiting/deferred period, they’ll get €657 every week from their insurer plus €208 from state illness benefit giving a total weekly income of €865 until they get back to work.

Without income protection, they would only get €208.

€208 or €865 per week – imagine the difference in your quality of living.

Quote Type: Income Protection

First Person: Non-Smoker, born on 23/12/1982

Cover Amount: €34,704 per year until age 65.

Occupation Class: Class 1 Office Based

Deferred Period: 26 weeks

Initial premium: €68

after tax relief: €40

FORTY EUROS PER MONTH

If you thought it would cost a lot more, you’re not alone.

Most people wildly over-estimate the cost of income insurance. For just €40 per month, you can sleep easy knowing if you’re unable to work long term, you have the safety net of a guaranteed income until age 65.

Hopefully, now you can understand why I think you’re stupid if you don’t have income protection.

You can’t self insure against long term absence from work.

It’s impossible to save enough to replace a long term lost income.

How much financial torture and stress will you avoid by having a piece of paper with “income protection” printed on it.

I’ll leave you with this:

What are your financial goals in life? Are they similar to mine?

The common denominator in all of these is a steady flow of income. If it stops, those goals become a pipe dream.

This is why income protection is the most important thing you can buy.

It’s your first step to financial peace of mind and the foundation of any solid financial plan.

If you think it’s time to sort out your income protection but you have some questions, please call me on 05793 20836 or schedule a callback here.

If you’d like a quote, complete this short questionnaire so I can email you some options.

Thanks for reading

Nick

As Ireland's leading life insurance broker, we specialise in comparing the rates and policies from the top five Irish life insurance providers and offering the very best value quotes to suit the individual needs of our clients. Our expertise lies in finding a suitable insurance plan for those with specific needs, be it a particular illness, occupation or claim history, we've got you covered in every sense!

Watch our video