Cast your mind back to being 12.

Puberty.

Sticky up hair.

Spots.

Teachers who just didn’t understand.

Frequently threatening to call Childline because your parents aggrieved you in some minor way.

Now we’ve set the scene, picture this:

12 years old you shuffling into a stuffy school hall filled with creaky old desks.

Mr Gowl handing you an exam paper full of weird questions that you had to answer to get into said stuffy school.

No doubt, even if your school didn’t put you through this rigour, you’ll have done something similar yourself (because you were secretly convinced you should be in Mensa)

Trying to decode the difference between Mortgage Protection and Life Insurance is a bit like doing that test.

So let me help, you can even cog off me if you like.

Here’s me in a video explaining the Basics of Mortgage Protection for those who don’t like reading words.

Is life insurance and mortgage protection the same thing?

They both payout if you die but how much pays out if the big difference.

Normally people buy mortgage protection when they’re getting a mortgage.

Mortgage Protection covers your bank’s arse. It’s mandatory if you’re buying a house in Ireland.

Yes, you read that right: the banks make you take out an insurance policy that pays them money if you die.

I’d say they’re a bunch of scoundrels, but sure look it, I’m sure you knew this already. Really, it’s all a bigger scam than that time Bran took the Iron Throne.

But you can buy life insurance for a mortgage – I say don’t but you’re the boss!

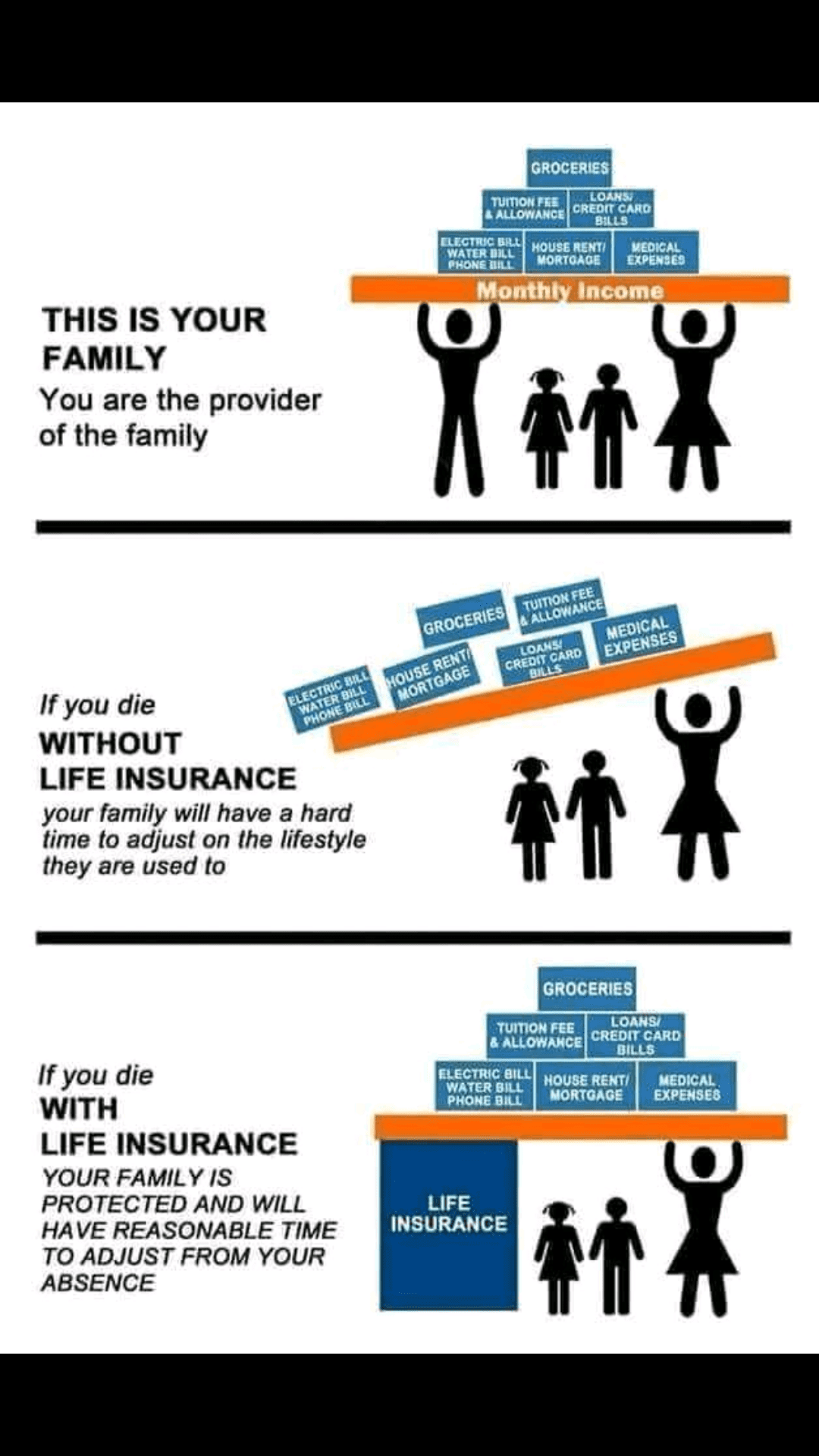

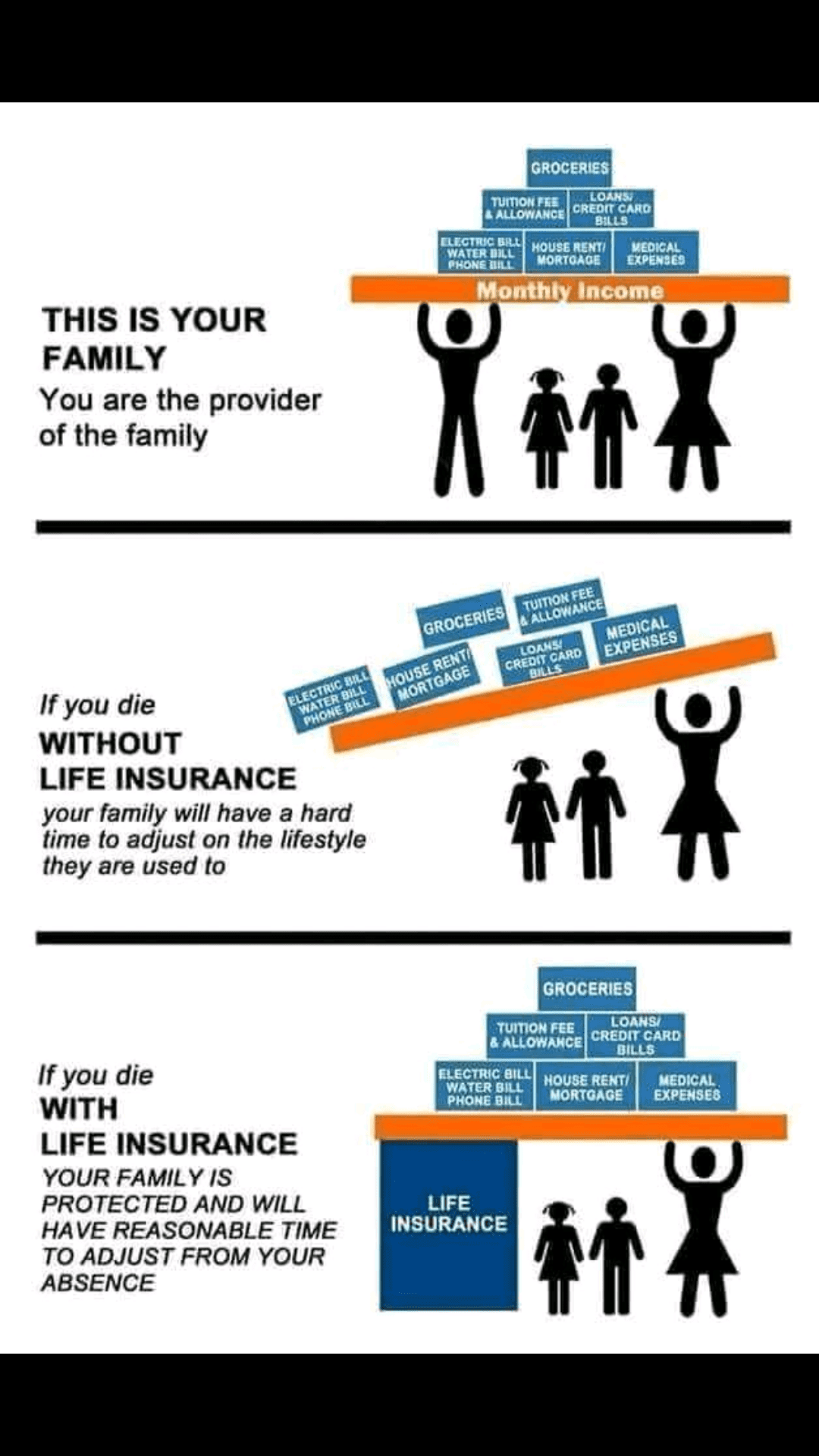

So when should you buy life insurance – if you have kids or someone who depends on you financially?

Have a flick through this blog “do you even need life insurance?” to check if life insurance is for you.

More on this over on our Instagram page – go check it out.

If you’ve been perusing this here internet, you may have come across a bunch of similar phrases that seem like the same thing but maybe aren’t.

Mortgage Insurance. Mortgage Life Insurance. Mortgage Life Cover. Mortgage Protection, Decreasing Term Insurance, Reducing Term Insurance, Life Home Cover

Spoiler alert: they’re all the same.

You might be wondering why the insurers (they of upstanding character and definitely-not-moral-dubiousness) would do this.

In short, it’s because if it’s confusing, it makes it harder for you to know what you’re buying. Thankfully, the insurers are starting to get a lot better at speaking like actual humans. Still, these phrases are a bit of a hangover.

Mortgage Protection is the cheapest type of Life Insurance you can get – probably because there’d be ructions if it was enforced and very expensive. (*Cough* stamp duty *cough*.)

Let’s look at an example of Mortgage Protection in real life.

John and Mary are in their thirties and so far are very happy together. They want to buy a house for €250,000 in Wexford. They moved back in for a while with John’s parents to save the dreaded deposit. At one point, things got so rough they considered never buying and instead, becoming vagabonds because saving €25,000 in a short amount of time is a fate worse than death.

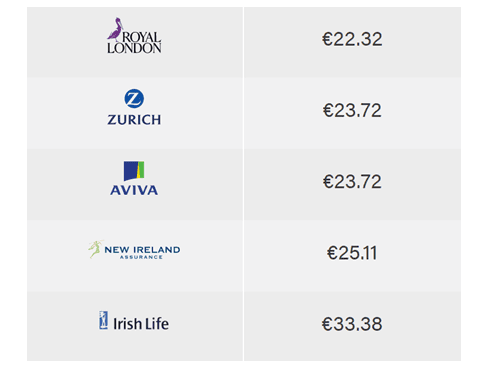

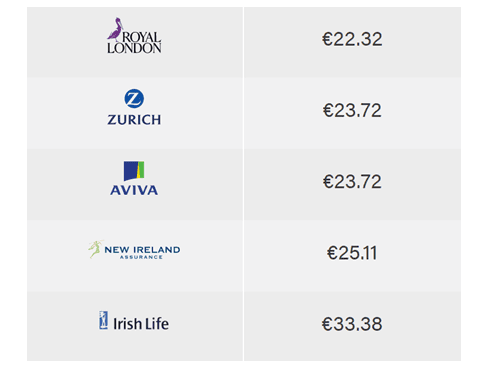

However, they persevered and are looking for €250,000 in Mortgage Protection over 30 years – the length of their mortgage. Their quote would look a bit like this:

Price-wise that doesn’t seem too bad. Although if you take the cheapest (€22.32) and multiply it out by the lifetime of the mortgage (€22.32 x 12 x 30), you’re looking at a hefty enough payment (€8,035) to our pals in insurance.

Some extra info that’s important to know is that your cover reduces across the lifetime of your mortgage but your premium is fixed. How’s that for fairness?

With John and Mary, their initial cover is €250,000.

In 5 years, their mortgage and Mortgage Protection would be around €240,000, and onwards until it hits zero.

Let’s not forget that this is all for your bank’s benefit.

This is also important if you’re looking at Serious Illness Cover (SIC) from your bank too. You can bundle Mortgage Protection and Serious Illness Cover, but if you get ill, your payout GOES TO THE BANK.

So don’t do it. If you’re considering SIC, add it to your life insurance policy, so you get the payout.

Likewise, you generally shouldn’t get Mortgage Protection from your bank, even if they’re insisting on it.

You don’t have to.

Your best bet is going with a broker or getting quotes from all the insurers yourself.

You shouldn’t buy Mortgage Protection from your bank because:

The one thing we can all agree on here is that the bankers come out of this looking like arseholes.

Now, Mary and John do have one extra option:

Dual Mortgage Protection. Dual mortgage protection can pay out twice, yep you both have to die which is a bit of a drag but still, your beneficiaries will be delighted. ???

One payment goes to the bank to clear the mortgage; the second payment goes to your family even though your mortgage is cleared.

Yes, I know, it’s confusing, just trust me on this one – buy dual cover, not joint.

To clear things up completely, let’s also look at an example of Life Insurance in real life (#irl)

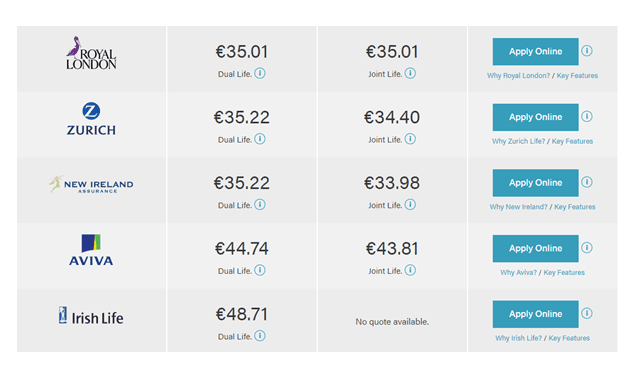

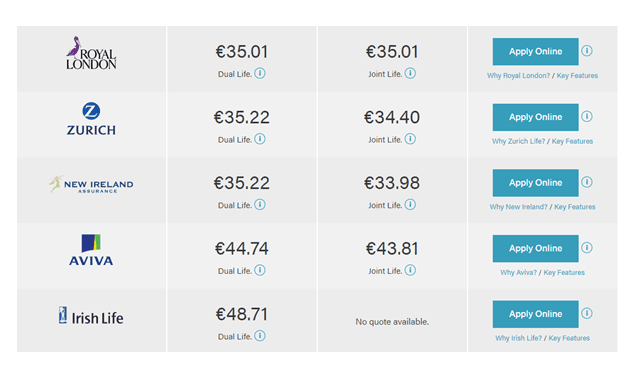

Mary and John are back at it again, not as happy as when they first met, and now they have an extra mouth at the table. This time, they want to get €250,000 worth of Life Insurance each over 30 years just in case they kill each other.

With Joint Life Insurance, they get one fixed pay-out of €250k when whoever dies first goes kaput.

If Mary and John are smart, they’ll get Dual Life Insurance, which pays out on each death. Their future offspring, once they’d gotten over the initial sadness of their parent’s deaths, would be rolling in money.

Their life insurance quote looks like this:

As you can see €250k mortgage protection comes in at €22.32, whereas life insurance comes in at €35.01. It’s not hard to tell why the banks try to sell you life insurance instead of advising on mortgage protection.

Sorry to kill you off, pal.

Let’s say you’ve got €50,000 left on your mortgage:

Mortgage Protection would pay that off, but there’s no extra monies for your fam.

Whereas, with life insurance, your family would get the other €250,000.

But let’s say you leave us unexpectedly early with the whole €250,000 left on the mortgage.

In this scenario, the Life Insurance won’t leave any spondoolies to your family as the full 250k would be required to clear the mortgage.

That’s why it’s dangerous to use life insurance to cover a mortgage. Your family may end up with nothing if you shuffle off early.

Instead, buy two policies:

No, you have to buy it and pay for it separately although some banks will bundle the payments together so you don’t know how much your mortgage protection costs.

Sch-neaky.

Yes, reducing life insurance is mandatory for a residential mortgage unless the bank allows a waiver. Again for those as the back, all you need is reducing life insurance (AKA mortgage protection)

Income protection pays a replacement income if you can’t work due to illness or accident. Mortgage protection clears your mortgage if you die.

I can’t give you a catch-all answer here as I don’t know your circumstance, but my rule of thumb is quite simple when it comes to choosing Mortgage Protection or Life Insurance.

If you have financial dependents, always buy a separate Life Insurance policy in addition to your basic Mortgage Insurance.

If you don’t have financial dependents (someone who would be affected financially by your death), then you’ll be grand with basic Mortgage Insurance.

Let me know if I can help you decide what cover you need – you can get in touch by completing this questionnaire or schedule a callback here

Talk to you soon.

Nick

As Ireland's leading life insurance broker, we specialise in comparing the rates and policies from the top five Irish life insurance providers and offering the very best value quotes to suit the individual needs of our clients. Our expertise lies in finding a suitable insurance plan for those with specific needs, be it a particular illness, occupation or claim history, we've got you covered in every sense!

Watch our video