You’re here because you’re getting a mortgage, welcome, thanks for joining us.

But before we go any further, I have something to tell you.

Are you sitting comfortably?

You won’t believe what I’m going to say.

Are you ready?

Here goes…

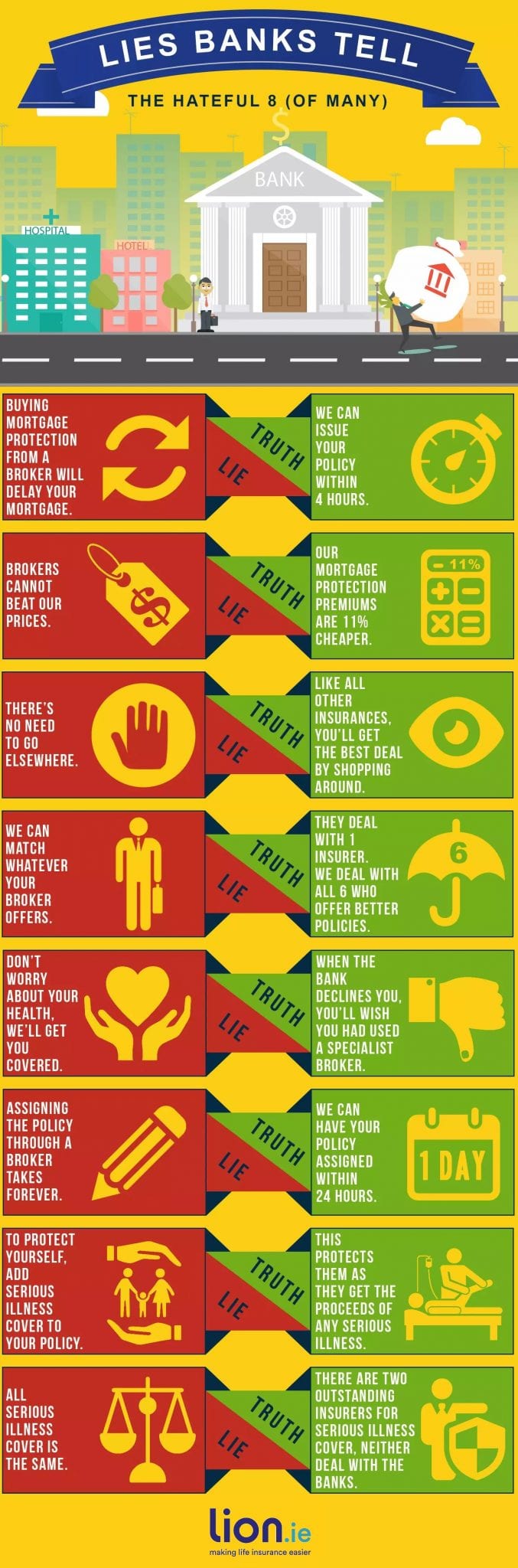

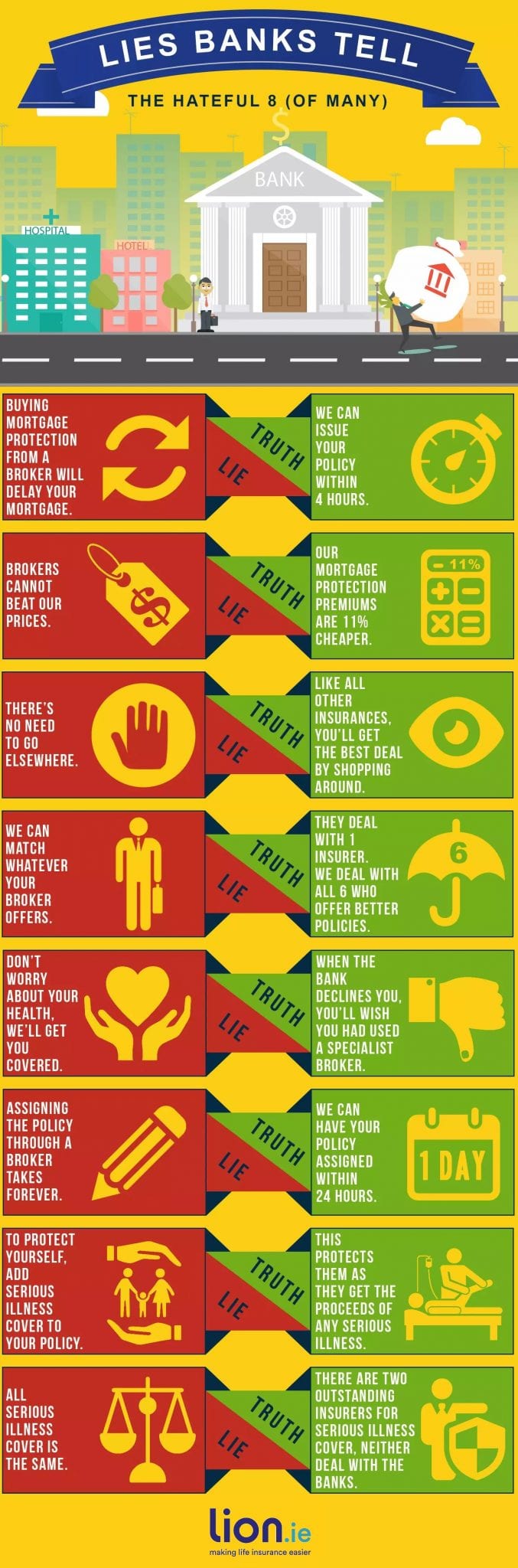

Your bank may be telling you porkies

I know, you’re probably not one bit surprised.

But according to my wonderful clients, here are some of the whoppers they use to try and force you into buying a mortgage protection policy.

We’re an online broker so you can complete your application online, sign all necessary paperwork digitally and I can email you your policy cert.

We’re quick, very quick.

Meanwhile, some banks still use fax machines…remember them?

Which lender are you using?

If it’s AIB, EBS, Ulster Bank, PTSB or KBC then they can only sell Irish Life policies.

If it’s the Bank of Ireland, they can only sell you a New Ireland policy.

So you won’t get advice on policies from Aviva, Royal London or Zurich Life from any Irish bank.

These insurers regularly offer discounts, at the moment one of them is offering to match the cheapest price on the market and discount it by 20%.

Mention that to your banker and see them squirm!

Under the Consumer Protection Code, you are free to shop around when arranging mortgage protection.

If your banker has encouraged you to shop around before signing up, fair play.

If not, consider getting your mortgage insurances elsewhere.

Even if the bank tries to match, they cannot match the benefits available elsewhere.

This is the most dangerous lie.

Unfortunately, I’ve had to deal with the fallout.

This may sound familiar…

You go to the bank, complete their mortgage protection application form and disclose a health condition.

The banker says

underwriting will have to review it but it should be grand.

In fact, it’s not grand at all because Irish Life/Bank of Ireland Life end up refusing you cover.

That’s when your banker will sheepishly advise you

Eh, maybe try a broker?

But at that stage, because an insurer has already said no, you’ll have to disclose this in all subsequent applications.

As you can imagine, a previous decline will put the other insurers on alert making it more difficult for you to get mortgage protection.

If you have a medical condition (no matter how small the bank may say it is), please run it past a specialist life insurance adviser before applying for cover.

How do you assign a mortgage protection policy?

Always buy your serious illness cover separately from your mortgage protection, here’s why

We’re not massive fans of switching insurer every year but there’s nothing to stop you from doing so if you can get a better deal.

And you can do so without penalty, no matter what your bank may tell you.

That’s totally fine, they are two excellent insurers.

The good news is that brokers deal with Irish Life and BOI Life too so we really can match anything the bank offers you (except the OnePlan)

If you want advice on mortgage protection from all 5 insurers, you’ve come to the right place.

I’d love to help you put the best policy in place.

If you’d like me to make a no-obligation recommendation on the types of cover you should consider, please complete this questionnaire and I’ll be right back.

Alternatively, give me a call on 05793 20836

Chat soon!

Nick

As Ireland's leading life insurance broker, we specialise in comparing the rates and policies from the top five Irish life insurance providers and offering the very best value quotes to suit the individual needs of our clients. Our expertise lies in finding a suitable insurance plan for those with specific needs, be it a particular illness, occupation or claim history, we've got you covered in every sense!

Watch our video