Ready to shop around for a new life insurance plan but you’re thinking where in de bejaysus do you start?

I hear ya.

Choosing the right life insurance policy is a boring daunting experience.

With loads of different insurance companies, plan types, and benefits, it’s hard to know where to start.

So let’s start at the very beginning.

Remember, you’re not meant to know anything about life insurance at this stage.

But there are a few basic life insurance concepts you need to master to protect your family.

By the way, we have a life insurance crash course that simplifies this into 5 bite-sized emails. If you don’t have time to read this whole article, you can sign up here:

There are three main places you can get Life Insurance Advice here in Ireland:

A bank can only sell you a policy from their tied insurer.

A bank cannot offer life insurance advice on a range of policies from various insurers.

Again, this limits your options.

If you go to Zurich Life, they will sell you a Zurich policy.

Approach Aviva and they will sell you an Aviva policy.

Savvy?

A life insurance broker can offer policies from the 5 leading providers in Ireland.

If you feel your broker is slinging policies from just one insurer, beware!

The beauty of a broker is choice and discounted premiums compared to going through the bank or direct to the insurer.

This is the tricky part.

You can do it yourself using any of the 987 life insurance calculators you can find online (I’ve counted them)

Or you can take guidance from a bank, insurer or broker (with the caveats above)/

But please, if any of them recommend €250,000 over 25 years, make your excuses and leave…

€250,000 is the same as plucking a figure out of thin air.

You could do that yourself.

How do you figure out the correct amount of life insurance?

Death, inability to work and serious illness are the risks that will hit us or our families right in the pocket.

Each type of life insurance policy offer protection from these risks.

Here’s a quick breakdown of the policies available

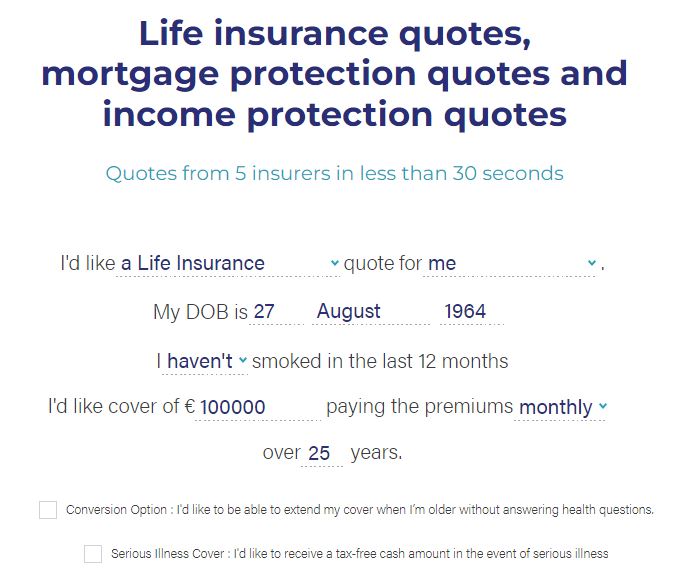

Yeah, not that type of quote.

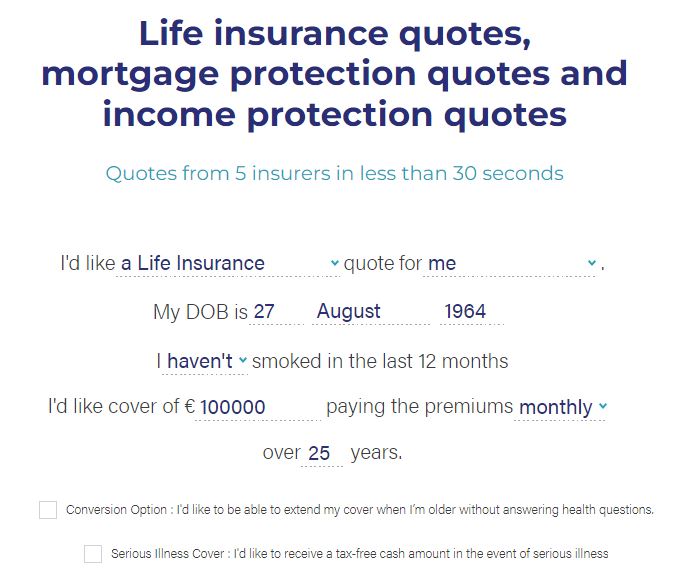

This type:

Most banks, insurers and brokers have an online quote system.

The beauty of ours is we don’t force you to give us your contact details.

We know how annoying follow-up sales calls are so we don’t do them – unless you ask us to!

We give you time and space to make a decision.

If you choose us to arrange your cover.

Yey!

If not, hey-ho, can’t win ’em all, we’re jst happy we played some part in getting your and your family covered.

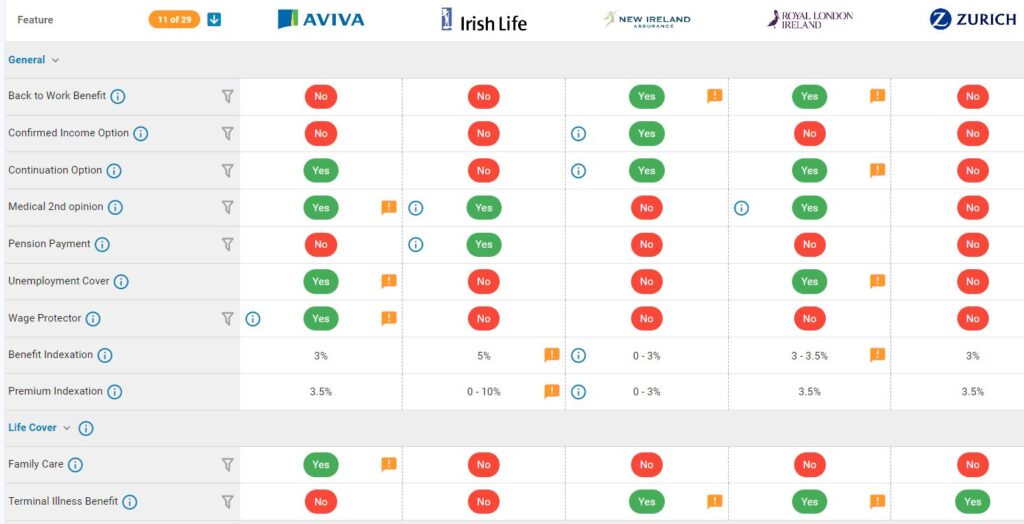

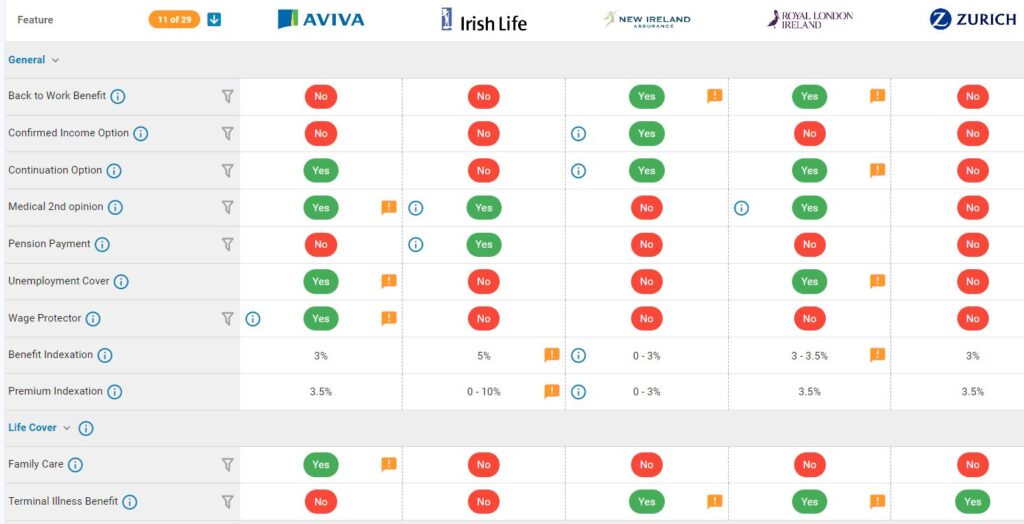

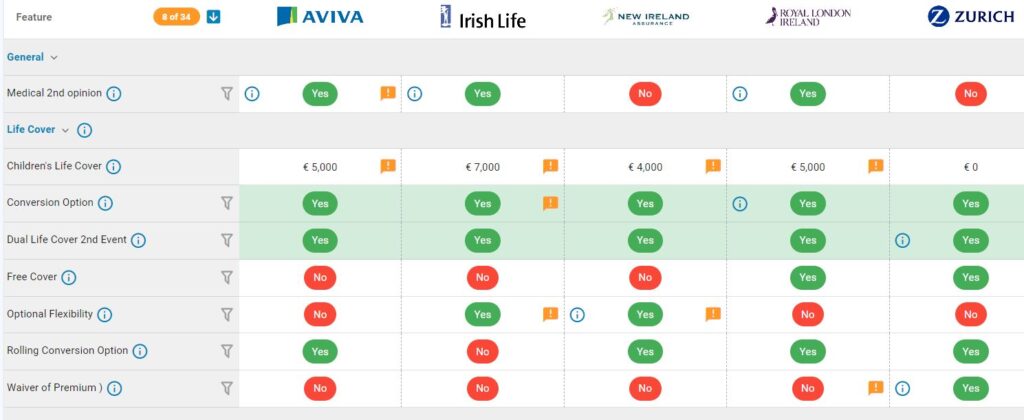

Which insurer should you choose?

Your options are bewildering but I can help.

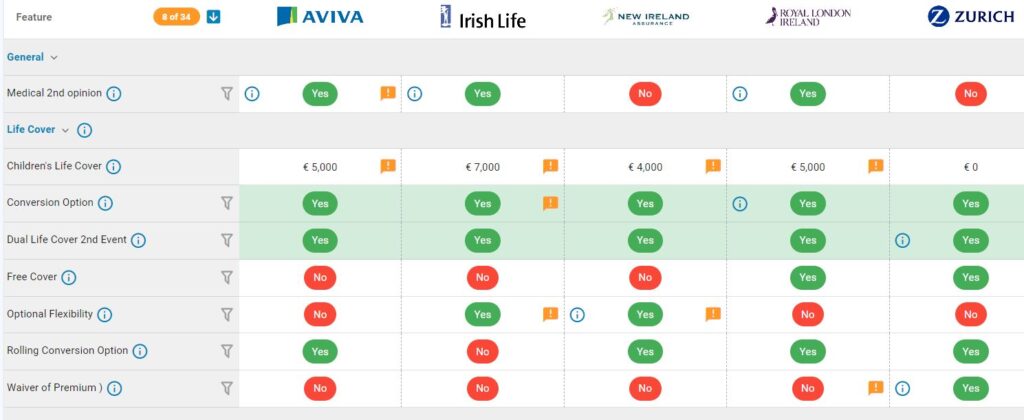

Here are some handy charts that compare what’s on offer at each insurer

There are too many illnesses to list but Royal London and Zurich Life are best for serious illness cover.

Still with me?

If you have no health issues, this is the simpleton’s guide to choosing an insurer 😋

When promotional discounts are available, we immediately reduce our quotes so you know you’re getting a competitive price.

Aviva, Zurich, New Ireland and Royal London offer discounts.

Irish Life don’t offer any discounts – why would they, they are creaming all that business from the banks!

Make sure your bank, broker or insurer is offering you the full discount.

We discount the prices on our quote system, no shenanigans here, what you see is what you get.

The initial quotes you get, from a broker, bank or direct from the insurer assume you’re in perfect health.

So, if you have any current or previous health conditions, you may end up paying more than that initial quote.

Therefore, it’s important to run any health by me before you make an application so I can find the most suitable insurer for your condition.

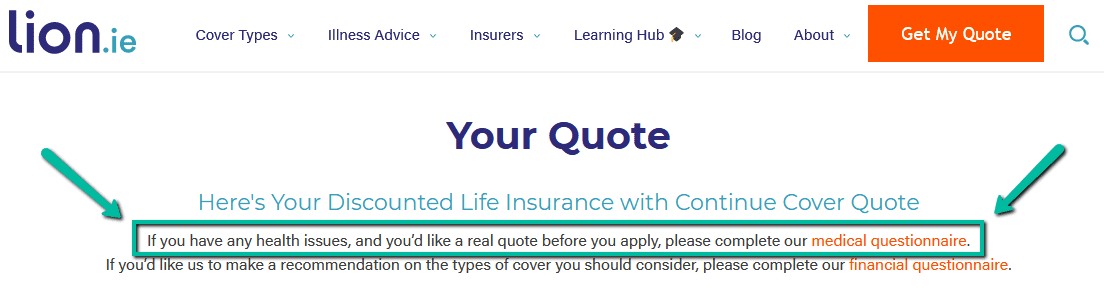

As you can see on our quote system, we highlight this fact:

We don’t give you some unrealistic quote just to get you to apply through us, and then hit you with a ludicrously more expensive quote after you answer the medical questions.

What’s the point?

You probably can’t afford the new premium so we’ve wasted your time and ours.

If you have any health issues and you’d like an accurate quote, please tell us about them upfront.

You can read more about the life insurance medical conditions we specialise in here.

I hope that gives you the basics of how you should choose a life insurance plan.

If it all makes sense and you’re confident you can do it yourself…fire ahead.

But if the thought of arranging your cover without getting life isnuance advice makes you do this…

We’re here for you!

Complete this questionnaire and I’ll be right back.

Thanks for reading.

Nick

lion.ie | Protection Broker of the Year 🏆

As Ireland's leading life insurance broker, we specialise in comparing the rates and policies from the top five Irish life insurance providers and offering the very best value quotes to suit the individual needs of our clients. Our expertise lies in finding a suitable insurance plan for those with specific needs, be it a particular illness, occupation or claim history, we've got you covered in every sense!

Watch our video