So, you’re buying your first home – how exciting – congratulations 🎉

And you’re looking for the best deal on mortgage protection insurance, amirite?

But it’s all so confusing:

What’s the difference between mortgage protection and life insurance? 🤔

What’s dual life cover?🤷♂️

What the hell is a conversion option? 🤯

Which insurer is the best?

Don’t worry; we’ve got your back.

We know how stressful buying a house is, so we’re here to make the mortgage protection part a breeze.

Mortgage protection is a life insurance policy that pays off your mortgage on your death.

It’s a legal requirement , but the bank, at their discretion, may waive the need for mortgage protection in the following circumstances.

Remember, Mortgage Protection clears your debt to the bank.

In other words, it covers the bank’s arse if you die – that’s why they insist you take it out.

Mortgage protection is also know as Decreasing Life Insurance because the amount of cover on a mortgage protection policy reduces over time.

Here’s an example to clear things up.

Let’s you’re getting a mortgage for €250,000 over 25 years.

Mortgage protection will never leave money to your partner or children.

If you have children, you should also consider a life insurance policy to protect them from financial hardship.

Yes, that’s two policies.

The cover on a life insurance policy is fixed.

Using our previous example of a mortgage for €250,000 over 25 years.

Some people attempt to combine life insurance and mortgage protection under one policy.

We think this is a big no-no so please don’t do it (or at least read this article first)

As you can see from the above example, if you die early in the policy, your family will be in trouble because after the mortgage is cleared they will only receive €2000 from your life insurance policy.

How long could they survive on that?

If you have a mortgage and kids or a partner who depends on you financially, you need a mortgage protection policy and a separate life insurance policy.

Income protection is the most important type of life insurance policy that you’ve probably never heard of.

You see mortgage protection will clear the mortgage on death.

But what happens in the awful situation that you fall ill and can’t earn an income?

You’ll have to pay the mortgage or face becoming homeless.

This is where income protection saves the day.

If you can’t work for over four weeks due to any illness, income protection will pay you up to 75% of your income until you get back to work or until your policy ends.

Income protection is the foundation of a solid financial plan.

Without it, you’re taking a huge risk getting a mortgage.

Your income pays for everything.

Please protect it first before everything else.

Especially if you are currently renting.

Want to learn more – here’s our FAQ – a must read.

Serious illness cover is an additional type of cover that will pay out a tax-free lump sum if you’re struck down with an awful illness (cancer, heart attack, stroke and 54 others), letting you focus on getting better without worrying about how to pay the mortgage.

We prefer income protection but if you have certain health conditions, you may not be able to get income protection .

In this case, serious illness provides a useful alternative form of protection.

Serious illness cover v Income Protection

Always buy serious illness cover on a separate policy. If you add it to your mortgage protection policy, the bank will get the proceeds on any claim.

Read more about serious illness cover for your mortgage

There are a few factors the insurers have to take into account when calculating how much you will pay for mortgage protection.

I knew you would ask that…so I covered it in detail here.

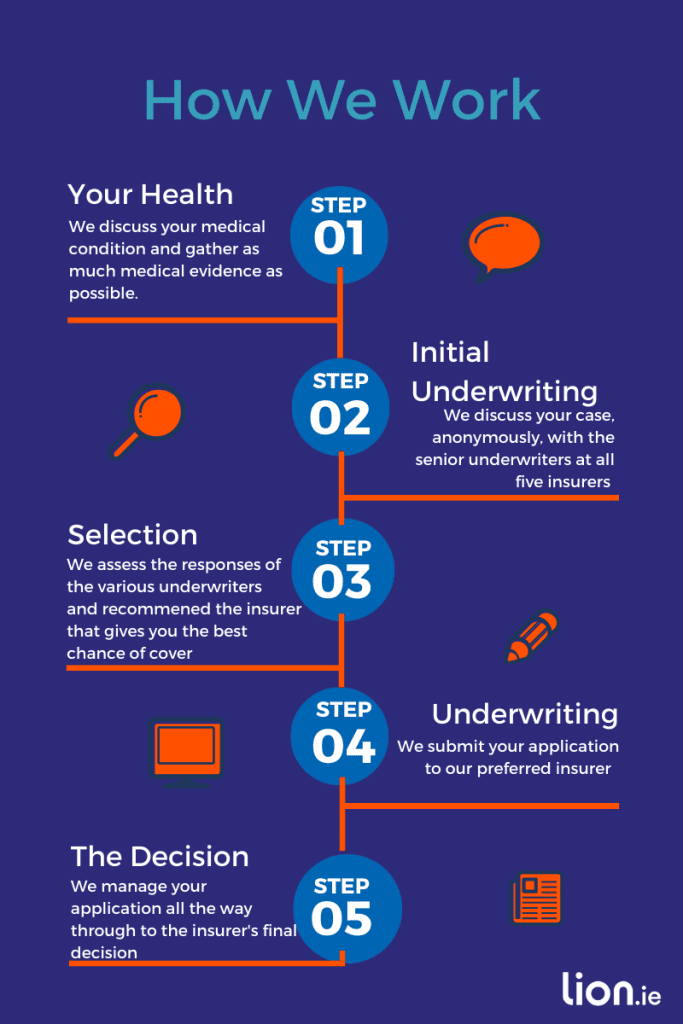

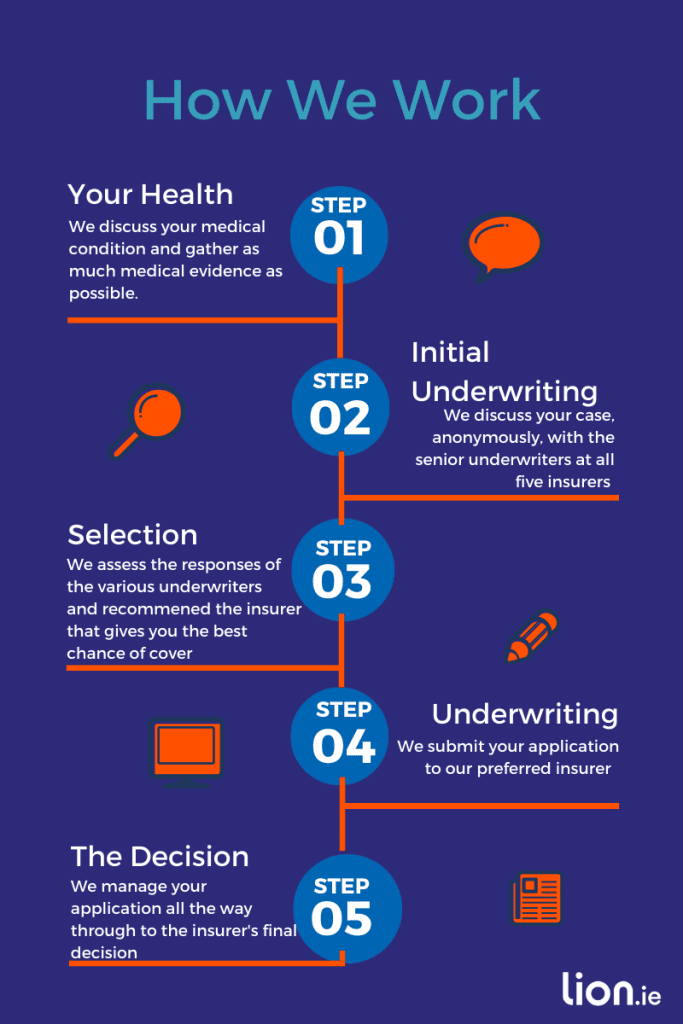

The best mortgage protection quotes are available through a broker, not your bank.

And unlike going to your bank, we can offer quotes from 5 insurers, your bank is tied to one insurer (usually Irish Life).

We offer discounted quotes and straight-talking advice on policies from:

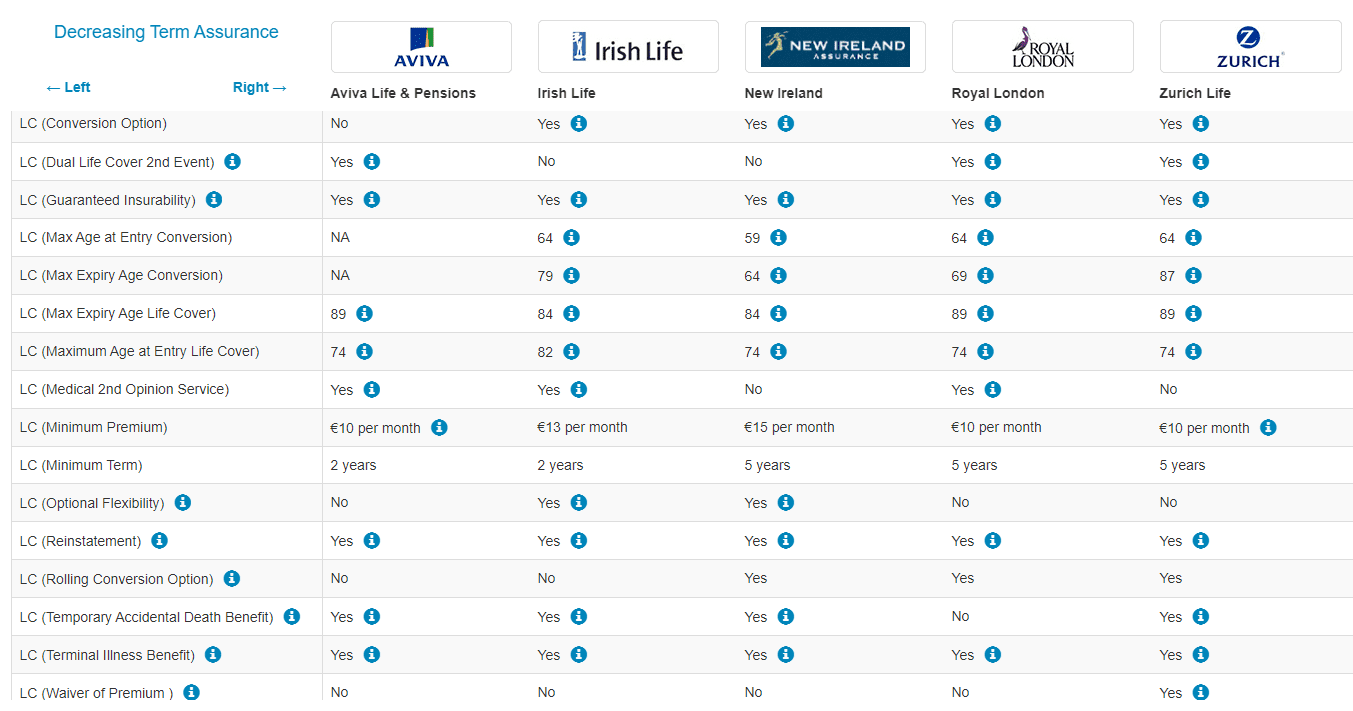

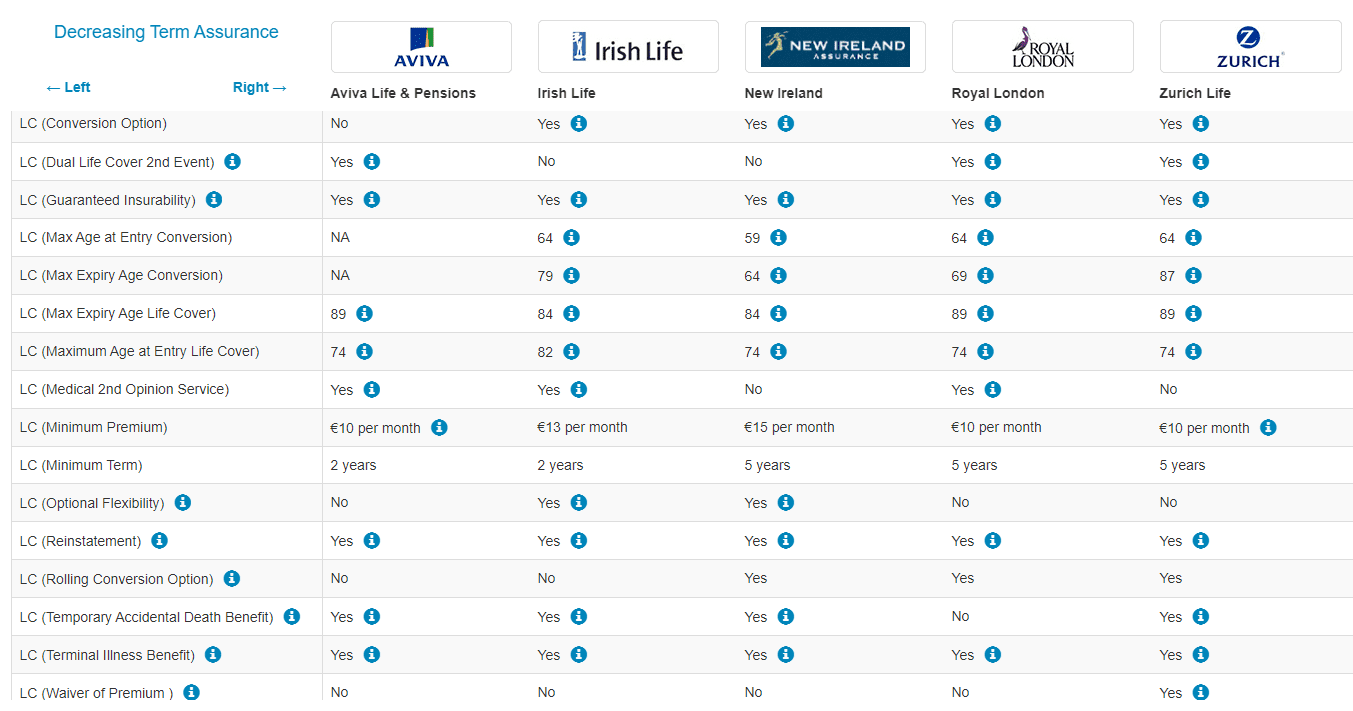

Our mortgage protection comparison table makes it easy to compare the various policies on offer at a glance:

And here’s an in-depth look at how to compare mortgage protection in Ireland

Generally, the bank will require your policy a couple of weeks before you’re due to draw down your mortgage, so they have time to review the documentation and assign it.

Watch out, though!

This is unfair and used purely to stop you from shopping for a better value policy.

If your bank is asking you to do this, ask them why?

Remember, you don’t owe the bank anything until they hand over the mortgage cheque, so why should you have to pay mortgage protection premiums before then?

I kinda went off on one there, sorry…back to the question, when should you apply?

I discuss this topic in detail here:

You should apply well before you are due to sign binding contracts.

If you have an underlying condition, apply asap because it could take ages to get cover if your GP isn’t on the ball.

And please make sure you don’t have any open referrals, tests or investigations as these could result in a postponement.

You won’t pay a cent until you have the policy in your hand so you can apply well in advance without being out of pocket.

Some of our insurers will give you free cover for the first month (you won’t get that at the bank!)

We know how stressful buying a house can be – so many questions and so many different answers online.

If you’d like us to help, please call 05793 20836 or email nick @ lion .ie

Till then…good luck with the house hunt!

You might find this Glossary / Jargon Buster useful.

By the way, if you’d like me to take a look at your current situation and advise what types of cover you should consider, please complete this questionnaire, and I’ll be back over email with a no-obligation recommendation.

Thanks for reading

Nick

This blog was first published in 2017 and has been regularly updated since

As Ireland's leading life insurance broker, we specialise in comparing the rates and policies from the top five Irish life insurance providers and offering the very best value quotes to suit the individual needs of our clients. Our expertise lies in finding a suitable insurance plan for those with specific needs, be it a particular illness, occupation or claim history, we've got you covered in every sense!

Watch our video