Zurich Ireland employs over 1000 people between their life insurance and general insurance arms. Zurich Life is currently protecting over 490,000 Irish people. They are a part of the Zurich Insurance Group, headquartered in Zurich, Switzerland, where it was founded in 1872.

Zurich Life is well capitalised with a solvency ratio of 129% (as at 31 December 2019).

This shows that as well as having enough capital to pay all their liabilities, including predicted future claims, they have 1.29 times the capital required under Solvency II rules.

Here’s Nick’s take on Zurich:

And below are the answers to some of the most common questions we get asked in relation to Zurich Ireland by our customers.

Mortgage protection is the cover you have to buy for the bank to get a mortgage. As the bank is going to get the payout, you should give them the bare minimum. If you’re considering add-ons like serious illness cover, you should buy this on a separate policy so you get the payout.

If you have any health issues, please get in touch with us before you choose an insurer. Each insurer underwrites health conditions differently so we can match you with the insurer that’s most sympathetic to your condition.

Assuming you have no health issues, when it comes to choosing which mortgage protection is best, it comes to down to price and benefits.

1) Price/Premium: Zurich is usually one of the most competitive insurers because they offer large discounts if you buy through a broker.

2) Waiver of premium benefit. This is exclusive to Zurich Life. If you can’t do your job for over 13 weeks due to illness or accident, they will waive your mortgage protection premium. This means they will keep you covered but you don’t have to pay your premium. You should give Zurich Life serious consideration if your premium is going to be on the high side.

3) Dual life mortgage protection. This isn’t available through your bank, it gives you twice the cover of a joint life insurance policy.

4) Conversion option. This allows you to turn your mortgage protection policy into a life insurance policy at any time in the future.

5) 6 Month Reinstatement Clause. Let’s say you don’t pay your premiums for 3 months but your partner passes away within those 3 months. As long as you pay the missed premium, Zurich will pay the claim on the policy. Yep, even if a claim has arisen, Zurich will honour the policy.

5) Six weeks of FREE COVER. We can activate your policy and get you cover six weeks before your first payment is due. ?

1) They don’t offer free child cover on their mortgage protection policies.

2) They don’t have any valued added benefits available at some of the other insurers.

Life insurance is the type of cover you buy if you have financial dependents who rely on your income to survive. Think children, elderly parents or a partner or spouse who doesn’t work or earns much less than you. If you die, they are in serious trouble. Therefore you need to do the right thing and make sure they are taken care of whether you’re present or departed.

You protect them with life insurance.

If you die your life insurance policy will leave a lump sum that they can use to replace your income. They will invest this lump sum to generate an income or the policy can pay out a monthly income instead. This reduces any risk for a spouse or partner who isn’t comfortable investing a large amount of money.

1) Price/Premium: Zurich is usually one of the most competitive insurers because they offer large discounts if you buy through a broker.

2) Your life insurance can payout on a monthly basis.

3) You can use the conversion option up until age 87

4) Pre-payment of €10,000 for funeral expenses – no need to wait for a Grant of Probate.

5) 6 Month Reinstatement Clause. Let’s say you don’t pay your premiums for 3 months but your partner passes away within those 3 months. As long as you pay the missed premium, Zurich will pay the claim on the policy. Yep, even if a claim has arisen, Zurich will honour the policy.

Serious illness cover is what we call living insurance as in it pays out while you’re still alive.

If you get a serious illness as defined on your policy, the insurer will pay you a one-time tax-free lump sum to the value of your serious illness cover. You can use the money as you wish – e.g pay medical bills or pay for structural adaptations to your home that is required as a result of the illness.

If you get a serious illness, you’re unlikely to be working for a while so the payout you receive will replace this lost income until you’re well enough to go back to work. The last thing you want when you’re trying to get better is money worries.

When considering who to choose for serious illness cover, you should read this article first – how to compare serious illness cover providers.

1) Easiest to claim definitions for heart attack, cancer and stroke (the main causes of serious illness claims)

2) Price/Premium: Zurich is usually one of the most competitive insurers because they offer large discounts if you buy through a broker.

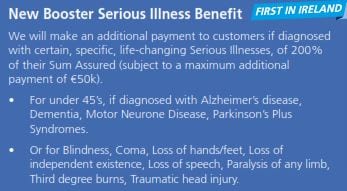

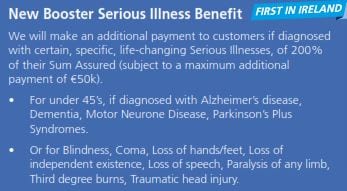

3) Booster Payments that give you an additional payout if you are diagnosed with certain illnesses:

4) Children’s Overseas Surgery payment of €25,000

Hum, nothing much to see here, I can’t think of anything.

Look no further.

Income Protection from Zurich Life | Review

If you’re keen to learn more about Zurich’s policies and benefits, please click on the image below to open their Customer Guide.

Get a massively discounted quote from Zurich Life and the other 4 main Irish insurers Aviva, Irish Life, New Ireland and Royal London using our quick quote tool below.