Everyone wants a quick answer to this question, but I’m going to have to disappoint you and give you the dreaded “it depends….”

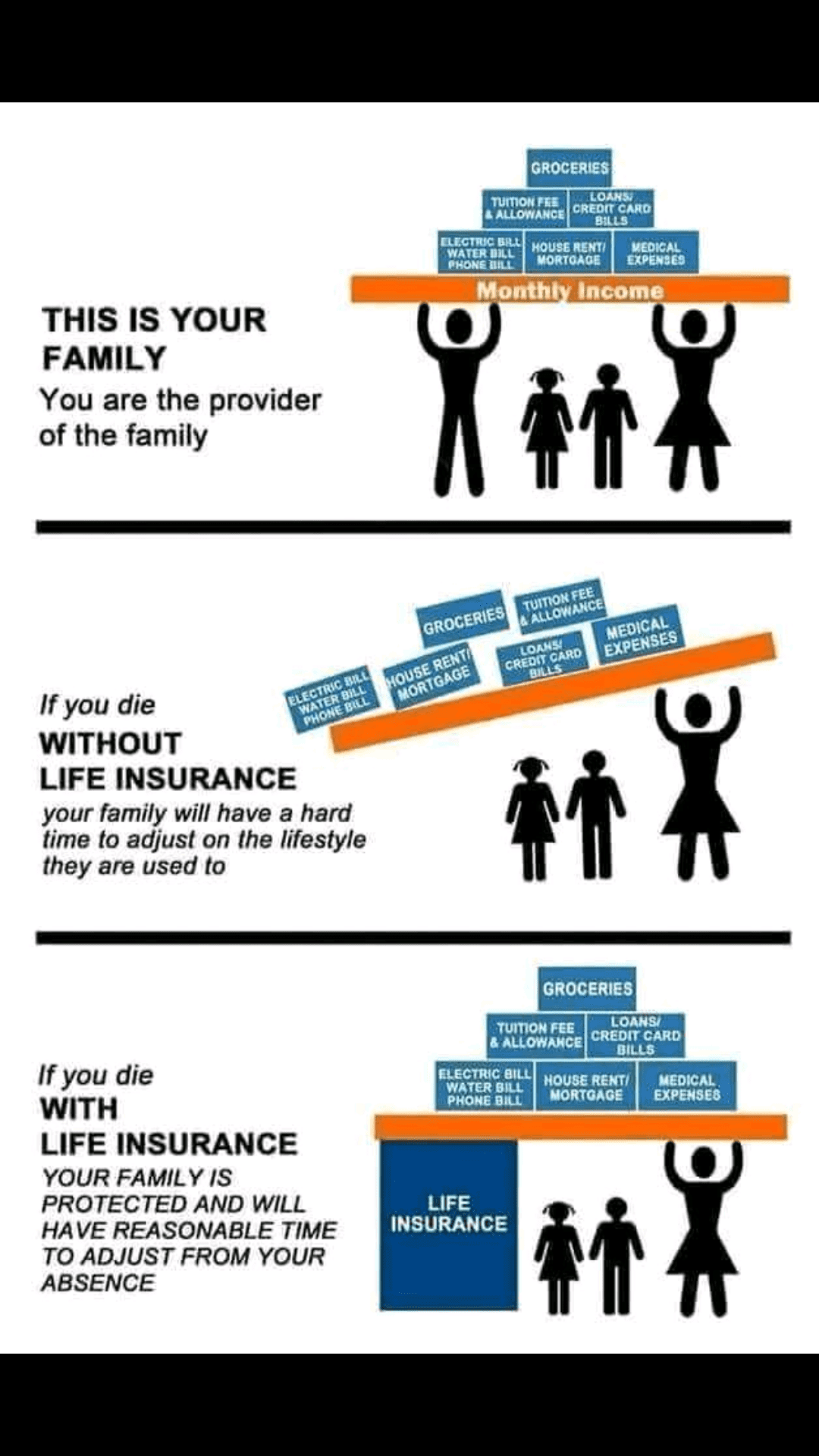

You see, life insurance exists to replace your income if you die, so your family are financially ok.

If everyone earned the same amount, my job would be a breeze. I could tell you to buy €x and be done with it.

However, we all have different income levels, so we all need different levels of life insurance.

You know WHY you need life insurance, but HOW MUCH life insurance do you need?

Life insurance is a smart idea, but figuring out how much you need can be a bit of a guessing game. At the end of the day, there’s no magic number that works for everyone and every situation.

In this article, I’ll provide some basic guidelines to help you plan out what’s best for you.

There are two ways you can provide for your family on your death.

I’ll now go through both options in more detail:

Let’s says you earn €50,000 per year and expect to work for the next 30 years.

You have potential earnings of €1,500,000 over those 30 years.

If you die, your family loses that potential income.

So do you need €1,500,000 worth of cover?

No.

Your mortgage protection policy will clear your mortgage, so that eliminates one significant outgoing.

Plus you’ll be gone too, and so will your day to day costs (food, clothing etc.), so that reduces the amount of cover your family need even further.

Here’s how to quickly calculate how much life insurance you need:

Multiply your current income by your years to retirement.

Then multiply the answer by 0.66

Using our example above:

(€50,000 x 30 years) x 0.66 = €990,000.

So for somebody on €50,000 with 30 years left to retirement, I recommend life insurance of €990,000 over a 30-year term (or how many years to have until you retire).

If you have a separate mortgage protection policy, you can further reduce the amount of life insurance you buy.

Instead of using years to retirement, you can use the age of your youngest child to work out the cover you need.

Say your youngest child is 3:

Give it a try yourself below in our handy wee life insurance calculator tool:

As you can see, each calculation gives a different number because there is no correct answer.

Plus it comes down to your budget, it would be great to buy €1m worth of cover but if you smoke or have an underlying condition, this level of cover may be unaffordable.

Therefore you need to manage your expectations alongside your budget.

What was she meant to do with 1 million euros?

John had looked after that side of things, and she looked after the children. It was old school, but it worked. She stared blankly at the piece of paper, the only time she had seen so many zeros were on those novelty Lotto cheques.

The bank manager again offered his condolences then asked:

“Do you know what you’re going to do with it or would you

like some advice. It’s a lot of money”

She took his advice. What else could she do? She was useless with this kind of stuff.

Three years later, her €1m was worth €400,000. The property and bank shares she bought had nosedived. Her advisor apologised, saying nobody had seen it coming.

Her children (4 and 6) now faced an uncertain future. One million euros would have put them through school and college without her having to return to work. Now she would have to get a job to secure their future and ask her elderly mother to look after them while she was at work.

This isn’t what John had planned….

So why am I telling you this?

If your spouse received a lump sum of money to take care of your family, would they know what to do with it, or is there a chance it could also disappear in bad investments?

Managing a large lump sum can prove a real challenge if you have just lost a loved one. If you want to make the money last, you need to budget and invest in the stock market. How comfortable is your spouse with risk? Dealing with investments of this is complex at the best of times. Imagine how stressful it would be when you’re grieving. It would be so easy to get talked into a dodgy investment by a silver-tongued investment advisor.

Monthly income benefits appeal to those who want to guarantee their family receive a regular income making it easy to handle the bills. You can make sure that the income lasts for the most appropriate length of time. This might be up until you plan to retire or when you expect the children to be financially independent.

You can make things simpler with monthly income benefit life insurance that pays your family a sum of money every month to replace your income.

And do you want to know the best news?

It’s cheaper than lump sum life insurance.

Significantly cheaper

Let’s take a 40-year-old as an example:

€1m worth of lump sum life insurance over 20 years will cost you €80 per month.

The equivalent risk-free life insurance guaranteeing a monthly income of €4166 for 20 years will cost you €60pm.

If he dies tomorrow, his wife will either get a huge cheque for €1m that she’ll have to invest or €4166 paid into her bank account every month for the next 20 years.

Which would she prefer?

Which would be best for the children?

It’s better for your pocket too.

Over the policy’s lifetime, the risk-free life insurance will cost €4,000 less than the equivalent amount of lump sum life insurance.

Of course, if you pass away towards the end of a life insurance policy, the full €1m will payout. The payout will be much smaller if you pass with only a few years left on the monthly income policy.

Like the sound of it? Here’s a “deep dive” ? into Monthly Income Life Insurance

Are the thoughts of working out how much life insurance you need making your head explode?

Then perhaps, you’d prefer I did it for you – it’s why I’m here!

Complete this financial questionnaire, and I’ll be right back with a recommendation on the type and amount of cover to suit your situation.

Nick McGowan

lion.ie | making life insurance easier

057 93 20836

Ask a question

As Ireland's leading life insurance broker, we specialise in comparing the rates and policies from the top five Irish life insurance providers and offering the very best value quotes to suit the individual needs of our clients. Our expertise lies in finding a suitable insurance plan for those with specific needs, be it a particular illness, occupation or claim history, we've got you covered in every sense!

Watch our video