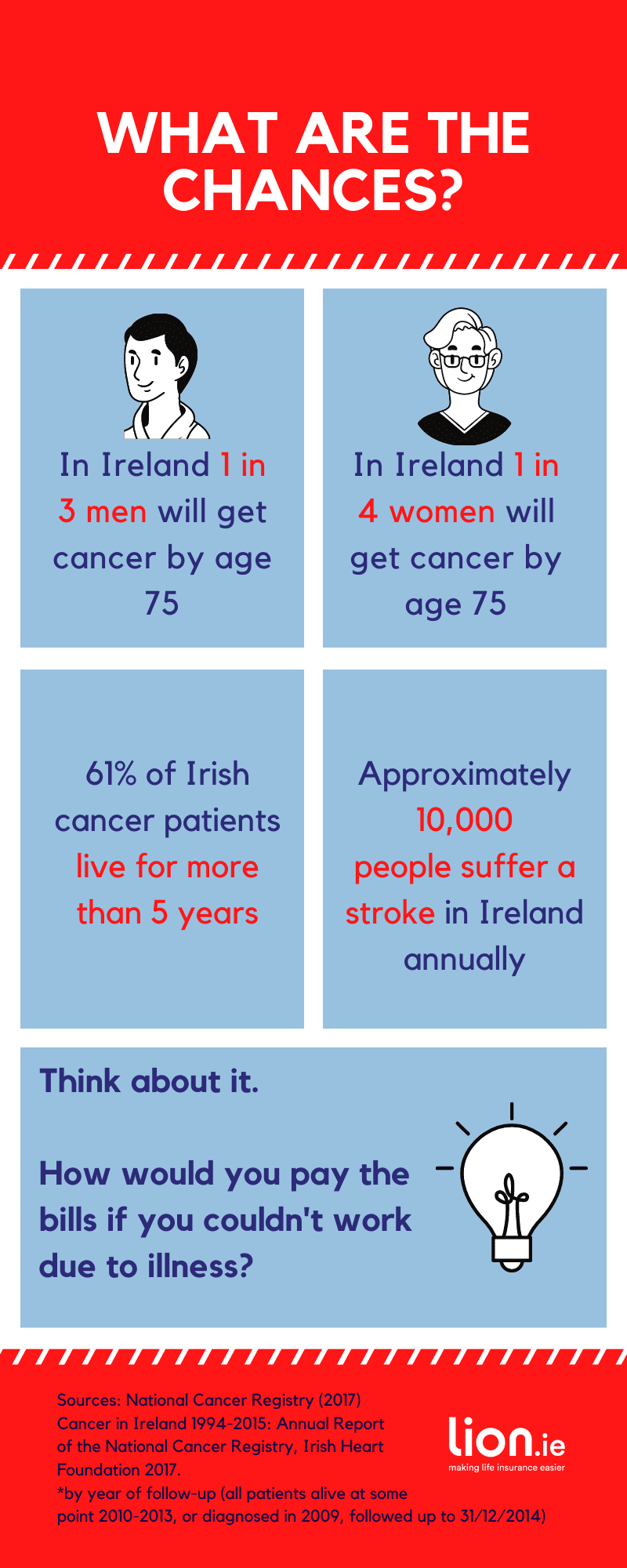

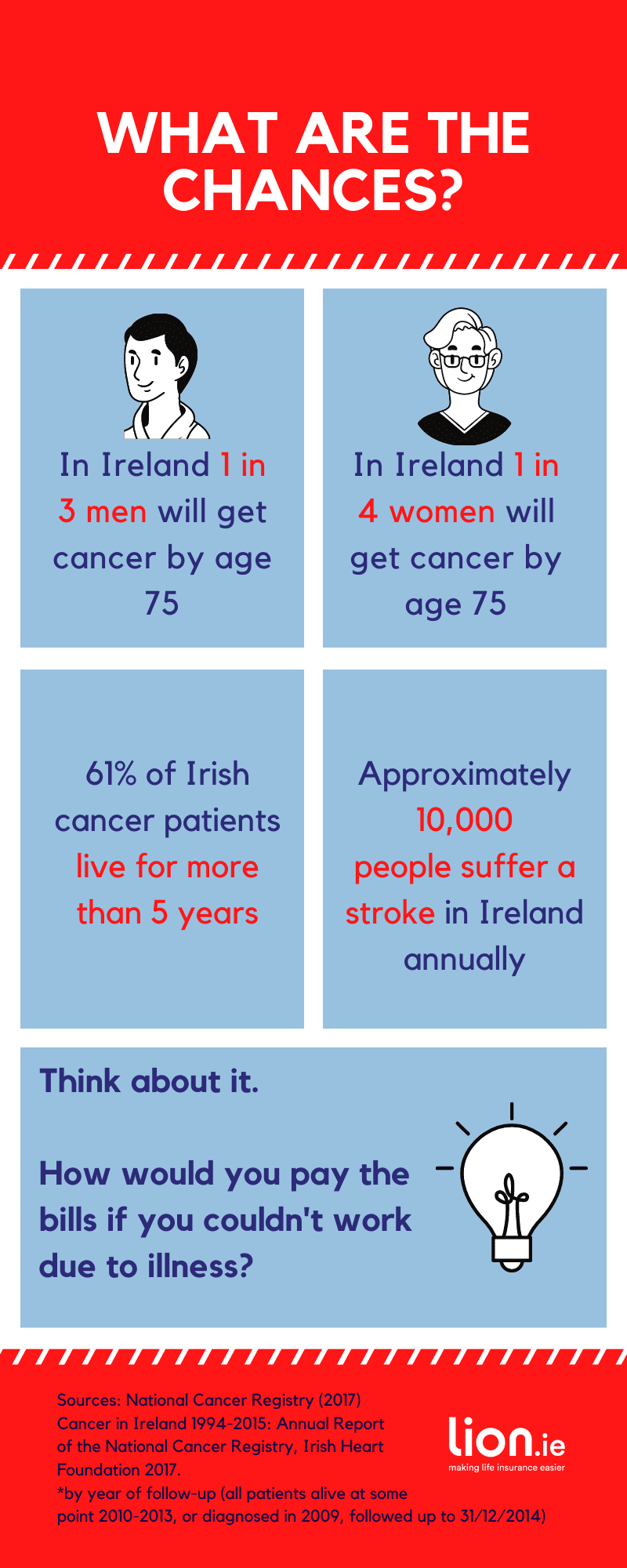

Cancer.

Heart attack.

Stroke.

They’re the kind of illnesses that can change your entire life.

Recovery can take months, and the impact can linger for years.

They’re grim – and that’s before you even consider the financial implications of being out of work for so long.

Serious Illness Cover (sometimes called Critical Illness Cover or Specified Illness Cover) pays you a lump sum if you get sick with one of the illnesses listed on your policy.

If you’re ill, the last thing you’ll want to worry about is money, so a Serious Illness Cover payout will bring huge relief – and let you focus on the important thing: getting better.

The late Dr Marius Barnard was a key member of the team that carried out the first human to human heart transplant and as a “super surgeon” he both contributed to and witnessed the increased survival rates and life expectancy that resulted from improvements in medical science.

He observed the financial costs of survival as whilst his patients increasingly lived with, and beyond, life changing medical diagnoses and procedures, sadly their financial health and wellbeing failed.

Marius argued that as a medical doctor he could treat his patients’ physical health and improve their quantity of life, whereas financial advisers were better placed to treat his patients’ financial health, so improving their quality of life and ability to cope with the monetary costs of survival.

Critical illness cover was not devised by some insurer as a money-making scheme but rather by a surgeon who took a holistic approach to improving patient’s health and wellbeing.

Take 3 minutes and watch this video.

Serious Illness Cover is something of an international man of mystery.

A James Bond, if you will. Not because it’s a spy who comes out of the water in tiny trunks.

Or even because it’s a person. It most definitely is not.

However, it has lots of names. Code names, if you will. Just as Bond has 007, Serious Illness Cover has… Critical Illness Cover and Specified Illness Cover and Specified Serious Illness Cover.

Which are all precisely the same thing!

Why does this one thing have several different names? Not a rashers, to be honest.

But don’t let that mix of names dissuade you from diving in. You’ve made it this far on your quest for knowledge; you can make it the rest of the way too!

So, in one short sentence: Serious Illness Cover/Critical Illness Cover/Specified Illness Cover is a type of insurance that pays you a lump sum if you get one of the illnesses your policy covers.

In an even shorter sentence: you get sick with an illness in your policy (?) = you get a wedge of money (?).

The idea is that you can use this money to cover your rent or mortgage or hospital expenses. Whatever you want really. No one actually checks in to see what you spend it on so you can go on a mad one if you really want. Probably wouldn’t be great for the auld recovery though.

Surely the government and sick days will help?

Guess how many sick days you’re legally entitled to?

Go on.

Guess.

ZERO.

Yeah. None. Your employers aren’t actually legally obliged to pay you if you’re out of action due to sickness. Now, most do, because they’re sound. However, that soundness tends to extend to three days off for the entire year. There are around 250 working days in the year.

That means you can take 1.2 per cent of the year off and get paid for it. The other 98.8 per cent is coming out of your pocket.

Doesn’t that make for harsh reading?

It’s almost enough to make you throw your laptop out a window, tell your boss you quit, buy a van and go driving around the wilds of Kazakhstan.

Unfortunately, the wilds of Kazakhstan may wait. Gotta pay mortgage and bills and raise kids. WHO KNEW BEING AN ADULT CAME WITH SO MANY RESPONSIBILITIES?

As for the government, sure: yes, the State Illness Benefit exists.

But guess how much pocket money you’re entitled to?

GUESSSSS.

You can probably already see where this game is going.

I’m not Keith Barry, so I don’t know what number you have in your head, but the correct answer is €203 a week. That’s €812 a month.

How much is your rent or mortgage? Deduct that number from €812, and that’s your spending money.

Don’t worry if you’re in a big screaming negative; that’s not uncommon.

All of this is to say that if you were to get sick long-term, would you be financially okay? The answer, I’d imagine, is ‘nope’. But that’s alright, too; that’s why we’re here.

Not in a profound existential way, mind. If we truly gave in to the existential pull, we’d be in that van in Kazakhstan. Maybe we’ll start a commune. Interested parties, please email existentialdrivel@gmail.com. That could be a real email address. Send an email. See what happens. Let me know.

You could be forgiven for thinking that health insurance could be useful if you’re out sick from work for ages – and you’re not wrong in the broad sense.

Health insurance is a plan that covers the day-to-day reality of being ill: hospitalisation fees, surgery, treatments—that sort of thing. The more you spend on your cover, the more wots covered, mate.

However, let’s come back round to the question of rent/mortgage and bills and food. Who would pay for that?

And that’s before we even consider the costs of the van you’re going to drive around Kazakhstan when you realise life is all one long, expensive con.

While health insurance is an excellent safeguard if you are ill or need surgery, or similar, it’s not much use for day-to-day expenses. That’s why you might consider Serious Illness cover.

You choose an amount of money (let’s say €50,000) that you want the insurer to pay you should you get a critical/serious illness. These illnesses are clearly defined (clearly may be a stretch) but they are defined in your serious illness insurance policy documents.

For examples, here’s the cancer definition from Royal London:

If you are diagnosed with a malignant tumour as defined above, your policy will pay you €50,000 tax-free.

Sounds pretty simple right, so why the bad press?

Problems arise where people are economical with the truth when completing the application form.

e.g there is a question about moles on the application form:

In the last 5 years have you had a Lump, growth, cyst, mole or freckle that has bled, changed shape, colour or size or become painful?

If you “forgot” about the time you went to the GP about that itchy mole “that turned out to be nothing” and then try to make a claim for melanoma, the insurer will decline your claim.

Instead, tell the truth on the application form and if you contract an illness as defined by your policy then your serious illness cover will pay out.

But…if you “forget” to mention a health issue to the insurer, or if your illness isn’t actually covered by your policy, then your policy won’t pay out.

It’s that simple.

Let me introduce you to Partial Payment Specified Serious Illness Cover

As well as around 50 full payment specified serious illnesses, there is also a partial payment if you are diagnosed with one of 33 less severe specified illnesses. The partial payment will be €15,000 or half of the full payout, whichever is lower. In our example, there is €50,000 cover so the maximum payable on a partial serious illness would be €15,000.

A claim can be made once for each illness covered under the partial payment illness subject to the total amount not exceeding €15,000 or half of the full payout

Examples of partial payment serious illnesses are:

Recently, a client of ours (let’s call him Sean) had a successful claim paid out for prostate cancer.

But when he called us to make his claim, he called us more in hope than expectation.

For some reason, he had it in his head that his claim wouldn’t pay out.

For us, the main worry at claim stage is non-disclosure by the client. Fortunately, we knew that Sean was an honest fella so we had little to worry about….but you never know.

The second thing to worry about was whether Sean’s diagnosis fitted the definition of the illness on his policy.

Sean was diagnosed with level 6 prostate cancer, the policy definition stated that a claim would be paid for prostate cancer “above level 6”.

Would the insurance company try and weasel it’s way out by saying “above level 6” means level 7 + or would it allow the claim?

It was part of a mortgage protection policy so the benefits were paid directly to the lender – half of his mortgage was cleared.

Cancer has forced Sean to take time off work so the reduction in payments has really helped him cope financially so he can focus on getting better without money worries.

Yes, if you’re truthful on the form and your illness is covered by your policy.

Just ask Sean.

Three illnesses account for around 85% of all serious illness claims:

The reality is that if you get one of the big lads, you’ll get your pay-out and all will be well.

The next 8 serious illnesses together account for approximately 10% of claims paid.

The remaining illnesses account for only around 5% of claims. So don’t be swayed by the insurer who offers cover for the largest number of illnesses. They are mostly just window-dressing. Instead, check their definitions for cancer, heart attack and stroke. Some are a lot stricter than others and offer some vastly differing benefits, premiums and charges, which is why we’re here to help ensure you get the best possible quote for your own unique set of circumstances.

The other illnesses:

You can see what I mean by the specificity of the terms and conditions. For example, you could have a stroke and be out of work recuperating for two months and not get any pay-out because it didn’t result in specified symptoms.

You might be thinking “but Mr lion.ie man, that’s ridiculous.”

And it is a bit, yes.

But!

Serious Illness Cover is actually quite cheap, and a little goes a long way. Plus, around 85 per cent of claims are paid out for cancer, heart attack, or stroke.

Think of it like this: if you want to safeguard yourself against the big three (cancer, heart attack, and stroke), Serious Illness cover is an excellent way to buy cheap peace of mind.

To be fair, the insurers also offer partial payments of up to €20,000 for less severe illnesses like early stage cancers.

The exact phrasing they use is “milder but still life-altering illnesses”.

If you’d like something more comprehensive, I suggest you pop over to our Income Protection Insurance section for the full skinny. Income Protection plans more expensive, but they pay you up to 75 per cent of your salary (until you retire or go back to work) if you can’t do your job FOR ANY REASON.

Aviva have recently improved their Serious Illness Cover and have created a handy interactive tool that shows the parts of the body that are covered.

You can give it a whirl here

I believe ole Willy Shakespeare was definitely talking about Serious Illness Cover when he wrote that famous line.

A little secret for you: there are three ways to buy Serious Illness Cover:

Your options are:

And in this article, we show you how to compare the serious illness cover provider in 4 simple steps.

This is where you buy Serious Illness cover on its own.

This is the most expensive way to buy serious illness cover. Historically, there are more claims on standalone serious illness policies compared with serious illness cover bundled onto a life insurance policy.

Life Insurance + Serious Illness cover. If you get a serious illness pay-out, that number is deducted from the amount of Life Insurance you have left.

Life Insurance + Serious Illness cover. If you get a pay-out, the amount of Life Insurance you have isn’t affected.

As for the providers, a big thing to know here is you get some additional benefits with some insurance policies – some perks even.

To run through it quickly:

Booster Serious Illness Benefit

Zurich will make an additional payment if you’re diagnosed with certain, specific, life-changing Serious Illnesses, of 200% of their Sum Assured (subject to a maximum additional payment of €50k).

• For under 45’s, if diagnosed with Alzheimer’s disease, Dementia, Motor Neurone Disease, Parkinson’s Plus Syndromes.

• Or for Blindness, Coma, Loss of hands/feet, Loss of independent existence, Loss of speech, Paralysis of any limb,Third degree burns, Traumatic head injury.

Let’s say you have €50k serious illness cover and your claim falls into either of the above categories – Zurich will pay out €100,000

Aviva Family Care is a counselling and support service which can help support your mental health. . The service includes up to six telephone or video counselling sessions. This service is available to you, your dependent children (over the age of 18) and your spouse or partner PLUS your parents.

If a member of your family was ill or diagnosed with a chronic illness, naturally you would want them to have the best treatment available to them. You would probably have lots of questions and you might be in need of some independent medical advice or a second opinion on a treatment plan. Best Doctors, provides you with access to over 50,000 of the world’s top physicians.

You can explain you or your family member’s case in confidence; they will then gather all of your medical information and match you to the best medical expert. Best Doctors supports your treating doctors, it doesn’t replace them AND you don’t have to leave your home to avail of this service. This service is available to you, your children up to age 18 (or 23 if in full-time education) and your spouse or partner PLUS your parents and your spouse’s or partner’s parents.

I’m aware there are a lot of words there so if you’d like me to explain any of the terms or to recommend the ones that make sense for your situation, give me a call on

Your last consideration is the price, though I’ll get into that more in a bit.

I mention this now because you might be in the middle of getting a mortgage. Which is great. Be saddled with years of debt to eventually own your own house.

In all seriousness, it is exciting so fair play.

If your bank happens to ask if you’d like a side order of Serious Illness cover with your Mortgage Protection, you’re going to tell them ‘no’.

BECAUSE THE BANK GET THE PAY-OUT MONEY if you ever had to cash in on your Serious Illness Cover.

Frankly, this should be illegal. Alas, it is not.

I tend to recommend Zurich Life as their policies are the best for my money. A wife range of illnesses are covered, claiming isn’t too tricky, and the perks are decent.

However, with insurance, I always recommend that you find the right fit for you.

For example, you might be interested in cancer-only cover. It’s pretty much exactly what it sounds like, though as we now know with our pal Serious Illness cover, it comes with terms and conditions around severity and type. It’s cheaper than serious illness cover and is open to you even if you have some other health issues going on. Ordinarily, if you have MS or Diabetes, you won’t qualify for serious illness cover but cancer only cover is an option.

How much Serious Illness cover costs is a decent place to start, though the better question is first considering: ‘How much Serious Illness cover do I need?’

That’s your starting off point because the amount of cover you want will fairly solidly correlate with the cost of it.

Out of hand, my rule of thumb is €30,000.

Now, I’m not yer da so don’t take that as me telling you what to do – but it is a good number to start with. The Journal ran an article around cancer costs that I like to quote here that surmises (v fancy with the lingo there) that cancer treatment can cost €1,000 a month.

That’s shocking.

So that’s €1,000 a month. I also like to estimate that you’re going to solidly lose out on your spending money in the month too: that’s another €1,500 while you give up work or reduce your hours.

That adds up to €30,000 a year.

And that’s why I recommend the 30k. That said, if you can afford it, €50,000 is a safer bet to keep you in the black for longer.

And now onto the maths.

I’m sure we all love maths.

Who doesn’t?

Most people, in fairness. But don’t worry, it’s simple maths.

So, here’s how we work out the cost. I’m working under the assumption you’ve taken my recommendation to bundle Serious Illness cover and Life Insurance.

An example: Harry is 40 and wants a €250,000 Life Insurance policy over 30 years.

His quote:

Harry decides to listen to my advice (he’s a wizard, that Harry) and he opts into €30,000 Serious Illness cover alongside his €250,000 Life Insurance cover.

His new quote:

The difference is about €20. That’s a fiver a week.

Sure you’d be mad not to chuck it in there too.

As with all things Life Insurance, I hope you never have to actually make a claim – because that usually means something has gone wrong to the tune of either death or grievous injury or illness.

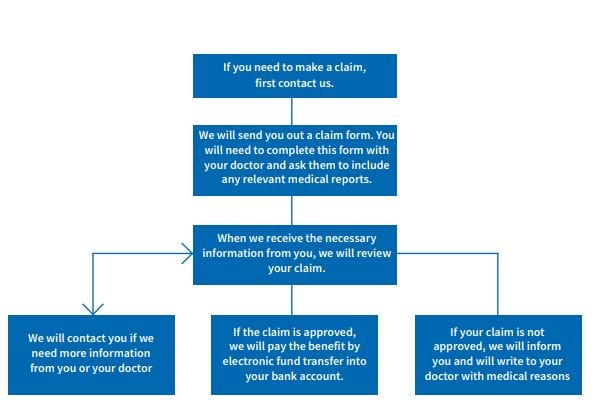

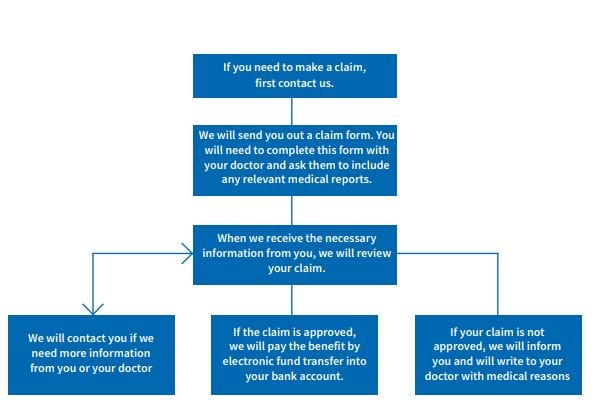

Presuming you have the right paperwork, making a claim on a Serious Illness cover policy isn’t too tricky. You’ll start by calling your insurer and giving them details of your claim, your policy number, that sort of thing. If it fits the bill, you’ll fill out and return a claims form. You may also need to send ID. The insurer will then ask for medical proof, receipts, GP’s letter – that kind of thing, to make sure that everything checks out.

Maybe.

I’m not going to give you an outright yes as I don’t know your exact situation. My gut instinct is to always recommend Income Protection first.

If Income Protection is out due to budget or health, then go for Serious Illness cover.

One last time, I also firmly advise not adding Serious Illness Cover to your Mortgage Protection. Just don’t do it. It’s a bleeding nightmare and a weird trap the banks are allowed to lure you into.

That’s my advice to you.

As for why you should listen to me? You may have landed on lion.ie and this blog incidentally on your hunt for insurance advice. A little about lion.ie: we’re an online insurance broker with a small team based out of Offaly.

We believe that life insurance should be for everyone.

That means stripping away the bullshit and making it accessible. And it goes even further than that for us: we have a long history of helping traditionally ‘quirky cases’ get insurance. We’re also fully online, so you can go from quote to signing without coming in to see us.

Anonymity is golden especially if you have health issues that you’d rather not discuss with the local bank manager.

The truth is: I don’t like spending my money every month on the various life insurance policies I have – but I do it to keep my family safe. I get it’s a necessity, but a begrudging one. To that end, I can help you find the right policy for you that you can begrudgingly pay for too.

Don’t just take my word for it though. Have a nose through my customer testimonials and see what our legion of satisfied customers have said, having saved them a bunch on sickness insurance.

Once that’s done, and if you’d like my help, you can fill in this form or give me a call on , and we can take it from there.

I know what you’re thinking: why trust this guy? He’s just another broker out to make a quick buck on other people’s misfortune.

Harsh!

Scroll down to read some of my testimonials from my lovely clients. You won’t find a single bad one – and there’s a reason for that – bribery I mean, GREAT CUSTOMER SERVICE

I believe in plain English and in avoiding the makey-uppy terms insurers and banks use to bamboozle you. After all: if you can’t understand what they’re saying, how are you meant to get the best deal?

For example, did you know that you should NEVER bundle Serious Illness Cover and Mortgage Protection because the bank get the pay-out if you get a serious life-threatening or chronic illness.

That’s cheeky – and it’s also not something the banks are in a rush to disclose.

I’ll lay it all for you in plain English and I’ll give you independent, unbiased advice so you can get the right deal for you. I can’t wait to speak with you and to make life insurance a little less drab and a little more fun.

Nick McGowan

lion.ie | making life insurance easier