From the minute you set foot in school, you’re taught to pay attention, work hard, and apply yourself in the hopes that you go to college and get a good job.

All so you can hop onto the fabulous hamster wheel of life and fill the void with money.

Keep the wheel spinning, keep money coming in and, the theory suggests, you’ll be able to buy stuff that will make you happy.

As the ancient philosopher, Ariana Grande once said,

whoever said money can’t solve your problems must not have had enough money to solve ‘em’.

And while money is no guarantee to a happy life, it definitely helps insofar as being able to afford your rent or mortgage, Wi-Fi, keeping your motor on the road, horse riding for young Joffrey and ballet lessons for little Guinevere.

But what happens if the wheels come off the hamster wheel or said hamster is hit with a crippling case of depression?

The wheel stops.

In this metaphor, the money ceases too.

It’s wheely terrible news.

Guinevere is gonna have to hang up her ballet shoes.

And that’s where Income Protection Insurance steps in to save the day.

Income Protection, noun: a bleedin’ massive lifesaver if you can’t work, long-term for any reason.

Which is to say: a type of insurance that pays you up to 75 per cent of your salary if you can’t go back to work for any reason. This could include depression or back problems – which are two significant areas that aren’t covered with other types of insurance (Serious Illness Cover, specifically).

I use this example a lot, but rightfully so.

Let’s say someone gives you a money machine that prints actual money in your kitchen.

Best gift ever!

Now, this money machine chugs away and affords you a sweet life.

But if it breaks, there goes your money!

What if you could insure the money machine so that you’d continue to get money while it got repaired?

You’d immediately insure it, amirite?

You can see where this is going, no doubt.

Let’s say you’re in a car crash and are seriously injured.

Don’t worry: you make a full recovery. I’m not an animal!

However, your back is in bits, and you’re laid up in bed for two years getting better.

You might think that sick pay is going to save the day.

It isn’t.

How many days sick pay do you get in Ireland?

Still, check your contract to see if you can scrounge a few weeks, anyway.

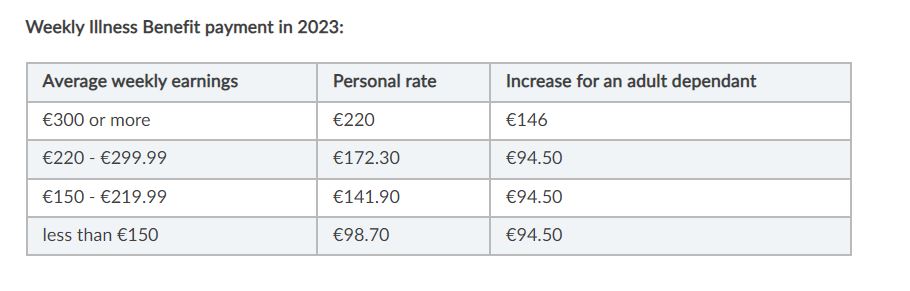

Disability or Illness Benefit might be another option.

You’ll get a max of €220 a week, though.

Poor Guinevere is still not getting those ballet lessons.

She could be a budding Baryshynikov but she will have to hang up her ballet shoes.

You might also have some savings.

But do you really have enough to cover two whole years of salary?

If you do, fair play, you’re doing better than most.

Even then, it’s a cruel way to have to spend your hard-earned spondoolies, they were earmarked for a dream holiday or the kid’s education.

I bet the aforementioned money machine AKA Income Protection Insurance, is starting to make a lot of sense around about now.

Pretty much everything is taxed if you think about it.

Smokes.

Booze.

Netflix.

Anything that comes with VAT attached to the price.

Income Protection is treated as a replacement income. Which means you pay tax.

However, you also get tax relief at your marginal rate of income tax so you get a kickback of 40% of your premiums – assuming you pay 40% income tax.

Essentially, the insurance company will become your employer while you’re out of work and pay you a replacement income every month.

Bear in mind: you can cover yourself for any per cent up to 75.

The less you cover, the cheaper it is – but be sure to weigh up if it’s actually worth it if you go for a lower percentage.

The idea of an insurance company doling out your salary might make you feel a bit icky, but look it: it’s better than relying on the €220 a week you’d be getting from the State, isn’t it?

By the way, if you continue to receive benefits, they’re deducted from your total too.

What do I mean by benefits?

As soon as your waiting period is over.

This waiting period is known as a deferred/deferral period, because lol insurance.

It’s almost as if they make it unnecessarily complicated to trip you up.

Almost as if.

You choose the deferred period you want.

The deferred period is how long you need to be unable to do your job before you can receive your payout.

Anyone of: 4, 8, 13, 26, or 52 weeks. If you opt for 4 weeks, it’s more expensive. Likewise, it’s cheaper at 52 weeks.

But think long and hard about this one.

Can the hamster reaalllly afford to wait 52 weeks till he gets paid again? Probably not unless you have a partner on a decent wedge.

When you’re choosing this one, it’s always good to consider how your savings are looking and if work will cover you for a certain amount of time. Be smart about it is what I’m saying.

Otherwise, it’s a hamateur mistake.

That pun almost works.

If you can’t do your job due to illness or accident, it will pay you until your chosen ceasing age (55-70) or to the end of your employment contract.

That’s what makes Income Protection so magic.

Did you know the average claim is five and a half years?

Imagine how much money you’d need to cover your salary for that amount of time. It’s probably €150,000+, bare minimum.

Which leads nicely on to:

Every situation is different, so it will vary from hamster to hamster.

Factors include age, occupation, income, and health. If you have a dangerous job, it’s more expensive too.

Income protection has a perceived high cost.

But how much would you be willing to pay for such insurance?

On average, people say they would be happy to put aside 5 per cent of their income to make sure they had an income if they couldn’t work.

Let’s look at an example.

Helen is 40 years old.

She works in marketing and earns €60,000 so 5% of her monthly take-home pay is €175

She doesn’t smoke (have you ever seen a hamster that does?) and she wants to cover her maximum income with a 26 week waiting period.

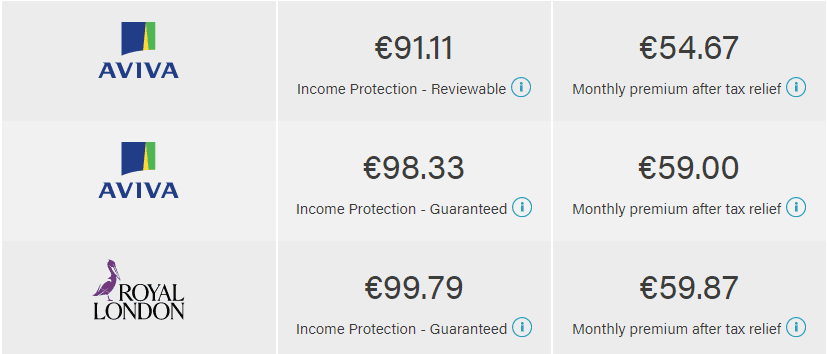

Helen’s Income Protection quotes look like this:

Quote Type: Income Protection

First Person: Non-Smoker, born on 02/01/1980

Cover Amount: €34,444 per year until age 68.

Occupation Class: Accountant (Class 1)

Deferred Period: 26 weeks

For those who weren’t paying full attention earlier (can’t say I blame you; insurance isn’t that interesting).

YOU’RE ELIGIBLE FOR TAX RELIEF on Income Protection Insurance, so the insurance actually costs (after tax relief) the smaller number on the right.

For around €60 a month, Helen can insure her income.

That’s less than 2% of her monthly income! (1.71722% to be exact)

Kind of worth it on balance, right?

In short: do you need Income Protection Insurance?

Quick answer: no. But will it absolutely save your skin if something crappy happens?

There you go.

Over to you…

If you’re considering Income Protection, complete this short questionnaire and I’ll send you a quote that we can discuss over email or chew on over on the phone.

Thanks for reading

Nick

lion.ie | Protection Broker of the Year 🏆

Editor’s Note. We first published this blog in 2012 and have regularly updated it since.

057 93 20836

Ask a question

As Ireland's leading life insurance broker, we specialise in comparing the rates and policies from the top five Irish life insurance providers and offering the very best value quotes to suit the individual needs of our clients. Our expertise lies in finding a suitable insurance plan for those with specific needs, be it a particular illness, occupation or claim history, we've got you covered in every sense!

Watch our video