So you’re looking for an income protection calculator are you?

Well, you’ve come to the right place because we’ve made it ridiculously easy to get a quote.

You can get an instant quote on our income protection quote machine, or if you’d prefer me to do it for you, please complete this questionnaire, and I’ll email you some quotes. No hassle!

But if you’d prefer to do it yourself (very brave!) – here’s a quick rundown on how the calculator works.

Let’s start with the first page you will see:

Now I’ll go through the quote system step by step to show how easy it is to get a quote…

I’m sure you can figure out your DOB

You’re a smoker if you’ve smoked tobacco in the last 12 months (strictly speaking, even a sneaky one while out with your pals makes you a smoker, especially if you’re down as a smoker with your GP)

You’re also a smoker if you’ve used e-cigarettes or any nicotine replacement (even 0% nicotine)

If you’re an employee:

You can insure up to 75% of your before-tax income, less €10,556 (state illness benefit).

So if you earn €50,000, you can insure:

75% x 50,000 = €37,500

€37,500 – €10,556 = €27,464

You can insure up to €27,464 per year or €2,288 per month.

Therefore if you’re unable to work, the insurance company will provide you with a taxable income of €2,288 per month until you get back to work or your policy ends.

If you’re self-employed:

You’re not entitled to any illness benefit, so you can insure up to 75% of your before-tax income.

If you earn €50,000, you can insure up to €37,500 (€3,125 per month)

So if you cannot work for a certain period, the insurance company will provide you with a taxable income of €3,125 per month until you get back to work or your policy ends.

Take a minute and work out how much you can insure.

Ready…good.

Let’s continue!

Now take note of your occupation class.

Excellent, let’s go!

On our income protection quote machine, you can choose various deferred/waiting/absence from work periods, namely

The longer the deferred period, the lower the premium.

So if you choose a 4-week deferred period, your policy pays out after four weeks of absence from work.

If you choose a 26-week deferred period, you must be out of work 26 weeks before you receive a payout.

That may seem a long time to wait…but what if I told you the average length someone is out on claim is four years.

I’m sure you could somehow muddle through without an income for 26 weeks.

Imagine having to survive for 208 weeks without an income.

So what deferred period should you choose?

Some people take savings into account, but I wouldn’t.

Think about it, what are you saving for?

It’s not to replace your income if you can’t work. You can buy income protection for that 😉

I’m sure you’re saving for something more enjoyable, a holiday perhaps or a new car.

Keep your savings for the finer things in life.

So you now know how much you can insure, what class your occupation is and when you’d like your policy to pay out; the next step is to use those details to get an income protection quote.

I’ll wait for you.

Ready?

Nice one…let’s look at your results page.

So, you now have your quote, and you’ll see a results page showing what you have to pay per month for your cover.

We’re making you a software developer earning €62,000 per year.

Quote Type: Income Protection

First Person: Non-Smoker, born on 18/08/1981

Cover Amount: €35,944 per year until age 65 (based on earnings of €62,000)

Occupation Class: Software Developer (Class 1)

Deferred Period: 26 weeks

Assuming you pay 40% tax and using the lowest quote below of €76.02

The net cost of your income protection (how does the tax relief work?) is just €45.61 per month.

If you think about it, your monthly net income is €3582 per month. So you would only have to use 1.2% of your net income to protect 75% of your income.

It’s a no-brainer.

You’ll also see Reviewable on some of the quotes above. Here the insurer fixes your premium for the first five years but can review and increase your premium after five years.

Here’s a more in-depth article on reviewable income protection.

With Guaranteed quotes, the provider fixes your premium for the life of your income protection policy – I recommend this option.

If your initial quote is too high, hit the back button and re-quote:

Playing about with these numbers will bring your quote to a more reasonable level.

Some income protection is better than no income protection.

For ages, Ireland only had two income protection providers: Friends First and Irish Life.

Then came New Ireland, soon followed by Aviva.

In 2016, Royal London joined the party.

2019 saw Aviva takeover Friends First.

And last year, Zurich finally started offering personal income protection (they have been offering group income protection through employer-based schemes for years, so they’re not “new” to the income protection market.

How to Compare Income Protection Providers in Ireland

Price is important, but the ancillary benefits the insurers offer are also important.

If you’re out sick, you’ll soon want to get back to work as soon as possible before you die of boredom.

So here’s an article comparing the back-to-work benefits of income protection.

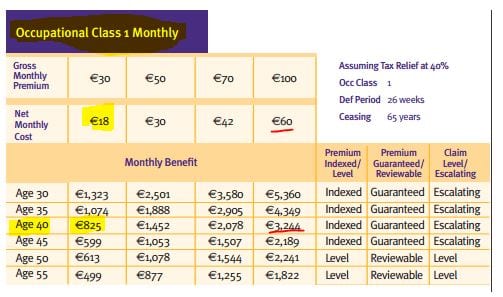

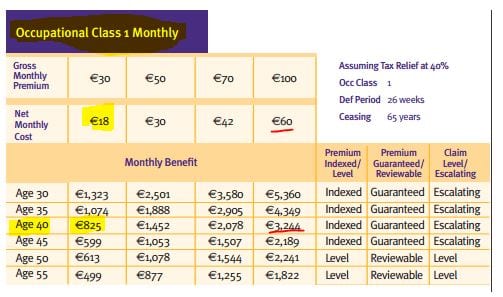

Look at this “ready reckoner” focusing on the top left – a Class 1 Occupation (office worker).

As you can see, if you’re a 40-year-old office worker, you can spend as little as €18 per month to cover an income of €825 per month.

Or you can spend €60 per month to insure an income of €3244 per month

That’s €60 per month to avoid relying on state illness benefits should you find yourself unable to do your job.

And remember, if you’re self-employed, you don’t even get that measly state benefit.

Click here, choose income protection and get your instant quote.

I hope you find our quote machine helpful and easy to use.

If you want to know all about income protection, you can find all the answers in this whopper of an article:

There’s a lot to consider with income protection, so please take independent advice.

Everyone’s circumstances are different, so an adviser’s job is to tailor a policy to your specific needs.

The benefits of speaking with an adviser are numerous:

1. Help you select the right policy options

The adviser will find out about your income needs, outgoings, expected retirement age, sick pay and savings to tailor your policy options.

2. Compare the various insurers

The best insurer for you depends on your occupation, business travel, health, smoker status and hobbies, so an adviser’s role is to find the best terms across all insurers.

3. Access more insurers

Make sure you use an advisor who has excellent relationships with all five insurers and doesn’t place all their business with just one insurer.

4. Saves you time

A specialist protection adviser will know all the policy terms inside out and can talk you through all your options, saving you hours of research.

There are a lot of benefits to speaking with an income protection specialist; the best part is their advice is usually free.

You see, the adviser is paid a finder’s fee by the insurer for placing business with them, and the premiums are the same if not less than going direct to the insurer (they pay brokers less than they have to pay their sales staff)

If you don’t have an advisor, I’m here for you.

Complete this short income protection questionnaire, and I’ll be right back with a personalised recommendation.

Chat soon

Nick

057 93 20836

Ask a question

As Ireland's leading life insurance broker, we specialise in comparing the rates and policies from the top five Irish life insurance providers and offering the very best value quotes to suit the individual needs of our clients. Our expertise lies in finding a suitable insurance plan for those with specific needs, be it a particular illness, occupation or claim history, we've got you covered in every sense!

Watch our video