Table of Contents

Greetings, my learned friend!

You’ve studied hard – contract, tort, land law, jurisprudence and the rest.

You’ve trained hard, getting through Blackhall place and your apprenticeship unscathed.

Now that you’re finally earning a decent salary, isn’t it time to do the clever thing and safeguard it should you fall ill?

I know you’ve been putting it off, we all have.

In this article, I’ll explain what income protection is…and what it’s not. Income protection is not the same as serious illness cover.

You don’t have to suffer a specific illness for your policy to pay out. Income protection will cover any injury or illness that prevents you from doing your job as a solicitor.

You’ve trained and worked hard to get where you are, so make no apologies that you’re well paid.

But the more you earn, the less help there is, in relative terms, if you cannot work.

Let me explain:

Let’s say a friend of yours takes home €500 per week.

If she can’t work due to an illness, she is entitled to €220 in disability benefit per week.

So her income drops by 56%.

Let’s say you take home €1000 per week.

If you can’t work, you’re entitled to the same €220 per week.

Your income drops by a huge 78%!

You see, the more you earn, the more you’re exposed if you cannot work long-term.

Imagine getting a pay cut of 78%; could you survive financially?

The main factor affecting the price of income protection is your risk of injury.

Solicitors’ income protection is classed as category 1, which is the lowest risk.

The lower the risk, the lower your premium will be.

If you are an employee paying the higher tax rate, you can claim tax relief on 40% of your income protection premiums.

This means a monthly premium of €166 per month really only costs you €100 net per month after tax relief!

You can insure up to 75% of your salary, less disability allowance (assuming you’re entitled to it).

Let’s look at an example to see how it works in practice:

If you cannot work long-term due to any illness or injury, you are entitled to an annual income of €48,560 + €11,440 = €60,000 per year until you return to work.

Without income protection, you would have to survive on state illness benefit of €11,440 (and this is means-tested after two years, so you might not qualify if there is a second income in the home)

Just think about that for a minute, could you even pay your mortgage, let alone feed and clothe your family on €220 per week?

Self-employed solicitors are not even entitled to the €220per week.

I’m afraid you’re on your own if you can’t work.

You will face a 100% drop in income.

If you’re self-employed in any occupation and don’t have income protection, you’re either very brave or very foolish.

A little-known trick could save you a fortune on your premiums in the long run.

If you’ve just started out as a solicitor, you can get an income protection policy right now, while your salary is at the lower end of the scale.

This helps you lock in a lower price based on your age and good health, while also allowing you to buy more cover in the future without answering medical questions.

Income protection providers give you the option to increase your coverage automatically by 20% every three years.

But every year you put income protection on the long finger, your premium will increase as you get older.

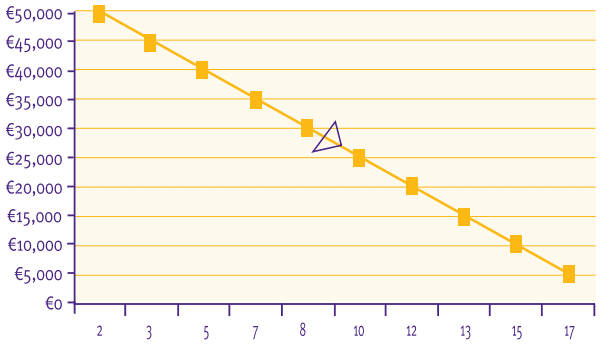

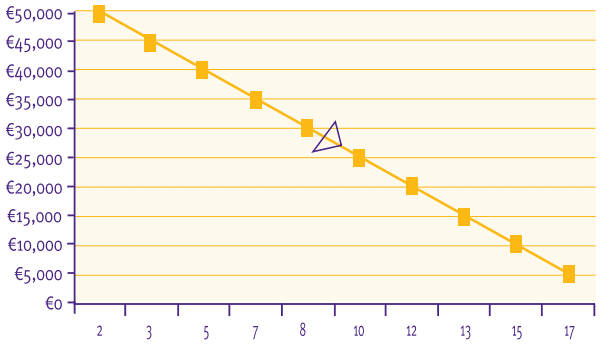

They say a picture paints a thousand words…

You may work in a high-pressure, high-stress environment, so you must protect yourself from work absences due to mental fatigue.

Last year, mental health conditions like depression, anxiety, stress and burnout accounted for 25% of all income protection claims.

Traditionally, solicitors’ practices don’t have a formal sick pay arrangement, so you might only be covered for a couple of weeks (if you’re lucky)

Income protection can payout after a 4-week absence from work, although you will have to pony up for a policy with such a short deferred period.

Your income protection will continue if you change jobs, regardless of what your new job entails.

And if you move from one firm to a new one, your policy is still valid.

It’s easy to think

It won’t happen to me

but here are some stats that may surprise you. Unfortunately, illness and injury can strike at any time:

How long would €50,000 in savings last, do you think?

Five years, three, two years?

If your spend €3000 per month on the mortgage, food, bills etc., that €50,000 will last just 17 months.

What happens then?

1. Does it cover absence from work due to work-related stress?

Yes.

2. Does it cover absence from work due to traffic accidents, sports injuries, and illness?

Yes

3. What level of medical certification is required?

A report from your GP generally suffices, but the insurer can ask for more medical information.

4. Are my Doctor’s fees covered in addition to income protection?

No, income protection replaces your income only.

5. Is there a time limit on how long my income will be protected?

You choose the time limit; the maximum age is to age 70.

6. Will I receive my current full after-tax income for the duration of the protected period?

No, you will receive 75% of your gross income, less state disability benefits. Your gross income is taxable.

7. How long will it take to receive payment from the date of submission of a claim?

Once all relevant medical information has been received and is satisfactory, payment will begin immediately.

8. Is there a limit on the number of times I can claim or a period that I can’t claim after making a claim and receiving income protection payment?

No.

9. Does it cover redundancy?

No.

10. How much does solicitors’ income protection cost?

You can use our income protection calculator to get an indicative quote.

Alternatively, if you’d like me to draw up some options for you, please complete this questionnaire.

Right, that’s a fairly detailed introduction to income protection, but I’m sure you have lots of questions.

My direct line is (01) 693 3382, or you can schedule a callback here

Thanks for reading,

Nick McGowan BCL – nearly made it 🙂

Editors Note: This post was first published in 2017 and has been updated regularly since.

As Ireland's leading life insurance broker, we specialise in comparing the rates and policies from the top five Irish life insurance providers and offering the very best value quotes to suit the individual needs of our clients. Our expertise lies in finding a suitable insurance plan for those with specific needs, be it a particular illness, occupation or claim history, we've got you covered in every sense!

Watch our video