Table of Contents

Life is unpredictable, and ensuring your family’s financial security is essential.

This guide explains Pension Term Assurance in simple terms, highlighting its benefits and how it can save you money on taxes.

Pension term assurance is a type of life insurance with tax releif that pays out a lump sum if you die before a certain age, typically before retirement.

It’s designed to provide financial support for your dependents if you pass away.

You can get Pension Term Assurance if you are:

You can’t use your policy as security for a loan so you can’t assign it to the bank for a mortgage.

But apart from that, it works exactly like a standard life insurance policy.

The major attraction of Pension Term Assurance is you can claim tax relief on your premiums.

So, it will cost you 40% less than a regular life insurance policy

In real terms, a €100 per month premium just €60 per month

Example:

Tom runs his own business and pays tax on his earnings at 40%.

He’s self-employed and hasn’t maxed out his pension contributions so qualifies for Pension Term Assurance.

At year end, he can claim 40% tax back on his monthly premiums.

So, Tom’s €100 monthly premium actually only costs him €60 making it more affordable than standard term life insurance.

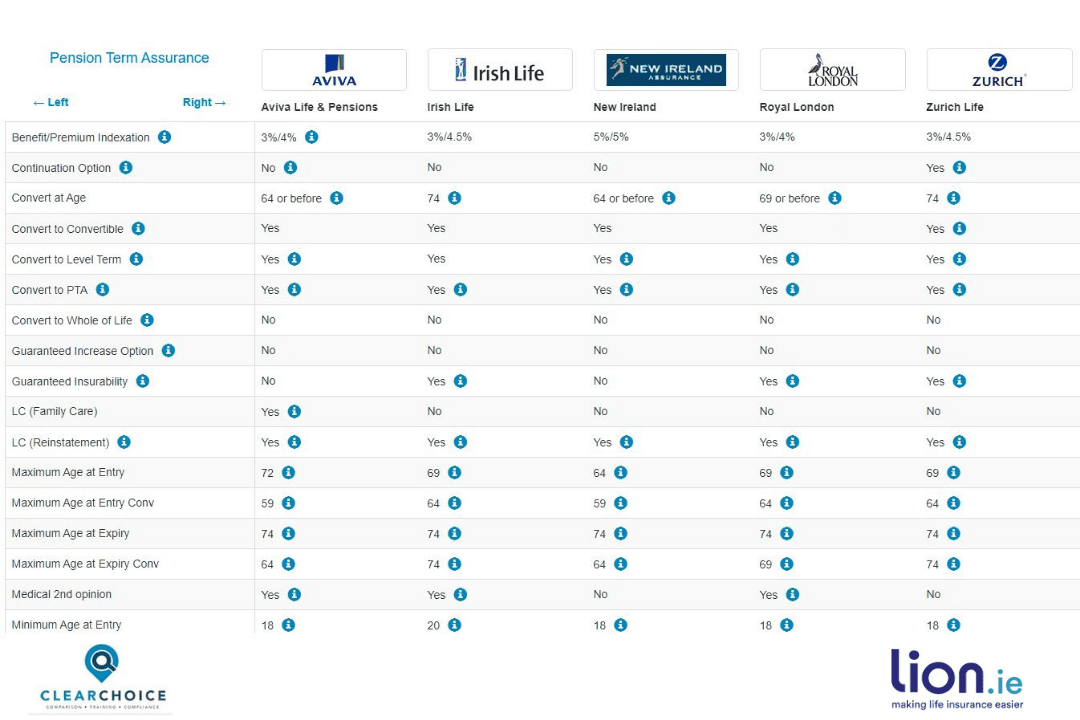

The five main providers of life insurance in Ireland all offer PTA:

As with all type of life insurance, each policy has it’s own quirks so you should take advice before purchasing.

Executive Pension Term Assurance is life insurance paid for by the employer.

It will leave a lump sum for the family of the employee if they die before retiremement age.

It’s also knows as Death in Service benefit.

There is no BIK payable by the employee and the premiums are a tax-deductible expense for the employer so the employer can claim tax relief on the premiums.

Win-win!

No there are some restrictions:

There is a limit on the maximum amount that can be paid out as a lump sum.

The lump-sum cannot be more than 4 times the employee’s final salary.

Any excess must be used to provide a pension for the spouse/dependent.

Example:

Sarah earns €85,000 per annum.

She has Death in Service of 6 times her salary (€510,000).

The maximum lump sum her spouse can receive is 4 x €85,000.

Sarah’s employer uses the €170,000 balance to buy an annuity/pension for her spouse.

An annuity is a type of retirement income product that pays a regular retirement income either for life or for a set period.

No, this option is for those who are self-employed or not in an employer’s pension scheme.

You can claim through your payroll if facilitated by your employer or via self-assessment.

Yes. The cover stops, and you won’t get the benefits unless you reinstate the policy, which may require a new medical assessment.

For example, you take out the policy as a self-employed person but change jobs and become a PAYE employee.

With some insurers, you can exercise a conversion option so your cover continues as a personal life insurance but you won’t be able to claim tax relief.

Unfortunately, some other insurers will cancel your policy if you move from self-employed to PAYE.

This is why it’s important to choose the most suitable insurer for your Pension Term Assurance

On special occasions, yes, you can increase your cover:

No.

The life insurance company will make the payout as a tax-free lump sum.

If the person receiving this money is a spouse, then no tax is payable.

Depending on their relationship to the deceased, other beneficiaires may have to pay tax.

If you’d like some help arranging your cover or you’re wondering whether you qualify, give me a shout.

Complete this questionnaire and I can email you a free, no-obligation recommendation.

Alternatively, if you’d like to discuss this over the phone, click the button to arrange a call-back.

Thanks for reading

Nick

Editors Note : We first published this blog in 2021 and have updated it since.

As Ireland's leading life insurance broker, we specialise in comparing the rates and policies from the top five Irish life insurance providers and offering the very best value quotes to suit the individual needs of our clients. Our expertise lies in finding a suitable insurance plan for those with specific needs, be it a particular illness, occupation or claim history, we've got you covered in every sense!

Watch our video