Fill out this short form and I’ll work out the most affordable way to protect your kids from Revenue. No waffle. No pressure. Just straight-up advice.

You may, mistakenly, believe that inheritance tax is a rich person’s tax that won’t affect you.

But if you intend to leave a property worth over €400,000, it will affect you.

And this doesn’t take into account any other assets your children may receive on your death – cash, investments, cars.

So if a €400k house makes you rich, welcome to the Country Club (the hostesses will be round with canapes soon).

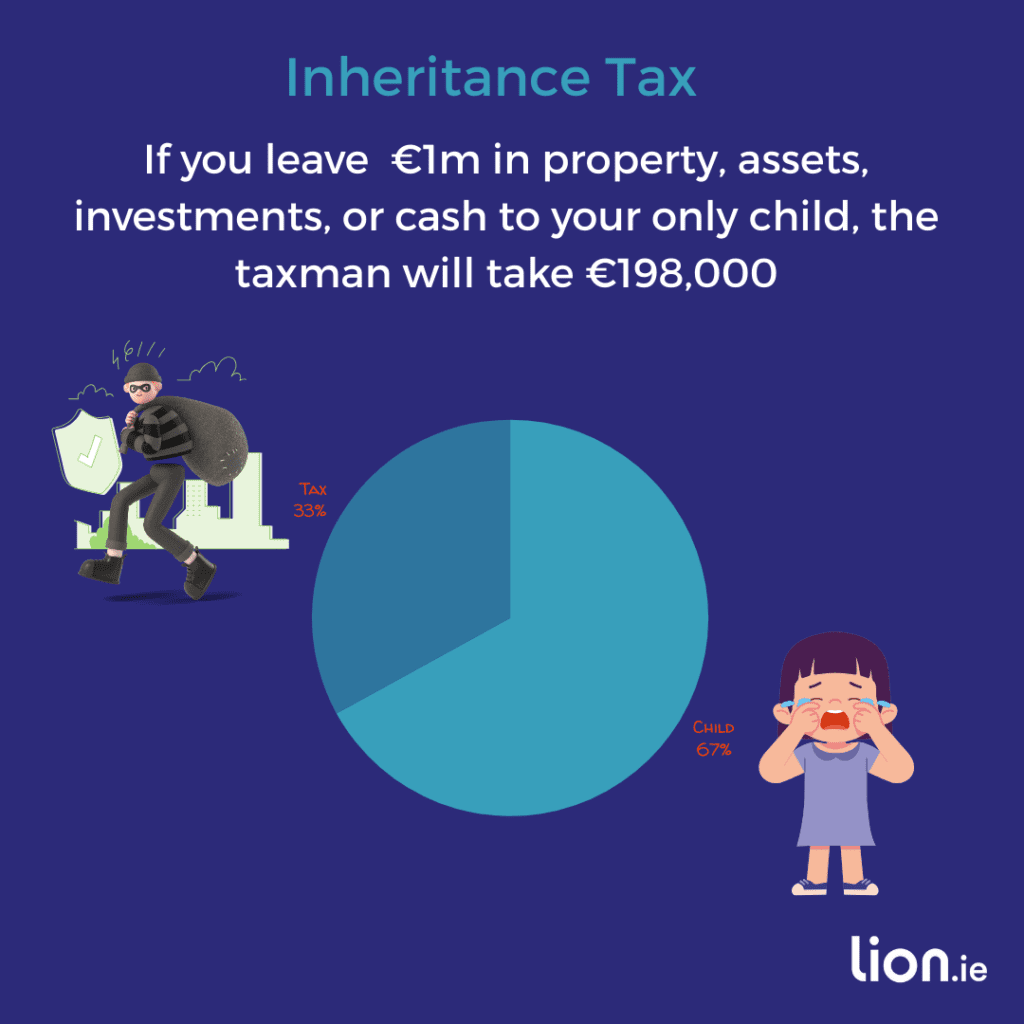

But let’s go mad and say your total assets are worth a cool million.

Here’s what his or her nibs will have to stump up in tax before they can get his hands on any of it.

Look, we know that inheritance tax is an abomination.

You’ve already paid tax on the assets you own while you’re alive, and then Revenue wants another slice when you pass away.

Now, I’m not here to debate the rights and wrongs of that — I’ll leave that to people much smarter than me.

But what I can do is show you how to plan ahead, so the Taxman doesn’t help himself to a chunk of your kids’ inheritance.

Let’s start with the basics…

CAT isn’t something most of us deal with every day, so don’t worry if you’re not entirely sure what it is.

It’s essentially a tax on receiving something of value — and it comes in two forms:

This article is all about helping you prepare for the second one — inheritance tax — because, well… death and taxes, as the fella says.

If you’re a spouse or civil partner, good news — you won’t pay inheritance tax on anything you inherit from your other half.

Everyone else?

They’re on the hook.

And it’s usually your children who are most at risk.

The more they inherit, the bigger the potential tax bill.

If the value of what you inherit is under your tax-free threshold (we’ll cover that in a sec), you’re in the clear.

But anything over your threshold?

It gets hit with a hefty 33% tax.

Let’s break it down from your children’s point of view:

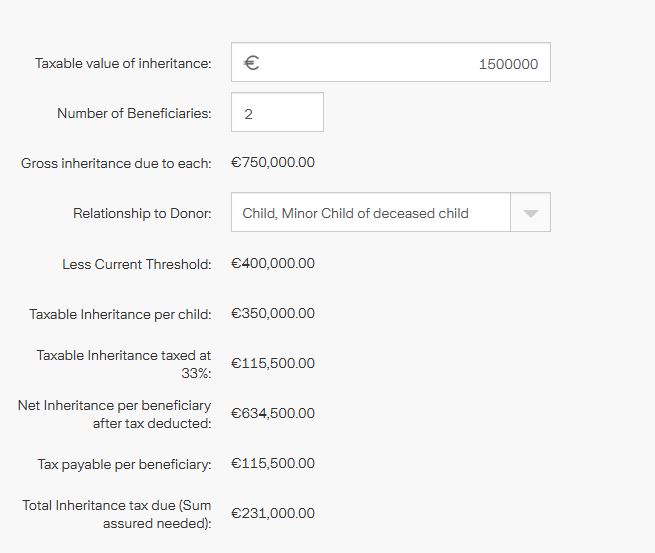

Say your two children are inheriting €1.5 million worth of assets from you— that includes property, savings, jewellery, cars, crypto, the lot.

Assuming they’ve received no previous gifts from you, they are each looking at an inheritance tax bill of €115,500

And here’s the kicker — Revenue wants that in cash.

Miss the deadline?

Revenue will happily slap on penalties and interest until it’s paid.

They might be able to arrange a deferral, but eventually, they’ll still have to cough up €115,500 each

Sure, I could walk you through all the steps and formulas…

But honestly, who has the time (or the desire) to make their brain melt trying to figure it all out?

Much easier: use a calculator.

Here’s the one I recommend from Zurich→ [https://www.zurich.ie/life-insurance/life-insurance-calculators/inheritance-tax-calculator/]

Let’s go back to the example above.

They are inheriting €1.5 million from you

But this time, let’s say they have already received €100,000 each from you in the past — maybe from a gift or earlier inheritance.

That €100,000 eats into their Group A threshold, reducing it from €400,000 to €300,000.

Now their taxable inheritance jumps to €450,000 (€750,000 – €300,000), leaving them with an inheritance tax bill of €148,500

Once their threshold is fully used up, every cent they inherit from you gets hit with a 33% tax.

No discounts.

No mercy.

If the parents are married or in a civil partnership, they can pass assets between each other completely tax-free.

So inheritance tax doesn’t usually bite after the first parent dies — the surviving spouse simply inherits everything without a bill from Revenue.

The issue comes later:

That’s when inheritance tax kicks in — and often, it’s a big number.

To avoid leaving your children with a surprise tax bill (and a scramble to find the cash), parents should consider taking out a Section 72 Life Insurance Policy.

This special type of cover pays out on the death of the second parent, and — here’s the magic bit — the payout is Revenue-approved to cover the inheritance tax bill so it isn’t liable to tax.

More on how Section 72 works in a bit…

Yep — and they can make a big difference to your final tax bill.

There are a few special reliefs that can reduce the amount of inheritance tax owed, depending on your situation. Here are the main ones:

Explaining all the rules for these would melt your brain (and break this blog), but if you think any of them might apply to you, you should contact someone with a bigger brain (specialist tax advisor).

📌 We can help with the next step.

Now that you know how inheritance tax works, the next step is figuring out how to plan for it — without your kids having to sell the house to pay Revenue.

The good news?

You can do that using a special Revenue-approved life insurance policy called a Section 72.

A Section 72 policy (previously known as a Section 60) is a Revenue-approved life insurance policy designed specifically to cover inheritance tax.

The magic of Section 72 is this:

The payout is tax-free as long as it’s used to pay an inheritance tax bill.

That means you can use the proceeds of your life insurance to pay their tax, so your children get the full inheritance.

Technically yes, but practically — not ideal.

A standard life insurance payout is added to your taxable estate, which can actually increase the inheritance tax bill.

So while it helps in theory, it may actually make things worse in practice.

Stick with Section 72.

It’s built for this.

Step one: estimate your kid’s potential inheritance tax bill using this calculator:

https://www.zurich.ie/life-insurance/life-insurance-calculators/inheritance-tax-calculator/

This isn’t an exact science — there are three big unknowns:

So it’s more of an educated guess than an exact figure.

Once you’ve got your estimate, get in touch with us and we can tell you how much it will cost per month.

If you’re married or in a civil partnership, you can set up the policy on a joint life, second death basis.

The Section 72 policy pays the tax, and your children receive the full inheritance, tax-free.

Yes — a few, but they’re simple:

Yes — and this is actually very common.

If your parents can’t afford the premiums, it makes total sense for the kids to pay.

After all, they’re the ones getting the benefit of a tax-free inheritance.

However, the insurers are cautious about kids insuring parents

Instead, each child can gift up to €3,000 per year to each parent tax-free, which can be used to pay the premium.

Yes and no.

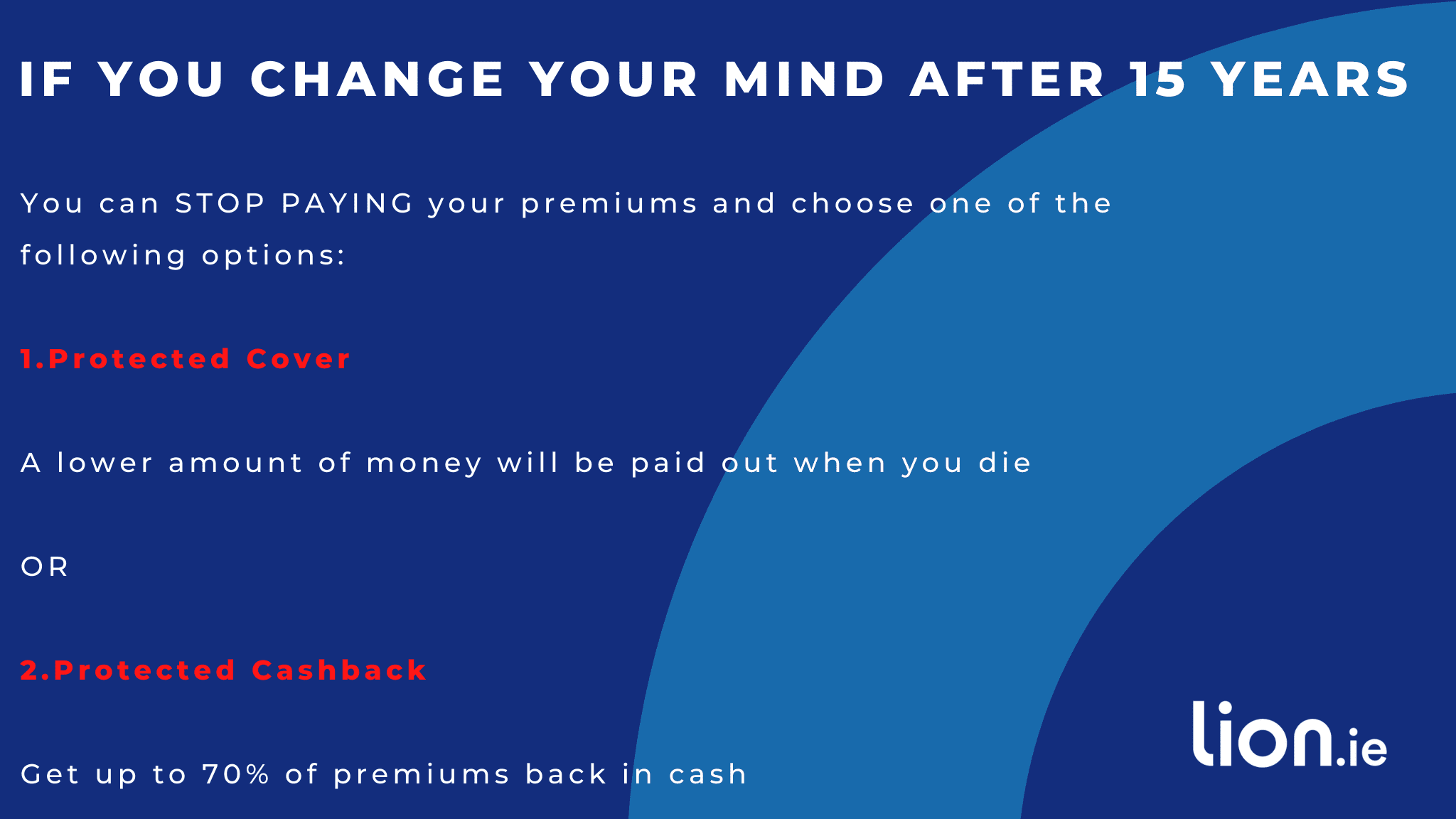

Section 72 Life Insurance is a Whole of Life policy, which means the insurer is guaranteed to pay out as long as you keep paying the premiums.

Unlike term life insurance (which only covers you for a set number of years), you can’t outlive a whole of life plan. So from the insurer’s point of view, a payout is inevitable — and that’s why it’s more expensive than term life cover.

When you take out whole of life cover, you’re not just buying insurance, you’re buying a long-term financial asset.

It has guaranteed value, because it will pay out someday.

And you can make it even more valuable by adding the Life Changes Option to your plan:

That’s a pretty comprehensive look at how you can use a Section 72 Life Assurance policy to cover a potential inheritance tax bill.

In my experience, there are two types of people in the world:

📅 Schedule a call: https://info.lion.ie/meetings/nick352

📞 Call: 05793 20836

📧 Email: nick [@] lion.ie

Talk soon,

Nick

Editor’s Note | We published this blog in 2017 and have updated it regularly

057 93 20836

Ask a question

As Ireland's leading life insurance broker, we specialise in comparing the rates and policies from the top five Irish life insurance providers and offering the very best value quotes to suit the individual needs of our clients. Our expertise lies in finding a suitable insurance plan for those with specific needs, be it a particular illness, occupation or claim history, we've got you covered in every sense!

Watch our video