Table of Contents

You’ve probably read that title and recoiled a bit with the bang of BS.

Maybe you’ve rubbed your chin in contemplation, thinking,

But isn’t the whole point of Life Insurance to give your family money after you give up the ghost.

Give up the ghost.

Cash in your chips.

Exit stage left.

Die.

Whatever you want to call it.

And yes, you’d be right.

It does sound far-fetched, but you can buy Life Insurance in Ireland that refunds cold, hard cash.

And that cashback is a whopping 70% of your premiums.

With regular Life Insurance, you pay a monthly premium/cost.

This will cover you for either

a) the length/term/years of the policy that you chose (e.g. 25 years) or

b) the whole of your life.

When you die, your loved ones get a tax-free lump sum to mask their grief with wads of cash pay for your funeral.

The extent of the “wads” will depend on how much insurance you bought.

Term Life Insurance, which is the one with a limit, i.e. a term, is generally less expensive.

The insurer is betting you will outlive the policy, so they get to keep your money and not have to pay out when you die.

On the other hand, you are betting you will die within the term.

When you look at it that way, it might give you the heebie-jeebies!

Whole of Life Insurance, as the name suggests, covers your whole life. Because the payout is guaranteed, whole of life costs more than term life cover.

Enter Royal London’s Life Changes Option, a type of Whole Life insurance that you can cash in.

Fun fact: Royal London’s brochure for the Life Changes Option pictures a family going for a walk in the woods with the slogan ‘Giving you a whole lot more.’

Who wouldn’t go for a nice walk in the woods to celebrate taking out a whole-of-life policy?

That’s how you know it’s legit.

Marketing eh? (marketers, you know I ♥ you)

No, but in all seriousness, this is a pretty good policy choice.

The Life Changes Option is a whole-life policy, meaning it covers your whole life and is guaranteed to pay out, assuming you keep paying your premiums.

Deep breath.

We’re about to give it a good sniff to check it out.

So, if you take out the Life Changes Option with Royal London and pay your policy for at least 15 years, you can choose between two options:

However, the Cashback Option is 10 per cent more expensive than their standard whole-of-life cover, so you’ll pay more for this luxury.

But I think it’s worth it.

The longer you continue to pay your premiums before stopping (let’s say 20 or 25 years), the higher the claim or cashback will be.

Don’t worry; we’ll look at examples now in a tick.

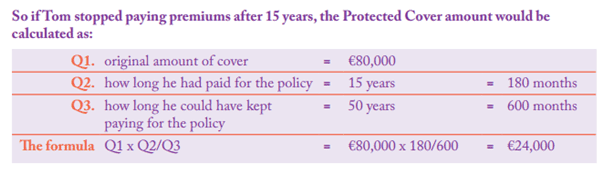

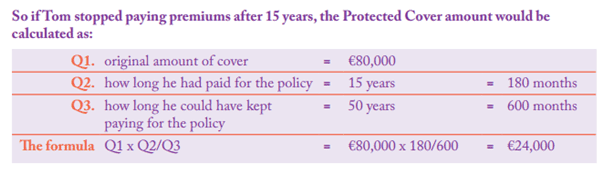

With this one, the revised amount considers the monthly premiums you have paid and the number you would have paid to age 100.

It’s based on a formula of the original cover amount x (the number of months you have paid for / the number of months you could have paid for up to age 100).

Yay maths.

Did that make sense to you?

Nope. Well, Royal London doesn’t care, so you just have to accept it.

An example, forthwith.

Tom, aged 50, takes out €80,000 Whole of Life Insurance with the Life Changes Option.

After 15 years, Tom stops paying the premiums and gets free cover of €24,000 for the rest of his life.

Like so:

It’s a bit more complicated for couples because the age of both partners revolves around who is younger (and further from 100).

The amount you get back will be 70 per cent of the premiums you have paid so far (excluding the Government levy at 1 per cent).

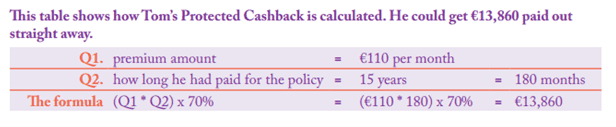

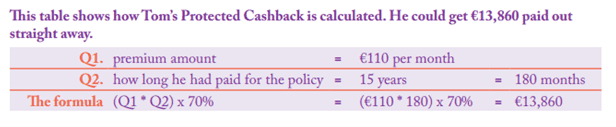

For example, using Tom above will clear things up.

He paid €110 per month for his €80,000 cover for 15 years, or €110 x 12 x 15 = €19,800 in premiums.

Tom can cancel his policy, and Royal London will pay him back €13,860 (70 per cent of his premiums) in cold hard cash.

Just wait until all of civilisation lives in flesh robots and is created in artificial wombs. Royal London is gonna be so pissed about this ‘100+ policy’.

Look, I don’t know how many of us will live past 100, but I do know from the papers that the secret to living that old is battered fish and chips on a Friday.

Either way, if you live past 100, the premiums are free.

Sure, it won’t be the full shebang, but it can be an option if your financials are under pressure or if you’re happy with the amount of cover you’re leaving behind.

The other insurers have a minimum age of 40.

Again, this can be complicated, so make sure you know what you’re doing.

Talk to a professional, or me if you can’t find one.

If you’re diagnosed with an illness that has no cure and which will kill you within 12 months, the policy will pay out immediately.

Helping Hand gives you one‑to‑one personal support from your own Nurse Adviser from Red Arc, who can help you and your family cope with the effects of illness or bereavement.

As you can see from the above, Life Insurance with a guaranteed cashback will have higher initial premiums than term life insurance.

because 15 years from now, you can get back 70 per cent of the money you paid.

Let’s take Fiona, a 40-year-old who is buying €250,000 worth of cover. She wants coverage until she is 90.

This could cost her €60,000 in premiums, but she will get nowt if she celebrates her 90th birthday.

She could pay €183,600 in premiums (to age 100), but there is a guaranteed payout of €250,000

At any time, from age 65, Fiona can change her mind and cancel the policy to get back 70% of her premiums that she paid to that point (€32,100)

Please complete our financial questionnaire so that I can recommend a level of cover that suits you (and your wood-walking family).

Or you can request a callback here:

Chat soon

Nick

Editor’s note: We published this article in 2019 and have regularly updated it.

As Ireland's leading life insurance broker, we specialise in comparing the rates and policies from the top five Irish life insurance providers and offering the very best value quotes to suit the individual needs of our clients. Our expertise lies in finding a suitable insurance plan for those with specific needs, be it a particular illness, occupation or claim history, we've got you covered in every sense!

Watch our video