Table of Contents

Despite how it sounds, Section 72 isn’t the name of a military base deep in America where aliens are being investigated.

I mean, it could be.

CIA, don’t come for me.

In the context of Life Insurance, Section 72 is certainly not the name of a secret military base where aliens are being investigated.

Instead, Section 72 is a Life Insurance policy you can take out in Ireland to pay off Capital Acquisition Tax.

Also known as CAT.

Also known as ‘meow’.

Also known, more commonly, as inheritance tax.

Inheritance tax is the bogeyman of tax.

It’s also fecking ridiculous.

So, let’s start by talking about that CAT.

Let’s say you own a house.

When you die, you want to leave it to your kids.

Maybe you plan to leave it to the simple yet sound one of the family because the others are already wealthier than you are.

That’s fine.

I’m not here to judge.

Either way, a house is being bestowed to a child.

You die. (It’s okay: you live to be 97 and pass away quietly in your sleep beside your lifelong partner. Both of you are oblivious and go out dreaming about peaceful, lovely things)

Good innings, etcetera etcetera.

You leave the house to your child.

Revenue then slams said child with a 33 per cent tax bill they’ll need to pay to Revenue sharpish.

They’ll be hit with penalties and interest if they decide not to pay it (or, more likely, if they can’t).

Not ideal.

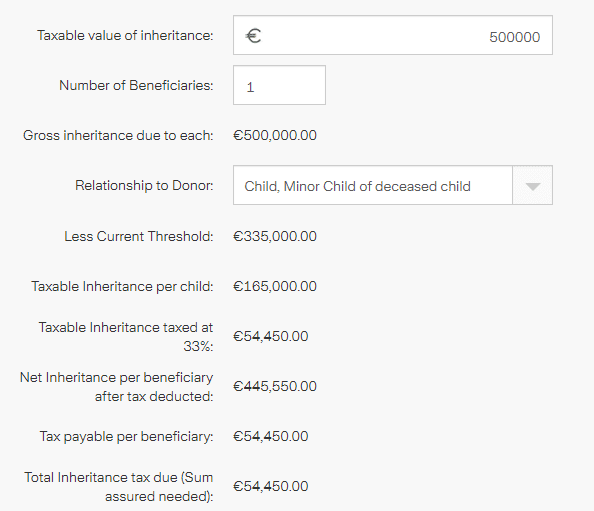

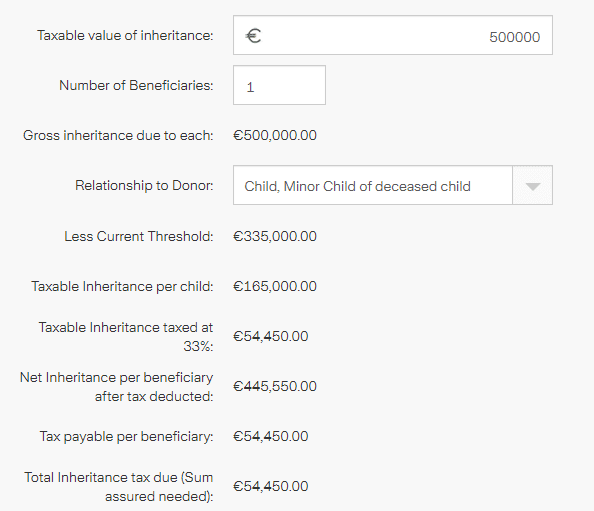

Certain factors (like thresholds, and if they’ve already gotten gifts from you, the number of beneficiaries) come into play for the final tax bill, but let’s look at an example.

You want to leave your favourite child, Nick, a house worth €500,000.

He’s the sole beneficiary.

Little Nicky will have to pony up €54,450 in tax.

That’s quite the wedge to have to hand over.

And yes, we can all agree it’s an affront that inheritance tax exists.

We meet at dawn tomorrow to riot in the streets.

Should the riot fail, Section 72 Life Insurance will have to do.

Section 72 Life Insurance is a type of Life Insurance that parents buy in Ireland to pay their children’s inheritance tax bill.

It’s called S72 because it’s defined under Section 72 of the Capital Acquisitions Tax Consolidation Act 2003.

It works much the same as regular Life Insurance in that you take out a policy and pay your premium; when you die, the insurer pays out a big lump of money.

In the case of S72 cover, the money is held in trust to pay the inheritance tax bill.

The caveat is that Section 72 insurance must be taken out on the life of the person leaving the inheritance.

It’s a bit like taking out a hit out on them, except to insurers, and not, you know, the mafia.

NB: The person insured has to pay the premiums.

All of this is to say that your kid, i.e. the beneficiary, can’t take a Section 72 policy on behalf of the person leaving the inheritance.

BUT!

Using the small gift exemption, they can gift you up to €3000 tax-free annually.

You can then use this gift to pay the premiums on your policy.

Since your children will be getting the policy’s benefits, it’s only fair they pay for it or at least contribute.

It’s pretty straightforward and depends on how much inheritance tax will be owed.

If you calculate that your assets will result in an inheritance tax bill of €100,000 for your kids, that’s the amount of cover you’ll need.

When you die, the insurer will make a payout, so your estate can pay the bill, and your child can inherit the estate tax-free.

Like any Life Insurance plan, the amount you pay for your policy varies from person to person.

No two people are the same, so no two policies are the same.

Generally, the significant factors affecting the cost include your age, whether you smoke, any health issues, and the amount of cover you need.

Regarding your age, there’s not much you can do about that.

You’re as old as you are.

If you’re a smoker, consider quitting – and applying in a year or so.

Smoking DRAMATICALLY increases the cost of your cover.

Plus, smoking is outright bad for you, so it’s another smart reason as any to bin the coffin nails.

Unfortunately, if you have a health issue, your application might be a bit more complicated.

Say it’s a mild, manageable condition; you might get away without paying more.

However, you will likely have to pay more if it’s more severe.

Again, it’s unfair, but there’s not much we can do about it.

(Whisper it: the revolution begins at dawn.)

The amount of coverage is straightforward: the bigger the inheritance you have to cover, the more insurance you need = the higher the premium.

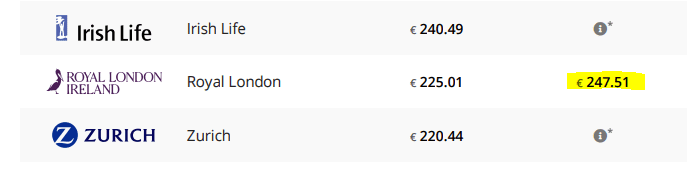

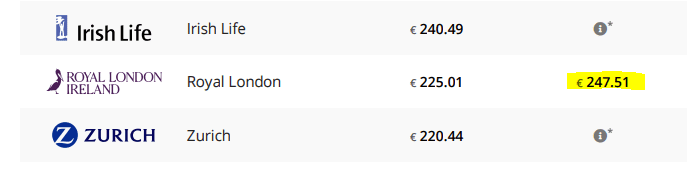

In Ireland, Zurich Life, Irish Life, and Royal London offer plans for Section 72.

Fortunately for you, we deal with all three to get you the best deal.

You can independently contact all three insurers or ask a friendly insurance broker to do it.

Me.

I mean me.

Yes, using the small gift exemption I mentioned above.

Yes, there is, it’s 74.

If you’re 75 or more, you’ve missed the boat, I’m sorry to say..

Calculating the amount of inheritance tax and the cover to suit requires a bit more math and tinkering, so we can’t give you an instant quote online.

We can provide you with a S72 insurance quote, though we can’t give specific tax advice, so if you’re about to inherit a farm from your sick Uncle Jimmy and you’re wondering what you can do, don’t ask me!

However, if you have taken tax advice or you know you’re looking at an inheritance tax bill of €x, complete this short questionnaire, and I’ll be right back with a quote.

OK, since you asked so nicely.

Here are some indicative quotes for a 60-year-old non-smoker in good health who requires €100,000 S72 Inheritance Tax Cover

The lowest quote is with Zurich @ €220 per month.

Do you see the highlighted yellow one?

That’s from Royal London.

The beauty of this policy is that you can cash it in after 15 years and get a refund of 70% of your premiums (€31,186!).

If you’d like to know about inheritance tax before taking the plunge, you can read my blog about it here.

Thanks for reading

Nick

Editor’s note: We first published this blog in 2020 and have regularly updated it since

As Ireland's leading life insurance broker, we specialise in comparing the rates and policies from the top five Irish life insurance providers and offering the very best value quotes to suit the individual needs of our clients. Our expertise lies in finding a suitable insurance plan for those with specific needs, be it a particular illness, occupation or claim history, we've got you covered in every sense!

Watch our video