Table of Contents

If you’re a small business owner, you want to know that if something horrific were to prevent you from working, you and your family would be financially secure.

A long-term disability or income protection policy can help cover the costs of day-to-day living while you can focus on getting better without money worries.

But some business owners don’t have income protection.

Why?

Usually, because they never heard of it.

You may have stumbled across it yourself and wondered, “Can a Self-Employed Person Get Income Protection?”

Yes is the answer!

Whether you run a small business online or are client-facing, you can protect yourself. Whether you are a contractor on a 6-month rolling contract or the director of your own company, you can protect yourself.

So why don’t you?

The most common reasons SME owners don’t get long-term disability insurance are:

These are all myths. Or excuses, if you’re honest.

Here’s the truth:

To qualify for income protection, you must be earning an income as a full-time worker (40 hour-a-week job with a high hourly rate is considered full-time work)

And to make an income protection claim, an illness or accident must prevent you from earning an income.

You can insure up to 75% of your taxable income, and the insurer will pay this until you get back to work or up to age 70.

Without income protection, your income will stop completely as you’re not entitled to state support.

It’s that simple…and terrifying.

The cost of income protection depends on three things: your age, previous health history and your occupation.

If you’re young, your premiums will be relatively low. If you’re older, your premiums will be higher.

You’ll pay more if you have a high-risk profession, but most business owners will be office-based, which is the lowest risk class.

You will pay more if you have a health issue, or the insurer may exclude you from claiming that pre-existing condition.

As a rule of thumb, the average monthly cost of an affordable long-term disability policy is around 2% of your net monthly income.

Take Sarah, a 40-year-old Love Island, lovin’ Graphic Designer. She’s a sole trader, and her small business is doing well, posting profits of €60,000 last year.

However, Sarah has been winging it on the whole insurance front since she left her perk-filled job at Amaz-google-soft, but now she has some cash flow; she would like to insure the full 75% of her profits.

Quote Type: Income Protection

First Person: Non-Smoker, born on 16/08/1981

Cover Amount: €45,000 per year until age 65.

Occupation Class: Graphic Designer (Class 1)

Deferred Period: 26 weeks

In this example, Sarah’s net premium is just 1.6% of her monthly take-home. In other words, she can use a tiny fraction of her net monthly income to safeguard a massive 75% of her gross income should she be unable to do her job for more than 26 weeks.

Income protection takes an enormous weight off her shoulders for a small financial cost. She had imagined the worst and how daft she would have felt if she had fallen ill without income protection.

Now she can put her feet up, watch mindless TV and chill.

When you sign up for an income protection policy, you start to pay premiums immediately, so you’re covered immediately.

Back to Sarah, who took out her policy last month and was in a car accident the next day, suffering crippling whiplash and back injuries, meaning she’s out of work for at least 12 months. Once 26 weeks have passed, she’ll be able to claim. The insurer will continue to pay Sarah until she returns to her job. Sarah has been suffering some panic attacks since the accident. If she feels she cannot run her small business, the insurer will continue to pay her.

We see this often with clients who are out of work due to cancer treatment. Even when they get back to work, they often find the day-to-day work too stressful so that they can make a subsequent claim.

You can claim multiple times on income protection, and if you find you can’t work due to a relapse, you don’t need to serve the waiting period again.

The insurer will restart your claim immediately.

There’s no need to prove your income when taking out income protection. The insurance provider will take your word for it.

But this doesn’t mean you can make up any old figure because this will come back to bite you on the arse should you ever need to claim (see point 6 below).

If you are a sole trader, you can insure up to 75% of your profits, NOT YOUR DRAWINGS, because your drawings aren’t taxable.

Trying to insure your drawings is a common mistake that can lead to heartache if you need to make a claim:

Imagine your Sales are €300,000 and your expenses are €250,000, so your profit is €50,000. However, you are taking drawings of €60,000 per year, so you take out income protection of 75% x €60,000 = €45,000

Unfortunately, you have to claim, so the insurer requests proof of income which shows your profits are €50,000. Therefore the maximum they will payout is 75% of this €50,000 = €37,500 even though you have paid premiums for €45,000 cover. Don’t make this mistake.

Things are a lot straightforward for a company director. You can cover 75% of your basic income and a percentage of any bonus or commission payments.

One of our insurers offers a Confirmed Income Option where you can prove your income upfront with payslips and accounts.

They guarantee to payout based on your proven income if your future income falls below this level.

e.g. you show an income of €60,000 and take out €45,000 income protection.

In 3 years, you claim, but your income has dripped to €30,000. Regardless, the insurer will pay you €45,000 annually for income replacement.

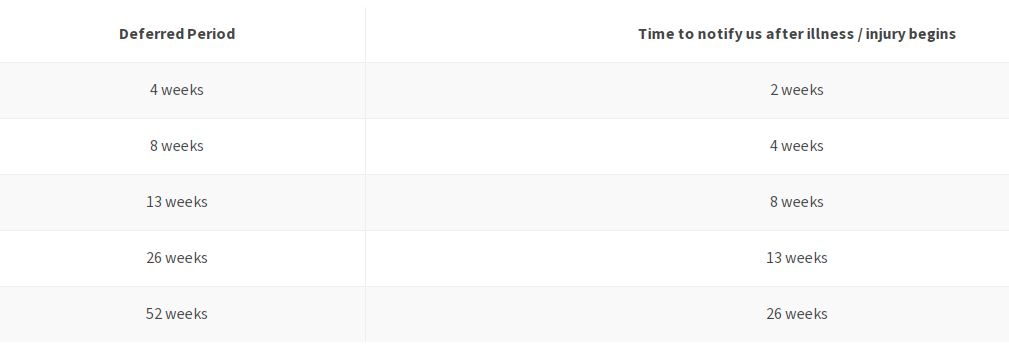

You must inform your insurer if you feel you cannot work for longer than the deferred period.

They will send you a claim form to complete and send a Medical Certificate to your GP.

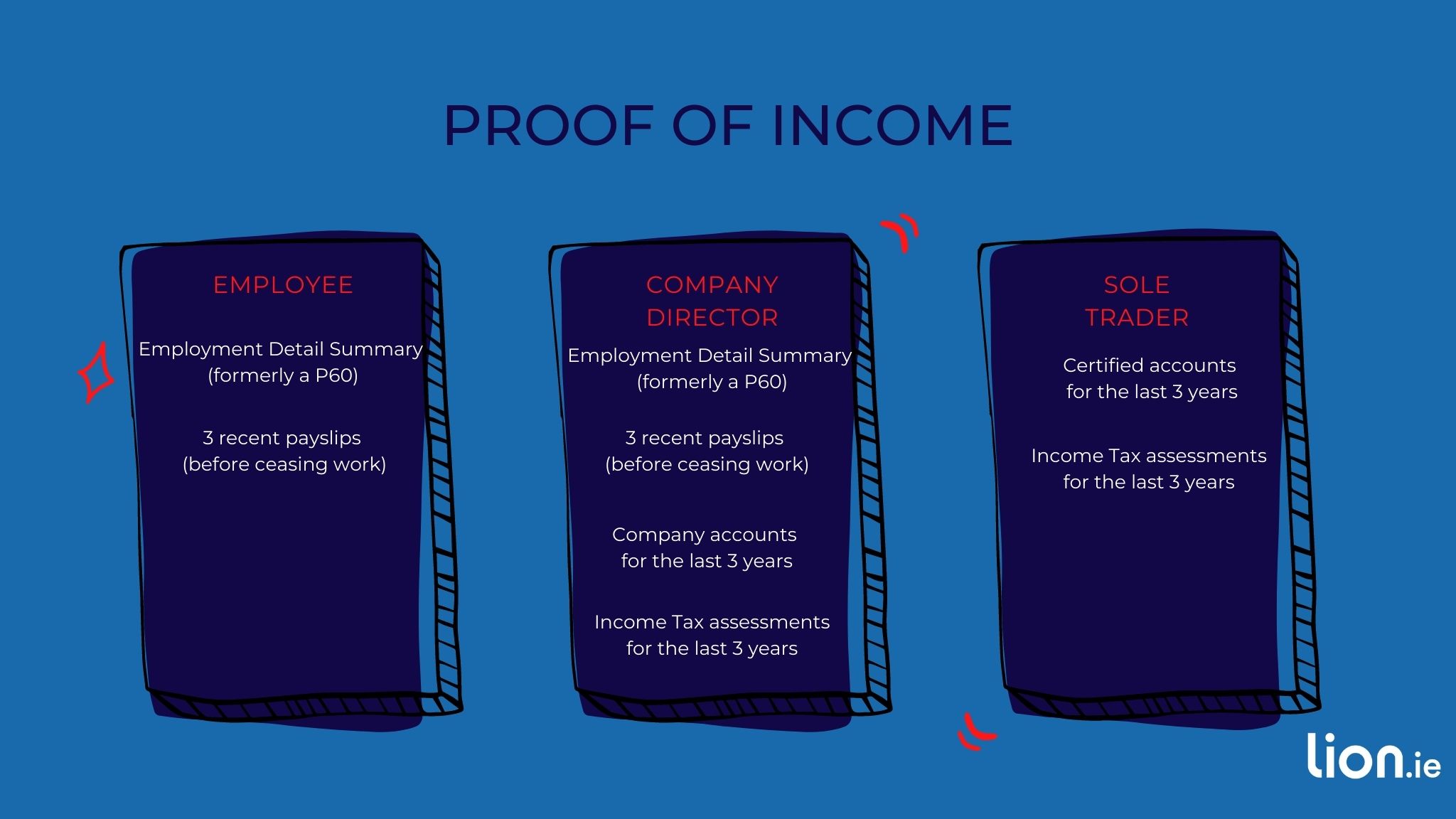

The insurer will not look for proof of income when you take out your income protection policy. However, should you need to make a claim, you will have to produce financial statements:

Once the insurer accepts your claim, they will send payment electronically to your bank account.

If you’re considering applying for long-term disability insurance, here’s what you need to know.

Q: What is income protection insurance? Income protection insurance is a type of insurance that will help ensure you’re protected if you’re ever disabled and unable to work for an extended period due to illness or accident. This type of insurance spans your entire working career, even after you can no longer work due to disability.

Read: How Income Protection Works in Ireland

Q: What kind of coverage can you buy?

You can choose a cover with a fixed premium that is guaranteed not to increase throughout your cover, or you can choose a reviewable cover:

Read: Reviewable v Guaranteed Income Protection

Q: What is the length of coverage?

The minimum period of cover is ten years, and the minimum ceasing age is 55. You can buy cover that protects you up to age 70, assuming you would still be working at age 70.

Q: Who is covered by a long-term disability insurance policy?

Just the life insured. If your partner or spouse needs cover, they will need to take out a separate income protection policy?

Q: How does tax relief work on income protection?

You can claim tax relief at your marginal rate on your income protection policy. Let’s say you get a quote online as Sarah did; you’ll see two figures:

Sarah will pay €94.36 per month, and then her accountant will claim 40% tax relief in her annual return.

Q: Are income protection payouts taxable?

As its replacement income, it is liable for income tax, PRSI and USC.

Q: I’m self-employed as a director of my own limited company. Can my company pay the premiums for me?

Yes, this is the most tax-efficient way to set up your policy, as there is no BIK for you, and the company can claim tax relief on your premiums.

Sole traders must pay their policy premiums from personal, after-tax income, but they can claim income tax relief at the marginal rate.

Q: Can I apply online without having to talk to anyone?

Yep, you can get a quote and apply online here. We can arrange your cover over email.

Q: Will I need to do a medical?

This depends on how much cover you need. Generally, if you insure more than €1000 per week, you must undergo a nurse’s medical screening.

Income protection is the foundation of any solid financial plan for the self-employed because if you pay Class S PRSI, you’re not entitled to any state support if you can’t do your job.

Your income will fall to a big fat ZERO.

Yep, we take all the risks, create employment, and pay shed loads of tax, but we don’t get the same benefits as everyone else who turns up and clock in for their 9-5.

If you’re seriously considering income protection and want some help figuring it out, please give me a shout.

Complete this income protection questionnaire, and I’ll be right back with a recommendation.

Alternatively, you can schedule a callback here, where I can answer all of your questions.

You’ll be so glad you did.

Talk soon

Nick

PS: We offer income protection from Irish Life, Aviva, Royal London and New Ireland, so you can be sure you’re getting advice on the whole market.

As Ireland's leading life insurance broker, we specialise in comparing the rates and policies from the top five Irish life insurance providers and offering the very best value quotes to suit the individual needs of our clients. Our expertise lies in finding a suitable insurance plan for those with specific needs, be it a particular illness, occupation or claim history, we've got you covered in every sense!

Watch our video