10-second summary: Income protection for solicitors replaces up to 75% of your income if illness or injury stops you working. Because solicitors (and barristers) are Class 1 professionals, premiums are low and you can claim 40% tax relief.

Editor’s note: First published 2017 | Refreshed November 2025 with updated Class 1 pricing, Irish claim data and tax-relief examples.Greetings, my learned friend!

Fun fact — I studied Law at UCD back in the late ’90s. Ten hours of lectures a week and the rest spent in the Student Bar 🍺.

Maybe that’s why I never became a practising solicitor — but it did leave me with a soft spot for those of you who did.

I still remember my friends complaining about how little they were paid starting out.

But now that you’re finally earning well, isn’t it time to protect that income in case life throws you a curve ball?

If you haven’t a notion what income protection is, read this first.

The State pays €244 a week in Illness Benefit — the same for everyone. If you’re earning €2,000 a week, that’s a 90% pay cut overnight. You’ve worked too hard for State Illness Benefit to be your safety net.

You’re a Class 1 profession — the safest category. That means cheaper cover than almost any other job, with full benefits for both physical and mental health claims.

Because you pay the higher tax rate, you can claim 40% tax relief on your premiums. A €150 monthly premium effectively costs €90 after relief. Here’s how the tax relief works.

Income protection can replace 75% of your salary (less any State benefit). On earnings of €80,000 a year, that’s an extra €47,312 on top of State Illness Benefit — or enough to keep the lights on, the mortgage paid, and the kids in clothes while you recover.

No sick pay, no State Illness Benefit — nothing. Without income protection, you’re one accident away from a 100% drop in income.

And if you’re a barrister? Same story. Self-employed, no safety net. Income protection can replace up to 75% of your average earnings if illness keeps you out of court — a lifeline when your income depends entirely on appearances.

Get a policy early in your career and you’ll secure lower premiums for life. Most insurers also let you increase cover by 20% every three years without new medicals. Wait too long and you’ll pay more simply for having another birthday.

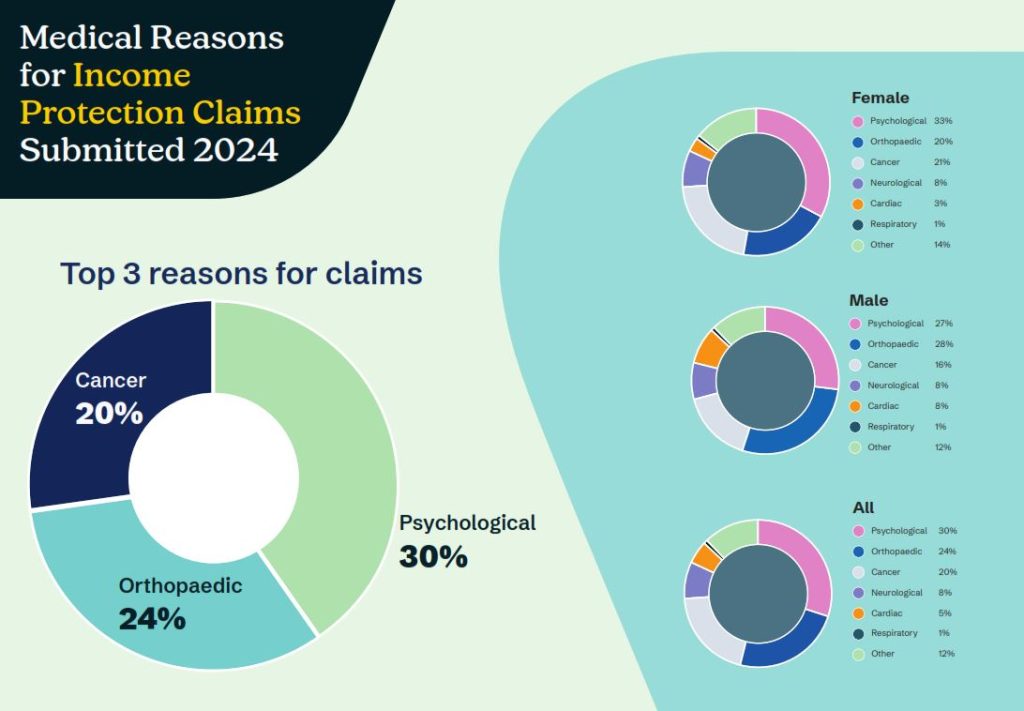

Mental-health-related claims — stress, anxiety, depression — now account for around 30% of all Irish income-protection payouts.

Did you know statutory sick pay is just five measly days?

Law firms aren’t exactly known for being generous with sick pay — most cover a week or two at best. Income protection lets you choose how soon your policy kicks in — as quickly as four weeks if you wish. This is known as the deferred period.

Having a policy is the difference between a safety net and freefall.

Switch firms, go in-house, or hang up the wig — your policy follows you. It’s attached to you, not your employer.

Ready to see your options? Get a personalised quote by completing the Income Protection Questionnaire — it only takes 2 minutes.

It’s easy to think, “It won’t happen to me.” But illness and injury aren’t picky. Averil Power, CEO of the Irish Cancer Society, recently noted that families affected by cancer face around €700 extra costs per month and an average income loss of €1,500 (The Journal, Jan 2025).

Let that sink in. That’s €700 more going out every month — with €1,500 less coming in.

That’s a swing of €2,200 every month until (or if) you can get back to work full time. It’s a brutal reminder that getting sick isn’t just about recovery time — it’s about financial survival too.

And it’s not just cancer — around 30,000 people in Ireland live with long-term disability after a stroke.

Medical advances mean you’re more likely to survive a serious illness than ever, but recovery often means months or even years off work.

That’s where income protection has your back.

Most Irish law firms are partnerships or LLPs, not limited companies, so each solicitor pays their own premium and claims the tax relief personally.

Absolutely. Your policy follows you — it’s tied to your occupation, not your employer.

Most insurers include a free Guaranteed Insurability Option letting you raise your cover by 20% every three years without medicals. You can also add indexation or claim escalation to increase your cover annually and your claim should you be unable to work long term.

No — it only covers illness or injury certified by a doctor. Redundancy, firm closures or being let go aren’t covered.

You know the law of contract better than most — and income protection is just a contract that keeps its promises when your body doesn’t.

It’s boring until it isn’t.

If you want to talk through options without the hard sell, here are my details:

📞 (057) 93 20836 | Book a callback here

Thanks for reading.

Written by Nick McGowan, QFA RPA APA (and BCL, since I finally found a use for it 💅)

Nick is a qualified financial advisor and founder of Lion.ie, an independent Irish life-insurance and income-protection brokerage based in Tullamore. He’s been helping clients get fair, transparent cover for 15 years — and was named Protection Broker of the Year 2022.

If you’d like straight answers (without the sales pitch), learn more about Nick here.

As Ireland's leading life insurance broker, we specialise in comparing the rates and policies from the top five Irish life insurance providers and offering the very best value quotes to suit the individual needs of our clients. Our expertise lies in finding a suitable insurance plan for those with specific needs, be it a particular illness, occupation or claim history, we've got you covered in every sense!

Watch our video