10-second summary: If illness or injury knocks you off work, income protection replaces up to 75 % of your salary until you’re back on your feet — or the policy ends. It’s your pay-cheque safety net, not a luxury.

Think about this for a second.

If you had a money-making machine in your house, would you insure it?

Of course you would — because you, dear reader, are that money-making machine.

Over your lifetime, you’ll generate hundreds of thousands, if not millions, of euro. If that machine breaks down — injury, illness, burnout — the money stops. That’s what income protection is for: keeping your pay-cheque alive when you can’t work.

Some people like to read, some prefer videos.

You do you, Boo.

If you like videos – here’s our Income Protection Explainer Video.

If you prefer to read, let’s crack on!

We all insure the car, the house, maybe even the dog — but not the thing that pays for all of them: your income.

Income protection steps in when illness or injury stops you earning. Learn more about how policies differ here.

It pays a monthly income after a short wait (you choose how long) and keeps going until you’re back, retired or hit the policy finish age.

No drama, just money in your account when you need it most.

Without it, your big safety net is the State Illness Benefit — €244 a week for at most two years… if you qualify.

If you’re self-employed?

Nothing. Zilch. Sweet FA.

For the self-employed, the only potential fallback is the State’s Invalidity Pension — but you’ll need to prove you’re permanently incapable of work for at least 12 months, and likely for another 12. You might have to show years of medical records and tax history to qualify. In other words, it’s no safety net at all. Income protection is your real-world backup plan.

Aviva’s numbers from 2024 show the average claim lasted 7 years 4 months. One person’s been on claim for 33 years.

That’s not bad luck — that’s life happening. Compare providers in Ireland.

If losing your pay-cheque would cause financial hardship, you need it.

And yes, that pretty much covers every person working in Ireland unless you have access to a trust fund, yaw.

Most private-sector jobs stop paying after a few weeks’ sick leave.

Public sector? It used to be six months full pay + six half. Now it’s three + three.

And if you’re self-employed like me, you’re on your own.

So, unless your mortgage, groceries and kids all agree to take a break while you’re off, income protection is essential.

You can protect up to 75 % of your gross income (minus any State benefits).

And here’s the good bit — you get tax relief at 20 % or 40 % on your premiums, so it costs a lot less than people think. See how tax relief works.

Take a 35-year-old on €60 000. They insure 75 % = €45 000 less state illness benefit of €12 688 = €21 062.

Premium ≈ €100 a month gross → €60 after tax relief.

If they’re off work for a year, that’s €21 062 extra income alongside €12 688 from the State.

That’s not pocket change — that’s the difference between “coping” and “crisis”.

When people compare income protection quotes, they often notice big price differences for what looks like the same cover.

One of the main reasons is whether the policy is reviewable or guaranteed.

With a guaranteed policy, the premium is fixed at the start.

It won’t change because you get older, claims increase, or the insurer changes its pricing strategy. As long as you keep paying, the price stays the same.

It costs more at the outset, but you know exactly where you stand long term.

Reviewable policies start cheaper.

The insurer reviews the premium at set intervals, usually every five years. At review, they can increase the cost, keep it the same, or reduce it.

In practice, reductions are rare.

The review is not based on your health or personal claims history. It’s based on the insurer’s overall claims experience across similar policies.

That means your premium can rise even if nothing about you has changed.

Because they transfer some long-term pricing risk back to the customer.

If claims across that block of business rise, premiums rise too.

For some people, especially those closer to retirement or working to a tight budget, reviewable cover can still make sense. For others, the uncertainty defeats the point of the cover.

It’s easy to get a policy.

It’s much harder to get the right one.

Reviewable versus guaranteed is one of those decisions that only really shows its importance years down the line, when changing or replacing cover may no longer be straightforward.

Good for you. So were most claimants. There’s a 30 % chance you’ll be out of work for 90 days or more during your career. You don’t have to be unlucky — just human.

€244 a week for two years. That’s day-to-day expenses money, not mortgage money.

If you’re self-employed, you get nothing.

Most don’t. Ask HR before you bet on it.

Our preferred provider Aviva paid 92 % of all claims last year.

If a doctor signs you off work, the insurer starts paying after your deferred period (4 – 52 weeks).

It covers every medically recognised illness and injury that stops you working.

It does not cover redundancy or deciding you fancy a sabbatical in Bali.

Think of it this way: if you were explaining income protection to a five-year-old, you’d say “Mum is sick and can’t go to work, so the people in suits are going to give her money to buy food and toys until she’s better.” That’s really all it is — your income keeps coming in, even when you can’t earn it yourself.

| Cover Type | When It Pays Out | Who It Helps |

|---|---|---|

| Life Insurance | When you die during the policy term. | Your family / bank. |

| Serious Illness Cover | Lump sum for specific listed illnesses (e.g. cancer). | You — one-off boost for bills & treatment. |

| Income Protection | Monthly income while you’re too sick to work. | You & your family — keeps money coming in. |

More detail: Income Protection vs Serious Illness Cover.

Many people are told they have income protection through a bank policy. In most cases, this is Bill Pay.

Bill Pay can help short-term with specific bills, but it does not replace your income, usually stops after a fixed period, and does not qualify for tax relief.

If this sounds familiar, it’s worth checking what you actually have before assuming you’re covered.

Most full-timers and the self-employed can get cover, but insurers still look at three things: your health, your job and your habits.

Chronic back pain or dodgy knees might mean an exclusion, and if your work involves climbing cranes for fun, expect to pay a bit more.

If you’re unsure, we’ll tell you straight. No nonsense, no hidden loadings. If you’re self-employed, read this.

If you’re hospitalised over seven days, many insurers start paying early.

In short: you handle the forms, wait out your period, and the insurer keeps your pay-cheque flowing.

Information cross-checked with Aviva Life & Pensions Ireland (2025 claims guidelines).

Some lucky ducks get group cover through work — usually big companies or the public sector.

But leave that job and poof — it’s gone.

A personal policy follows you wherever you go.

You own it, you claim the tax relief, and you don’t lose it just because you switched bosses. If you’re self-employed, here’s what to know.

A 30-year-old teacher on €45 000 pays around €40 net a month (after tax relief).

A 40-year-old engineer on €60 000 pays about €65.

A GP on €100 000 pays roughly €100.

It’s small money for big peace of mind.

Absolutely.

Your policy doesn’t have to stay frozen at the same amount forever. If your salary rises, you can increase your cover too — and there are three simple ways to do it.

Indexation doesn’t increase your initial premium, but it’s an optional benefit — you must include it when setting up your policy.

Each year, your premium increases by 3.5% and your cover increases by 4.5 %. It quietly keeps your benefit in line with inflation so your payout maintains its buying power.

Once it’s added, it runs automatically.

This option will increase your initial premium, but you’ll be glad you have it if you claim is lonmg term (remember the average duration of a claim at Aviva is 7.5 years)

Claim escalation doesn’t increase your amount of cover while you’re healthy, but once you’re out on claim, your payout will increase by 3% each year you’re out of work.

It’s designed to stop inflation from eating into your income during recovery — a small extra cost that can make a big difference over time.

This is an automatic free benefit built into most policies. It lets you increase your cover by up to 20% every three years without any new medical questions — so it’s a brilliant way to future-proof your cover.

You can use this option up to five times during your policy, effectively doubling your original cover as your earnings grow. When you exercise it, your premium will rise based on how much extra cover you add, the premium rates at that time, and your age when you increase it — but never your health.

That’s the beauty of the GIO: even if your health changes down the line, you can still boost your protection without a single medical question.

Quick recap: Indexation must be added at the start and keeps pace with inflation, claim escalation costs more but protects long-term claimants, and the Guaranteed Insurability Option lets you grow your cover over time — no medicals, no hassle, just higher peace of mind.

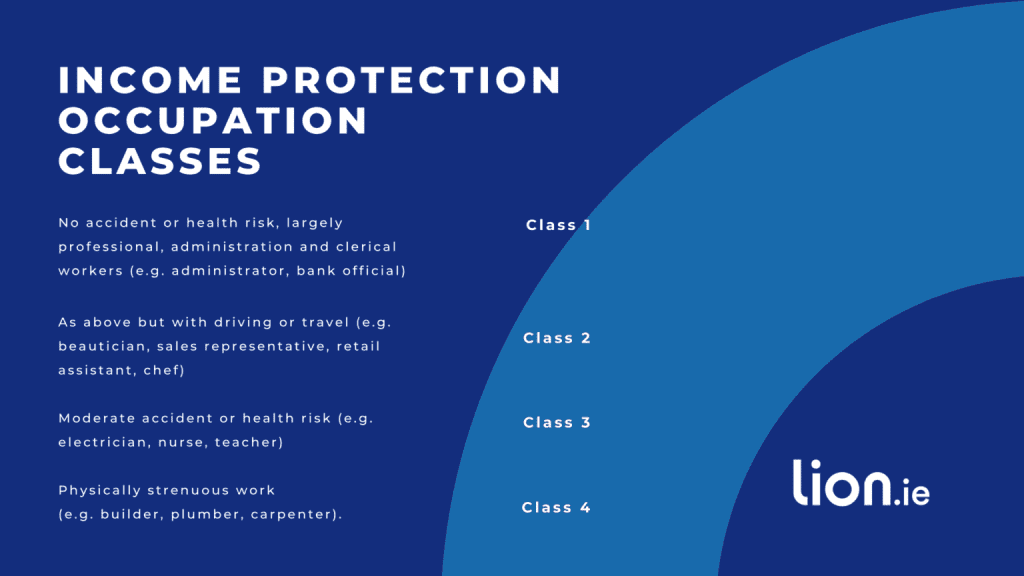

Insurers sort every occupation into one of four occupation classes. The higher the chance of a claim, the higher the class and the premium.

If your role lands in Class 3 or 4, the premium will be higher — or you might look at a Wage Protector plan instead.

Watch two short claimant stories from Aviva and you’ll agree that it’s the most important thing you can buy:

Marc’s story → |

Vanessa’s story

💬 Thinking about protecting your income? Start with our short Income Protection Questionnaire and get a no-obligation recommendation from a real human (me).

Editor’s note: First published 2020 | Refreshed February 2026 to clarify the difference between income protection and bank-sold Bill Pay.

Written by Nick McGowan, QFA RPA APA

Nick is a qualified financial advisor and founder of

Lion.ie,

an independent Irish life insurance and income protection brokerage based in Tullamore.

He’s been helping people get fair, transparent cover for over 15 years — and was named

Protection Broker of the Year 2022.

If you’d like straight answers (without the sales pitch),

learn more about Nick here.

I know what you’re thinking: why trust this guy? He’s just another insurance broker out to make a quick buck on other people’s misfortune.

That hurts maaaaan.

Scroll down to read some of our testimonials from our lovely clients. You won’t find a single bad one – and there’s a reason for that – bribery I mean, GREAT CUSTOMER SERVICE

Buying life insurance can be a frustrating experience. Our mission is to make buying a life insurance policy on the Irish market easier:

We’ll lay it all for you in plain English and give you helpful advice so you can get the right deal for you. Our goal is to make life insurance a little less drab and a little more fun.