Table of Contents

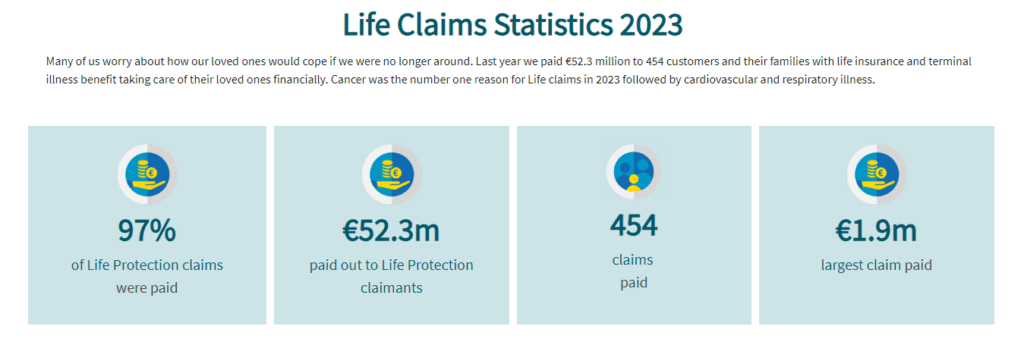

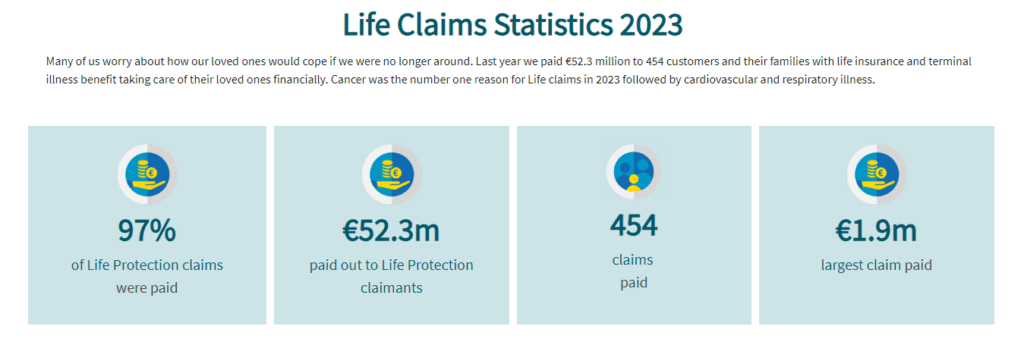

The thing about claims is that people have wildly incorrect opinions about them.

Even people with life insurance think it’s a bit of a con.

And I get it; I do: it feels like a gamble paying a faceless company a chunk of money every month, hoping your family get paid if you die.

But over 97 per cent of all Life Insurance claims are paid out—and if they’re not, it’s usually the applicant’s fault for lying on their application form.

When it comes to Income Protection, people out on a claim cannot work for an average of five and a half years.

Imagine having no income for that length of time.

Seriously, take a minute and watch your current standard of living crumble into tiny pieces all around you.

Income Protection, outright, is the best way you can protect yourself from whatever life throws at you.

No messin’, no foosterin’.

This insurance is worth its weight in gold because it pays you up to 75 per cent of your salary if you’re unable to work long-term due to illness, and the beauty is that it pays out UNTIL YOU GET BACK TO WORK.

It’s better than Serious Illness Cover (SIC) because SIC only pays out for a certain amount of illnesses.

SIC is a one-and-done tax-free lump sum, so when it’s gone, it’s gone.

You’d be surprised how quickly you’ll burn through said lump sum.

Remember, you must get a specific illness covered in your policy to qualify for a payout!

And, sure, Life Insurance is the biz – especially if you have kids – but it’s not really all that much use to you, the insured, because you have to die to receive it.

Which, you know, is a bit of a buzzkill.

I’d go so far as to say that Income Protection is even more critical than pensions, investments and savings.

You’re probably thinking, “Jaysis now, the insurance broker is making his pitch to get my money.”

And while I do like business and making money, the one thing you’ll see about the team at lion.ie is that we don’t do bullshit.

We’re not here to make a fast buck; we’re here to help long-term clients get policies that will actually protect them.

So, let’s look at this in real terms.

Joan is 45 and an accountant.

She’s got a lovely husband called Bill.

Joan is in an awful car crash and has health complications and depression.

Poor Joan can’t return to work, so she’s facing several years on the sidelines.

Her salary is €50,000.

Let’s say it takes her five and a half years to return to work (remember: that’s the average length of a claim).

She will lose €275,000 in earnings (that €50,000 x 5.5).

That’s a lot of money.

Realistically, it’s someone’s entire life.

It’s rent, the mortgage, bills, food, water, clothes, and all the fun stuff that makes life worth living.

It’s everything.

Most households can’t afford to take a hit like that.

Especially when State benefits are €232 a month…for two years.

Money is the last thing Joan needs to be thinking about.

She needs to focus on getting better, but unfortunately, money worries are taking a significant toll on her and lovely Bill.

It feels like everything is going wrong.

Sounds fairly grim so far, doesn’t it?

In reality, it was worse; Bill, bless him, gave up his own job to become a full-time carer for Joan.

Their income plummeted.

Thankfully they had cleared their mortgage already, accountants are a savvy bunch.

But what if Joan had Income Protection?

Bill could remain her carer, knowing a decent income was still coming into the house from Joan’s income protection policy.

Now, do we agree on how vital an Income Protection plan is?

If not, watch Marc’s story.

Sure, but they’re not nearly as good.

It’s like dreaming about a sports car Lamborghini and ending up with a pair of rollers skates instead.

Our pal Joan, being an accountant, is very good with money.

Her pay of €50,000 equals about €3,000 take-home, after-tax.

She has a considerable kitty of €50,000 saved.

Maybe she’s planning to use it as her pension, or perhaps she’s planning to circumnavigate the planet in a custom-built hot air balloon for two years.

It’s Joan’s money; she can do whatever she likes.

So, how long does this big ole nest egg last?

Just 1 year and 5 months.

And if you recall, the average length of an Income Protection claim is five and a half years.

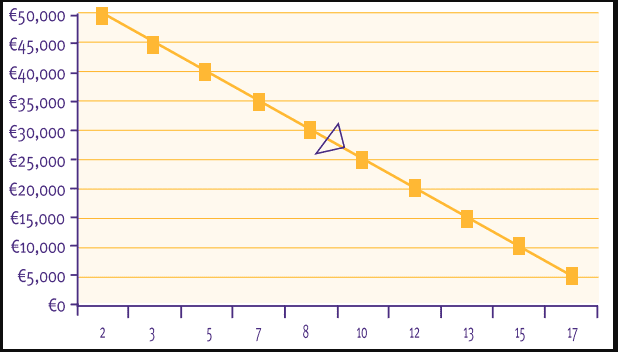

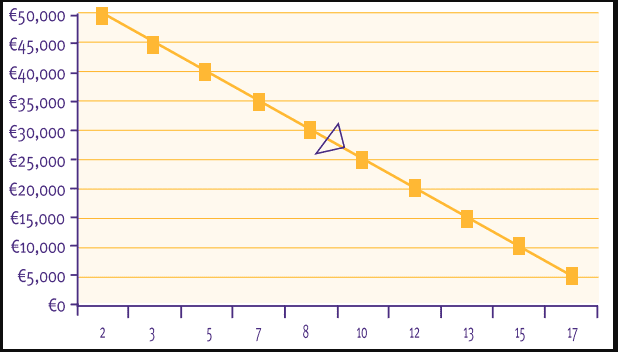

You know I mean business when I break out a beautifully drawn graph.

The y-axis is months, FYI.

€50,000 savings would last Joan for 17 months if she continued to spend €3k monthly.

Yes, she could probably make it last longer if she eked out a living.

But here’s the thing: she shouldn’t have to live frugally.

Beans and rice only become a reality if she doesn’t have Income Protection or appears on #IACGMOOHeeeere

The whole point of saving is to enjoy nice things.

Feck the rainy day fund; you’ve worked too hard for that, it should be a sunshine fund.

Insure against rainy days instead!

What’s the point of living if you can’t spend your hard-earned spondoolies joyfully?

Your savings shouldn’t be your replacement income.

That’s precisely what Income Protection is for!

This varies from company to company, so I suggest you buzz Helen in HR.

Off you go. I can wait.

Average sick pay entitlements

Running off to a cushy public sector job is your best bet, but even that well will dry up verrrrrry quickly.

Lol.

Our pals in the State are very good at looking out for themselves and not much else.

Just look at the housing crisis.

I mentioned this briefly earlier, but the State Illness Benefit is limited to €232 weekly.

And you can only receive it for a maximum of two years.

I mentioned this earlier briefly, but let’s tangle with this devil again here so you understand what you should do next. (In brief: go get yizzerself some Income Protection.)

All-caps, pals, because it’s crucial.

Some more reasons why they differ:

Here is more detail on the differences between Income Protection and Serious Illness Cover.

As you can see, the alternatives to income protection aren’t great, so I’ll leave you with this question:

Imagine you had a machine that could print money in your kitchen.

Would you insure it?

Of course you feckin’ would!

If you’d like me to make a recommendation and send you a quote for income protection, please complete this short questionnaire, and I’ll get back to you ASAP.

As for cost, let’s say our pal Joan wants to get Income Protection.

She wants to insure the full wedge of 75 per cent, with a waiting period of 8 weeks.

It’s around €55 a month, after-tax relief.

I bet you pay more for the Internet and TV.

Think about it!

Nick

Editor’s Note: We first published this blog in 2020 and have regularly updated it since

As Ireland's leading life insurance broker, we specialise in comparing the rates and policies from the top five Irish life insurance providers and offering the very best value quotes to suit the individual needs of our clients. Our expertise lies in finding a suitable insurance plan for those with specific needs, be it a particular illness, occupation or claim history, we've got you covered in every sense!

Watch our video