People search for “best life insurance in Ireland” because they want a straight answer.

They don’t want a lecture. They don’t want waffle. They just want to know who to go with and move on with their lives.

Fair enough.

I’ve been arranging life insurance for Irish families for nearly twenty years, and I can tell you this:

There isn’t one “best” life insurance company.

There’s the best insurer for your situation.

And that depends on more than just price.

Yes, price matters.

Of course it does.

You’ve probably already used a quote calculator and seen the prices lined up from cheapest to most expensive.

It’s tempting to just pick the lowest one and call it a day.

But life insurance isn’t like booking a flight. The cheapest isn’t automatically the smartest.

In real life, it usually comes down to four things.

Price. Obviously.

Policy structure. Does it have flexibility? Conversion options? Guaranteed insurability?

Underwriting approach. How will they treat your health history?

Claims philosophy. When something happens, do they pay fairly and promptly?

Most comparison sites focus almost entirely on the first one.

I spend most of my time thinking about the other three.

If you’re young, healthy and just buying straightforward life cover, the differences between insurers are usually small. In that case, price and flexibility often decide it.

If you’re arranging mortgage protection, Royal London have been very strong in recent years. Their dual-life structure and conversion options are excellent. But that doesn’t mean they’re automatically right for you, especially if you have any medical history.

If you’re combining life insurance with serious illness cover, Royal London tend to lead on product strength. If price is tight, Zurich is often very competitive.

For income protection, Aviva have been consistently strong, particularly on claims experience. That said, they can be stricter on occupation classes, so the “best” option can change depending on what you do for a living.

Notice the pattern?

The answer keeps changing.

The biggest mistake I see is someone applying directly to the cheapest insurer without thinking about underwriting.

If you have a high BMI, past mental health treatment, heart issues, diabetes, cancer history or even something minor that required monitoring, insurers do not assess risk the same way.

One might load you heavily.

Another might offer standard rates.

Another might postpone you.

And once you’ve been declined or postponed, that has to be disclosed in subsequent applications- it will follow you.

That’s why “best” is often less about features and more about strategy.

It depends on:

Where you are in life.

Whether someone relies on your income.

How much cover you need.

And importantly, what your medical history looks like.

If you’re completely healthy and just want the cheapest solid option, we can show you that quickly.

If you have anything in your background medically, the conversation changes. The best insurer is the one most likely to accept you properly first time, at a fair price.

If you want a side-by-side look at the main insurers in Ireland, see our comparison guide here.

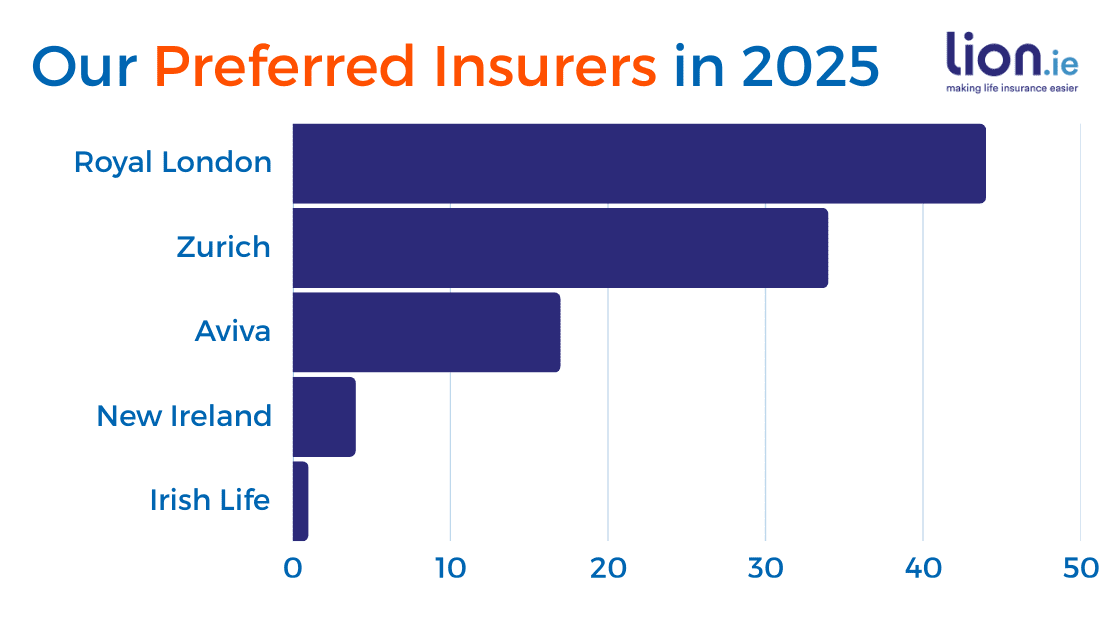

Below is the breakdown of where we placed business last year.

We’re the only broker to publish this every year because transparency matters.

It shows one simple thing — we don’t push one insurer. We match clients to whoever suits them best.

If you want someone to run through your situation properly and tell you which insurer makes the most sense, schedule a callback here or if you prefer email, fill in the short questionnaire here.

No pressure, just helpful guidance.

You don’t need to spend weeks analysing this.

It just needs to be set up properly so you don’t have to think about it again.

Thanks for reading

Nick

Editor’s note: First published 2018. Updated in 2026 to reflect current insurer rules and pricing structures and our preferred insurers.

Written by Nick McGowan, QFA RPA APA

Nick is a qualified financial advisor and founder of Lion.ie, an Irish life insurance and income protection brokerage based in Tullamore.

He’s been helping people get fair, transparent cover for over 15 years — and was named Protection Broker of the Year 2022.

If you’d like straight answers (without the sales pitch), learn more about Nick here.

057 93 20836

Ask a question

As Ireland's leading life insurance broker, we specialise in comparing the rates and policies from the top five Irish life insurance providers and offering the very best value quotes to suit the individual needs of our clients. Our expertise lies in finding a suitable insurance plan for those with specific needs, be it a particular illness, occupation or claim history, we've got you covered in every sense!

Watch our video