If you’re thinking about taking out life insurance, the question rattling around your brain my be

Does this stuff even pay out?

That’s normal, you’d have to be some sort of weirdo like me to trust an insurance provider.

Sure aren’t the feckers always on the look-out for a way-out of paying-up?

Try staying awake while reading through the T&Cs – clear as mud and impossible to decipher.

Have you ever tried to claim on house, car or travel insurance – a nightmare!

Thankfully the insurance providers are a lot fairer.

Yeah right Nick, you would say that.

Fair enough, I have skin in the life insurance game, but let me ask you a question:

Out of every 100 life insurance claims, how many do you think the insurers DECLINE/REFUSE TO PAY OUT on?

Take a guess, out of 100 claims, how many are rejected?

If you say 10, you’re wrong

Try again.

5 you say….you’re getting closer.

If you said 1 to 2, ding, ding, ding, winner-winner, chicken dinner.

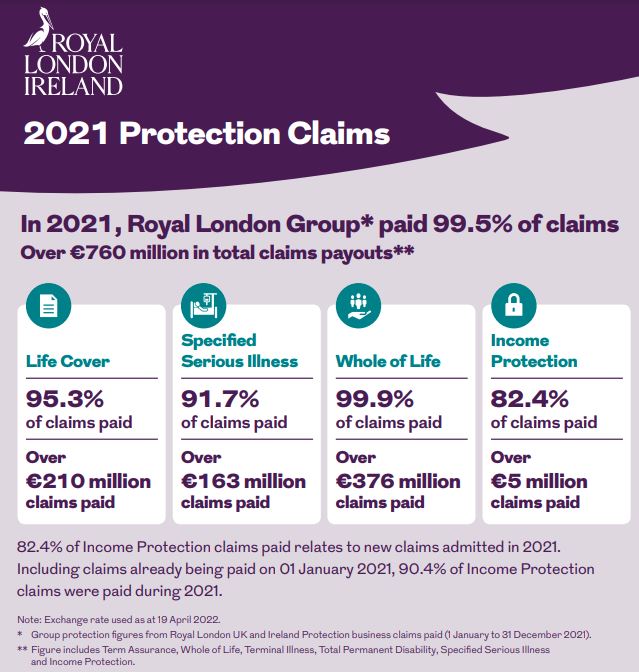

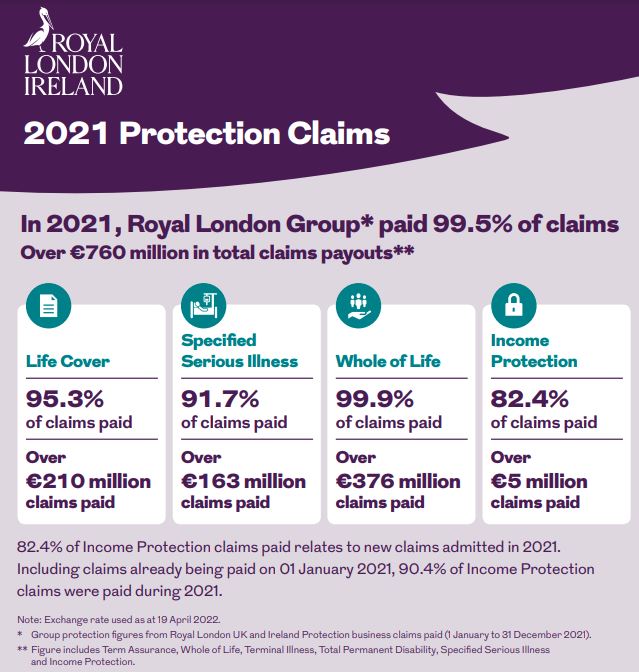

This means around 95% of all death claims are paid every year.

Look, it’s rare for an insurer to refuse to pay out on a death claim.

As the insurers love to say:

We pay 100% of valid claims

For the tiny proportion of life insurance claims that the insurers decline, there are two main reasons:

Non-disclosure (telling porkies, like saying you don’t smoke when your medical report says otherwise) or fraud (trying to pull a fast one) when applying for your policy.

An insurance contract is a “contract of utmost good faith”, which means that you must tell the truth, the whole truth and nothing but the truth.

You must disclose all facts that are “material” (relevant) to your application. This isn’t rocket science, simply answer all the questions on the application form truthfully and you won’t have an issue at claims stage.

If the insurer doesn’t ask you specifically about a health condition, you don’t have to disclose it. The insurance company should have made their application water-tight, if they didn’t and they reject your claim, we’ll see them in court (well, you won’t if you’re dead like, but your family will see them in court – you can just haunt them).

When you apply for life insurance with us, we’ll make sure you tell the truth.

We’re pernickety, punctilious, particular and pretty effing annoying when it comes to making sure you complete the application form correctly.

If you don’t feel the same, then we won’t be a good fit.

The last thing we want is an issue if you need to claim.

You’ll be gone, we’ll be left with the fallout. We’ll be there to comfort your grieving family and try to explain why you lied on your application form, and because of that there won’t be a life insurance payout so little Timmy will have to go working down the mine.

You buy life insurance to give yourself and your family peace of mind. Our raison d’etre (ooh la la) is to make sure that if the worst did happen, your family is protected, and if a claim is made, it’s paid out quickly.

If our process for making sure your cover is kosher adds some time to your application, we’re ok with that and I hope you are too…otherwise, you’re probably better off applying elsewhere.

What are material facts?

Anything that the dudes in the dungeon (underwriting) feel would affect their decision:

WARNING:

The insurer takes you at your word and won’t always double-check with your GP about the information you disclose. So don’t assume “sure it’ll be grand, my GP will tell them everything”. You’d be shocked at how little information is on your GP file especially if you’ve seen a few medical consultants in your time. Not all consultants send their reports to your GP.

If you don’t tell the whole truth, your application could be treated as void from the start, your premiums refunded and your life insurance claim rejected.

If you’re in doubt as to whether something is relevant, tell me and I’ll find out before you apply.

Fraud at it’s most basic level occurs when someone submits a fake life insurance claim.

It’s usually a deliberate act by the policyholder who is not, in fact, dead or terminally ill. Do you remember the Darwins?

Fraud is rare but can happen, examples include:

The insurers are experiencing a lot more non-disclosure in relation to alcohol consumption (COVID is driving us all to drink) so be careful when answering that question.

Sometimes I’m asked something along the lines of:

What if I lie about being a smoker but die in a car crash? Will my life insurance claim be rejected.

Probably not, but the insurer can decline if they want to, and believe me the stricter insurers will decline.

You see, it all goes back to “material facts”.

If the underwriters knew you were a smoker, they would have increased your premium.

The fact you were paying a lower premium gives the insurer grounds for voiding your policy ab initio (ooh la la part deux). It’s as if your policy never existed.

Insurers are in the business of paying claims so in this case because the non-disclosure was unrelated to the death, the insurer will more than likely make a full payout.

Not always.

There was a recent case of a client who took his own life.

The insurer found that he had a history of depression that pre-dated his application.

So depression should have been disclosed on his application form.

You might think that the insurer would automatically weasel out of paying the claim on grounds of non-disclosure.

But rejecting claims is bad for business, remember the insurers want to pay claims. They don’t want the bad publicity (nor the breakdown of the relationship with their broker) that goes with rejecting claims.

In this case, the insurer took the view that even though the client didn’t disclose depression, it was mild depression and wouldn’t have affected the premium had it been disclosed.

They paid the claim in full.

So you see, they’re not as bad as you think!

Life insurance companies are not out to reject claims, in fact, they’ll do all they can to pay life insurance claims.

Without claims being paid, what’s the point of having cover?

However, if you deliberately and fraudulently try to mislead the insurer, they will do all they can to fight the claim.

Leaving out information or not answering all the questions in full, honestly and to the best of your knowledge, could prove costly if you need to make a claim. Keep this in mind before completing your application and when checking your answers – there may be more information that, on reflection, you need to add. Better to include too much information than not enough.

If the information doesn’t affect your application – excellent, you will get cover at the normal price and can sleep soundly knowing your family are protected. Job done!

If your disclosure does affect your application, it also would have affected any claim had you not disclosed it. It’s better ti be aware of this before taking out a policy.

If you’re in doubt whether a medical issue in relevant, tell me, I’ll run it by all my insurers and we’ll apply to the most sympathetic.

Tell the truth, and shame the devil – that was beaten (literally) into me back when I was a gossun.

Keep it in mind when completing your application form.

You see, our expertise is in finding the insurer that will offer you cover with the least amount of hassle, at the lowest price.

If you have any doubts about which insurer would be best for your “disclosures”, complete this questionnaire and I’ll be right back.

Alternatively, if you’d like a quick chat first, please book a time that suits here

Nick McGowan

lion.ie | making life insurance easier

As Ireland's leading life insurance broker, we specialise in comparing the rates and policies from the top five Irish life insurance providers and offering the very best value quotes to suit the individual needs of our clients. Our expertise lies in finding a suitable insurance plan for those with specific needs, be it a particular illness, occupation or claim history, we've got you covered in every sense!

Watch our video