Let’s imagine you’re in the market for a job.

You apply to the first ad you see, and get called for an interview and ace it.

Happy days.

They tell you your salary but there are no negotiations allowed, take it or leave it.

Do you accept?

Or how about this: you apply for a whole load of jobs and get a bunch of offers.

Of the two scenarios, which do you think works out better for you?

Sure, the first job offer could be spectacular.

And maybe you’re about to be ridiculously well-paid to sit in a swanky office drinking coffee that George Clooney, swoon, may or may not have been in adverts for to fund spy satellites in Sudan.

Go George!

Or you could have just been sold a pup.

And the worst part?

You’ll be over the moon with this pup because you’ve nothing to compare it with.

That’s sorta how buying insurance works.

And it’s why you should go with a life insurance broker instead of taking the first offer from your bank.

But more on that in a second.

A caveat: I’m presuming the broker you choose to deal with is decent at their job; otherwise you’re back to square one.

A little secret of the trade, new internet friend: the banks are generally tied to one insurer. If you go with a bank, you’ll get a Life Insurance quote from that one provider.

Of course, if you go straight to an insurance company, they’ll also only give you one quote.

However, if you’re clever and you go with an Ireland Best Protection Broker (ahem, that’s us by the way, officially, we even have a trophy!), we’ll contact all our providers to make sure you get he best deal.

That’s Aviva, Irish Life, Bank of Ireland Life/New Ireland, VHI/Zurich and Royal London.

More choice = better value.

Life insurance brokers are also sound for passing on any discounts they get from the insurers. Insurers want lower costs and it’s cheaper for them to pay a broker compared to hiring full-time sales staff so they give us discounts to make it more attractive to use a broker.

Insurance is full of mumbo-jumbo jargon that sounds like it belongs in a technical manual or a dull novel like Harry Potter and the Curse of The Convertible Life Insurance Loadings.

Pageturners.

But seriously, do you know what indexation is? Or what a convertible option is?

If you don’t, a good life insurance broker will and they’ll break it down for you, until it makes sense – which is invaluable when you consider you’re about to sign a contract to spend several thousand euros in premiums over the next couple of decades.

You might only see it as €32 per month but that’s €14,700 over the life of the policy.

When’s the last time you spent the guts of €15k without seeking expert advice to make sure you were getting the best deal?

When you’re buying insurance, you’re not just buying insurance. You see, there’s a load of value-added extras that you haven’t even heard of.

For example, did you know you can get free access to a second medical opinion if you or your parents fall ill?

Or speak with a personal nurse advisor from day one of your policy.

Although all insurers do the basics well like payout on death or serious illness, they differentiate themselves by adding additional benefits to their policies.

Some are better than others, and that’s where your broker earns their coin. They will offer you the best cover from the most suitable provider based on where you are in life.

For example, we know that if you buy Serious Illness Cover on a mortgage protection or life insurance policy and assign it to the bank, THE BANK will get the pay-out if you claim on the Serious Illness Cover.

Yes, you read that right.

Yes, the banks never explain this to you.

Yes, there’s a word for them, and funnily enough, it rhymes with ‘bankers’.

Another secret some insurers will keep schtum about is the existence of Dual Mortgage Protection policies, where you can get TWO pay-outs. If you buy cover from certain insurers, it pays out on the first death only.

Yeah, I know, pretty morbid but look if you can buy a dual-life cover for the same price as a joint cover you would be crazy not to.

There’s plenty more where that comes from, so choose your broker wisely.

This leads right onto:

Will “because we’re the best life insurance broker” cut it?

Seriously though, buy Life Insurance where you feel most comfortable.

If that happens to be from a different broker, then so be it. We’ll be sad to see you go but relieved you’re buying cover somewhere. Just make sure you purchase cover somewhere!

So why us?

Not a whiff.

You’ve been on this blog for a couple of minutes, so you’ll have realised that we’re more straight-talking than your average insurance type.

So no bullshit; just truth.

Don’t waste your precious time setting up boring meetings with a financial advisor or sales guy from the bank.

It’s easy to arrange your Life Cover online.

Here you can do it at your own pace from your own place.

At home, at work, on the train – wherever you like.

Your run-of-the-mill Life Insurance broker will send you a long-winded paper application form by snail mail.

It will take ages to arrive.

Once it finally arrives, you have to complete it, search for an envelope, buy a stamp, find a postbox (in the rain) and send it back.

Then you cross your fingers and hope it gets there on time and that you’ve filled it in correctly. Good luck with that!

Once you’re happy with your quote on lion.ie you can:

Simple, quick and hassle-free!

You can “meet” us any day without leaving your home or office.

Just like Cathy:

Many thanks for all your help and assistance. You provide a very fast and reliable service and it was great being able to get everything done through email. I will be recommending you in the future.

However, if you prefer to speak to someone, we’re readily available. In fact, you can schedule a call here

Or, you can go ahead and get a quote right now if you like.

Not all brokers are created equal.

Some brokers will have their favourite provider who will get their business regardless of your circumstances as that’s the way they always do things.

Others will apply to the provider offering the cheapest quote even if you have any health issues so it’s unlikely you’ll get that quote.

And finally, some will go straight to the provider who pays the highest commission or bring them golfing in Abu Dhabi (I kid you not); these are the ones you should be most wary of.

Do you hear the faint sound of barking?

That’s the pup they’re trying to sell you.

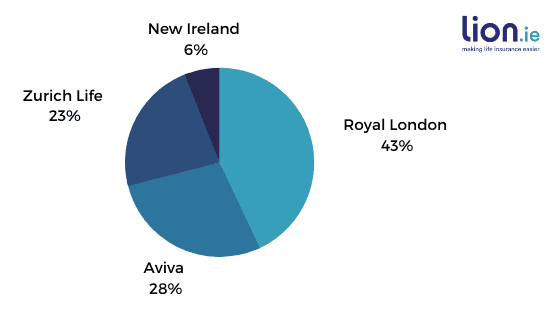

We’re the only broker who tells you exactly where we place our business. We do this every year. 2021 is here

Being small and unbiased means we focus on just one person: you. We go to all the insurers and get you all the information.

We’ll compare all the quotes available, explain the different options in plain English, and help you pick the insurer that is best for you.

Look, I’m not saying that banks and insurance companies are stocked by humanoid Area-51 escapees, but sometimes it feels like that.

You’ll always get to speak with a human here. No dial one for this, dial two for that nonsense and having to listen to god-awful hold music.

Sure jaysis you might be thinking, isn’t everyone award-winning these days?

All of our staff are qualified to give you the best advice on protection.

We know all of the products inside out because we focus on Life Insurance only, we don’t advise on pensions, investments or any of that malarkey.

Life insurance is tricky enough; if you’re not focused 100% on it, you will miss stuff.

We want you as a customer for life.

That’s why we offer lower premiums than other brokers.

We don’t try to get you in the door with gimmicky one-year discounts, then ramp up the price in year two.

We offer lifetime discounts.

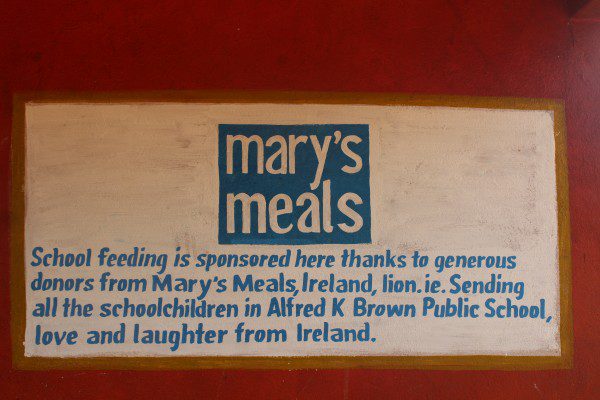

And if you’re feeling particularly squicky about the icky money movements going on here (I do still have to eat!), you’ll be happy to hear that for every policy you buy, we provide a school meal to a child every day for a year through Mary’s Meals.

So far, thanks to our customers, we have provided 493,115 meals to schoolchildren in the Alfred K Brown School in Liberia

Does that make you feel a little better about lining the insurance companies’ pockets?

Me too, pal, me too.

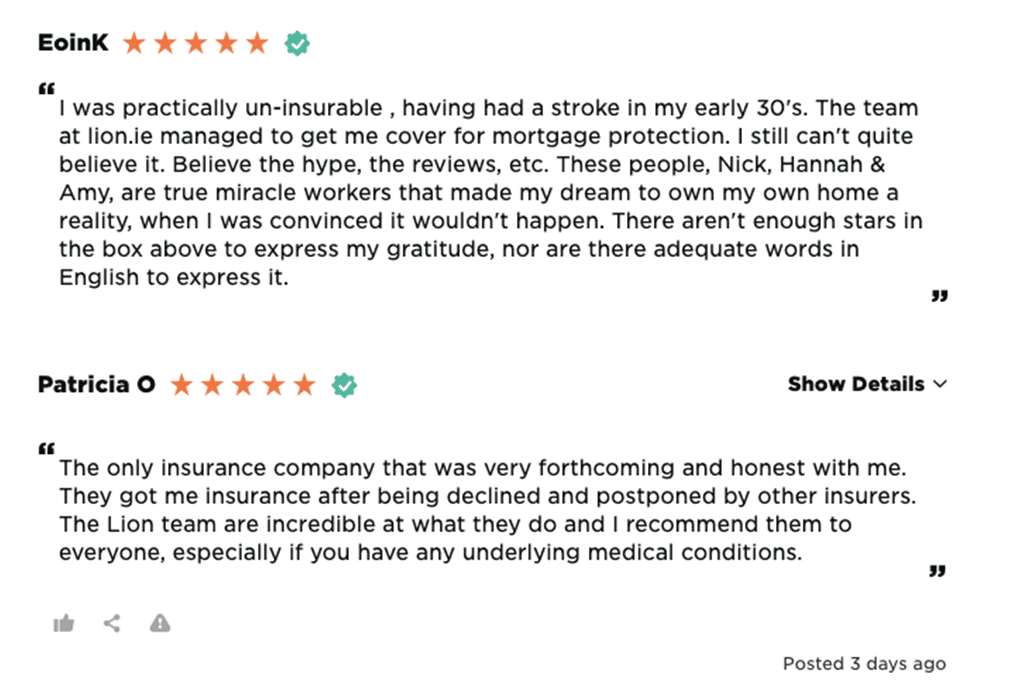

If you have a health issue, you’ll be glad you came to us.

We’re the specialists in placing more difficult Life Insurance cases and in doing so, have built strong relationships with the underwriters at the various Life Insurance companies.

If anyone can get you covered, we can.

Have a look through our testimonials to see how we have helped our customers get more complex cover. To save you a click, here are two testimonials from people we’ve helped who we’re particularly proud of:

That’s enough trumpet-blowing from me!

Why not have a nose at our free courses and guides?

Sign up for the one you’re most interested in and see what we’re really like.

The email course will give you a good idea of whether we’re a good fit.

If you’re looking for cover right now, please complete this questionnaire and I’ll be right back.

Chat soon

Nick

057 93 20836

Ask a question

As Ireland's leading life insurance broker, we specialise in comparing the rates and policies from the top five Irish life insurance providers and offering the very best value quotes to suit the individual needs of our clients. Our expertise lies in finding a suitable insurance plan for those with specific needs, be it a particular illness, occupation or claim history, we've got you covered in every sense!

Watch our video