Table of Contents

She walked slowly into the room and looked John straight in the eye.

“I’m sorry, but I have bad news…”

John heard the word “cancer” then his own thoughts drowned out the words tumbling from his doctor’s mouth.

“How long have I got?” he interrupted.

“It depends on how you respond to the treatment. All I can say for sure is that there’s a long and arduous journey ahead” came the solemn reply

“Will I have to give up work?”

“Most certainly”

John’s first thoughts, like the thoughts of any parent, were not of himself, but of his family. They were already struggling on one income.

Then:

How did this happen to me?

John was the classic “never sick a day in my life” sort of fella.

Granted he had put on a few pounds since he turned the big four-oh, and his diet wasn’t Olympian.

But cancer?

He knew there was something up but being an“ah it’ll be grand” sort of fella, he put a check-up on the long finger.

When his doctor referred him to the specialist, he knew something was up.

But cancer – not in a million years.

They had some investments, maybe enough to see them through a year of him not working.

He rang his financial advisor to see how quickly he could cash them in.

It wasn’t a conversation he was looking forward to.

“I don’t know how to put this but I have cancer and I’ll be out of work for a while so I need to get my hands on as much cash as possible as quickly as possible”

His advisor sounded as shook as John felt.

“I’m really sorry to hear that John, are you ok, sorry stupid question, gimme a minute and I’ll check your file”.

John heard some taps on a keyboard, more taps, a long pause then more tapping.

He had a horrible sinking feeling that something was wrong.

Had his investments tanked?

He hadn’t check them in ages but presumed they were ok.

“Is everything ok?”

he heard himself ask.

“John, you do know you have serious illness cover on your mortgage?”

Suddenly, John was swept back to a meeting with his financial advisor years previously when they discussed specified illness cover.

John had been very hesitant but his wife had pushed him into it.

“Does this mean…?”

“Yes, your policy will clear your mortgage. You can focus all your energy on beating this thing”.

And he did.

True story.

John is now 53, cancer-free and mortgage-free.

We all hate it.

We all know someone who has been affected by it.

We’re all at risk of it.

TMI alert!

Last year, I had to bring my goolies for an ultrasound, and I was bricking it. No matter how brave you are, when the technician squeezes that freezing cold gel on the family jewels and they pop up on screen, you mumble a silent prayer to whatever god you believe in that everything will be ok. Thankfully it was all clear.

The one thing that gave me comfort was that I’m insured out the wazoo (thanks to Hannah) so my family would be ok financially if something sinister had been found.

Anyway, back to the reason I wrote this here blog – how to make sure your family are ok should you get the big C.

You can look at cancer cover in two ways:

For some age groups, cancer cover is half the price of illness cover.

And as cancer accounts for around 80% of all serious illness claims, it’s worth considering.

Imagine you buy a serious illness policy that covers you for a rake of illnesses. You then take scissors to that policy and cut away all the illnesses until you’re just left with the cancer part.

That’s what cancer cover is.

It contains the same cancer cover as a standard specified serious illness policy…but at a much lower cost.

It offers a full payout for invasive cancer (cancer that has spread beyond the layer of tissue in which it developed and is growing into surrounding, healthy tissues) but also offers a partial payout for less severe cancers such as :

So let’s say you take out €100,000 cancer cover and get invasive cancer – the insurer will pay you the full €100,000 tax-free.

If your cancer is a less severe cancer and falls into the partial payment category the insurer will pay you €15,000.

As with all life insurance policies, knowing what isn’t covered is just as important as knowing what is.

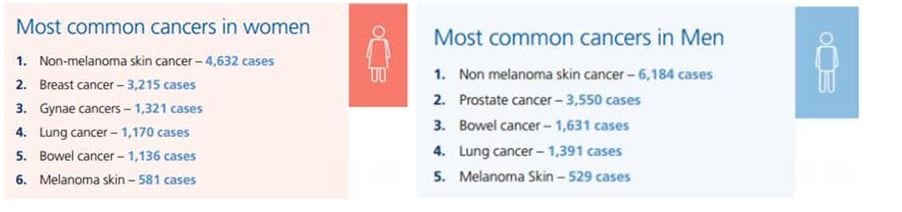

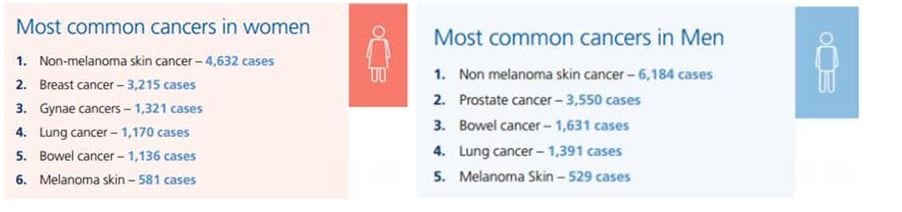

For example, Ireland’s most common cancer is non-malignant melanoma skin cancer. Because it’s usually relatively easy to treat and non-life-threatening, this type of less advanced cancer is not covered under the terms of the plan.

However, malignant melanoma skin cancer, a more severe form of skin cancer is covered.

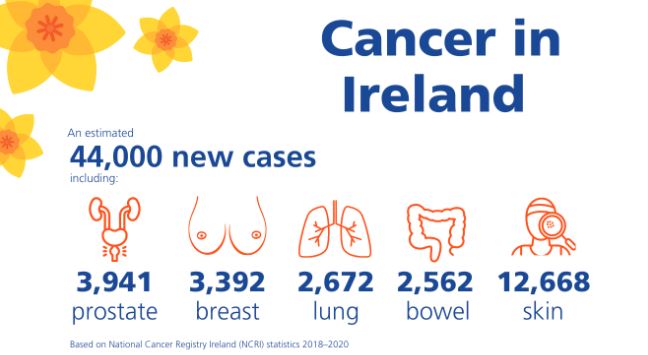

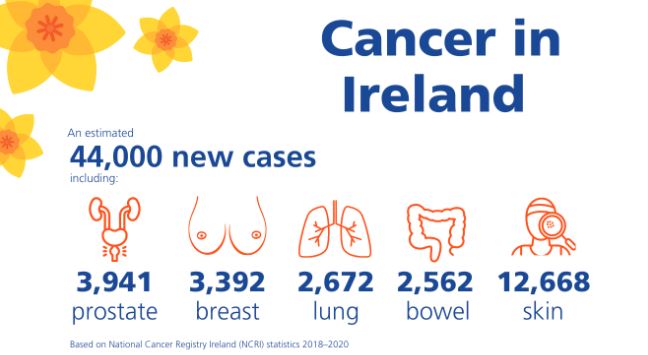

Every 3 minutes in Ireland someone gets a cancer diagnosis.

That’s one person since you started reading this article.

Every hour someone dies from cancer.

As well as being the toughest fight you will face, cancer is expensive.

When you’r enot working an earning an income, small things become a financial burden.

Think of a simple thing like hospital parking.

What if I told you it can cost up to €300 per month.

A report by the National Cancer Registry Ireland highlighted the severe financial implications of cancer on Irish families.

These include:

While we all understand the medical horrors of cancer, the effect it has on your financial situation is sometimes forgotten.

The report highlighted the increased financial stress and strain experienced by households where someone has been diagnosed with cancer.

All of this adds unnecessary worry, at a time when you should be focusing on your treatment and recovery.

The payout from a Cancer Cover policy will give you some financial breathing space so you have the option of returning to work when you feel you can, not because you need to in order to pay the mortgage and other bills.

According to Irish Cancer Society Director of Advocacy Rachel Morrogh:

Almost half of cancer patients say diagnosis hurt their career

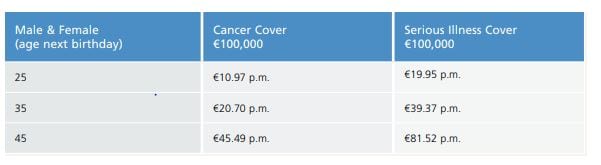

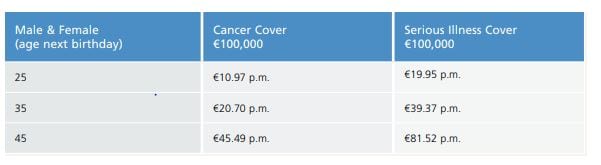

Now let’s look at how much Cancer Cover costs.

The good news is that cancer cover is affordable.

A 35-year-old with no health issues could €50,000 worth of Cancer Cover for just €20 per month.

That’s less than a fiver a week to protect future you.

Here you go!

As you can see it’s around 50% cheaper.

Survival rates for cancer are improving with over 60% surviving for more than five years.

But surviving cancer is expensive especially if your cancer has advanced to a stage where you’re no longer able to work.

Cancer cover is an affordable way of protecting yourself today from what could happen in your future.

One in two people in Ireland will receive a cancer diagnosis in their lifetime, a stark reality, but one that researchers across the island of Ireland are tackling with incredible results thanks to the support of leading charities like Breakthrough Cancer Research

I’m no Paddy Power but even I know those odds aren’t great for any of us.

Please schedule a call here if you’d like to know more, or complete this questionnaire if you’d like a recommendation on how you can best protect yourself.

Thanks for reading

Nick

lion.ie | Protection Broker of the Year 🏆

Editor’s Note. We first published this blog in 2018 and have regularly updated it since.

As Ireland's leading life insurance broker, we specialise in comparing the rates and policies from the top five Irish life insurance providers and offering the very best value quotes to suit the individual needs of our clients. Our expertise lies in finding a suitable insurance plan for those with specific needs, be it a particular illness, occupation or claim history, we've got you covered in every sense!

Watch our video