Table of Contents

Editor’s note: First published 2019 | Refreshed November 2025 with updated 2024 insurer data, real claim examples, and payout trends from Aviva, Zurich, Irish Life, Royal London, and New Ireland.

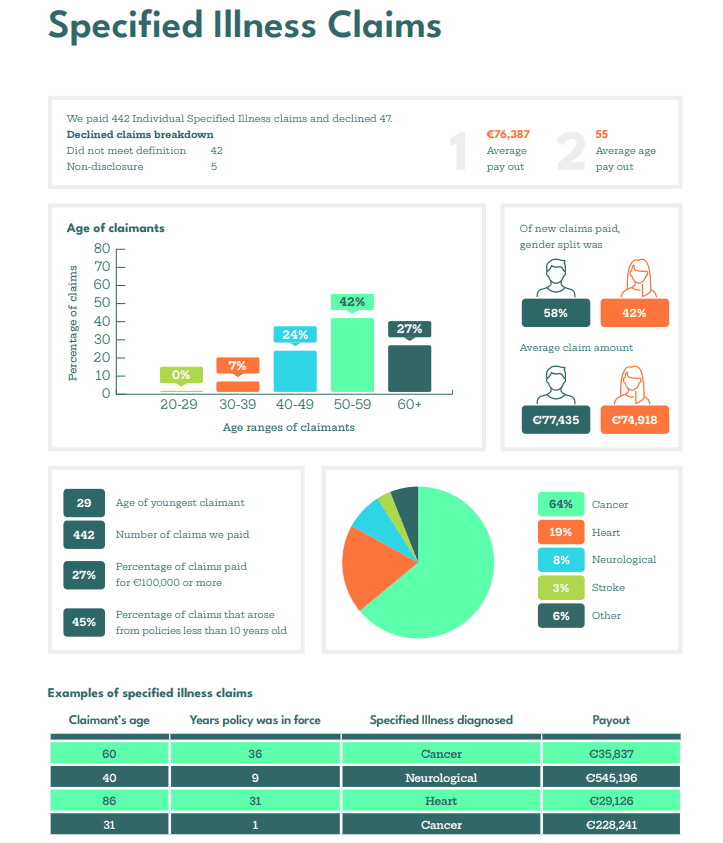

10-second summary: Around 90–95 % of critical illness (serious illness) claims in Ireland are paid every year. The few that aren’t? Usually, because the illness doesn’t meet the insurer’s definition, or something important wasn’t disclosed on the application.

You might have seen people online saying “critical illness never pays” — but in Ireland, the numbers tell a different story. Irish insurers do pay out most of the time. The key is meeting the illness definition and being upfront on your application.

When a claim does fail, it’s almost always for one of two reasons:

Let’s look at how Ireland’s biggest insurers handled real claims in 2024.

When you see consistent 80–95 % payout rates across every insurer, year after year, it’s clear these policies work when you need them most.

Cancer continues to dominate. In 2024:

Heart attacks and strokes follow, then neurological conditions like MS or Parkinson’s.

Serious illness cover mostly protects against the big, common conditions that upend families overnight.

Here are New Ireland’s stats from 2024

Every insurer has its own medical definitions. To get a payout, your diagnosis must meet that exact definition — not just sound similar.

Example: A policy might cover prostate cancer only if it’s above a certain Gleason score. Early-stage or low-grade forms could trigger a smaller partial payment instead of the full lump sum.

If you accidentally (or intentionally) leave out a medical detail that would’ve affected your underwriting decision, your claim can be refused.

That’s why we spend time going through your health history carefully before applying — not to be nosy, but to protect your future claim.

Real case: An Irish court upheld a woman’s MS claim even though she forgot to mention eye tests eight years earlier. The judge ruled it wasn’t intentional — and the insurer had to pay €95 000.

If your cover wasn’t in force at the time of diagnosis — maybe a direct debit failed or the policy was cancelled — the insurer can’t pay.

Most give you around 90 days to catch up missed payments, so check now and then.

If you ever need to claim, we’ll handle the paperwork and deal with the insurer so you can focus on getting well.

Critical illness (serious illness) cover works. Roughly 9 in 10 Irish claims are paid; the few that aren’t usually involve a missed definition or non-disclosure.

To see how life insurance payouts compare, read our Life Insurance Claims Guide.

Or if you’d like a second opinion before applying, fill out our quick questionnaire, but don’t be surprised if we recommend income protection over serious illness cover.

Written by Nick McGowan, QFA RPA APA

Nick is a qualified financial advisor and founder of Lion.ie, an independent Irish brokerage based in Tullamore specialising in life insurance and income protection. He’s been helping people get fair, transparent cover for over 15 years and was named Protection Broker of the Year 2022.

As Ireland's leading life insurance broker, we specialise in comparing the rates and policies from the top five Irish life insurance providers and offering the very best value quotes to suit the individual needs of our clients. Our expertise lies in finding a suitable insurance plan for those with specific needs, be it a particular illness, occupation or claim history, we've got you covered in every sense!

Watch our video