Table of Contents

Misinformation, white lies, little porkies, telling fibs, being economical with the truth, non-disclosure.

Whatever you call it, lying is lying, and you definitely shouldn’t be doing it if you are applying for a life insurance policy.

But why?

Surely a little lie isn’t a bad thing, right?

Wrong.

Because lying on your life insurance policy could leave you high and dry when you or your family needs help the most.

It is a biggie, so wait for it…

Lying on your life insurance policy = No payout.

Lying on your mortgage protection proposal form or purposely withholding information could lead to your insurer refusing to payout upon your untimely demise.

Meaning you could leave your precious family in the shit with no way of financially protecting themselves.

You will have wasted all those years of paying a monthly premium.

You would be better off saving up that cash in a disappointing savings account than throwing it at a life insurance policy you have told fibs to get.

Look, it’s a broker’s job, my job, to get you a life insurance policy, and it’s rare for an insurer to decline, although being rare doesn’t stop the heartbreak for that person.

Examples of automatic declines include a BMI of 50+, Stage 4 cancer, or a history of multiple suicide attempts/ideations.

Postponements are more common, and these are more a bump in the road than an outright no.

On that very rare occasion that someone is refused, it’s upsetting, especially if it’s because of something outside their control, like a congenital heart defect.

If every broker in town has tried to get you a life insurance policy and every single life insurance provider has shut their doors to you like the innkeepers on Christmas Eve, I really am sorry.

It sucks, and it’s rare, but if you need cover for a mortgage, you can always apply for a waiver if you can’t get mortgage protection.

OK, I feel your pain.

You’ve been honest, told the truth on your application form and were up front in asking for a waiver, and the bank still said no.

Is it any wonder why you are tempted to lie on your application form to get a roof over your head?

Look, I get it; you want to buy a house, you need a mortgage.

You need life insurance or a mortgage protection policy to get a mortgage.

And if certain circumstances in your life are stopping you, then it can seem the only solution is to lie.

Your only goal is to get a mortgage, so it doesn’t seem as big a deal.

But lying on your mortgage protection application to get a mortgage could have dire consequences for your family.

A life insurance or mortgage protection policy protects you, your family, and the bank in the unfortunate event that you meet your maker far sooner than anyone expected.

It’s a way of ensuring that your mortgage gets paid either way, that the bank gets their money, and that your home stays in the family.

You risk your family ending up without a home by lying on your life insurance policy.

When you pop your clogs, your mortgage won’t die with you. If your family can’t make the repayments, eventually, the bank will turf them out onto the street.

Maybe, maybe not. You could tell a little fib and get your policy paid out.

Then again, it might not be.

And if it’s just a tiny, unassuming lie, your best to let your broker know and let them decide whether it’s worth disclosing. They are the professionals, after all.

But let’s walk through what could happen in the event of a claim.

Johnny has a BMI of 49. He knows he can’t get mortgage protection but intends to lose weight in the future, so he completes his application using his expected weight.

Johnny gets covered based on a BMI of 39. All grand, mortgage drawn-down, everyone is happy.

Ten years later, Johnny has lost a lot of weight and is down to a BMI of 35 but passes away after a massive heart attack. His bank claims his policy.

The insurer requests a medical report from his GP that confirms Johnny’s BMI at 55 around the time he took out his policy. The insurer refuses to pay the claim. Unfortunately, Johnny’s wife can’t keep up the mortgage repayments and loses the family home.

Most life insurance policies are paid out every year.

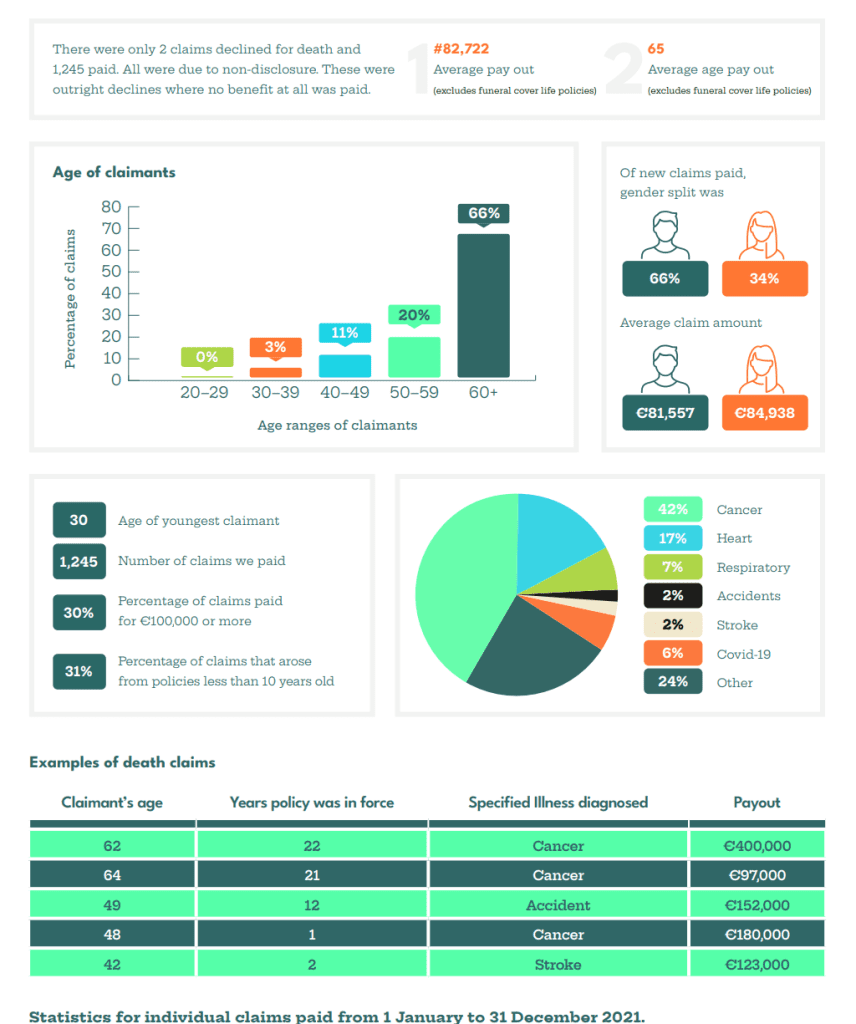

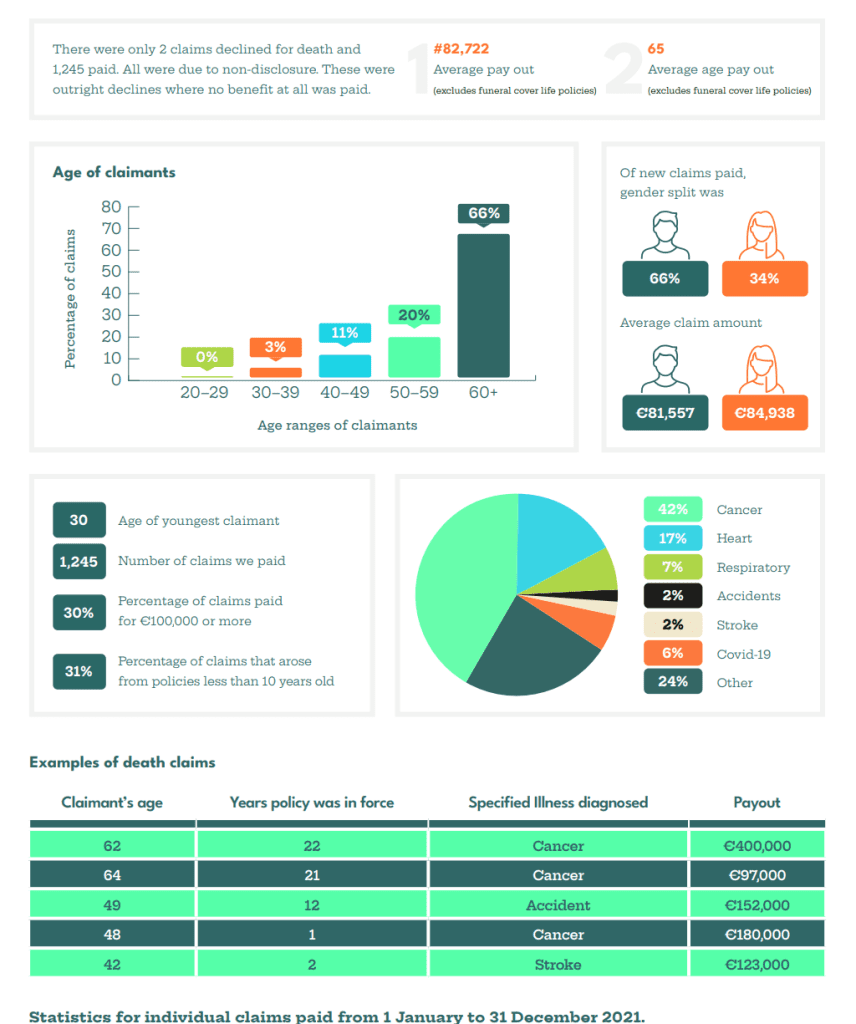

Last year New Ireland paid 99.84% of death claims. There were only 2 claims declined for death and 1,245 paid. All were due to non-disclosure.

Non-disclosure/misinformation/untruthfulness = Lying.

There’s no sugar coating it.

Barry’s a bollox and gives our industry a bad name.

If you trust a fella who says lying on a life insurance policy is ‘no big deal, then I wish you and your family the best of luck.

But I can tell you he doesn’t have your best interest at heart.

It’s no secret that we brokers get a little commission every time we get you to sign on the dotted line of an insurance policy.

Brokers like Barry love the commission. It’s the only reason Barry and his cohorts do this job until something better comes along.

Thankfully the Barrys of this world are few and far between.

Most brokers do this job because they enjoy helping people, not to line their pockets by fleecing you of your hard-earned cash.

Please get your policy the right way, so you and your family are protected.

We are PROTECTION brokers.

But hey, if Barry is the more appealing option, you do you, but believe me when I say that nagging doubt is always going to be there, lingering and festering in the back of your mind.

We have some clients who previously lied to get a mortgage, and they admitted the relief was palpable when we got them a real replacement policy that would actually pay out.

The likelihood of you being declined during your life insurance policy application is very low.

Nearly everyone can access life insurance or mortgage protection, even if their health is bad.

In those situations, you may have to pay a higher monthly premium for the peace of mind of that kind of protection.

For those who genuinely can’t get a life insurance policy without telling a few porkies, well, I’m really sorry.

I know it won’t be the news or advice you’re looking for but lying on a life insurance policy is worse than no life insurance.

The only difference is that with one, you are paying money for something that won’t work out in the end anyway.

If you can’t get approved, look at a high-yield savings account or maybe even start investing as a backup death plan.

That being said, if you go this route talk to a qualified financial advisor who can advise you on how to invest etc.

Because I have no idea how that stuff works!

So, if you haven’t got the hint yet.

Do not lie on your life insurance policy application.

I know this whole life insurance game can be overwhelming and sometimes a little confusing.

If this blog has set off an alarm bell and you want to talk it through, schedule a callback here

Likely, that thing you consider lying about isn’t as big of a deal as you first thought.

Thanks for reading

Nick

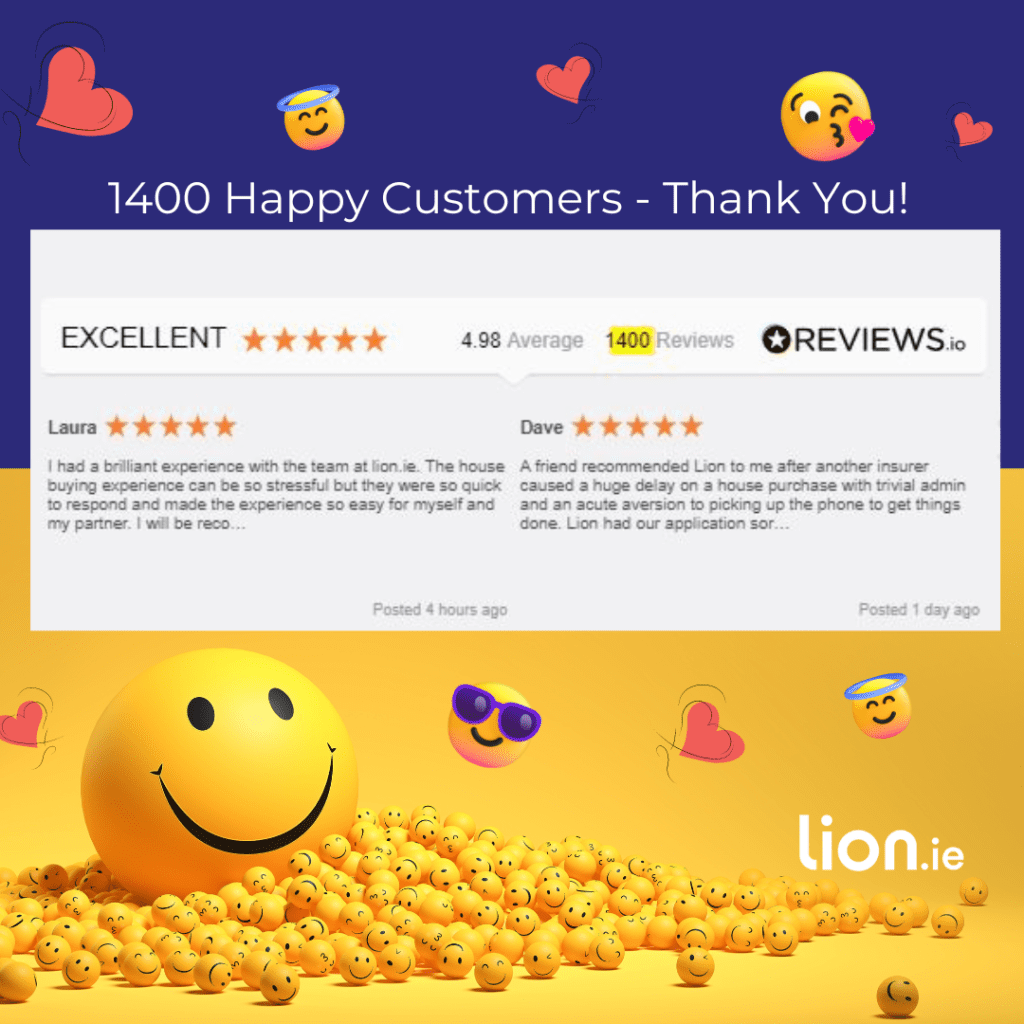

PS: We hit 1400 Reviews today. Round numbers make me happy. Thanks to the best clients in Ireland 🙂

As Ireland's leading life insurance broker, we specialise in comparing the rates and policies from the top five Irish life insurance providers and offering the very best value quotes to suit the individual needs of our clients. Our expertise lies in finding a suitable insurance plan for those with specific needs, be it a particular illness, occupation or claim history, we've got you covered in every sense!

Watch our video