Table of Contents

Once upon a time, Ireland’s entire housing market descended into a massive ball of fire.

I’m sure you’re familiar with it.

It’s what sparked the recession back in the late noughties.

The arse fell out of the market, and the country went into a tailspin that only really started to recover properly in the last few years.

You could easily blame the bankers and the government who’d seen foreign borrowings grow from €15 billion to €110 billion in 2004-2008 in rollover schemes to fund building projects that wouldn’t sell for several years (or sell at all, as the case may be).

The worldwide market crashed, and the Celtic Tiger let loose one last roar, keeled over, and died.

It was grim for a good few years.

One of the things that fell away, alongside property prices, was the habit of switching mortgages.

But switcheroos are back, and the banks are throwing money at you for your remortgage.

Money, money, money.

Or: switch and save.

When you take out a mortgage, you can do so on a variable rate (the interest rate you pay goes up at down at the lender’s command) or a fixed rate (your interest rate is fixed for a set number of years)

The idea of switching is to move your mortgage to a lender with a lower rate than you currently pay so you can save on the repayments.

Many lenders will also give you incentives to switch your mortgage.

In theory, it’s straightforward: move your mortgage money to the lender with the best rate and lock in lower monthly repayments.

You can indeed if you meet the key criteria:

The terms aren’t wildly different from how you signed up in the first place.

If you said ‘yes’ to all the above, you should be able to remortgage.

Of course, there are certain warnings you should heed as well – you know, the ones most people ignore, but that would scare the bejesus out of you:

Know what you’re getting yourself into because we all know what happened the last time we kept our blinkers on.

The truth is that switching can save money—but you must be smart about it.

The lowest rate is a 4-year fixed rate at 3.45% (you’ll need a B3 BER rating or better to qualify) from Haven.

Avant Money has the lowest long-term fixed rates in the market:

H/t to them for bringing competition to the market, which will spur the other lenders to drive down rates that are currently the highest in Europe.

To save you the hassle, I’ve reviewed the best remortgaging offers currently available. Some of them may well wet your whistle and get you to move. Obviously, terms and conditions apply, so read all the documents before you take the plunge.

Fixed rates are currently lower than variable-rate mortgages in Ireland.

Is that a sign that rates are on a downward trend – probably?

Haven offers the lowest 4-year fixed rate at 3.45% (you’ll need a B3 BER rating or better to qualify).

Avant Money has a 3-year fixed rate of 3.85% with no BER conditions.

Some lenders are offering cashback incentives to entice you to switch your mortgage, but generally, over the term of the mortgage, you will pay more if you take a cashback deal.

I would forego the cashback for a mortgage with a lower total borrowing cost over the mortgage term.

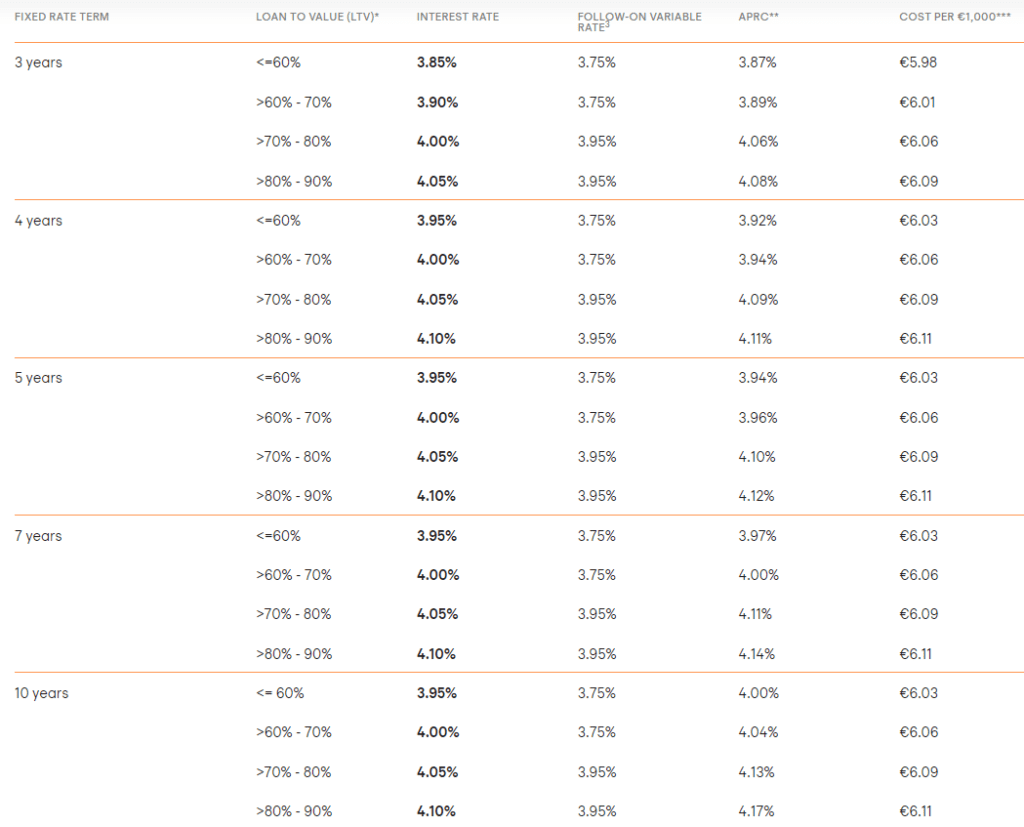

The first thing to do is to figure out your Loan to Value (LTV) ratio.

In simple terms, this is the amount outstanding on your mortgage as a percentage of the current value of your house.

If your mortgage balance is €200,000 and your house is worth €400,000, then your loan to value is 50% (200,000/400,000)

To get the current value of your house, you will need to get it valued, which will cost you €130/€150.

You can get the current balance on your mortgage from the bank.

Once you have the LTV, you can shop around for better rates than you currently pay.

Remember to check with your current bank, too, as they may match a rate on offer elsewhere.

This is especially true if your LTV is low; they want to keep these mortgages on their books.

Switching to a new rate with your current bank is quicker and easier than switching to a new lender – no need for a solicitor to get involved.

This all seems grand in theory, but do you remember the insurance policy you took out as part of your mortgage?

Yeah, you know your Mortgage Protection plan?

If you made the unfortunate mistake of taking it out with your bank, did they ever tell you what would happen if you tried to switch to another bank?

Sit back and listen up.

Like many things in insurance, it depends.

This time, it depends on two things:

If you had the nous to buy your policy from a broker/insurer, you can take it with you to the new lender

The premium and level of cover will remain the same.

You will need a “letter of no further interest” from your current lender.

You see, when you get a mortgage, the bank takes ownership of your policy by way of an assignment.

As the bank owns the policy, the insurance company can’t change it without the bank’s permission, hence the need for a letter confirming that the bank is okay with you moving your policy to a new lender.

Yeah, this can be painful.

Let me explain so you can be ready for it.

Imagine you have a mortgage protection policy with Aviva that you have assigned/passed ownership to AIB.

You want to switch your mortgage to Avant for their sexy new fixed rates and use your current mortgage protection policy.

However, AIB isn’t playing nicely.

They won’t remove their interest/assignment on your mortgage protection policy until Avant clears the current mortgage.

But Avant can’t proceed with your mortgage without mortgage protection.

From experience, the bank you are switching to (Avant in this case) will be happy to proceed as long as you provide evidence that you have an active mortgage protection policy in place.

They may also need a one-liner from your solicitor who promises to assign the policy to Avant as soon as AIB releases their interest.

If you bought a block policy, the bank will cancel it when/if you switch your mortgage.

So, you’ll have to apply for cover all over again, and it may cost you more, as you’ll be older than when you first took out the policy.

And if you’re not in good health, you’ll have to pay a higher premium, or you may not be able to get cover at all.

If you can’t get cover, you won’t be able to switch your mortgage.

You’ll be stuck with your current bank.

Scoundrels.

So you know, all that money you thought you could save, well, it might be about to get awkward…unless you have the right help.

Not all heroes wear capes, my friend.

If you need a new mortgage protection policy in a hurry, please complete this questionnaire.

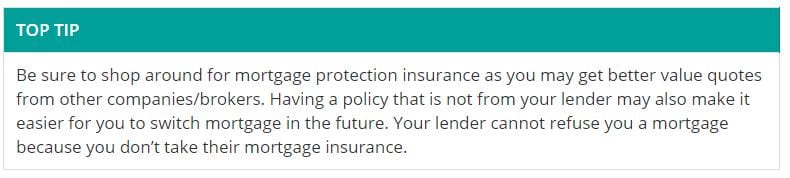

You can switch your mortgage protection anytime.

Even if you made a grave error and bought from the bank within 30 days of taking out your policy, you can cancel and get your premiums refunded (provided you give a replacement policy to the bank)

You can switch insurers outside of 30 days without penalty, and the bank can’t stop you.

From the Consumer Protection Website:

If you take out a new policy, you will have to re-apply and answer health questions.

For this reason, you should never cancel an existing policy until you have a replacement policy ready to go.

Just in case, like.

Recap time!

You can take that policy to your new lender if you’re switching mortgages and have existing Mortgage Protection bought from a broker.

However, if you bought a block policy from your bank, they will cancel it, so you need a new Mortgage Protection policy.

This time, if you are switching mortgages, be clever and buy your mortgage life insurance from a broker so you don’t get caught again.

If you don’t have a trusted broker, I’d be happy to help you sort out your cover.

Complete this short questionnaire, and I’ll be right back with a quote.

Or if you prefer, call us on 05793 20836.

Thanks for reading

Nick

Editors’ note : We first published this blog in 2022 and have updated it since

As Ireland's leading life insurance broker, we specialise in comparing the rates and policies from the top five Irish life insurance providers and offering the very best value quotes to suit the individual needs of our clients. Our expertise lies in finding a suitable insurance plan for those with specific needs, be it a particular illness, occupation or claim history, we've got you covered in every sense!

Watch our video