Table of Contents

You’ve probably already seen social media posts and reel containing not-very-helpful money management advice.

This sorta stuff:

But here’s the thing: it’s all good advice.

You could save hundreds a year if you live like that.

But you could also save thousands if you swap to a Breatharian diet and live on water and air.

And no, I didn’t just make that up but of course, someone did.

Money management is stressful.

It’s even more stressful if you’re living with a chronic illness.

The truth is that everything is a bit more difficult with a chronic illness: all the doctor’s appointments and treatments; flare-ups; time off work; and stress.

So today I’m skipping all the ‘ditch takeaways’ budgeting advice and filling you in on what you need to know about managing your money if you’ve got a long-term illness.

Your Insider Guide To Illness Benefits And Surviving Time Off Work

Dealing with a long term illness can feel like a job all of its own – especially during a flare-up where you might be exhausted or stressed or in constant pain.

You’ll have a rota of medication and treatment and doctors to go to.

You may have to take time off work, or you may not be able to work at all.

It’s a scary thought – and the information available online can be confusing to wrap your head around.

A lot of it is wrapped up in mumbo-jumbo about means tests and PRSI and qualified adults.

Which doesn’t really mean anything to most people.

On top of that, the different state benefit payments all have different terms and conditions.

The basic types of payments are:

That’s from my blog about illness benefits and surviving time off work.

I take a look at the options, some of the terms and conditions, and how to apply right there.

As well as that, the HSE also has a Long-Term Illness Scheme that lets you get certain drugs, medicines, and medical and surgical appliances for free – though it only applies to the following illnesses:

The medical card is another option, though it’s means tested too.

As a final tip: if you have chronic pain and you have a compensation claim or Income Protection Policy claim in or you’re looking to get help with social welfare, make sure you go to a doctor who has the right training in pain medicine.

Otherwise, it’s a bit like going to see a chiropractor for a headache – so it could make it harder to get any forms filled in, compensation, or the right help.

I know. I know.

Captain Obvious reporting for duty.

A pleasure to be of service.

Remember what I said about ditching coffee and changing broadband provider and all that stuff?

Helpful, yes – but not exactly all that specific to you.

A chronic illness means you’ll have to budget for things you wouldn’t otherwise have to, which is what I’m talking about here.

Maybe you have to change your diet or switch to expensive organic food.

You might have a hormone-related illness, so you might need to change products entirely and buying in bulk could be cheaper.

Likewise, you’ll absolutely need to budget for appointments and any treatment expenses, as well as other appointments like with a nutritionist, counsellor, or specialist.

Lastly, you may need to budget for your time – essentially, time off work.

Hopefully you work for a business that has flexible hours, but for most people that’s not really an option so you’ll need to account for that by keeping some money tucked away.

We’re all about honesty at lion, so I’m going to start by telling you that the banks and insurers make it harder for you to apply for cover if you’re chronically ill.

Insurance is all about risk and in their eyes, you’re a riskier case to them.

But!

That doesn’t mean you can’t get cover.

I’m also going to tell you right now that you probably won’t be able to get Income Protection, without an exclusion for your current condition.

But all other illnesses that may prevent you from working are covered. I

know that sucks but them’s the rules.

Serious Illness Cover (a tax-free lump sum paid to you if you fall ill with one of the illnesses covered in your policy) is also trickier as you can’t get cover for the illness you have but again, you’ll be covered for everything else.

However, you should still be able to get Life Insurance and Mortgage Protection, which should come as a big relief if you have or are planning on having a family.

I’m not just saying this to hawk you a crappy insurance deal.

I’ve worked with hundreds of people like you who struggled to get insurance because of an illness.

Some of them had been declined or postponed or were getting quotes that were way too expensive.

See, the insurers all treat different illnesses differently.

Let’s say you have MS but are in remission.

One insurer might give you an entirely different quote to another.

All the insurers treat illnesses differently.

Likewise, the banks only work with one insurer (and most of them work with the same insurer) so if you go to your bank, your chances of getting a good deal are much lower.

Same if you apply directly to an insurer like VHI or Laya.

Now, no one has time to go all of the insurers and wade through different quotes and policies.

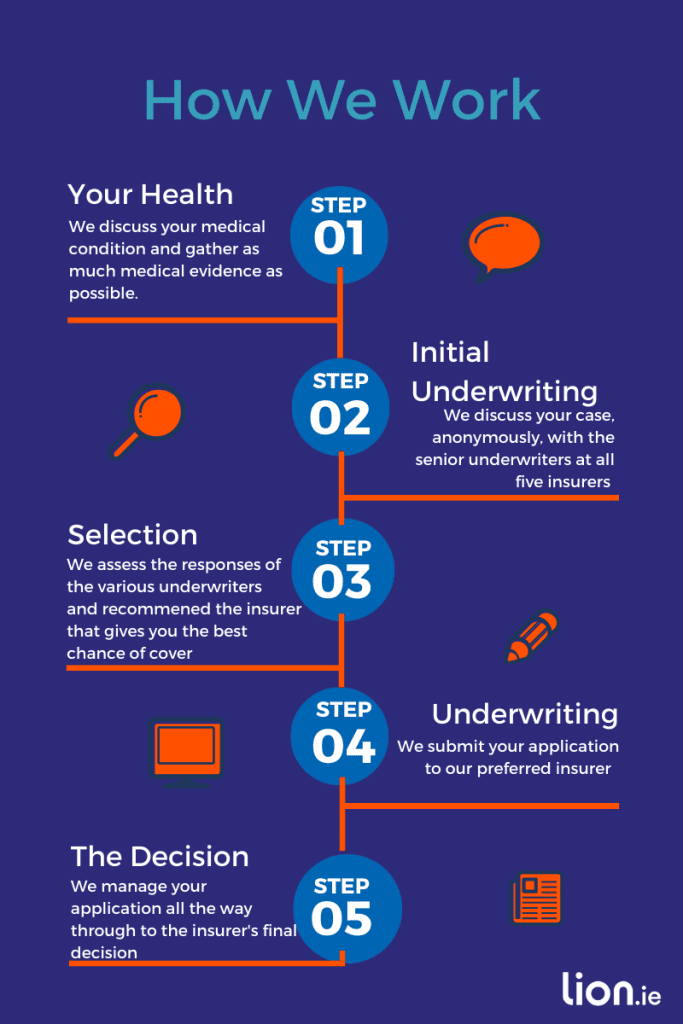

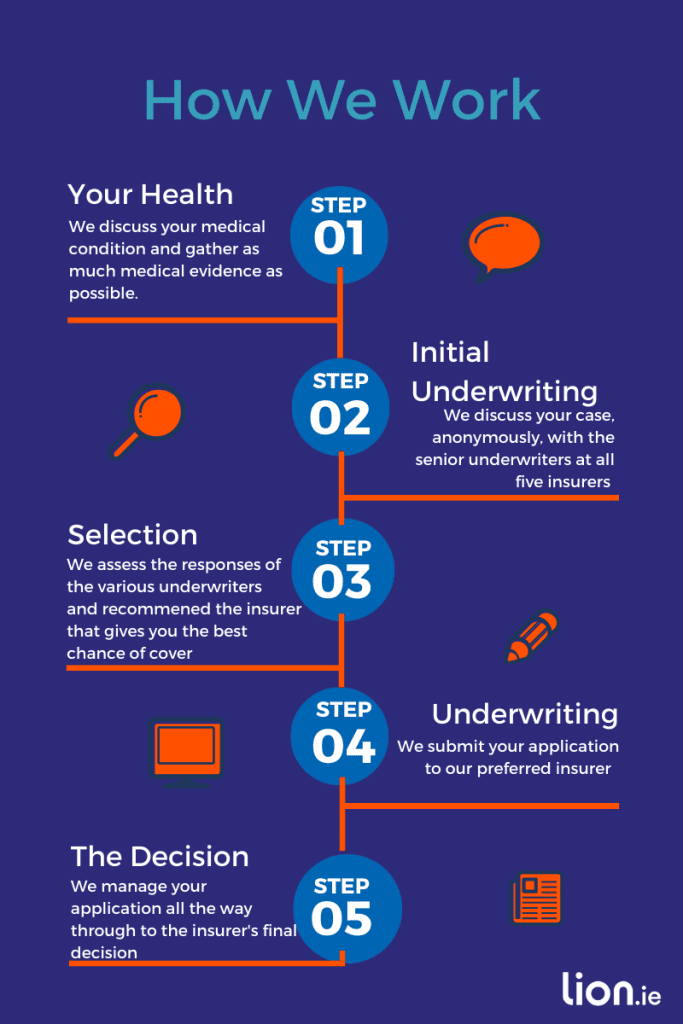

That’s where a broker like me comes in.

I’ll take on your case, we can have a chat, and I’ll go to the insurer that I know is the most sympathetic towards your illness.

That way you’ll get the best deal for you.

Life with a chronic illness is stressful enough; getting cover shouldn’t have to be!

Don’t let your health condition discourage you from applying for Life Insurance or Mortgage Protection.

Cover is available if you do your homework and use a specialist broker who can deal with all of the providers.

That’s why we’re here, to guide you through the whole journey.

From beginning to end.

There are quite a few insurers in Ireland, which means that you could spend ages stuck on the phone, pressing one for this, two for that, feeling your life slowly ebb away.

And when you finally get to speak with someone they haven’t a clue about how your condition will affect your application.

They’ll send you a 20 page form to complete, cross their fingers and hope for the best.

Instead, let us do all of that hard work for you.

Calling us is like contacting all the insurers at once.

Where else can you get this kind of 5 star service?

I’m here waiting to help you.

The next step is to either fill out this questionnaire or give me a call on 05793 20836.

Thanks for reading

Nick

lion.ie | making life insurance easier

Editor’s note. We first published this blog in 2018 and have regularly updated it since.

As Ireland's leading life insurance broker, we specialise in comparing the rates and policies from the top five Irish life insurance providers and offering the very best value quotes to suit the individual needs of our clients. Our expertise lies in finding a suitable insurance plan for those with specific needs, be it a particular illness, occupation or claim history, we've got you covered in every sense!

Watch our video