Table of Contents

Sometimes finding information on illness benefits from government benefits websites can feel a bit like a hero’s journey straight out of your favourite fantasy novel.

Start on one website, end up on six different ones.

Finally, land on a page that’s meant to help – and yet you’ve still no idea what counts as a qualified adult and what all the numbers in front of you mean.

All you want to do is figure out what you get if you get sick!

So we’ve worked hard to make understanding it a lot simpler for everyone.

We’ll begin with the obvious: to be eligible for social welfare payments because you’re sick or have a disability, you first have to be certified by a doctor.

You can’t just wander into your local social welfare office and presume they’ll know what to do with you.

The options available to you will depend on how long you’ll need to recover; for example, a couple of weeks versus a year or longer.

Some social welfare payments are based on your PRSI contributions (the ah-heeeeeeere-but-has-to-be-done payment that automatically comes off your earnings and goes towards the Social Insurance Fund/social welfare).

If you don’t have enough PSRI contributions (for example if you’ve been out of work to raise your demon spawn have a family), other options exist that depend on a means test/an examination of how much you’re earning.

The basic payments are:

Each type of payment has different factors and pays different amounts; they also take into account if you have a dependent spouse/civil partner/cohabitant (the sexiest of all terms for your other half) and any dependent children (The independent ones get ignored).

Joking aside, a dependent kid is one who still lives at home, leeching off you, and is younger than 22 usually. (Mostly joking aside, anyway)

To make that clear as mud:

Unqualified adults need not apply. (Ba-dum-tish.)

This bit is gentler on the brain; it’s also probably what you’ve come here for.

Payment.

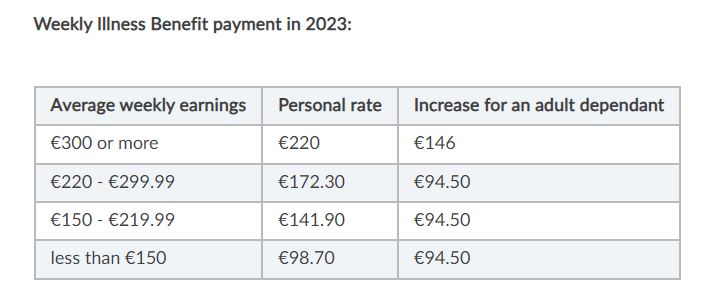

Illness Benefit rates are determined by your average weekly earnings in the relevant tax year.

So this is your total gross earnings (no deductions) in the relevant tax year divided by the number of weeks you worked.

That number determines the payment you’ll receive.

So let’s say you’re out sick and your other half counts as a qualified adult. You’ll get the €220 plus the additional rate.

Any Illness Benefit will be paid into your bank, building society account, or to a Credit Union that allows for Electronic Funds Transfer.

So just don’t expect them to hand it to you in person so you can stash it under your bed.

With the exception of increases for your child dependents, Illness Benefit is considered to be income for tax purposes so it’s taxed by reducing your tax credits and rate bands.

The application process for Illness Benefit is fairly straightforward:

Just keep in mind that you’ll need to see your doctor to get a MED1 medical certificate each week for as long as you’re ill or until you’re told that you don’t need to.

Why, yes, as it so happens: there is another option.

So you’ve probably read through all of this and got to the part with the numbers and seen that it tops out at €220 for the personal rate – and a few more quid if you have dependents.

You’ve probably read that and had a moment of contemplation.

That’s not a lot to live on.

Which is why insuring yourself makes sense.

Think about it: most employers don’t cover sick pay (or if they do, it’s for a couple of days).

And you now know Illness Benefits are fairly mangy.

Income Protection could be a life-saver for you if you’re out of work long term due to illness.

It will continue to pay you up to 75 percent of your income until you go back to work or retire!

I’ll let you in on a secret: the average length of an Income Protection claim is 5.5 years.

It can take 5.5 years to get back to work, on average, is what that’s saying.

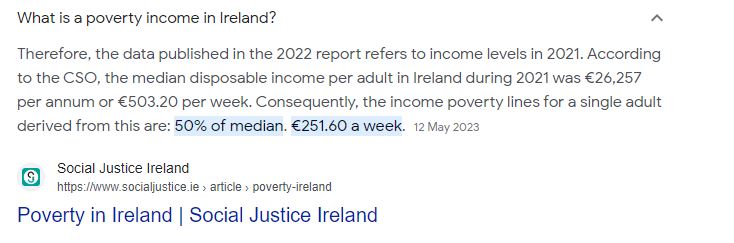

Imagine getting just €220 a week for 5.5 years.

That’s below the Poverty Line.

Yikes.

By the way, you’re also entitled to Illness Benefit if you have an Income Protection policy (unless you’re self employed, we get nothing from the government)

That brings us to the big cojones of questions:

Let’s look at a quote: your average 35-year-old accountant, earning €45,000 a year who wants the policy to kick in after eight weeks to cover her until she is 65.

Did you know you can get tax relief on income protection to make it more attractive.

Our accountancy friend will pay around a tenner a week net to ensure she receives €22,310 every year she can’t do her job..

Remember she will get €11,440 from the state too which will put a floor of €33,750 under her income.

It sure beats trying to live on €220 per week.

P.S. it’s even more affordable if you set the deferral period to be a bit longer (this is the amount of time before your cover kicks in). So there’s that, too.

There are five Income Protection providers in Ireland and each offers different benefits.

Make sure you get independent advice on all of the insurers.

If you’re considering buying Income Protection, complete this questionnaire and I’ll come back to you asap.

Thanks for reading

Nick

lion.ie | Protection Broker of the Year 🏆

Editor’s Note. This blog first appeared in 2018 and has been updated regularly since.

As Ireland's leading life insurance broker, we specialise in comparing the rates and policies from the top five Irish life insurance providers and offering the very best value quotes to suit the individual needs of our clients. Our expertise lies in finding a suitable insurance plan for those with specific needs, be it a particular illness, occupation or claim history, we've got you covered in every sense!

Watch our video