Table of Contents

Cohabiting couple.

It’s surely the unsexiest way of referring to living with your other half.

Given how expensive mortgages and weddings are, many people are choosing one or the other— or neither, in some cases.

In fact, the number of cohabiting couples (oof, there it is again) is actually on the rise.

As of the 2022 Census, there are approximately 152,302 cohabiting couples in Ireland. This represents a 6% increase since 2011, indicating a growing trend among couples who choose to live together without getting married.

And sure, you might be perfectly happy in your unwedded bliss, but you do need to consider certain tax ramifications.

I’m not saying you should get married because you’d have to pay less tax, but I’m also not saying you shouldn’t get married because you’d have to pay less tax!

Try it on any tax calculator, and you’ll see what I mean.

Let’s consider Tony.

Tony is 37 and living with his other half, Carmela.

Tony earns €50,000 a year.

As a singleton, Tony brings home €3,308 a month.

If Tony were married, this would jump to €3,408 due to the tax treatment of married couples (and would jump to €3575 if he were the sole earner)

Tax advantages are wildly unromantic reasons to get married, but the world needs pragmatists, too!

The perils of not being married also kick in around mortgages.

If you’re buying a house as a couple, you’ve two options: a single or joint mortgage.

All being fair, you’ll likely go with a joint mortgage, so both of your names are on the deeds.

Plus, with a joint mortgage, your earnings are added together, making it easier to prove repayment potential.

Part of the process of buying a house in Ireland is buying Mortgage Protection.

It’s fairly straightforward: you pay money for an insurance policy that will clear the mortgage if you (or your other half) pass away.

Cohabiting or otherwise, you’ll have to get it.

I will say this: don’t let your bank bamboozle you into buying their mortgage protection.

The banks are tied to one insurer – but to get the best price, you should look at ALL the insurers’ policies.

Of course, you can also ask a friendly neighbourhood broker to do it for you. 👌

Much less of a headache – and less pocket ache, too, as they can get you a better deal.

The Mortgage Protection is the easy bit — but what about Inheritance Tax?

Mortgage protection will clear your mortgage if one of you passes away.

Simple enough.

But here’s the sting in the tail:

If you’re not married, the surviving partner may be hit with a hefty Inheritance Tax bill — especially if tragedy strikes in the first few years.

I know it’s grim to even go there, but it’s a reality.

And it’s a very expensive one if you don’t plan for it properly.

If you’re not married, the most you can inherit tax-free from your partner is just €20,000.

Everything above that is taxed at 33%.

Let’s put that into real numbers:

Tony and Carmela (our fictional couple)

Bought a home for €350,000

Took out a €200,000 mortgage

A few years later, Carmela dies (let’s just say… under mysterious circumstances 👀)

Tony inherits Carmela’s half of the house:

Her share: €175,000

Tax-free threshold: €20,000

Taxable: €155,000

Inheritance Tax owed: €51,150

💥 That’s €51k out of Tony’s pocket, to keep living in his own home.

That’s a lotta scharole.

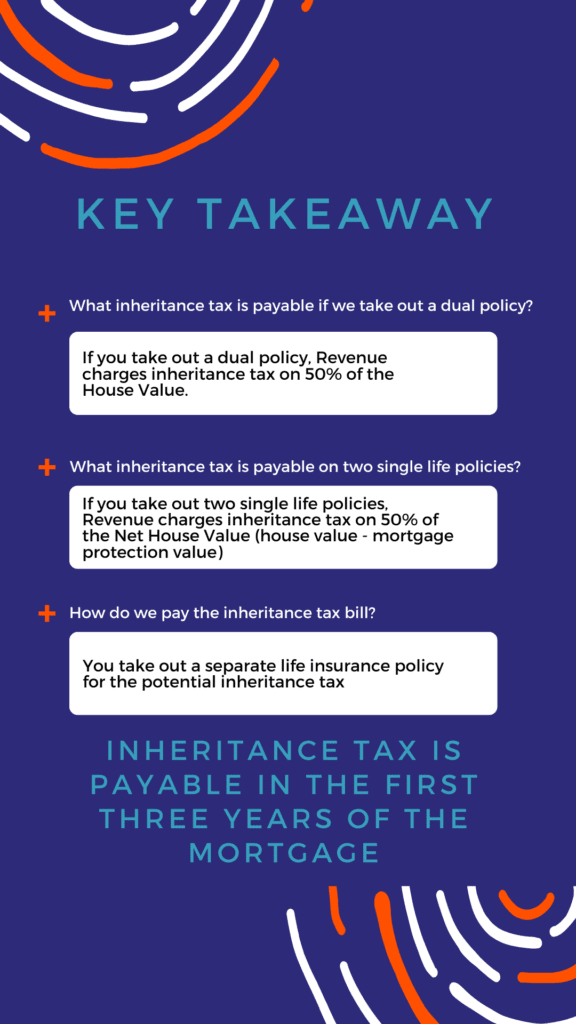

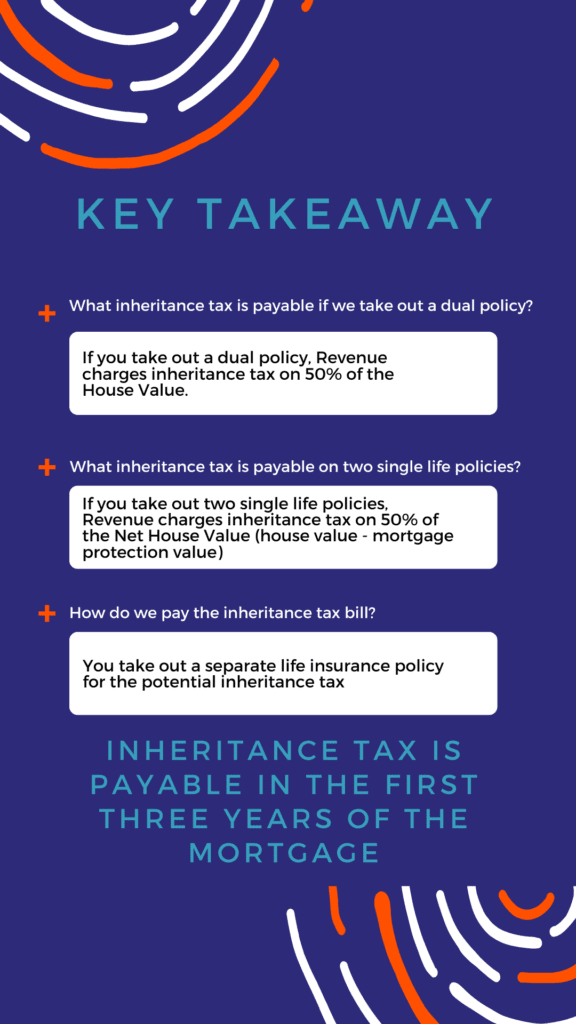

Tony and Carmela should have taken out two single “life of another” mortgage protection policies, with each one paying the other’s premium from their own bank account.

Why?

Because if one of them died, the survivor wouldn’t be hit with a massive inheritance tax bill.

Let’s say they bought a house worth €350,000 with a €200,000 mortgage.

If Carmela passed away, and they’d set things up correctly, Tony would be deemed to inherit just 50% of the net value of the home:

👉 50% x (€350,000 – €200,000) = €75,000

The tax-free threshold for cohabiting couples is €20,000, so Tony would owe inheritance tax on €55,000:

👉 33% of €55,000 = €18,150

Compare that to doing it the usual way, where Tony inherits half the gross property value and ends up with a tax bill of €51,150

💸 That’s a saving of €33,000.

Bada Bing.

Bada Boom.

As you can see, taking out two single-life policies will reduce the potential inheritance tax bill, but won’t eliminate it.

To pay the inheritance tax bill, you have two options:

a) Increase your mortgage protection by the amount of the potential inheritance tax

or

b) Take out separate life insurance policies to pay the inheritance tax.

Yes, but the premiums on the future dual-life policy could be higher than you currently pay for two single policies.

If you take a while to walk down the aisle, your age will count against you should you apply for a dual-life plan.

It might make more sense to keep the two single-life policies.

Still, from a tax perspective, there is no difference between the two because once you’re married, there’s no tax liability between spouses, regardless of how your policies are set up.

But, if you can save a few quid, there’s nothing to stop you from swapping the two single policies for one dual policy.

The final thing to consider is your health.

If you have suffered any health issues since you married, it would make more sense to stick with the single life plans.

The dwelling house exemption kicks in.

The Dwelling House Exemption in Ireland allows you to inherit or receive a house as a gift without paying Capital Acquisitions Tax (CAT) if certain conditions are met:

This exemption allows individuals to retain their inherited home without needing to sell it to pay taxes.

You can read more about it on Citizens Information.

Yes, Inheritance Tax is fairly ridiculous, but the rules are the rules.

That’s not to say that there aren’t ways around it.

As with all tricky tax issues:

We advise that you seek professional legal and tax advice as the information given is a guideline only and does not take into account your personal circumstances. There could be other assets and inheritances passing on death which could cause a CAT liability.

And if you are one of the unmarried cohabiteurs (pronounce it like it’s French, and it’s a bit less terrible), make sure you get a good deal on your Mortgage Protection.

You’ll have no control over some things – getting a good deal on your Mortgage Protection isn’t one of them!

If you’d like me to take a look at your personal situation and recommend the types of cover you should consider, complete this questionnaire, and I’ll be right back.

Of course, the obvious option to avoid inheritance tax is to get married or civil union-ed.

—

You could even get some tax back!

Thanks for reading

Nick

As Ireland's leading life insurance broker, we specialise in comparing the rates and policies from the top five Irish life insurance providers and offering the very best value quotes to suit the individual needs of our clients. Our expertise lies in finding a suitable insurance plan for those with specific needs, be it a particular illness, occupation or claim history, we've got you covered in every sense!

Watch our video