Table of Contents

The deferred period on an income protection insurance policy is how long you must be unable to do your jobh due to illness or accident before you can claim.

You can choose a 4, 8, 13, 26 or 52-week deferred period.

The deferred period is sometimes called

Example

If you choose an 8-week deferred period, you can claim on your income protection after 8 weeks of not being able to work.

Similarly, if you choose a 26-week waiting period, your policy will payout if you can’t work for more than 26 weeks.

Use these three easy steps.

This way, you’re covered seamlessly from when your employer stops paying you until your insurance kicks in.

Or look at your own situation and figure out how long you could survive without an income.

State illness benefit is just €232 per week (and isn’t available to the self-employed), so while it will help, you can’t really rely on it to pay the mortgage/rent, all the other bills and maintain your lifestyle.

Your income protection payment should kick in when the proverbial is about to hit the fan.

Visual Chart Page Iteration 3

Aviva, Zurich and Royal London offer 4, 8, 13, 26 and 52-week deferred periods.

New Ireland starts at eight weeks.

Irish Life at 13 weeks.

The longest waiting period for income protection is 52 weeks.

This is common to all of our insurers:

With a 52-week period, you must be out of work for a whole year before you can claim.

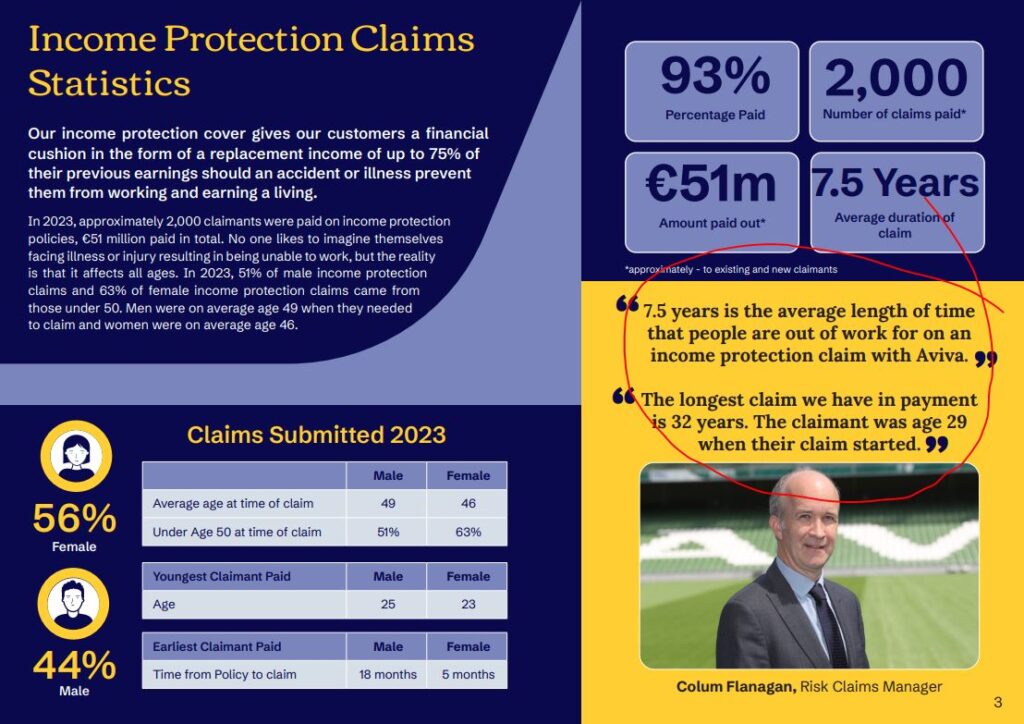

Twelve months without an income seems like a long time, but imagine being unable to get back to work for 32 years!

One Aviva customer was 29 when his claim started; he is now 61 and still receiving income from Aviva.

If you are paying your premiums personally, you can choose a 4, 8, 13, 26, or 52-week waiting period.

If your company or employer is paying the premiums, you can choose a monthly deferred period of 1, 2, 3, 6, or 12 months.

This one is simple

The shorter the deferred period is, the higher the premium you will pay.

This makes sense logically because the risk of a claim is greater for income protection policies with a short deferred period.

Example

A broken arm keeps you out of work for eight weeks.

If you have a 4-week deferred period, you have a valid claim.

However, if you have an 8-week deferred period, you can’t claim because you will be back to work before your deferred period ends.

So, you can see the risk of a claim is higher if the deferred period is shorter.

Higher risk of a claim = higher premium

Here are some examples over 4, 8, 13, 26, and 52 weeks for a 35-year-old desk jockey who does no manual work and earns €80,000 per year.

Quote Type: Income Protection

First Person: Non-Smoker, born on 01/01/1986

Cover Amount: €47,936 per year until age 65.

Occupation Class: Office Worker(Class 1)

Deferred Period: 4 weeks

Monthly premium: €264

after tax relief : €159 per month

Deferred Period: 8 weeks

Monthly premium: €187

after tax relief : €112 per month

Deferred Period: 13 weeks

Monthly premium: €128

after tax relief : €77 per month

Deferred Period: 26 weeks

Monthly premium: €89

after tax relief : €54 per month

Deferred Period: 52weeks

Monthly premium: €76

after tax relief : €46 per month

The most popular deferred period is 26 weeks.

In the example above, if you earn €80,000, you have a monthly take-home of €4497 per month.

The net premium on the 26-week deferred period policy is €54 per month, just over 1% of your monthly take home.

Please let that sink in.

You pay just €54 to insure a monthly income of €3994 you are 65.

Take a quick look at your bank statement.

See what’s coming in – your income.

See what’s going out – everything else!

The direct debit to protect your pay cheque should be the first payment leaving your account each month to guarantee that money will continue to pour into the account regardless of what happens to your health in the future.

If you want more information on income protection, our income protection FAQ is a good place to start.

Are you ready to get the ball rolling? Complete this income protection questionnaire, and I’ll be right back with a no-obligation recommendation.

I’m happy to discuss your options at 05793 20836, or you can schedule a callback below.

Talk soon!

Thanks for reading

Nick

Editor’s Note: We first published this blog in 2017 and have regularly updated it.

As Ireland's leading life insurance broker, we specialise in comparing the rates and policies from the top five Irish life insurance providers and offering the very best value quotes to suit the individual needs of our clients. Our expertise lies in finding a suitable insurance plan for those with specific needs, be it a particular illness, occupation or claim history, we've got you covered in every sense!

Watch our video