Table of Contents

You and I have a lot in common.

Like me, you’re self-employed (or your partner/spouse is).

Like me, you’ve taken a risk by leaving behind a cushy role as an employee where you had the comfort of a regular income.

No more benefits like income protection and death in service.

Wave goodbye to state illness benefits if you get sick.

Are you crazy?

No!

You’re a business owner and proud 🙌

You probably miss the regular income the most, but you can’t do anything about that for now.

But you can take steps to ensure that you have that regular income in the future – if you fall ill or have an accident that stops you from working.

In your former life, you could rely on the government for a helping hand in the form of a disability allowance.

It’s only €232 per week but still, better than nothing.

But now you’re self-employed, you get nothing, nowt, zilch, not a sausage if you can’t do your job.

That’s why income protection is essential.

Essential, as in, if you don’t have it, you’re

Look, I get it.

You know you should protect your income, but you can’t seem to pull the trigger and get it sorted.

I understand this completely because I took the same calculated risk when I started.

Therefore, examining the justifications we give ourselves for putting income protection on the long finger is useful.

We put it off because

we can’t afford it,

or we could save the money instead,

we don’t understand it,

or we don’t have time to arrange it,

we don’t think it will payout

or we’re overweight, have high cholesterol, are a bit stressed

we think self-employed people can’t get it,

or….you get the picture.

But you know, deep down, that these are all just excuses.

If you can’t work (especially if you’re the breadwinner), you’re financially fucked, plain and simple, and so is your family.

So isn’t it time to put on your big boy/girl pants and get your house in order?

Here are the reasons I dilly-dallied on income protection.

Do any of them ring a bell?

But thinking of the worst-case scenario, I knew I couldn’t afford NOT to have it.

I imagined I was in a car accident; multiple injuries meant I couldn’t work for 18 months.

My income dropped to zero, but the bills kept coming in.

I imagined the panic, the fear.

Three babies who depended on my income for everything, and I couldn’t provide.

I had a supportive partner who said all the right things, but I knew I had let her down because I didn’t protect myself against the biggest risk my family faced – the loss of my income.

You can afford some cover.

You may not be able to afford gold-plated cover right now, but you can afford some cover.

Start small and put something in place.

You’ll be surprised at how affordable income protection is if you insure enough to cover the mortgage and essential bills, choose an early ceasing age, and extend the deferred period.

Don’t forget you get full tax relief on your premiums.

Even better, your company can pay your premiums if you’re a Director without triggering a BIK liability, and the company can claim tax relief on your premiums.

Signing the company direct debit mandate is much easier than your personal one.

Ha, savings.

I was barely getting by, so putting a couple of hundred euros away per month was a non-starter.

And even if I could, I knew how long it would take me to save a worthwhile sum.

FOREVER.

But illness wouldn’t be kind enough to wait for my savings to accumulate before it knocked on my door.

It could happen at any time.

You might find this hard to believe, but when I became self-employed, I had no clue about income protection.

At the time, I was a mortgage advisor until the Celtic Tiger bounded off, leaving me scratching around for a new source of income!

And back then, no useful life insurance blogs (ahem) that explained this stuff in plain English.

In fairness, that was a bit of a Eureka moment for me.

As I learned about income protection, I wrote blogs to teach others.

And here I am – still writing!

What is self employed income protection?

At its core, income protection is simple:

That’s the basics – you can learn much more in our Income Protection FAQ.

Yeah, I had three babies, and I had a new business. I was busy, busy.

I get it; starting out as a self-employed person is non-stop.

But while you’re laser-focused on sales and marketing, you might get blindsided by an unforeseen, catastrophic event that puts your business on hold.

Stress is on the rise, especially among the self-employed.

Mental breakdowns are, unfortunately, commonplace.

But really, how long does it take to get a quote and complete an application form online?

10 minutes?

Even simpler, fill out this questionnaire, and I’ll send the rest via email, which you can read and reply to at your leisure.

Protecting yourself shouldn’t eat into your working day.

It’s an after-hours thing, but you must take the first step.

I can’t force you.

I’m not your Da.

Those insurers will find some way to wriggle out of paying, the swines!

I was new to this income protection game and felt the same.

It’s all a scam, they never payout.

I had previously made a house insurance claim and been refused, and friends had trouble with car insurance claims.

Logically, I thought life insurance providers were the same.

How wrong I was!

You can choose to believe this or not, but income protection providers welcome claims and want to pay them.

Otherwise, there’s no need for anyone to have a cover.

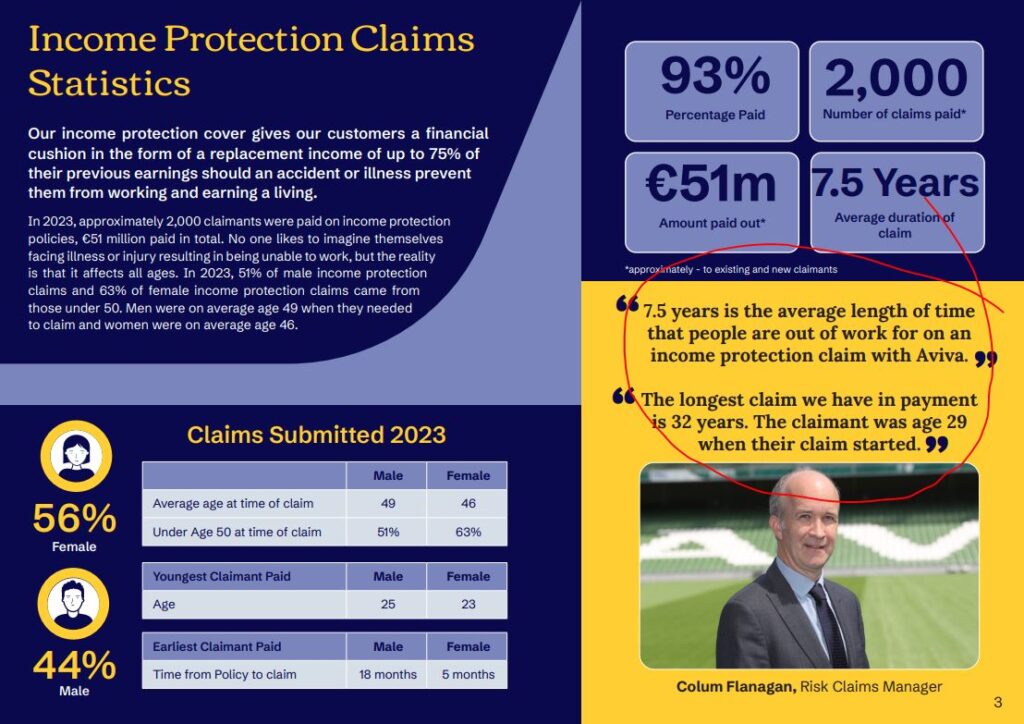

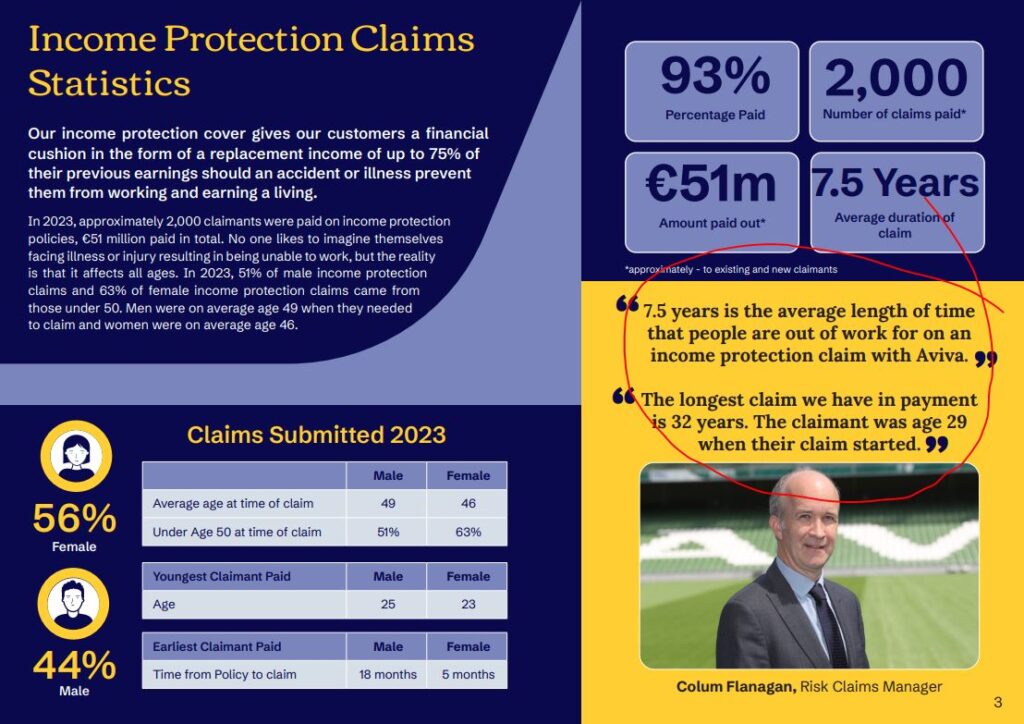

Income protection providers pay around 90% of claims (100% of valid claims).

The 10% they decline are due to

Here are the latest payout statistics from one of our providers.

Three things struck me

Ok, let’s get this out of the way.

Pre-existing conditions are likely to be excluded from your policy.

If you’re on medication for anxiety or depression, you will have a mental and functional health disorder exclusion on your policy.

If you suffer from continuous back pain and are on painkillers, you will have a back/spinal exclusion on your policy.

But you’re covered for everything else.

At worst, minor issues like a high BMI will result in a premium increase, but you’ll still receive full coverage.

If you’re a self-employed contractor, you will qualify for income protection because you’re in a permanent role on a self-employed basis.

Income protection insurance pays you a monthly income if you can’t do your job due to ANY illness or accident.

A, N, Y; THREE small BUT IMPORTANT LETTERS

Income Protection for the self-employed will pay for any illness, injury or disability that stops you from doing YOUR JOB (not any job).

Let’s take the fictional example of Sinead, a self-employed IT consultant working in Ireland.

In the last tax year, she earned a gross salary of €150,000 (taxable earnings)

After reviewing her monthly expenditure, she decides to insure 75% of her annual earnings, totalling €112,500 or €9,375 monthly.

Two years after taking out her policy, Sinead, unfortunately, is diagnosed with advanced cancer and is out of work for two years for treatment.

Sinead had selected a deferred period of 6 months.

She received €9,375 at the start of the 7th month.

Over the two years she’s out of work, Sinead receives 18 monthly payments of €9,375, totalling €168,750

Sinead gets back to work, but the worry about the cancer returning brings on anxiety, meaning she must take a further break.

She tries to return to work until her consultant steps in and signs her off as unable to work as a self-employed IT consultant.

Her insurer will pay her an income until her policy ceases at 68.

Sinead can focus all her energy on getting better without financial worries.

By the way, if Sinead wanted to retrain, the insurer would pay for this.

Using income protection for the self-employed, you can insure up to 75% of your gross (pre-tax) earnings.

But you don’t have to insure the full 75%.

If your budget doesn’t stretch that far, you can reduce the amount of cover

Not when you apply, but if you make a claim, the insurer will look for evidence of your income for the previous 12 months.

So, if your earnings fall, it’s important to contact the insurer and reduce your coverage because the insurer will never pay out more than 75% of your earnings at the date of your claim.

It’s important to note that some insurers will average your income over the previous three years.

Others will only look back over the previous 12 months.

You should consider this when choosing an insurer if your income isn’t regular.

One in two people in Ireland will develop cancer during their lifetime.

When I initially wrote this blog in 2018, the figure was one in three.

Michael, a recent claimant, thought it would never happen to him, but “having the policy meant everything” when he found out he needed it.

Here’s a snippet from his story:

I’d been self employed for about twenty years and never really had a day’s sick in my life. I felt in good health but developed what I thought was a groin strain from playing football and thought nothing of it. Being a typical male…I put off doing anything about it.

I eventually went to a local physio who concurred with me but sent me for an x-ray when there was no improvement after six weeks. The x-ray showed up what doctors term a ‘hotspot’ on my pelvis (an area of increased density on an x-ray) and referred me to a GP. A further scan in St. James’s hospital showed up a cancerous tumour in my pelvis. That was the start of three years off work while I received treatment. I underwent radiotherapy and chemotherapy.

If you have cancer and you’re in and out of hospital, the last thing you want to worry about is how am I going to pay the mortgage, the household bills? When you’re not able to work, you feel threatened. Having an income protection policy kick in meant I could concentrate on getting better. Without all the added financial worries of not having an income.The application process was straight forward, the staff in the insurer were supportive at all times. I had a dedicated contact person who was great to deal with.

All I had to provide was a report from the consultant and the occasional update. I am such a fan of the product now I tell everyone who will listen not to hesitate in taking out this valuable cover. So my advice is don’t hesitate. I thought it would never happen to me.

As you got this far, I hope you’re at least considering income protection.

So many self-employed people read this post; unfortunately, some of them are going to get sick.

I hope it’s not you, but there is a chance.

Take this opportunity to get your house in order and arrange income protection.

If not with me, that’s grand, but buy it somewhere.

Please.

If nothing else, it’ll give you a great night’s sleep, knowing your family is financially safe should the worst happen.

But if you are considering income protection and don’t have a trusted advisor, I would love to help you.

Complete this questionnaire, and I’ll be right back over email with advice and quotes on policies from the following insurers for you:

There are differences between the providers, so please take some advice before choosing or at least reading this blog comparing income protection providers in Ireland.

If you’d like a chat to discuss your options, you can open my diary and schedule a call here.

Thanks for reading!

Nick

Editor’s Note | We published this blog in 2017 and have updated it since.

As Ireland's leading life insurance broker, we specialise in comparing the rates and policies from the top five Irish life insurance providers and offering the very best value quotes to suit the individual needs of our clients. Our expertise lies in finding a suitable insurance plan for those with specific needs, be it a particular illness, occupation or claim history, we've got you covered in every sense!

Watch our video