Table of Contents

Illness — the sneaky bastard — has no manners.

It doesn’t text ahead or pencil itself into your Google Calendar.

One day you’re grand, the next, at 3am you’re googling “what does a heart attack feel like”

And it’s not just the big hitters — heart attacks, cancer, strokes — it’s the mental ones too: anxiety, burnout, depression.

The stuff your da used to call “being a bit soft” until he had that panic attack in SuperValu.

Even if your gene pool’s pure magic — both grandparents made it to 136 and were still giving out about the TV licence — it means shag all when you fall off a ladder hanging up Christmas lights after going full Buddy Hall.

Car crash.

Bike fall.

Tripped over the dog chasing the bin truck.

Doesn’t matter — any of it could take you out of work for weeks, months, longer.

So the real question is:

What happens when you’re off work — but the bills rolling in?

Insurance, at its core, is just risk management — or more accurately, getting someone else to deal with your crap if things go sideways.

Every single day, you’re carrying a risk: that you’ll get sick, injured, or flattened by something daft and can’t work.

It’s not glamorous, but it’s there just like your neighbour’s dodgy extension.

Always looming.

Now, you’ve got two options:

Shoulder the risk yourself.

Maybe you’re the type to cross your fingers, say a wee prayer, stroke a rabbit’s foot, and tell yourself “Sure it’ll be grand.”

Spoiler: that’s not a strategy – it’s just gambling.

Or, you chuck a few quid a month at an insurance company.

And when the worst happens — when you’re knocked off your feet — they step in, not with a flat bottle of Lucozade, but with a replacement income.

So you can recover without panicking about the mortgage, the electricity bill, or whether you can still afford the nice toilet paper.

Because stress isn’t great for recovery — especially the stress of dealing with OVERDUE letters.

I’m guessing right now, you’re carrying all the risk yourself — bold move, that.

Brave, even.

But let’s be honest: if you weren’t a bit worried, you wouldn’t be reading this.

A personal story for you:

It used to gnaw at me (like a dog with the Sky remote) whenever someone we knew got sick. I’d say to myself, “Right, that’s it, I’m getting income protection sorted.”

And then… life.

School runs, bin day, football training, whatever. It got punted onto the long finger.

It wasn’t until one of my younger clients — early 30s, full of life — got hit with cancer that it finally clicked. He was out of work for two years. His family was hanging on by a financial thread, but they survived (just)

They would be in a much better place if he had taken out income protection (as I advised).

That was it for me. I got cover sorted that week.

Now?

I don’t worry.

If the worst happens, at least I know my family won’t be living off beans and handouts.

Sure, it costs a few quid a month — money I’d rather spend on the kids. But let’s face it: they won’t exactly chip in to keep the roof over our heads. They won’t even load the dishwasher. Pay the mortgage? Not a hope. Leeches, the lot of them.

Loveable, expensive leeches.

And look, if you’re still carrying the risk yourself, you’re not alone.

Most people do.

We all think we’re indestructible… until someone close to us gets floored, and suddenly we’re doing the mental maths:

“What if that was me? What would we live on? Would we even be able to stay in the house?”

So here are a few questions for you to chew on:

If you’re not sure about a) or b), go do a bit of digging.

Not sure about c)? Stick with me — it’s all coming up.

Look, we’ve all got expenses coming out of our ears (and other places I won’t mention)

-Mortgage

-Crèche fees that cost more than a small car

-“Savings” (aye, if there’s anything left)

-Pensions

-School stuff

-The shopping (that somehow disappears within 12 minutes of hitting the fridge)

-Utilities

-Life insurance

And of course… pet insurance.

Funny how folk will insure the dog before they’ll insure the thing that actually pays for everything — their income.

Here’s the harsh truth:

If you lose your income, everything else goes up in smoke.

The mortgage? Gone.

The Netflix subscription? Cancelled.

Little Milo’s luxury kibble and paw balm? Forget it.

Your income covers it all — it’s the financial engine keeping the circus running.

So protecting it shouldn’t be a “nice-to-have” — it should be the first thing you do.

More important than the mortgage.

More important than pet insurance.

Hell, more important than that Airfryer you were convinced would change your life.

So if you’ve got insurance for your dog but not for your income…

You’re barking up the wrong tree.

And weirdly enough, putting income protection in place is actually the best thing you can do for Fido — because if your wages vanish, guess who’s not getting his €34-per-month organic duck treats?

Income protection. Keeping pets fed since 2025.

Fair play.

You’re stashing away €400 a month and sitting on a €50k rainy day fund.

Good hustle. Respect. You’re doing better than most.

But here’s the question no one’s asking you:

What exactly are you saving for?

Suppose it’s for your kid’s college fees — that makes total sense.

You can’t exactly insure against Leaving Cert results or “finding themselves in Berlin for a year.”

Same goes for a new car or a big holiday. You can’t ring Allianz and say, “Hi, I’d like to insure a week in Tenerife and a Golf GTI.” They’ll hang up.

But if you’re building that savings pot to cover being sick and out of work?

Then we’ve got a problem.

Because there’s a smarter, cheaper, already-invented way to deal with that.

It’s called income protection.

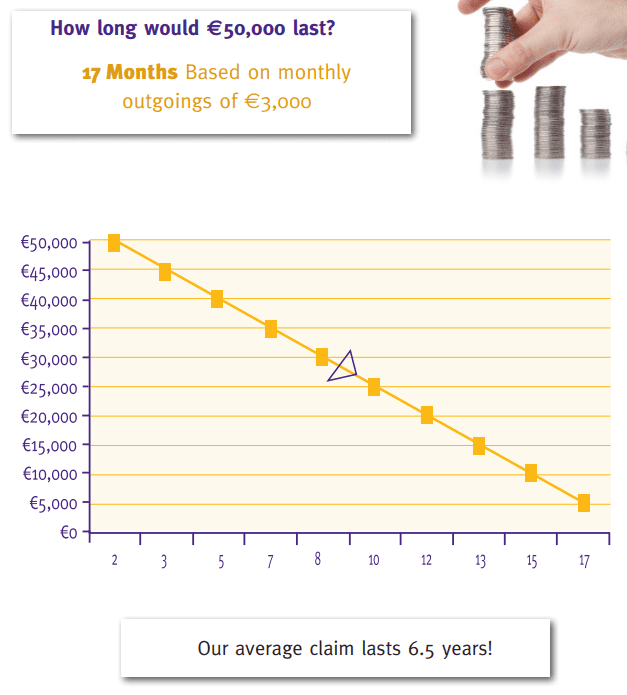

Say you’re out of work — no salary, just your rainy day fund to fall back on.

How long will your €50,000 keep you going?

Three years?

Two years?

Try 17 months.

17 months until you’re back to zero, staring at your empty bank app and wondering if Aldi tuna tastes any different to Lidl’s.

Seventeen months — less than a year and a half!

(I know, I know — call me Carol Vorderman.)

So what happens when the €50,000 runs dry… and you’re still not able to go back to work?

After all the years of graft, all the early mornings, all the meetings that should’ve been emails – no more pay cheques

Just you, Netflix (for now), and the growing dread every time the postman drops in a new bill.

It’s a scary thought, isn’t it?

Truthbomb

Saving your way out of long-term illness doesn’t work. Your savings aren’t built to take that kind of beating.

But here’s what does work:

Take a chunk of that €400/month and use it to insure your income.

Then stick the rest in a sunshine fund — a pot for holidays, bikes, barbecues, things that don’t make you panic when your back gives out.

Simple, really:

Insure for the rainy days.

Save for the sunny ones.

Let’s run the numbers.

Say you’re 40, a non-smoker, earning €60,000 a year.

You want proper income protection (not that crappy Bill Pay the banks try to sell) for the maximum possible = €32,312 a year.

If you can’t work for more than your deferred period (26 weeks), here’s what happens:

Your insurer pays you €621 a week

The State chimes in with €244

That’s €865 a week in total — until you’re back on your feet or hit retirement, whichever comes first

Without income protection, you would have to live on just the €244 from the State.

So it’s either:

€244 a week (beans on toast, lights off at 6pm)…

or

€865 a week (actual dignity and heating).

Big difference.

Massive.

And here’s the kicker — that level of cover doesn’t cost thousands.

It costs…

Yeah.

Not €400.

Not €150.

Just €40 after tax relief — that’s less than what most of us spend on:

Streaming services we forgot we had

Petrol station coffees

That gym membership we keep saying we’ll go back to in June

If you thought income protection would cost more, you’re not alone.

Most people wildly overestimate it — probably because it sounds too useful to be affordable.

But for the price of two takeaways or a half-night out, you get the peace of mind that if you’re hit by illness, injury or just life being a bit of a bastard… you’re covered.

So now do you get why I say:

If you don’t have income protection, you’re off your head.

I say it with love.

But also — seriously.

Sort it out.

You can’t self-insure against long-term absence from work.

Unless you’re sitting on a Lotto win or your da’s secretly loaded — good luck saving enough to replace years of lost income.

It’s just not doable.

Trying to save your way out of a long-term illness is like trying to fix a leaky roof with a mop.

And yet, one piece of paper — with “income protection” printed on it — can save you from months (or years) of financial torture.

Let me leave you with this:

What are your financial goals? Are they anything like mine?

Having your own place

Getting away somewhere sunny every year

Sending the kids to college (unless they get a scholarship for Fortnite)

Not waking up at 3am stressing about the bank balance

Retiring before you’re too knackered to enjoy it

Here’s the thing: every single one of those goals depends on income.

Cut off your income, and all those plans?

Gone.

Up in smoke.

Out the window with the heating.

That’s why income protection isn’t just “a good idea.”

It’s the most important financial product you can buy.

It’s not about fear — it’s about freedom.

Freedom to get sick without going broke.

Freedom to protect your family.

Freedom to breathe a bit easier when life takes a turn.

If you’re ready to get it sorted but have a few questions, call me at 05793 20836 or schedule a callback.

Want a quote instead? Just fill out this short questionnaire and I’ll send you some proper options — no faff, no flannel.

Thanks for reading.

– Nick

Editor’s Note | We published this blog in 2016 and have updated it since.

As Ireland's leading life insurance broker, we specialise in comparing the rates and policies from the top five Irish life insurance providers and offering the very best value quotes to suit the individual needs of our clients. Our expertise lies in finding a suitable insurance plan for those with specific needs, be it a particular illness, occupation or claim history, we've got you covered in every sense!

Watch our video