Table of Contents

Have you had the talk?

No, not the one about the birds and the bees.

The talk….with the bank.

Where they corner you in a dimly lit room and put the squeeze on until you say “no more” and sign up for whatever life insurance policy they’re hustling.

If you haven’t had the talk yet, count yourself lucky you found this page.

And if you have survived the talk without signing on the dotted line, then you, my friend, are a legend!

But don’t worry if you did crumble—you have a 30-day cooling-off period, during which you can cancel and get your money back.

And even after 30 days, you can cancel anytime and switch to a better policy.

Before we dive in, it’s disclaimer time:

We cannot sell you the One Plan from Irish Life. It’s strictly available from

So chances are, if you’re getting a mortgage in Ireland, you’re going to have to sit through the talk.

Before you do, let’s review the One Life.

The One Plan has One Thing going for it

If you

then you might as well stop reading!

You have totally zinged with the One Plan.

Go, run, get married and have many little One Plan babies.

Annoyingly, it bundles all the covers into one plan:

Mortgage protection, life insurance, bill pay, critical illness, and funeral cover.

This makes it harder for you to compare the One Life plan to other policies in the market (clever, eh).

Anyway, because no other provider bundles all the cover, it’s impossible to compare like with like.

So, if you show me your One Plan quote and ask for a better quote, that’s impossible; there is no comparable plan on the market.

WAKE UP, OTHER PROVIDERS; THERE IS AN OPPORTUNITY HERE FOR YOU!

They never listen.

OK, so not being able to compare it to a comparable product is a pain, but that’s not a reason to avoid it.

But these are:

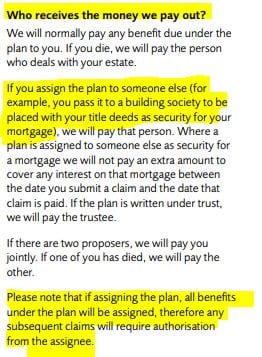

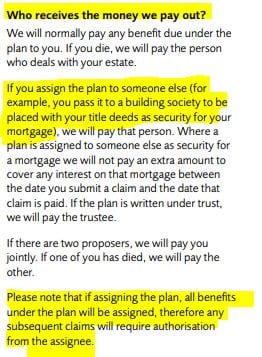

If you assign the policy to your bank—an unavoidable step if you want the mortgage moolah—the bank becomes the owner of your policy and is entitled to receive the payout

Yep, you pay the premiums, but the bank will receive the proceeds of any payout.

This is clear in the Terms and Conditions (if you look closely, but who does, right?)

Here’s the relevant section:

I don’t know about you, but I certainly don’t want my bank to get first dibs on a policy that contains my mortgage protection, life insurance, serious illness coverage, and income protection.

The mortgage protection part is grand; as I said, you can’t avoid your bank getting the payout on this but to give the rest over freely?

You’ve got to be kidding me.

Let’s travel into the future:

You suffer a serious illness (don’t worry, you make a full recovery) and need the serious illness payout to pay for life-saving surgery.

But you have assigned your policy, including the serious illness coverage, to the bank.

Well, in that case, the serious illness cheque would go to the bank to pay off your mortgage.

You wouldn’t have any say because, legally, the bank is the beneficial owner of your policy.

That’s why we recommend you buy basic death-only mortgage protection to satisfy the bank.

Keep life insurance, serious illness coverage, and income protection on separate policies so the bank cannot get its grubby little hands on them.

Bill pay is a type of protection available on the One Plan.

I guess during The Talk, it’s sold as income protection because people frequently tell me they have income protection on their One Plan.

Let’s look at the main difference:

The average income protection claim lasts seven years, so while temporary bill pay can be useful, it’s not the best solution for lifetime financial resilience.

The maximum payout available on bill pay is €2000 per month, so if you’re a higher earner, you will experience a significant drop in income.

However, you can insure up to €21,875 per month with proper income protection!

Finally, and most importantly, you can get full tax relief on income protection premiums, reducing the cost by 40%.

You don’t get tax relief on the One Plan.

This here is the biggie, so I’ll shout it.

NO SINGLE LIFE INSURANCE PROVIDER IS THE BEST AT EVERYTHING

So, if you want the best cover, you should buy from different providers.

All else being equal, no health issues, etc., we recommend:

Income Protection from Aviva | How to compare income protection providers

Life Insurance from Zurich Life | How to compare life insurance providers

Mortgage Protection from Royal London | How to compare mortgage protection providers

Serious Illness Cover from Zurich | How to compare serious illness providers

If you spread your coverage across multiple insurers. you also get the “value-added” stuff they offer, like Best Doctors and Family Care from Aviva, Helping Hand from Royal London and free Digital GP or Physiotherapist from New Ireland.

If you have a health issue and Irish Life isn’t the most sympathetic insurer for your condition, you will pay more than with another provider.

How Do Life Insurance Loadings Work?

So, to recap:

If you don’t care about choice and love convenience – fire ahead with your bank.

Everyone else, speak to a life insurance specialist who can advise you on all the insurers.

If you don’t have a trusted advisor, we’d love to help you.

You can check out our 1700+ reviews here to see what we’re about.

If you like what you see and want our help, please complete this questionnaire, and I’ll email you a no-obligation recommendation.

Thanks for reading

Nick

Editor’s Note: We first published this blog in 2020 and have regularly updated it.

As Ireland's leading life insurance broker, we specialise in comparing the rates and policies from the top five Irish life insurance providers and offering the very best value quotes to suit the individual needs of our clients. Our expertise lies in finding a suitable insurance plan for those with specific needs, be it a particular illness, occupation or claim history, we've got you covered in every sense!

Watch our video