Hello there!

Are you an engineer who wants to protect your income in case you get sick or have a slip, trip or fall that puts you on your back and out of work?

Excellent, you’ve come to the right place.

Whether you call it disability insurance, income replacement, or salary protection, it all boils down to one thing – ensuring that you have financial support when you need it most.

I know, it’s not the sexiest topic, but then again, neither is a life without a steady paycheque.

In this article, I’ll explain what income protection is, why it’s important for engineers and how to choose the right policy for you.

I’ll answer some of the burning questions you have about disability insurance but were too afraid to ask, like

Can I still collect benefits if I’m in a coma but my cat is doing my work for me?

Yes, you can!

So whether you’re a mechanical engineer, a chemical engineer, a software engineer, a civil engineer, an electrical engineer, a biomedical engineer or just an engineer of your own destiny, this blog is for you.

As an engineer you’re curious to know how things work so let’s break it down and dive in.

Income protection, also known as disability insurance or salary protection, is like your own personal cocoon shielding your wallet from harm.

Here’s how it works: if you’re unable to do your job due to any type of illness or injury, income protection will provide you with replacement money to help cover your expenses until you get back to your job.

Think rent or mortgage payments, utility bills, the weekly shop and the other less mundane stuff that makes life worth living, like family holidays, good coffee and meals out with friends!

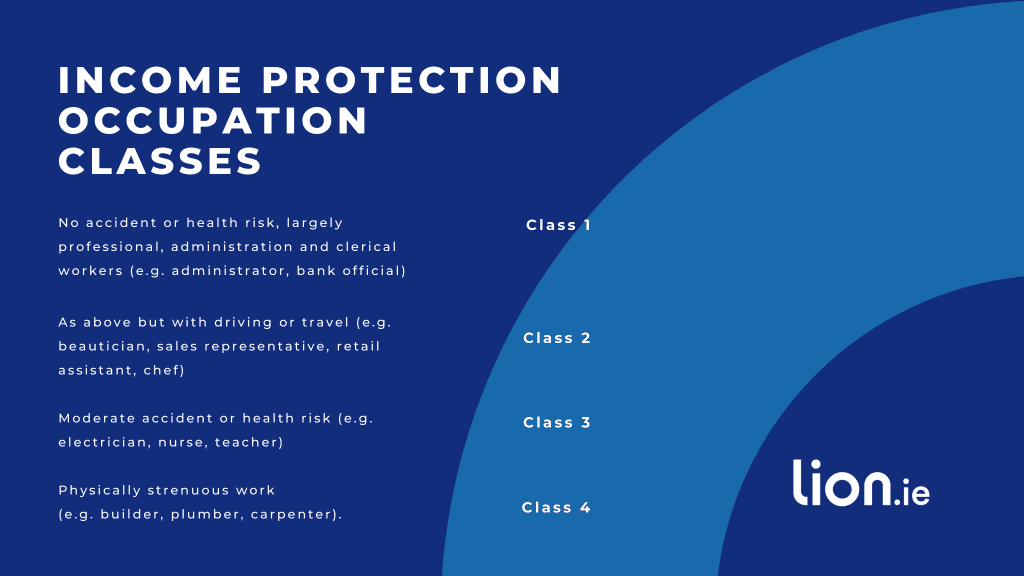

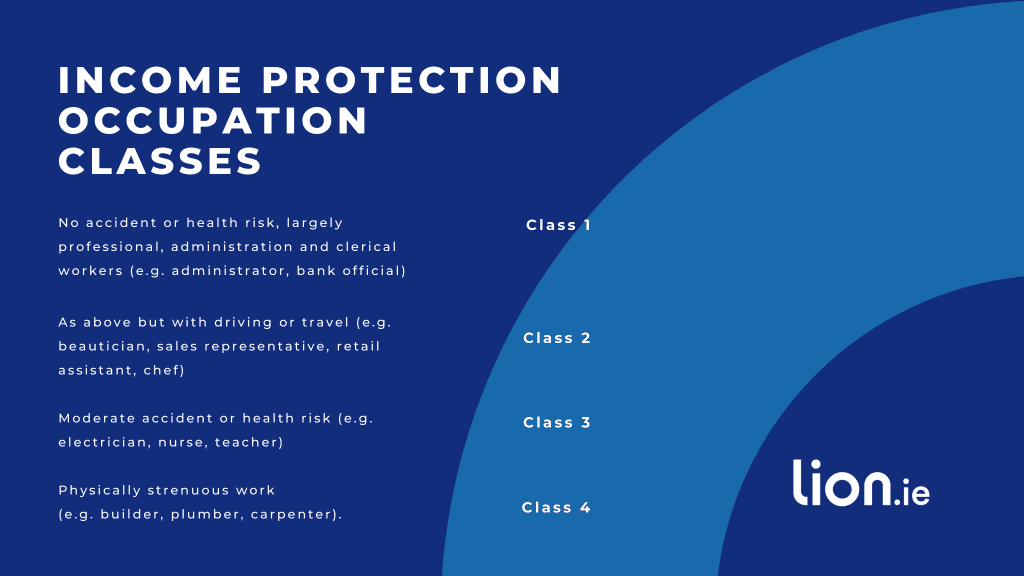

As an engineer, your occupation is likely to be classified as low to medium risk, which is great news because your premiums will be relatively low.

But, it’s important to check with each insurer to see how they categorise your job because the exact classification can vary from insurer to insurer.

If you’re in a low-risk occupation, like a software engineer, you will qualify for Class 1 lower premiums.

On the other hand, if you are an electrical engineer, be careful which insurer to apply to.

The lowest occupation class available is Class 2, but , some insurers will dump you into a Class 4 category so your premiums will be off the charts!

This is the amount of time you must be unable to work before you can receive a payout

You can choose a deferred period of 4, 8, 13, 26 or 52 weeks.

The shorter the deferred period, the higher your monthly premium.

Single applicants tend to go for 13 weeks.

If your partner is also working, you should be fine with a 26-week waiting period assuming they also have income protection.

Consider your financial needs and risks when deciding on a waiting period that works for you.

All the insurers will insure up to 75% of your income (less state illness benefits if you are an employee).

So let’s say you are a PAYE worker earning €100,000.

You can insure up to 75% of your income = €75,000 less state illness benefit of €11,440.

Therefore you can insure up to €63,560.

If you can’t work for longer than the deferred period, you will receive €63,560 from the insurer and €11,440 from the state.

Income protection is priceless but I’m sure you’re interested in how much it’s gonna cost!

The premiums you pay for income protection depend on factors such as your age, health, occupation, and level of coverage.

Here’s a quote for a 33-year-old Software Engineer earning €80,000.

Through her job she will get full sick pay for the first 26 weeks she is off sick.

If she cannot do her job for more than 26 weeks, her income protection will kick in and pay her €48,560 annually until she gets back to work or turns 65.

She will pay the figure in the left column and can claim tax relief annually (see here).

The net cost to her is the smaller figure in the right-hand column.

€40 per month to insurer almost €50k income is a incredible value.

As an engineer, your job is all about problem-solving and innovation.

But what happens when an unexpected problem arises that prevents you from doing your job?

That’s where disability insurance comes in.

Here are a few reasons why engineers should consider disability insurance:

As an engineer, your income is your biggest asset.

Don’t believe me?

Simply multiply your current income by how many years you have to retirement.

I’ll wait

–

–

–

It’s a big number isn’t it?

Bigger than the value of your car, your home, your investments?

Maybe even all three combined?

That’s why it’s so important to insure it (just like you insure your house, car and even your phone!)

A steady income allows you to pay your bills, support your family, and save for the future.

Without that income, you will quickly find yourself in financial trouble.

Depending on your area of engineering, your job may involve physical labour, exposure to hazardous materials, or long hours spent sitting at a desk.

These demands can take a toll on your health and increase the risk of injury or illness.

While some employers offer sick leave or other benefits to help cover the cost of time off due to illness or injury, these benefits may not be sufficient to cover all of your expenses.

Check with HR as to your sick pay entitlements.

Fingers crossed, you’ll find out you already have IP through your employer 🙌

While government benefits such as state illness benefits may be available, they may not provide enough support to cover all of your expenses.

Could you maintain your current lifestyle on €220 per week?

Alright, engineers, let’s talk about how to choose the right income replacement insurance policy.

This is the kind of decision you don’t want to take lightly.

We already looked at occupation classes and the deferred period. ☝

You’ll also need to consider:

You want to make sure you will receive enough income to support your monthly expenses and maintain your lifestyle in the event of a disability.

But you also want to land on a premium that doesn’t make you wince every time the monthly direct debit is called.

Hopefully, you’ll never have to call on your income protection so you want to pay as little as possible while making sure the policy is worthwhile in the event of a claim.

It’s a delicate balancing act that we can help you with.

If you don’t add indexation, your premium and cover will remain constant for the life of your policy.

However, with most insurers, you can increase your cover by yp to 20% every three years.

I prefer exercising this option on my policy rather than adding indexation.

With indexation, your premiums creep up slightly every year until all of a sudden your premiums are up 50%!

Now, onto the tips for selecting a policy that meets your specific needs and budget.

First off, shop around and compare policies from multiple insurers to find the best coverage and premium.

FWIW, the companies we deal with – Aviva, Irish Life, New Ireland, Royal London and Zurich are financially sound.

Aviva is the historic favourite here, they have a proven history of paying claims fairly so that’s our recommendation (all other things being equal)

Finally, make sure you read the policy details carefully to understand the terms and conditions of coverage.

Like the fine print on a contract – you want to make sure you know what you’re getting into.

Hit me up if you want to see the specific T&Cs for a particular insurer.

Now that you know why income protection insurance is so important, let’s talk about how to apply for a policy.

Applying for income protection insurance in Ireland is a straightforward process that typically involves filling out an application form and providing information about your occupation, income, health, and lifestyle.

It’s like filling out a job application, but for your finances, just make sure you don’t embellish the facts.

Being economical with the truth could nad you a job with Google but the same white lies on your income protection will spell disaster!

The only reason your income protection policy won’t payout is due to non-disclosure so please tell the truth, the whole truth and nothing but the truth

If you cover is above a certain threshold (usually €50k), the insurer will request you attend for a Nurse Medical Screening

Here are answers to some common questions that you may have about income protection insurance in Ireland:

The cost of income protection insurance varies depending on several factors, including your age, occupation, health, and the level of coverage you choose.

There is no typical cost, sorry!

But as you can see from our example above, our engineer friend could insure €50k income for €40 net per month.

Yes, however, the insurer is likely to exclude the condition from your policy.

So let’s say you suffer back pain, the insurer will exclude back pain from your policy so if you can’t work due to back pain, you won’t be abler to claim.

Some pre-existing conditions preclude you from getting income protection (e.g. Diabetes, MS, Heart Issues, HIV, Connective Tissue Disorders)

To make a claim, you’ll need to complete a claim form and your GP will be asked for documentation of your disability to meet the terms and conditions of your policy.

If you move to an EU country, your policy is still valid with most insurers – but double-check this before you sign up.

Feel free to gorge yourself on our Income Protection FAQ Blog – How Does Income Protection Work?

In conclusion, income protection insurance the only way that engineers can protect their income and financial well-being if they find themselves unable to work due to illness.

By understanding the application process, common questions, and tips for selecting a policy, you can ensure that you have the right coverage in place to keep you financially stable, even in difficult times.

Got questions or need guidance? Give me a shout for the inside scoop.

We’re here to match you with the perfect income protection policy that fits like a glove, both in terms of needs and budget.

Ready to get started straight away – please complete this questionnaire and I’ll be back over email with some options and quotes.

Thanks for reading

Nick

lion.ie | Protection Broker of the Year 🏆

This blog was first published in 2023 and has been update regularly since

As Ireland's leading life insurance broker, we specialise in comparing the rates and policies from the top five Irish life insurance providers and offering the very best value quotes to suit the individual needs of our clients. Our expertise lies in finding a suitable insurance plan for those with specific needs, be it a particular illness, occupation or claim history, we've got you covered in every sense!

Watch our video