Table of Contents

Hey Nick, My girlfriend had an eating disorder (bulimia) in the past. She’s grand now but has been declined by two insurance companies recently. Can you help her get cover? We’ve just had a baby and are buying our first house so we need mortgage protection. We never knew it would cause such a problem. Thanks in advance, Graham.

Yes, you can get life insurance cover if you’ve suffered from an eating disorder like anorexia or bulimia in the past.

However, if you’re currently experiencing symptoms, the insurers may postpone offering cover until you are symptom-free for a period of time.

Similarly, if you are undergoing treatment for your eating disorder, the insurer will postpone until your treatment is over and you are stable.

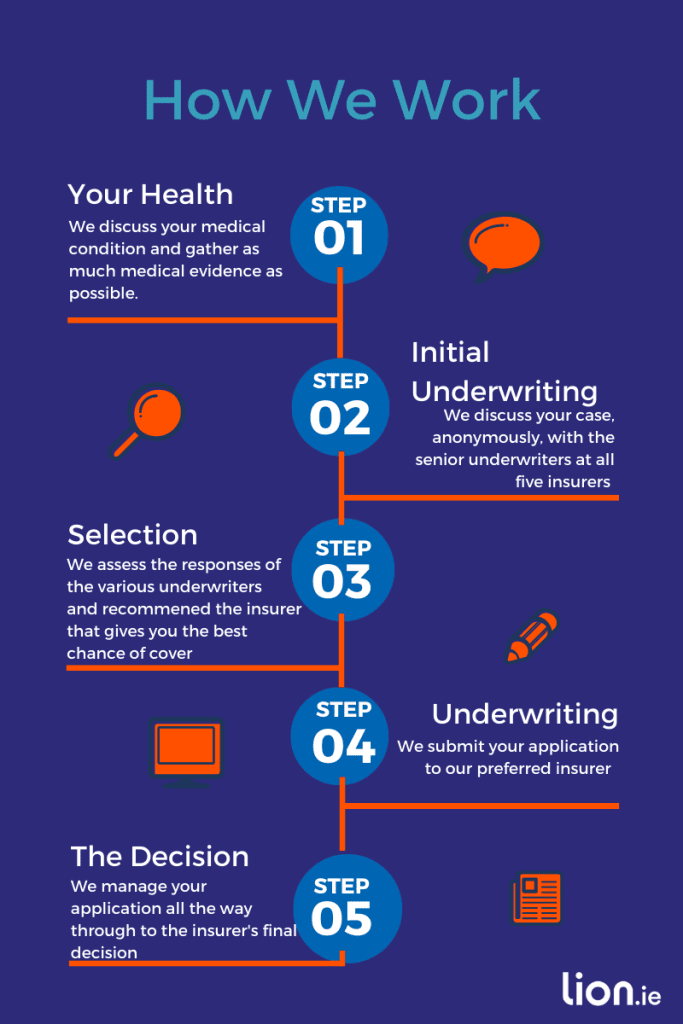

Some insurers are more understanding of eating disorders than others, it’s our job to find the most sympathetic insurer for your condition.

The most important factors the underwriters look for when assessing an application for life insurance with an eating disorder are:

I know it’s not easy to talk about but please be prepared for a lot of questions, I’m sorry.

It’s hard to say as the final loading will be specific to your application but generally, the increase in premium will be +50% to +100% extra on the standard price.

If there have been complications related to your eating disorder, your price will be higher.

Maintain a healthy weight over the long term (at least 12 months).

The insurers feel that the longer you are a healthy weight, the less chance of a relapse.

Do you have an eating disorder but you’re a little hesitant to talk about your health history?

Don’t worry, you’re not alone, we’ve helped a lot of people in similar situations.

If you’d like me to help, please complete this questionnaire and I can discuss your case in confidence with my panel of underwriters.

This means you avoid applying to companies who will refuse to insure you, or will offer cover at a ludicrous price.

By completing the questionnaire, you avoid wasting time and give yourself the best chance of getting cover.

If you’d prefer a quick chat first, please schedule a callback here.

Thanks for reading

Nick

Editor’s Note | We published this blog in 2017 and have regularly updated it

As Ireland's leading life insurance broker, we specialise in comparing the rates and policies from the top five Irish life insurance providers and offering the very best value quotes to suit the individual needs of our clients. Our expertise lies in finding a suitable insurance plan for those with specific needs, be it a particular illness, occupation or claim history, we've got you covered in every sense!

Watch our video