Table of Contents

If you Google the most popular fears, you’ll get a list that looks like this:

Which means that most people find the idea of public speaking scarier than death.

Jerry Seinfeld has a great quip that sums it up:

To the average person, if you go to a funeral, you’re better off in the casket than doing the eulogy.

But fears are funny: most people aren’t actually afraid of the fear.

You’re not afraid of the dark – but of what’s in the dark.

You know: the Boogeyman, a creepy clown with a knife, the crushing realisation that you don’t actually like people and that you’re slowly turning into your parents.

Death – well, death’s the kicker.

Which is why if you’re on this blog, you’re probably looking for reasons to get Life Insurance.

You’re gonna find five of them – and I swear they get a bit more insightful after number one.

Hopefully aged 96 and surrounded by your loved ones (presuming you haven’t done anything to piss ‘em all off).

Death is the one certainty in life because even taxes are avoidable.

So yeah. You’re gonna die. Doesn’t matter if you never smoke or drink and live your life like Ned Flanders.

Apart from having a family (leeches, the lot of them), dying is one of the most expensive things that can happen to you – well, to your loved ones.

You can’t really bury them in a shoebox in your garden or flush them down the toilet like you did with your beloved family fish, Tuna Turner.

RIP x 2.

According to Fanagans, a funeral care provider, you could be looking at coffin up thousands to cover:

On top of that are third-party costs like:

You could say it’s a grave matter but that would be insensitive and not funny at all.

Tomb much?

Cardiovascular disease contributes to over 9000 deaths per year in Ireland.

Which makes for grim reading.

Would you be covered if you were one of the thousands of people who suffer an unexpected heart attack/disease or stroke every year?

Life Insurance or Serious Illness Cover would make all the difference to you or your family if your ticker gave in.

Life Insurance is a bit like a fine wine – it gets more expensive with age.

A fancy Château Lafite-Rothschild 2010 (fruity, woody, notiony, blahblahblah) could cost you over a grand.

If you’re into your wine and you’re rich enough to consider buying a small, local football team that might sound reasonable.

Alternatively, you could get a perfectly serviceable wine (with 75 percent less notions) for €20 in the shop around the corner.

With Life Insurance, you could wait till you’re 50 and pay a fortune or you could save a packet and get insurance when you’re younger.

You can’t get the Widow’s Pension at the same time as the State Pension.

It’s whichever is higher.

Your entitlement to the Widow’s pension depends on the following, via Citizens Information:

Either you or your spouse or civil partner must have:

And

Or

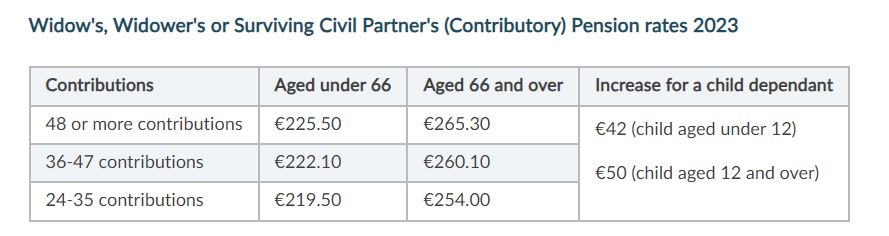

The weekly rates are:

In theory, that seems grand – but it’s not exactly a huge amount of money.

Life Insurance would be a secondary ‘income’ for your family if you passed away.

For the average 35-odd year old who doesn’t smoke, a €500,000 Convertible Term Cover policy starts at around €39 with New Ireland and goes up to about €55 with Irish Life.

To recap what that string of words means:

Those figures aren’t set in stone but it’s a decent example.

That €500,000 would make a huge difference to your loved ones and that €39 a month wouldn’t exactly break the bank.

That’s €1.28 per day to protect your family unit 🤓

I’m not sure it’d actually help with the whole ‘fear of death’ thing, but it’s definitely one less worry.

Life Insurance is never as complicated or as expensive as you think.

If you’d like some help, please get in touch.

We’ll go through your personal circumstances and draw up a plan that protects your family at a price you can afford.

Give me a call on 05793 20836 or complete this questionnaire and I’ll be right back with a recommendation based on where you are in life.

Thanks for reading

Nick

Editor’s note: We first published this blog in 2017 and have regularly updated it.

As Ireland's leading life insurance broker, we specialise in comparing the rates and policies from the top five Irish life insurance providers and offering the very best value quotes to suit the individual needs of our clients. Our expertise lies in finding a suitable insurance plan for those with specific needs, be it a particular illness, occupation or claim history, we've got you covered in every sense!

Watch our video