John, a 35-year-old father, has two young kids: Emma, who is 5, and Noah, who is 3.

John is the soler earner.

If something were to happen to him, Noah and Emma’s life would be a little bit different.

Please sir, I want some more

So John is wondering how he should arrange life cover to stop the kids ending up in the poor house.

But seriously, let’s look at what would happen if John passed away:

Immediate Needs:

His family would need money to cover funeral expenses and continue paying bills, like the mortgage.

Living Costs:

Emma and Noah would money for JustEat, SHEIN and WiFi.

Education:

Noah and Emma will likely need money for their education.

Fast forward twenty years, John is 55, and his kids are adults.

Emma has a job, and Noah is starting his career.

The family’s mortgage is paid off, and John and his wife are preparing for retirement.

At this point, John’s need for life insurance is greatly reduced because:

Fewer Immediate Needs:

The mortgage is no longer a concern, and immediate expenses are lower.

Independent Children:

Emma and Noah are self-sufficient, so John’s life insurance doesn’t need to cover their living or educational costs.

Retirement:

John and his wife have prepared for retirement, ensuring they have funds for the future.

So how should he arrange life cover?

He has two options

1) Level term life insurance

2) Decreasing term life insurance

John, like all of us, needs more life insurance when the kids are useless leeches.

This need reduces as our kids grow up and become financially independent (the sooner the better!)

So why do most people buy a level-term life insurance policy that will pay the same amount now as it will in 25 years?

Don’t you need more cover now and less in the future?

Is there a better way to arrange life cover?

Let’s say you’ve worked out that you need cover of €500,000 over 25 years to care of your family should you get hit by that bus we all fear.

Does it make sense for your family to get the same payout in 25 years as they would today?

Or is there an alternative?

Of course there is!

A quick crash course on the two types of life insurance available:

This is your run-of-the-mill life insurance.

You die during the term, and it pays out the agreed lump sum.

So if you take out €500,000 over a 25-year term and you die within those 25 years, it pays out €500k to your family.

Simple enough, right?

This is a life insurance policy where coverage reduces over time.

By the way, if you choose to assign it to a bank for a mortgage, it becomes what is better known as Mortgage Protection.

But what few people know is that you can buy reducing term life insurance and use it as personal life cover (even if you’re not getting a mortgage)

Using our example above but buying €750,000 reducing term life insurance over 25 years:

So reducing term life insurance pays out more when your family need it most – when the kids are young.

Because, in the future, when they’re financially independent, they don’t need a huge payout.

Therefore, arranging life insurance on a decreasing basis better meets your needs.

It protects your family when they are most vulnerable

And the real beauty is…

IT COSTS LESS THAN TERM LIFE INSURANCE

You might this hard to believe

Jack and Jill are both 35 and in good health, they have just had baby girl, Hillary (they call her Hill)

They have a budget of €55 to pay for life insurance.

By now, you know they have two choices

Level Term Life Insurance

They can buy €500,000 level term life insurance over 25 years.

Decreasing Term Life Insurance

For the same money, they can buy an extra €300,000 cover!

Yep, €800,000 decreasing term costs the same as €500,000 level term.

Pros

Cons

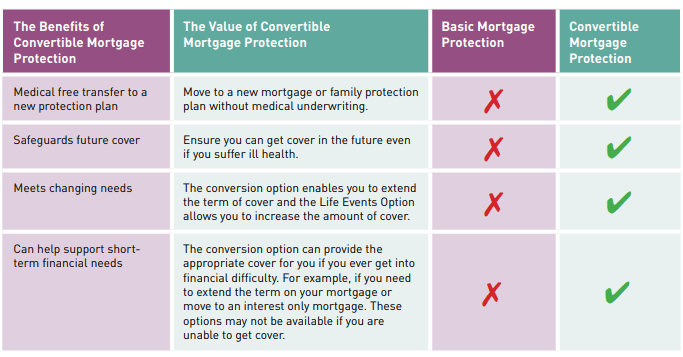

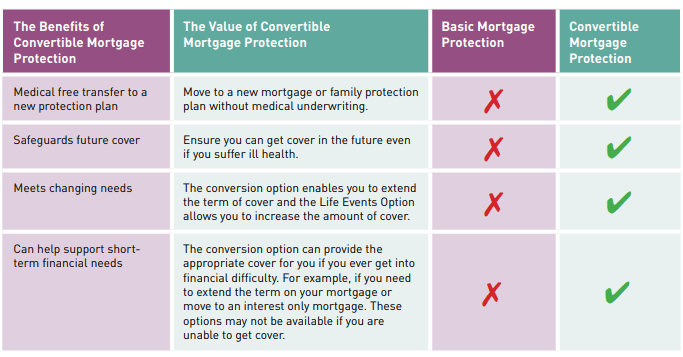

When I first wrote this blog, way back, there was no conversion option available for reducing life insurance policies, so you couldn’t extend your policy in the future.

Since then, Zurich Life, Royal London, Irish Life and New Ireland have all added a conversion option to their reducing life insurance policies.

The conversion option is magic (not as magic as that tractor that turned into a field, but magic nonetheless)

You can convert your reducing life insurance into level-term life insurance in the future without answering medical questions.

Consider it a safety net if you change your mind and prefer level-term life insurance.

Yes, you can, and I discuss that in great detail here:

What is Monthly Income Life Insurance?

I know this blog is a bit complicated, so I’m sorry if I have melted your head.

But if you complete this life insurance questionnaire, I can do the thinking for you and send you a personalised recommendation.

Or, if you’d like a quick chat to discuss, please schedule a time here.

Talk soon

Nick

Editor’s Note: We first published this blog in 2017 and have regularly updated it since

As Ireland's leading life insurance broker, we specialise in comparing the rates and policies from the top five Irish life insurance providers and offering the very best value quotes to suit the individual needs of our clients. Our expertise lies in finding a suitable insurance plan for those with specific needs, be it a particular illness, occupation or claim history, we've got you covered in every sense!

Watch our video