Table of Contents

I’ll admit I was worried when Vhi life insurance entered the market back in 2017.

Vhi has one million customers, that’s roughly 990,000 more than us.

Little Lion.ie taking on the mighty Vhi is like David taking on Goliath, The Rock and Stone Cold Steve Austin.

Plus Zurich Life were underwriting their policies.

As you know I like Zurich Life, so I felt betrayed.

How could they do this to me? Howwwwwwww?

But after reading through the Vhi life insurance bits and bobs, it didn’t seem so bad.

It was like waking from THAT Leaving Cert dream.

I realised only an eejit would buy from them, and our customers are far too discerning, aren’t you?

So let’s see what Vhi life insurance are all about….starting with The Good.

Vhi life insurance through Zurich has two benefits over our life insurance through Zurich Life.

This means you won’t have to pay your premiums if you’re unable to work for over 13 weeks.

That’s a handy one especially if your premiums are going to be on the high side (and they certainly will be high if you choose VHI)

Counselling support gives you access to face-to-face counselling (up to 4 sessions) and a 24/7 freephone helpline, provided by Vhi.

But this can be withdrawn at any time.

Moving onto The Bad…

This is where it gets interesting.

Although Zurich Life underwrites the policy, there are big differences in what they offer.

The devil is in the detail.

If you’re over 60, forget about applying, you won’t qualify.

But with our Zurich Life policy, you can apply for cover up to age 74.

You can only insure yourself up to age 70.

Once you reach 70, they cancel your policy…so if you plan on living to 71, you have a decision to make.

With our Zurich Life policy, you can insure yourself to age 89.

The conversion option allows you to extend the term of your policy at any stage.

But with life insurance from the Vhi, you can only extend your policy to age 70.

At 70, your policy ends and they pocket your premiums.

But with our Zurich Life policy, you can extend your policy to your 89th birthday.

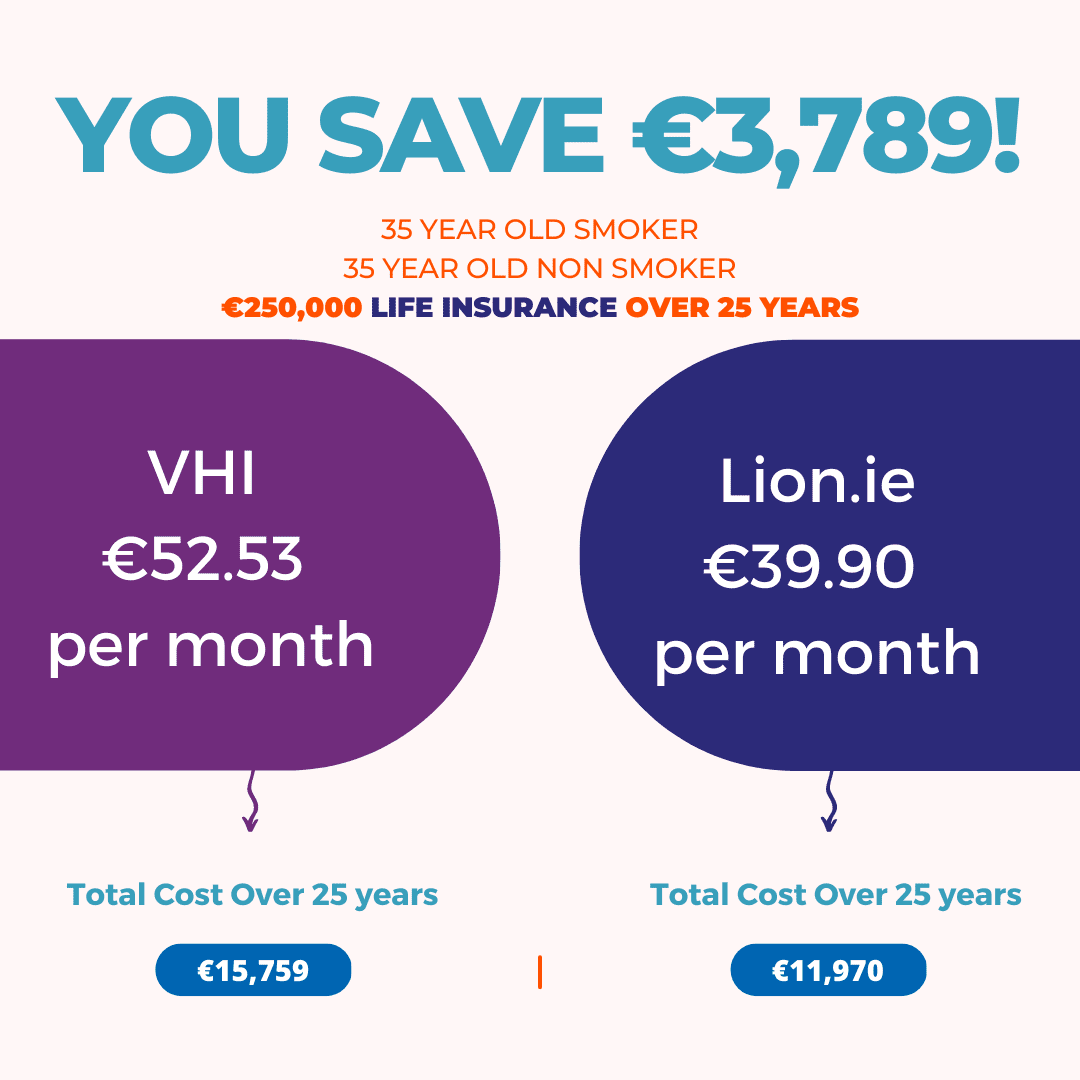

Finally, let’s look at the DOWNRIGHT UGLY elements of Vhi life insurance

A LOT MORE than it should is the simple answer.

Have a look at this quote:

One last thing to be aware of is that Vhi isn’t a life insurance broker.

They are a tied agent of Zurich Life so can only sell Zurich Life products, they cannot advise on life insurance available at the other insurers:

Aviva, Irish Life, New Ireland and Royal London.

We like Zurich for most things but for some underlying conditions, they are very strict.

Remember if VHI refuses your application, you will have to disclose this refusal in all subsequent applications.

This will raise a red flag at the other providers making it more difficult to get cover at the best price.

The Vhi life insurance terms and conditions are skewed in favour of the insurer, but with one million customers and a MAHOOSIVE advertising budget, I’m sure they’ll find a few suckers.

Hopefully you’re not one of them.

Vhi | Very High Insurance Premiums

If you’d like some help protecting your family, please complete this questionnaire and I’ll be right back with a no-obligation recommendation.

Thanks for reading

Nick

Editor’s Note | We published this blog in 2017 and have updated it since

As Ireland's leading life insurance broker, we specialise in comparing the rates and policies from the top five Irish life insurance providers and offering the very best value quotes to suit the individual needs of our clients. Our expertise lies in finding a suitable insurance plan for those with specific needs, be it a particular illness, occupation or claim history, we've got you covered in every sense!

Watch our video