Table of Contents

How many years do I actually need life insurance for?

If you’ve decided that now’s time to get life insurance for your family, congratulations!

It’s a smart move and the grown-up thing to do.

But how do you choose the right amount of years for your cover?

By the way, to avoid confusion, the amount of years on your policy = the term of your policy.

The length of cover you choose can significantly impact how much you pay – the longer the term, the higher the premium.

Why?

Because the Grim Reaper has longer to find you (statistically, the chance of a claim is more likely on a long term policy).

Therefore, it’s important to pick the right time frame for your needs, so you don’t overspend or find yourself underinsured down the track.

There are many factors to consider when choosing how long your policy should be in place, so to help get you started, we’ve come up with five scenarios for when it might be best to take out a shorter or longer policy.

If you think about it, as a parent, your job is to provide for your kids and make sure they reach adulthood safely.

While you’re above ground, that’s easy to do using the cold hard cash you earn in your day-to-day.

But what if Old Reaper calls you early?

What happens then?

Well, your paycheques stop immediately, so your family lose out on your future income stream.

This could amount to A LOT of dough.

Let’s say you earn €50k and pass away at 45 (20 years to retirement).

Your potential future earnings of €50,000 x 20 = €1,000,000 disappears. making your family €1m worse off.

To avoid that scenario, you put life insurance in place that will pay out a tax-free lump sum on your death to replace this lost income making sure your family are financially stable at a time of great emotional distress.

It’s the sound and responsible thing to do.

And what about the term?

We recommend cover until your youngest child reaches 25, so if your youngest is now 4, we recommend a 21-year term with a conversion option.

The conversion option guarantees you can buy a new policy in the future regardless of your health.

Once your youngest reaches 25 and is financially independent, you can let your policy expire if you feel you no longer need cover, or you can extend your policy using the conversion option.

However, if you feel your child will financially rely on you for longer than 25 years, you should adjust the original term on your policy accordingly.

As your partner relies on your income, you need to protect them as long you’re earning an income, so in this case, we recommend cover until you reach retirement age.

Remember, longer-term policies are more expensive than shorter-term policies, so to keep costs low, you could opt for a 10-year policy with a conversion option.

PLEASE NOTE

The initial premiums will be lower, but if you need to extend the cover in 10 years, the insurer will recalculate your premiums based on your ages at that time. However, you won’t need as much cover in 10 years as you do now because you will be ten years close to retirement.

Overall though, a 30 year fixed premium policy will cost significantly less than a 10-year policy, converted to another 10-year policy converted to another 10-year policy.

I hope that makes sense!

For final expenses, we recommend either

a) a whole of life plan or

b) a term plan with a whole of life continuation (the type that can pay for itself)

The whole of life plans is more expensive than term life plans because there is a guaranteed payout.

You can’t outrun Mr G.Reaper forever -a whole life plan will eventually payout.

If you don’t fancy your chances of living past 85, you can always take the risk and buy a term plan to an age of your choosing but with the caveat that you could outlive the policy.

However, if you survive past your 85th birthday, the life insurance provider will trouser your premiums and your cover will expire.

Death and taxes, yadda yadda, are the only two guarantees in life.

We’ve looked at death a bit – the fun we have, eh – but what about taxes?

On your death, if you’re fortunate enough to leave a few quid behind, the Revenue will want their cut.

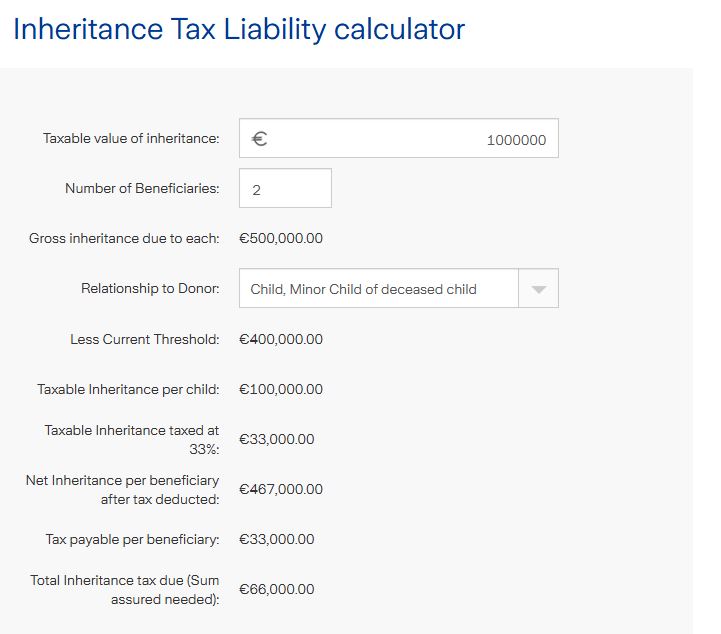

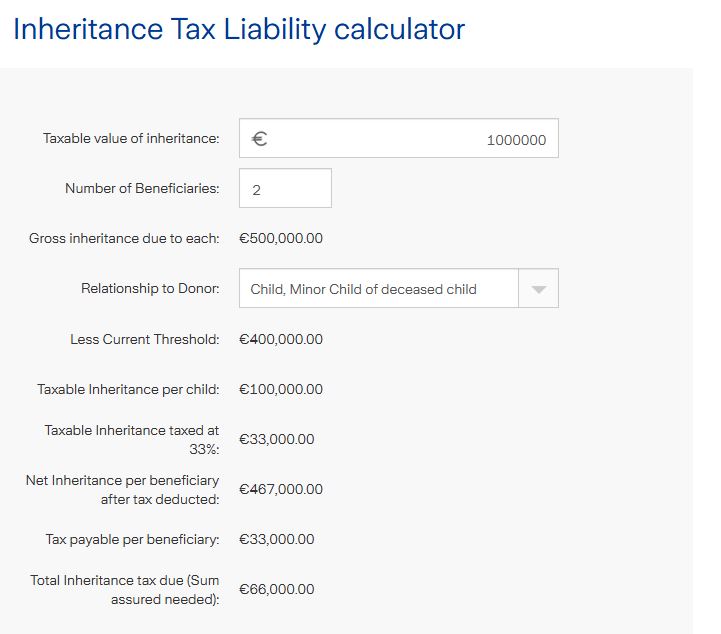

Imagine your assets (cash, house, car, bitcoin, Panini sticker album, Euro 88 jersey) amount to a cool million, and you have two children.

Assuming they didn’t receive any other inheritance from you in their lifetime, they will have to stump up €66,000 each in inheritance tax.

Most adults, let alone young adults, don’t have the means to cough up €66k to pay a tax bill!

To pay it, you can take out a Section 72 life insurance plan for your children.

If you pass away, the policy will pay €66,000 to Revenue, so your kids will get their inheritance tax free (the lucky sods!)

Generally, we recommend a whole of life policy for inheritance tax purposes, but there are some occasions where a term life plan is better and more affordable.

*Sounding the generous aunties and uncles klaxon.

The best term here depends on who you are leaving money to and the stage of life they will be at when they get the gift.

e.g. it’s for a favourite niece or nephew to pay for their education, match a term to when they have finished their schooling.

Or, if you want to leave something to a charity like your local dogs home, then a whole life plan is the way to go.

If you’re still not sure about the correct term and want some advice on your current situation, please complete this questionnaire, and I’ll be right back over email with some ideas.

Alternatively, give me a call on 05793 20836 or schedule a call back here.

That’s what Denis did!

Thanks for reading

Nick

Editor’s Note | We published this blog in 2021 and have regularly updated it.

As Ireland's leading life insurance broker, we specialise in comparing the rates and policies from the top five Irish life insurance providers and offering the very best value quotes to suit the individual needs of our clients. Our expertise lies in finding a suitable insurance plan for those with specific needs, be it a particular illness, occupation or claim history, we've got you covered in every sense!

Watch our video