Table of Contents

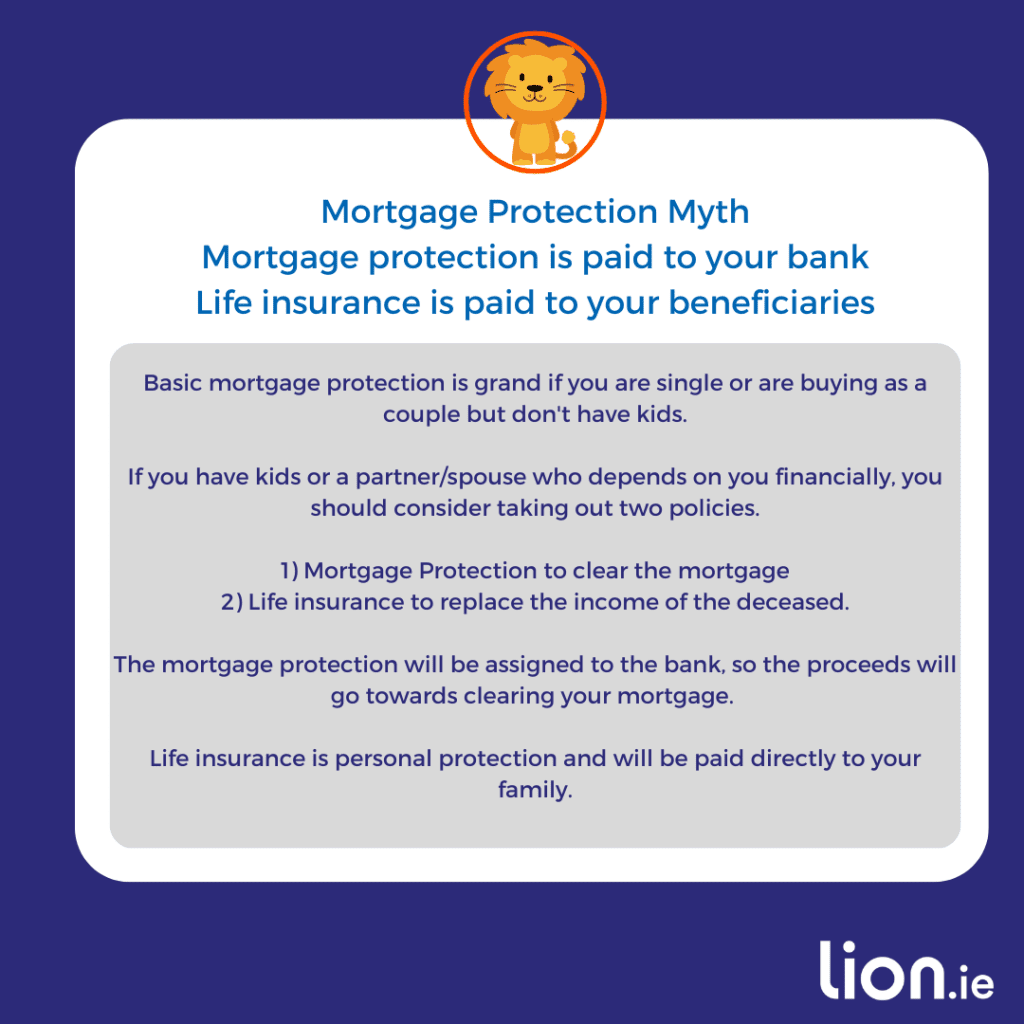

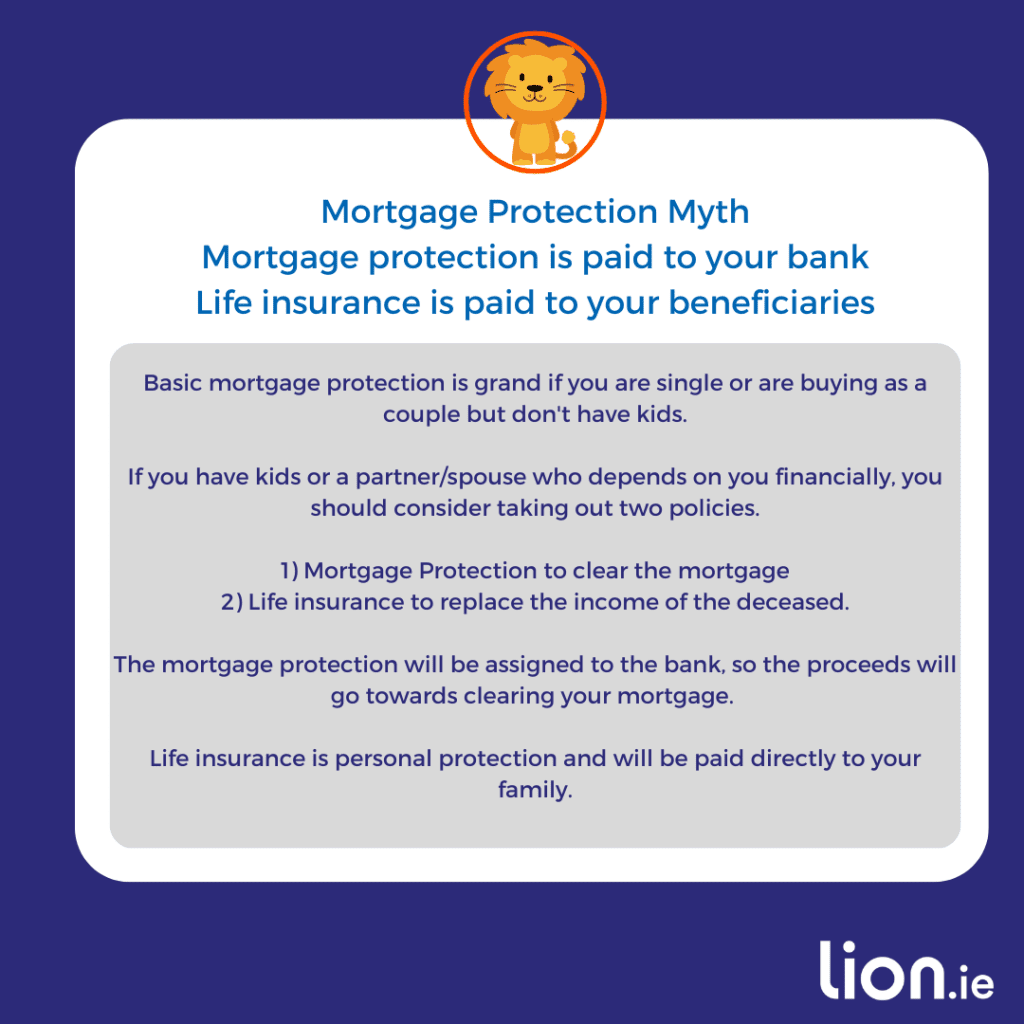

A. The cover on a mortgage protection policy reduces over time. The cover on a life insurance policy doesn’t. Life insurance costs more but all you need for a mortgage is mortgage protection.

And that, my friends, is the most frequently asked question in the whole wide world of life insurance!

Nick, I’m getting a mortgage from my bank, they are pushing life assurance. Do I need life insurance for a mortgage? John

Repeat after me:

Ignore your bank – they tell fibs.

Lots of them:

Take it from me; all you need is a bog-standard, basic mortgage protection policy (also known as a reducing term life insurance policy). And if you can get a better policy away from your bank, by all means, do so.

Mortgage protection insurance is compulsory for a mortgage (unless you get a waiver), but term life insurance is unnecessary.

But there’s not much price difference. Shouldn’t I buy life insurance to cover the mortgage and my family?

We all believe we’ll live to a ripe old age.

So, by the time we shuffle off, our mortgage balance will be tiny, and the life insurance policy will clear that tiny mortgage and leave a substantial lump sum to take care of our family.

Does this sound familiar?

But what if your future isn’t so rosy and you leave us early?

Your life insurance policy will only clear your mortgage balance, leaving nothing to take care of your family.

Let’s look at an example:

Say you’re getting a €300,000 mortgage for 30 years. You take out a life insurance policy for €300k assuming it will pay off the mortgage and leave a tidy lump sum to your loved ones.

Scenario a) You die in 29 years with €1000 left to pay on the mortgage. Your life insurance pays €300,000 to the bank; they clear the mortgage and give your family the balance of €299,000.

Scenario b) You’re hit by a bus tomorrow? After paying off the mortgage, your family gets nothing.

By arranging it this way, if you pass away, the mortgage protection policy will clear your mortgage, and the life insurance will leave an agreed lump sum to take care of your family, regardless of when you die.

Of course they are, because who gets the serious illness payout on a mortgage protection policy?

Hint, it’s not you…and I’ll bet nobody explained that to you either.

Here’s our review of the One Plan.

Yes, it’s compulsory in Ireland unless:

All the above is wrapped up under S126 of the Consumer Credit Act

Income protection, serious illness cover and life insurance are optional.

If you don’t have income protection through work, you’d be a brave person not to at least consider it.

Imagine you had a money machine in the kitchen spitting out your salary every month. Would you insure it?

Of course you would, it would be the first thing you would insure.

You are that money machine, income protection is your breakdown assistance policy!

Nor income protection, but if your sick pay is crap at work, I 100% recommend you get income protection regardless of whether you have financial dependents. Your income is your most valuable asset, so it should be the first thing you insure. How will you pay the mortgage if you don’t have an income?

Yes.

Existing life insurance can be used for mortgage protection as long as the coverage amount and the term (years on your life insurance) are at least equal to the amount and term of the mortgage.

Look, I’m not going to lie to you. Some banks will be quite aggressive when it comes to life insurance policies. They have targets to hit and mouths to feed, so I can’t blame them.

If you’re uncomfortable saying no to them, I understand.

But all is not lost; you can switch from the bank to another insurer anytime in the future without penalty. You get your money back if you switch in the first 30 days.

No, bill cover is a poor relation of income protection. You don’t need it for a mortgage.

Despite what the insurers say, no single insurer is best for life insurance, mortgage protection, serious illness cover and income protection. If your advisor is pushing one insurer, you should hear alarm bells. Is there more in it for them or you?

You’re doing it wrong if you buy all of your covers from one insurer.

Read: Can you combine life insurance and mortgage protection?

MPP or Mortgage Repayment Protection is a type of insurance that covers your mortgage repayment if you are made redundant.

Mortgage protection clears your mortgage if you die.

AVOID MPP! Claiming is a nightmare.

Are you in the same position as John?

Is the bank giving you the hard sell?

If you’d like a free, no-obligation recommendation, complete this financial questionnaire, and I’ll be back over email.

Thanks for reading 🙂

Talk to you soon.

Nick McGowan

lion.ie | making life insurance easier

As Ireland's leading life insurance broker, we specialise in comparing the rates and policies from the top five Irish life insurance providers and offering the very best value quotes to suit the individual needs of our clients. Our expertise lies in finding a suitable insurance plan for those with specific needs, be it a particular illness, occupation or claim history, we've got you covered in every sense!

Watch our video