Table of Contents

I have read in forums that it can be difficult to actually get a critical illness claim to pay out!

I hear this so often.

I’d love to know who’s spreading these scurrilous rumours!

Car insurance and house insurance can be nigh on impossible to successfully claim, but serious illness cover is different.

However, it’s normal to worry that the insurer will pocket your premium and then reject your critical illness claim.

Although life insurance providers will decline some claims (usually because of lying on the application form👇), if you have a genuine claim that meets the definition of the illness , they will happily pay out.

If the insurers don’t pay claims, then what’s the point of serious illness cover?

This is why they welcome claims so they can prove how important serious illness cover is.

So, let’s examine why an insurer may refuse to pay a claim:

Before you take out a specified illness policy, read carefully through the terms and conditions.

In there, you’ll find a list of the critical illnesses covered and how the insurer defines the illness.

Before the insurer can pay your critical illness claim, your illness must satisfy the definition.

As an example, here’s the definition of cancer:

Any malignant tumour positively diagnosed with histological confirmation and characterised by the uncontrolled growth of cancerous cells and invasion of tissue.

but you’ll also find an exclusion for low-grade prostate cancer

All tumours of the prostate unless histologically classified as having a Gleason score greater than 6 or having progressed to at least clinical TNM classification T2N0M0.

Therefore, although your policy covers prostate cancers, the actual type of prostate cancer that you get has to meet the definition.

The prostate cancer must have a Gleason score greater than 6 for you to get a full serious illness payout.

But you can qualify for a partial payout.

At its simplest, this is telling porkies on your application form, e.g. declaring that you’re a non-smoker even though you have smoked in the last 12 months.

But what if you make a genuine mistake on your application form?

And how are you meant to remember things from years back?

Have a look at this Irish case where the insurer had to pay the critical illness claim even though the insured forgot to mention a material fact.

In this case, a critical illness claim for MS was upheld in the Courts even though the life insured failed to mention that she had undergone tests for eye problems (her symptoms were indicative of MS) eight years before taking out her policy.

The Court case found in her favour and awarded her €95,230.76 representing the payment that should have been received by Ms Coleman at the time of her claims together with interest.

Here are the 2022 claims statistics from Aviva.

In the majority of the 11% of the claims that Aviva refused, the claim didn’t satisfy the definition of the illness.

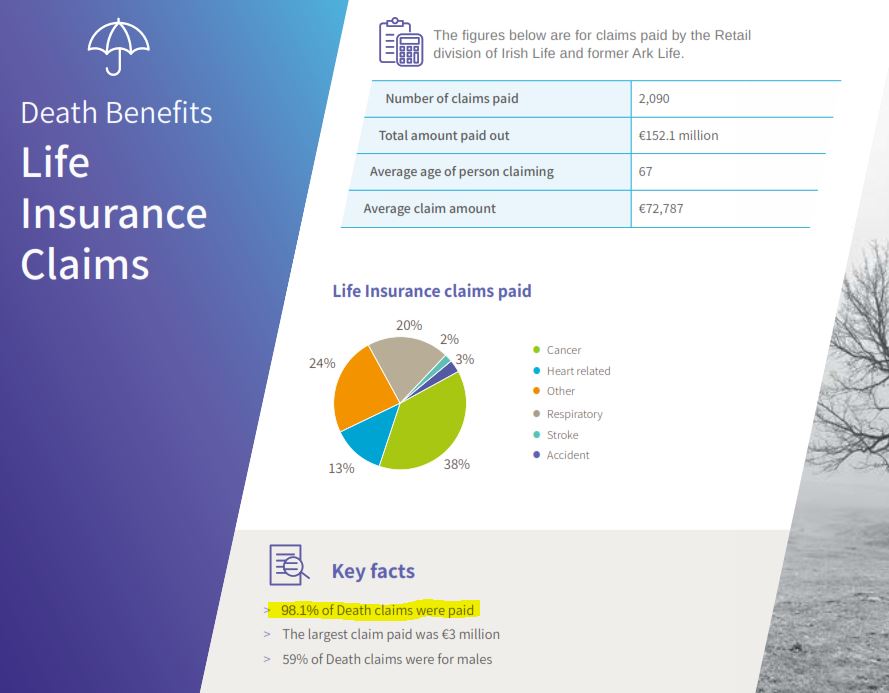

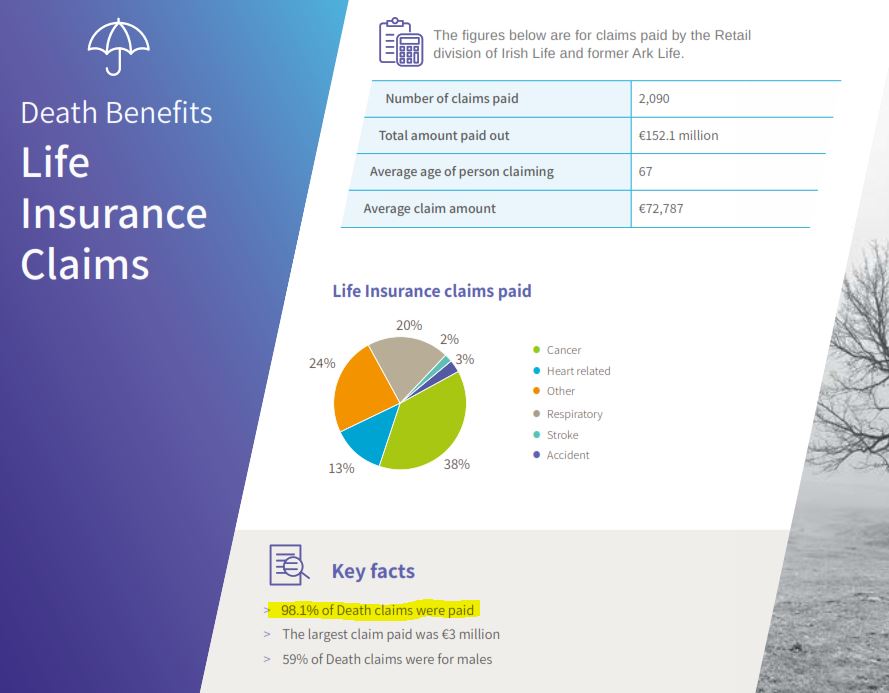

Let’s take a look at Irish Life’s death claims statistics for 2022

Are you surprised that Irish Life paid over 98% of their life insurance claims last year?

When asked, most people think insurers only pay around 60% of claims

Unlike serious illness cover, for a death claim, there is no “definition” to satisfy (if you’re dead, you’re dead).

Therefore the only reason for declining a death claim is non-disclosure.

And thankfully, this is rare.

Imagine having to explain to a grieving widow that her husband’s life insurance won’t pay out because he lied on the application form.

It’s our worst nightmare.

Please tell the truth on your application 🙏

Aviva, our preferred income protection provider paid over 90% of income protection claims last year.

With income protection, there is another spanner in the works when it comes to claims.

It’s called the deferred/waiting period – the time you must be out of work before the insurer can pay your claim.

So how does the deferred period affect your claim?

Let me give you an example:

Johnny has a 26 week deferred, income protection policy

He falls ill and can’t work.

After 13 weeks out of work he makes his claim, but before the 26 week period is up, he gets back to work, so he cancels his claim.

Aviva would have to record this as a declined claim 🤷♀️

I hope this gets rid of the heebie jeebie you may be feeling about buying life insurance, serious illness cover or income protection.

Life insurance providers are in the business of paying claims despite what your might read online.

By the way, if you are considering buying critical illness cover, please speak with an advisor first.

Preferably one that understands the differences between the policies on offer.

Although all the provider offer serious illness cover, some policies are much more comprehensive than others.

Don’t just go for the cheapest.

It could come back to haunt you when you try to make a critical illness claim.

Thanks for reading

Nick

PS: If you’d like me to review your personal situation and make a recommendation, please complete this questionnaire.

Editor’s Note: We first published this blog in 2019 and have regularly updated it since.

As Ireland's leading life insurance broker, we specialise in comparing the rates and policies from the top five Irish life insurance providers and offering the very best value quotes to suit the individual needs of our clients. Our expertise lies in finding a suitable insurance plan for those with specific needs, be it a particular illness, occupation or claim history, we've got you covered in every sense!

Watch our video