Table of Contents

Critical illness.

It’s a two-word pairing that strikes fear in your heart.

Like terminal cancer or heart disease.

Or Donald Trump.

All equally calamitous harbingers of doom.

But seriously, Critical Illness Cover, as the name suggests, is something you never actually want to cash in because it means…well, that you’re critically ill.

And when you think of critically ill, no doubt you go straight to visions of paralysis and comas and twisting tubes keeping you alive.

Critical Illness Cover likely covers many of these terrifying illnesses, which is quite possibly why you’re here.

Hello.

Nice to meet you.

Welcome to the article that will help you insure yourself should you catch a dose of heart disease.

But first…

Critical Illness Cover is a wearer of many hats.

Like a few other life insurance terms, it has many different names that all mean the same thing.

It’s also known as Serious Illness Cover and Specified Illness Cover.

In some circles, it’s also known as the ‘oh shit’ money.

In short, Critical Illness Insurance doesn’t stop bad things from happening…it just makes them more manageable.

For those yet to be indoctrinated into the cult of insurance (the insurers will try to convince you that it’s not a cult– but isn’t that exactly what a cult would say?):

Critical Illness Cover pays you a TAX-FREE LUMP SUM if you fall ill with one of the illnesses specified in your policy.

It can be a bit sneaky because the illnesses it covers are specific (hence why it’s called specified illness cover).

For example, you might have a heart attack, but it might not be severe enough to get a payout.

In fairness, people can have a “heart attack “and not even realise it so you can see why the insurers don’t pay out.

What is covered varies from insurer to insurer.

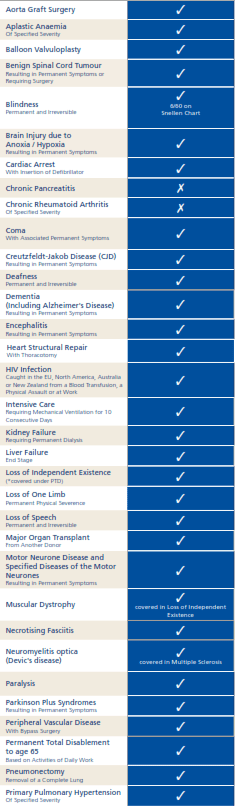

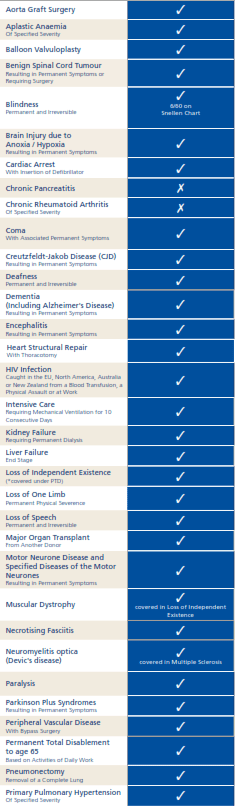

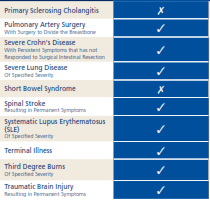

Zurich Life, for example, makes a full payment for 53 illnesses and a partial payment of €15,000 for 29 milder but life-changing diseases (called partial payment illness – see below)

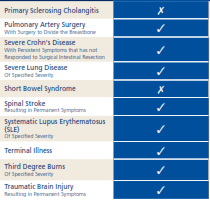

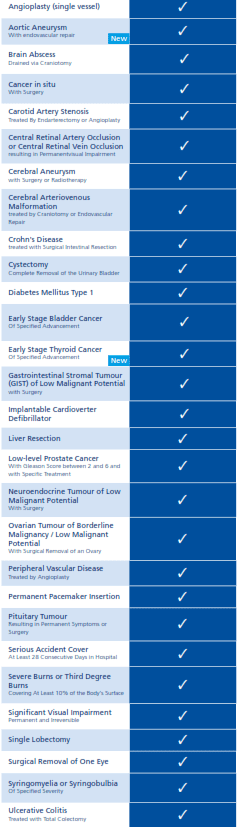

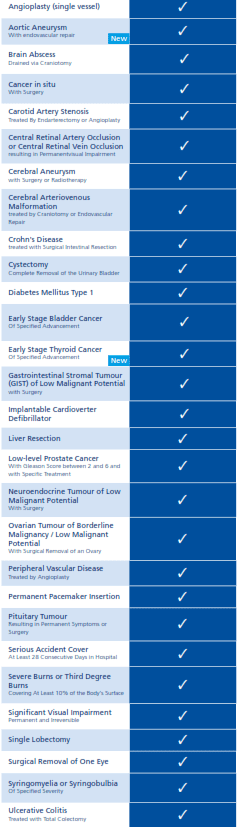

And here are the illnesses they cover:

These illnesses account for approximately 86% of all claims paid.

All of the insurers cover these three.

Around 10% of all claims are down to

If you’re a maths whizz, you can see that 96% of all claims are down to 11 illnesses.

Again, all of the insurers cover these illnesses.

These only account for 4% of all claims.

And look at how many there are!

For me, most of these are window-dressing

The insurers frequently add rare illnesses so they can crow about offering the largest number of illnesses.

Like, how many people do you know of who have suffered from Necrotising Fasciitis (flesh-eating disease)?

Don’t be fooled – focus on the big 11 illnesses and how easy it is to claim based on the specific insurer’s definition.

The kicker, however, is that pretty much all of the specified illnesses come with caveats:

And no, it’s not just Zurich Life that is making this epic attempt to flee from responsibility; all the insurers are much the same.

For example, Royal London covers 52 illnesses fully, with partial payment for 33 more.

But again, watch out for the caveats.

Like, it’d be a bit of a sickener to pay out for cover only to go into cardiac arrest and have a claim denied because you weren’t defibrillator-ed.

You’d probably keel over with a proper heart attack if you depended on that insurance to cover your hospital bills and time off work.

Well…no.

Getting struck down with a Critical illness is costly, and your policy 100% covers the horrible ones.

Did you know cancer can cost you €2,500 per month?

The Irish Cancer Society estimates it costs €1,000 per month for cancer-related bills such as medicine, transportation, parking and heating.

Yikes.

Add to this an estimated loss of income of €1,500 per month as you give up work or reduce your hours.

Imagine trying to work while enduring gruelling rounds of chemo.

So you’re down €1500 in income and up €1000 in expenses.

Realistically, would you be able to come up with the extra €2,500 per month for your treatment?

That’s €30,000 a year.

Even worse, from an article in the Journal:

The financial strain led to serious resentment from my husband and the breakup of our marriage in the end

Look, I’m going to tell you straight: Income Protection is a better option if you can afford it.

However, if your employer is generous enough to offer income protection at work, consider Critical Illness Coverage.

It’s cheap enough not to hurt your wallet while providing enough cushion to be a lifesaver if you need it.

This leads nicely onto:

Going off cancer cost of €1000 per month and loss of income per month of €1000 gives us a “cost of cancer” of €30,000 per year, so that’s the bare minimum you should buy.

Obviously, if you earn and spend more, it’s a different set of factors (one year’s after-tax income at a minimum)– but for most people, those €30k is a good shout without breaking the bank.

But if you can afford it, I’d stretch it to €50,000 to provide a cushion.

Also, the maximum payment on a partial/less severe illness claim is 50% of your serious illness cover amount, up to a maximum of €25,000. If you have €50,000 cover, you can get the maximum €25,000 payout.

However, if you buy €30,000 in cover, the max you’ll get is €15,000 should you suffer one of the less severe illnesses listed on your policy.

You have a couple of options here.

You can buy Critical Illness Cover on its own, or you can buy it as an add-on to Life Insurance.

Let’s look at a healthy 40-year-old couple getting dual Life Insurance.

In this first example, they’re just buying life insurance – dual coverage, €250,000 over 30 years.

It’ll cost them:

Remember: that’s just Life Insurance.

If they throw in €30,000 Serious Illness Cover as well, it’s:

The difference here is about €20 – a fiver a week.

Imagine how grateful you’d be that you paid the extra fiver if you got cancer and suddenly had to cough up that €2,500 a month.

I advise this: if you can afford it, go for Income Protection.

You can insure up to 75 per cent of your salary until you retire if necessary.

However, if you work in a higher-risk occupation and you’re getting Life Insurance anyway, it’s probably smart to spend the extra €20 a month and add illness cover.

If you’re going with the option of bundling Life Insurance and Critical Illness Cover, have a read of the additional benefits each insurer offers – for example, Royal London offers extras like Helping Hand Benefit while Zurich Life has a more affordable cancer-only option while Aviva has a scheme to get a second medical opinion.

On a final note on the bundling front, if you’re buying cover from your bank for Mortgage Protection or Life Insurance and they do the whole “by the way, we also do Serious Illness Cover; you should go for it too”, you should turn and runnnnnn.

Why?

In the event of a payout, your bank gets the money.

Yeah, I know.

So, in summary:

You don’t have to go nuts and spend loads on Critical Illness Insurance Cover.

Get a quote here for €30,000 and see if it’s within budget.

If it is, great. If it’s even less than you thought, then maybe consider Income Protection, too.

When it comes to protecting yourself, I advise buying a little bit of everything.

Let me know if I can help.

Complete this questionnaire, and I will send you a personalised recommendation based on where you are in life.

You can schedule a call here if you’d prefer a quick chat.

Talk to you soon.

Nick

Editor’s Note: We first published this blog in 2020 and have regularly updated it

As Ireland's leading life insurance broker, we specialise in comparing the rates and policies from the top five Irish life insurance providers and offering the very best value quotes to suit the individual needs of our clients. Our expertise lies in finding a suitable insurance plan for those with specific needs, be it a particular illness, occupation or claim history, we've got you covered in every sense!

Watch our video