Table of Contents

see here for life insurance with an overactive thyroid (hyperthyroidism)

Complete this questionnaire and I’ll send you a quote taking your Hypothyroidism into account

Yes, if you have hypothyroidism, you’ll be able to get life insurance, and if you play your cards right, you can get the standard price.

But it would be best if you spoke with a knowledgeable, specialist life insurance advisor who deals with all five life insurance companies in Ireland.

If you don’t get quotes from all five providers, how do you know you’re not paying too much for your cover?

Usually, you’ll get the normal price for hypothyroidism treated with medication like Levothyroxine/Eltroxin, assuming there are no complicating factors.

The insurer will need to know the following:

Our hypothyroidism questionnaire shows the exact information the insurer will require.

By the way, if you complete this questionnaire, I can discuss your case in confidence with all of my insurers and get you an indicative quote before you formally apply.

How does that sound?

Usually, if you complete the questionnaire in good detail, you can avoid needing a medical report from your GP that can take ages to sort out.

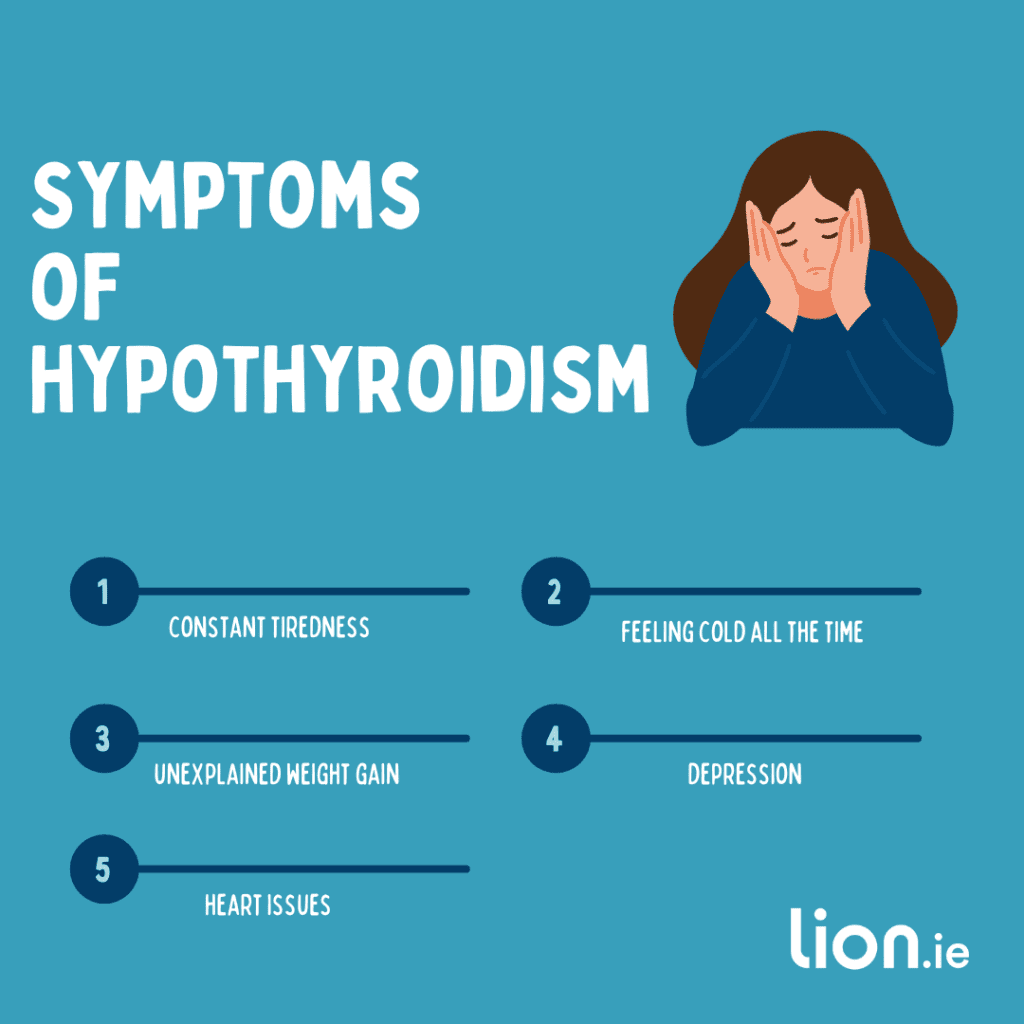

Hypothyroidism occurs when the thyroid gland fails to produce sufficient thyroid hormones.

A blood test measuring your hormone levels is the only accurate way to determine if there is a problem.

The Thyroid Function Test (TFT) looks at thyroid-stimulating hormone (TSH) levels and Thyroxine in the blood.

A high level of TSH and a low level of Thyroxine hormone in the blood could mean you have an underactive thyroid.

If your test shows raised TSH but normal Thyroxine, you may be at risk of developing an underactive thyroid in the future.

Treating hypothyroidism requires a lifelong replacement of deficient thyroid hormones using traditional medication or natural thyroid supplements.

Hashimoto’s Disease is related to hypothyroidism -it’s an autoimmune disorder. In other words, it’s a problem with your immune system rather than your thyroid gland. However, from an underwriting perspective, it is treated similarly to hyperthyroidism – if well controlled with medication, you should get the normal price for your cover.

Hyperthyroidism is when an overactive thyroid gland produces excessive thyroid hormones that circulate in the blood.

Getting life insurance with hyperthyroidism

Assuming no malignancy, thyroid removal surgery shouldn’t affect your premium, assuming you have fully recovered.

Yes, you can.

You should get the normal price if your thyroid issue is under control and you have no other complications.

Yep!

Again, the normal price is possible.

Hypothyroidism shouldn’t affect your life insurance premium if you apply to an insurer who understands your condition.

But remember, some insurers are better than others, especially if there is a related BMI issue.

If you’d like help, please complete this underactive thyroid questionnaire, and I’ll be back.

I will speak to all five insurers on your behalf, on a no-name basis, to see who can offer you the best terms before you apply.

It’s the most hassle-free way of getting life insurance quickly and easily.

We love what we do and are grateful for all our customers.

Thanks for reading

Nick

lion.ie | Ireland’s Protection Broker of the Year 2022 ?

As Ireland's leading life insurance broker, we specialise in comparing the rates and policies from the top five Irish life insurance providers and offering the very best value quotes to suit the individual needs of our clients. Our expertise lies in finding a suitable insurance plan for those with specific needs, be it a particular illness, occupation or claim history, we've got you covered in every sense!

Watch our video