Table of Contents

If you’re confused about where to begin:

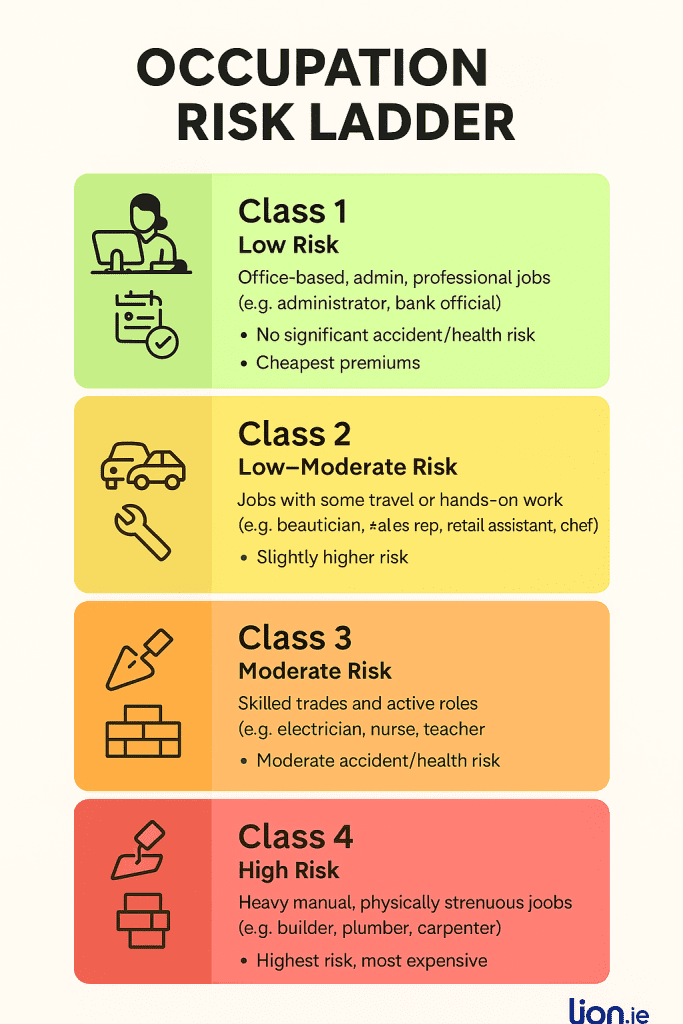

Insurers don’t just look at your age and health — they also look at what you do for a living. Every job gets put into an “occupation class”:

Insurers treat jobs differently — so your occupation can affect everything from the price to the fine print to whether you’ll even get cover.

One insurer may classify you as Class 1, while another gives you a Class 2 rating for the same job.

That could mean you pay a fortune more for no reason.

Even if you get Class 1, premiums can still vary between insurers.

That’s why it pays to compare all the providers before choosing the most suitable one for your occupation.

And with Lion.ie, you’ll also get a 15% discount on the normal price.

You’re classed as low-risk and typically qualify for the best rates — but don’t let that trick you into buying the cheapest policy.

Read more about income protection for accountants ➜

Commission-heavy roles can be hard to insure if your income isn’t guaranteed. We’ll explain how to protect what you actually earn.

Tips for income protection for OTE earnings➜

Between salary, dividends, and expenses, it’s easy to get confused — and lose money. Let’s break down what’s insurable and how to structure it.

Income protection for directors ➜

This one’s trickier. Not all insurers cover manual workers — and some won’t even quote. But there are workarounds.

How to get income protection in construction ➜

Changing contracts and income gaps can spook insurers. But if you structure your cover correctly, you’ll be in good shape.

How to get IP as a contractor ➜

Private practice? You’ll need cover for both income and overheads. We’ll show you which providers offer the best fit.

Income protection for dentists ➜

High income? High expectations. And high underwriting standards. Some insurers are better for medical professionals than others.

Which policies are best for doctors ➜

Office-based engineers tend to get better rates than site-based ones. Let’s make sure the insurer understands your actual job description.

If your job comes with added dangers — like construction, emergency services, or aviation — you may face insurer loadings or even outright refusals.

Explore high-risk job options ➜

You’re on your feet, working long hours, constantly moving, and exposed to risk. High risk = higher premiums, unfortunately.

See our nursing income protection tips ➜

Pharmacists are usually considered low-risk by insurers — which means you’ll qualify for the best rates. Whether you’re working in a hospital, retail, or running your own business, we’ll help you choose the right cover for your setup.

What pharmacists need to know ➜

You’re on your own without employee benefits or state support — making income protection essential. Learn how you can insure up to 75% of your gross earnings, how profits (not drawings) factor in, and what to expect when income varies.

Income protection for the self-employed & freelancers ➜

Sedentary doesn’t mean safe in the eyes of underwriters. Here’s what to watch for in the small print.

What solicitors need to check before buying ➜

Sick pay can be generous — but only for a while. After that, you’re on your own. The right deferred period can save you a fortune in premiums.

How to tailor income protection to a teacher’s sick pay ➜

Some roles don’t fit neatly into a single category. That’s where we come in. We’ll review your job title, duties, and income to recommend the best insurer for you.

Take the first step — complete our short questionnaire ➜

Yes. Insurers put jobs into “occupation classes.” A low-risk office job (Class 1) usually gets cheaper premiums, while more physical or hazardous roles (Class 3–4) pay more. The catch? Different insurers can classify the same job differently. That’s why it pays to shop around — or let us do it for you (we’ll even get you a 15% discount).

No problem. We’ll look at your exact duties, not just your job title. For example, some engineers are classed as Class 1 if office-based, but Class 3 if site-based. We make sure insurers understand what you actually do so you don’t get overcharged.

Yes — in fact it’s even more important, because you don’t have sick pay or company benefits to fall back on. You can cover up to 75% of your taxable profits (not just your drawings). We’ll help you structure it properly so you’re fully covered.

Both matter. Insurers look at your health history and your occupation together. Some conditions may mean exclusions or loadings, but not always. The good news is that different insurers treat the same condition differently — we check them all so you get the fairest offer.

Thanks for reading

Nick

As Ireland's leading life insurance broker, we specialise in comparing the rates and policies from the top five Irish life insurance providers and offering the very best value quotes to suit the individual needs of our clients. Our expertise lies in finding a suitable insurance plan for those with specific needs, be it a particular illness, occupation or claim history, we've got you covered in every sense!

Watch our video