Table of Contents

Not your job? See our full guide to Income Protection by Job.

Aside from the odd ‘best teacher’ mug and ‘we’ll miss you’ card you might get your hands on as the summer holidays creep in, teaching is a pretty thankless job.

But know this, I see you.

Not only do you educate my semi-feral children (more homework please, especially for the 11-year-old) but you also help them to navigate the difficulties of social interactions.

For those of you who work with our teens, well, good lord I don’t know how you do it.

The mood swings, and the Kevin and Perry style ‘why’s’ have me pulling my hair out.

So, battling the constant nonsensical moaning from a class of 30+ Kevins must be soul-sucking at times.

And stressful.

But what if it becomes so stressful that you need an extended break on medical grounds?

Sick pay is pretty limited and once you reach your maximum number of paid sick leave days, your income could all but dissipate like the whiff of Lynx Africa wafting down the high school halls.

This is where some type of salary protection insurance will save your bacon and give you a little bit of extra relief.

Luckily, the world of income protection for teachers is pretty simple to navigate.

Because your income is the very cornerstone of your lifestyle.

It’s your reward for slaving away on a daily basis and it pays for EVERYTHING.

From your mortgage to your food bills, to the crap you have to buy out of your own money in Mr Price to make slime, to that rather fancy holiday in Abu Dhabi, you are totally reliant on your regular pay packet.

You know the feeling when you just make it to the end of the month on fumes and then your wages hit.

Imagine if your wages didn’t arrive!

What would happen if you couldn’t work long-term?

If you had to exit the teaching job you love so much because of illness, injury, disability, or stress (the number one reason teachers claim income protection)

It’s not only the high-class holidays you would have to scrap but paying your mortgage would become the very stressor that keeps you from drifting off into the land of nod every night.

We all think

it’ll never happen to me

The “I’m fit as a fiddle” mentality is all well and good until you are suddenly faced with issues that force you to leave the workplace.

That lump you find, the stomach pain that keeps gnawing away or the headache that won’t shift.

Income protection is just your backup plan. You know, fail to prepare, prepare to fail, and all that jazz.

Once you have it, you will feel pure relief and PEACE OF MIND, and that’s what we’re all looking for these days.

If lads were selling bags of POM on shady street corners, we’d all be queuing around the block for a hit.

Gimme two bags of POM there bud. Sound.

Less stress, more certainty, a rosier future, and it’s legal!

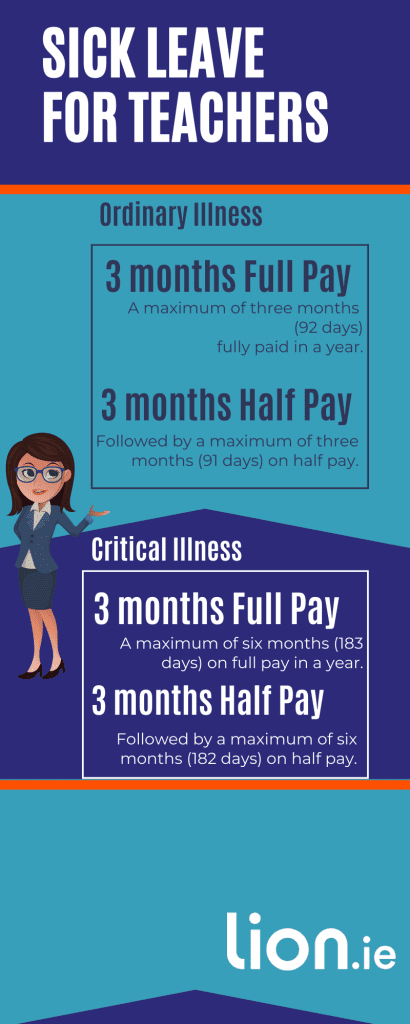

Now, teachers, I know there is a sick leave scheme you can avail of.

Here’s a reminder of how that works in a fancy nancy infographic.

You can score up to 3 months of paid sick leave if you can’t work due to illness or injury, but you need a medical certificate to prove your illness is ‘bad enough’.

Income protection, however, is pretty far-reaching, covering every medically recognised illness, accident or disability that stops you from doing your job as a teech.

And it can be paid out for as long as you are out of work, right the way up to age 70.

You still throw dusters right, I was ace at dodging them, twas harder to dodge a belt of a metre stick though. Oh the fun, we had in the 80s.

This kind of income insurance gives you and your family a replacement income of up to 75% of your normal annual income if you can’t do your job.

Mortgage repayment worries disappear if you show your policy certificate to your bank and tell them to call off the hounds.

Teachers are notoriously underpaid as it is, and with the current rate of inflation you’re probably already feeling the pinch.

And that’s on a full wage.

Imagine if it stopped.

Ok, you’ve got me against a wall here.

I could pull a number out of me arse to quell your curiosity but I’d probably be wrong.

I’d need a little more nitty-gritty details to give you a reliable quote (age, income, smoker/non, any health issues etc)

Actually, since I have you hop over and complete my income protection questionnaire and I’ll be able to email you some great deals within your budget (there are some huge discounts on income protection at the moment thankfully!)

That’s if you’re serious about looking after future-you.

If you prefer a chinwag first, you can schedule a callback here so we can have a chilled chat and answer whatever questions you have.

When it comes to salary protection all occupations are sorted into 4 different ‘classes’.

Think Harry Potter and the sorting hat for grown-ups.

Class 1 are low-risk jobs that the insurers rarely see claims from, and Class 4 included the highest risk occupations that see a lot of claim action.

Teachers tend to fall into class 3 and this is purely down to the possibility of hands-on work and also the higher stress environment you superstars deal with every day.

So, although you won’t be eligible for the cheapest income protection premiums, you won’t be lumped with the most expensive ones – silver linings, heh?

Yes, you can!

There’s a sneaky little bit of small print that talks about the deferral period.

This is basically how much time passes between you leaving the workplace due to illness, injury, or any other reasons you may not be able to work and when your income protection payments kick in.

As you can imagine, the quicker you want access to your wonga, the more expensive your premium will be to avail of this pleasure.

That’s why I always recommend having a small emergency fund nest egg of 6 months to a year, which covers your absolute minimum financial needs, so that you don’t have to pay the highest premiums.

It’s a little tough to do that in today’s financial climate, something I can completely appreciate, but it’s doable.

Also, you don’t have to insure 75% of your income.

Some people like to cover their mortgage repayment only, which makes it affordable AF.

Or finally, you could grab Wage Protector which is much more wallet-friendly and will pay out for two years.

Yup, the INTO scheme is insured by New Ireland but you don’t have to go there.

We can give you income protection options from Irish Life, Zurich Life, New Ireland, Royal London and Aviva.

It always pays to shop around.

See, I told you income protection for teachers was a pretty easy bit of landscape to navigate.

It’s not massively complicated but you don’t want to get saddled with a crappy deal.

That’s where myself and my superhero insurance team come in.

We want you to get the very best deal you possibly can, so what are you waiting for?

Here’s the questionnaire again if you’d like me to email you a no-obligation quote.

Thanks for reading

Nick

Editor’s Note | We published this blog in 2022 and have updated it since.

As Ireland's leading life insurance broker, we specialise in comparing the rates and policies from the top five Irish life insurance providers and offering the very best value quotes to suit the individual needs of our clients. Our expertise lies in finding a suitable insurance plan for those with specific needs, be it a particular illness, occupation or claim history, we've got you covered in every sense!

Watch our video