Table of Contents

10-second summary: Pharmacists are classed as low-risk (Class 1), so you’ll usually get the best rates for income protection. It replaces up to 75 % of your income if you can’t work through illness or injury — keeping your mortgage, bills, and sanity covered while you recover.

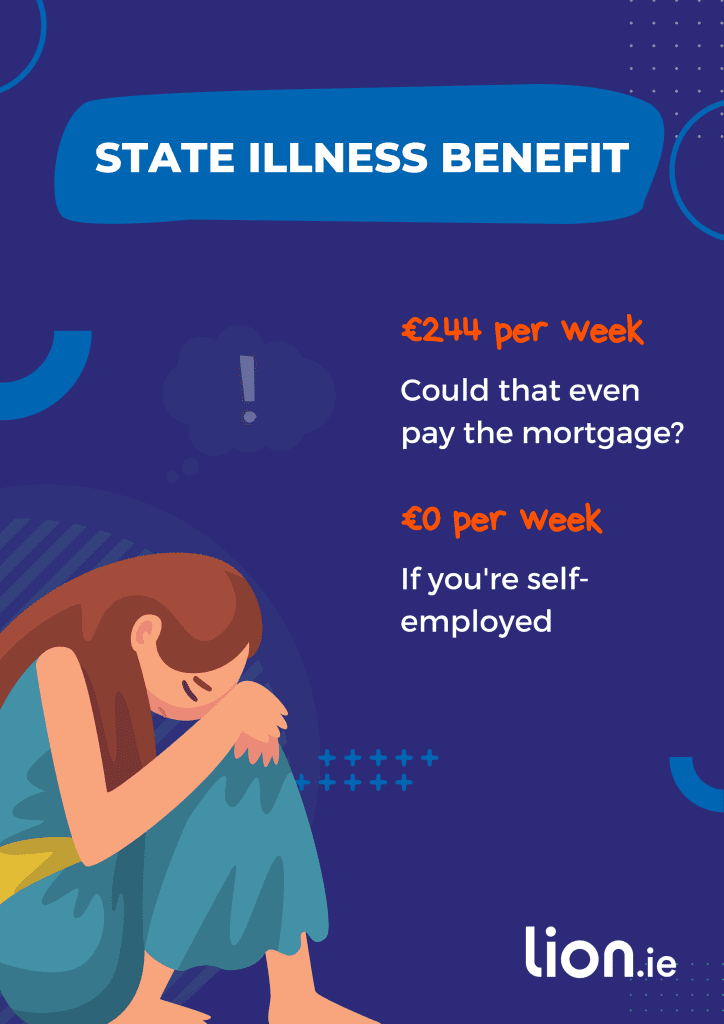

Editor’s note: First published December 2022 | Refreshed November 2025 with updated sick-leave rules, €244 State Illness Benefit rate, and confirmed Class 1 occupation rating.

Sick days are inevitable — the flu, a pulled muscle, a heavy night (don’t look at me like that!).

But did you know that legally, you’re only entitled to five paid sick days per year in Ireland?

Shocking, isn’t it?

And if you work as a chemist or can call yourself a pharmacist, you’re in the same boat as everyone else.

Thankfully, most employers are decent skins and will cover your sick pay for a wee while. But what happens if you go over your allotted number of paid sick days? How the hell are you supposed to pay the bills then?

Say you’re rear-ended or — God forbid — get cancer and can’t work because of how ill the treatment makes you.

How long will your savings last if you’re shelling out the guts of €2 k per month on the mortgage?

Not long is the answer.

In short, you’re screwed.

It’s a horrible thought, but we need money to survive.

Without it, your future is bleak.

Once you’ve used up your sick days, you could be scraping together a few quid for groceries — a situation far removed from where you are now.

An unexpected illness could put the kibosh on all those years of study and hard graft to get where you are today. So how do you stop this from happening?

Simple — prepare.

Put an income protection plan in place in advance.

The majority of pharmacists practise as sole proprietors or directors of limited companies.

This typically means that if they get sick or injured, there’s no employer sick pay to fall back on.

Stress, depression and anxiety are among the most common ailments pharmacists face — they account for roughly 70 % of income-protection claims, alongside cancer and musculoskeletal issues.

Pharmacists without income protection may have to keep working while recovering from an illness or, worse, stop completely without pay.

If you’re self-employed, income protection should be a top priority because you’ll get nothing from the state if you can’t work.

Life is expensive.

OK, that’s an understatement considering the current cost of living crisis.

Rent, mortgages, food, electricity, heating — you name it, you need money for it.

The more you earn, the bigger the drop if you lose that income.

Imagine waking up one day and working is a no-go. You’ll get about €244 a week from the State Illness Benefit (for up to two years).

Two hundred and forty-four euro. Would that cover the mortgage and let you survive?

By the way, life shouldn’t just be about surviving. Even if you’re unable to work, you still want to enjoy life as much as possible, right?

And yes, I am saying you need money to enjoy yourself.

Long walks in the woods are ace.

Long walks in the woods foraging for wild garlic and elderflower because you have no money to buy food… not so ace.

Income protection is the golden ticket that lets you keep buying Wonka Bars instead of surviving on nettle soup and dandelion tea.

It maintains your current lifestyle and, more importantly, your financial independence.

You won’t become a financial burden — which, let’s be honest, could be worse than the actual illness.

Salary protection pays you when you can’t work due to illness or injury.

Imagine you get into a fender-bender and are left with nasty whiplash or a broken collarbone that means you can’t stand or sit for long.

No amount of meds you hand over the counter is going to fix that. You’re going to have to take time off.

Your employer might cover a couple of weeks, but after that, you’re on your own.

If you’re self-employed, you’re literally on your own (read this now).

If you’ve had the smarts to protect yourself with an income-protection policy, you’re going to feel pretty relieved right now (and you’ll be incredibly grateful you stumbled upon this blog).

Once your deferred period has passed — more on that in a second — your policy kicks in and the insurer steps into your employer’s shoes, paying you a replacement income each month until you’re back working as a pharmacist.

That’s right: a salary-protection policy keeps paying until you’re back at your job. If you can’t return to work as a pharmacist, it continues until age 65.

So you can pay your mortgage, feed your kiddos (or Fido), fund your pension, and stay as financially secure as you were when working.

Now, about those deferred periods — they’re simply how long you must wait between stopping work and when payments begin.

The longer the wait, the cheaper your premium.

If you want access to payments sooner, you’ll pay a little extra for that privilege. That’s why having a savings nest egg to cover a few months is key. The longer you can “survive” without income, the more affordable your cover becomes.

I know this is the question you actually want answered, but I’m going to have to disappoint you a bit.

I can’t tell you exactly how much it’ll cost without knowing more about you (if you complete this questionnaire, I can email you the exact figure — to the cent).

What I can tell you is that pharmacists are lucky when it comes to premiums. Your chosen career sits comfortably in what insurers call a Class 1 Occupation. Fewer claims from Class 1 jobs mean lower premiums — simple as that.

Retail assistants in chemists? That’s a different story. Shelf-stacking and floor-mopping are considered slightly riskier, so insurers bump you up to Class 2. It’s not a massive increase, but worth knowing.

If you want to know exactly how much it’ll cost, bite the bullet and complete that questionnaire.

Well, since you asked nicely…

Assuming you earn €75 000, are 40, a non-smoker with no health issues, and want cover to age 65 with a 26-week deferred period:

Quote Type: Income Protection

First Person: Non-Smoker, born on 17/04/1985

Cover Amount: €43,562 per year until age 65.

Occupation Class: Pharmacist (Class 1)

Deferred Period: 26 weeks

That works out at around €21 per week to guarantee a replacement income of €831 per week. Less than you thought?

Even better, you can claim tax relief on your monthly premiums, which brings the net cost down to roughly €13 a week.

You’ve read this far, so you clearly care about protecting your income — and that’s half the battle won.

If you’d like some help figuring out the best cover for your situation, we can sort that quickly. Just complete our short income protection questionnaire and I’ll email you a personal recommendation — no pressure, no phone calls, just straight answers from all five Irish insurers.

Or if you’d rather chat things through, you can book a quick call with me here. It’s free, friendly, and takes about 15 minutes.

Next step: Protect your income before illness or injury ever gets the chance to derail your plans. It only takes five minutes to get started.

Thanks for reading,

Nick

PS: This guide explains exactly how income protection works in Ireland — worth a read if you want to see what happens at claim time.

Written by Nick McGowan, QFA RPA APA

Nick is a qualified financial advisor and founder of Lion.ie, an independent Irish life insurance and income protection brokerage based in Tullamore. He’s been helping people in Ireland get fair, transparent cover for over 15 years — and was named Protection Broker of the Year 2022.

As Ireland's leading life insurance broker, we specialise in comparing the rates and policies from the top five Irish life insurance providers and offering the very best value quotes to suit the individual needs of our clients. Our expertise lies in finding a suitable insurance plan for those with specific needs, be it a particular illness, occupation or claim history, we've got you covered in every sense!

Watch our video