Some things in life you just have to accept:

Dogs are better than cats.

Irish summers will be wet.

The girl/boy you are in love with will marry a knobhead.

You will die.

I will die.

And not because climate change will sweep us away in a surge of rising water or there will be a nuclear war or COVIDDeltaGoodrem Variant will get us.

Simply because it’s the one certainty of life.

Well, that and the fact your odd socks escape to another dimension through the back of your washing machine.

Death being the one definite outcome of life is the exact reason why you need Life Insurance.

And if you’re on this blog, it’s something you’re considering, so let’s crack on.

You can go over here and read “What is Life Insurance?” or I can give you the shorthand version: Life Insurance is a tax-free lump sum paid out to your loved ones after you die. It’s usually paid out in one big wad of cash, or it can be paid monthly.

It’s primarily intended to replace your income after you die. I could go a bit easier and say it’s designed to replace you, but let’s be real, in the rules of insurance, it all comes down to cold, hard money. Take your earning potential out of the equation, and you’re basically a walking flesh sack that isn’t valuable enough to be insured.

Soothing wha?

Now, while Life Insurance is the name that gets bandied around a lot, there are types of life insurance that are just, if not more, important:

Those are the quick explainers.

But it’s essential to understand them because they’re useful for different situations.

So when you ask ‘do I need Life Insurance?’, I can only give you an accurate answer if I know more about you. No two people are the same, so we’re going to look at it broadly under specific life categories.

Yes, if anyone depends on you in any way, shape or form in a financial manner.

So:

you need cover.

However, how you figure out the insurance you need will depend on which of the above categories you fall into. It’s not a blank slate, one-size-fits-all.

Kids are kind of like tiny drunks: they’re wobbly, mostly incoherent, and prone to lying on the floor and making weird noises. Let’s not forget the vomit and the poo.

Basically, they’re useless.

And sure, you love your kids at least 90 per cent of the time, but in practical terms, they’re a massive drain on your resources. And they continue to be a considerable drain until they’re old enough to make their own money. Even then they probably still slam their door and scream that they hate you.

However, once you’ve had one, you kinda have to stick by them so that they grow up to be reasonably responsible adults. A big part of that sticking by them is the emotional labour of raising a kid (and yes, it can really feel like labour at times) but a lot of it also comes down to money. House. Food. Clothes. Education. Wi-Fi.

The big things.

All of which are expensive.

In all seriousness, if you have kids, ask yourself if your little family would be okay if you or your partner died. Could you continue to pay for the essentials?

Likely, you’d struggle.

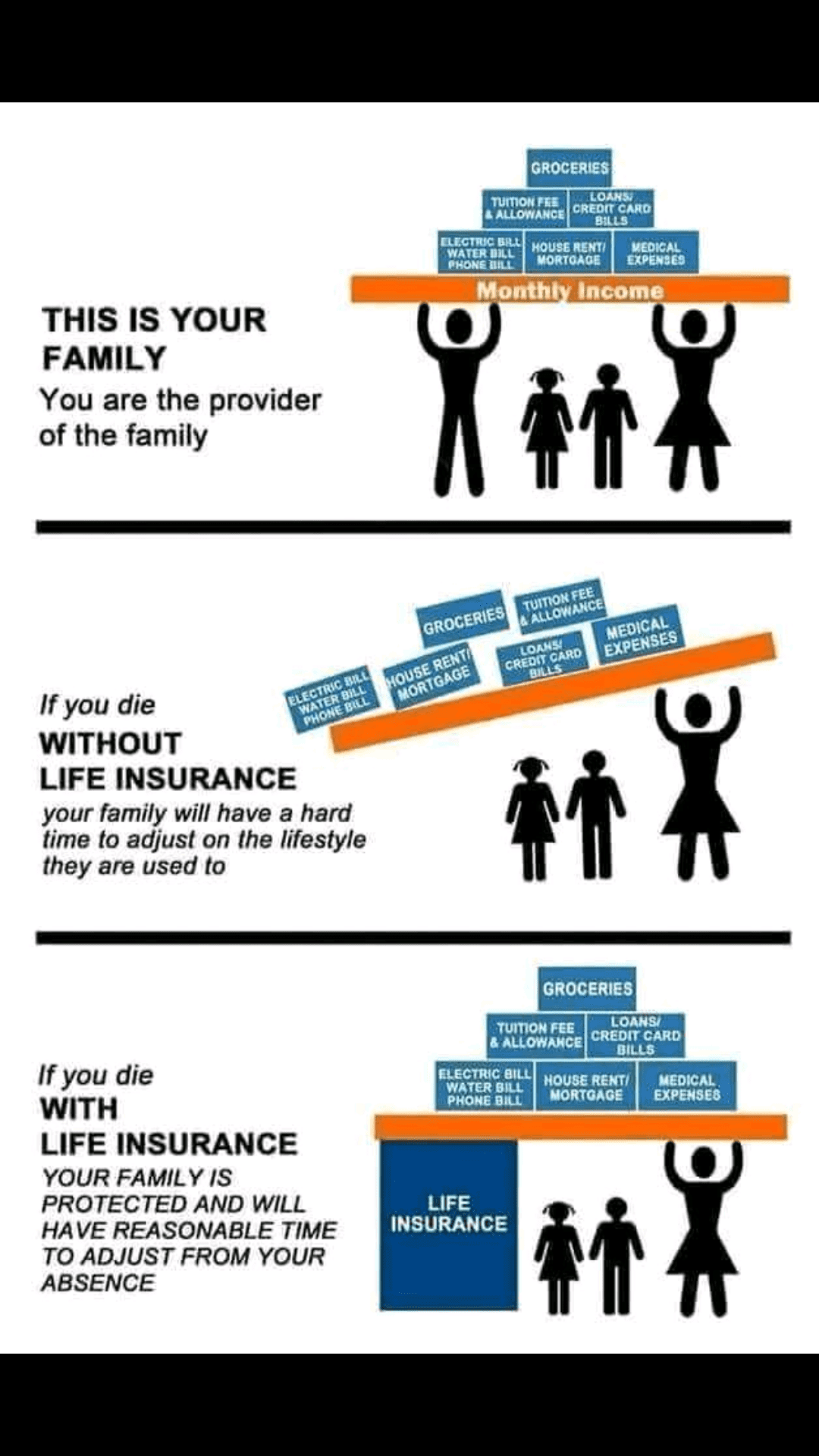

This graphic clearly brings home what would happen to your fmaily if you don’t have life insurance:

Life Insurance is the one real security you can put in place if you or your partner die.

With Life Cover, your family would be protected financially – and that truly is a blessing. The cover allows your family to deal with a loss without the added pressure of financial instability.

Especially if you have a young family.

Let’s look at it as plainly as possible.

If you died, would €200,000 help your family out massively?

Yes, of course, it would.

Now, if you could get that €200,000 in exchange for paying an insurer roughly €25 a month, would it be worth it?

Whether you’re a single parent, a couple with children, or a stay-at-home parent, Life Cover makes sense – it’s also not nearly as expensive as you think it’ll be. That €25 a month I cited above is a real example of a 30-something parent who’s looking for €200,000 on a 30-year term.

Now we’ve agreed that Life Insurance is essential for parents, let’s look at a couple of other considerations.

If you’re buying or own a house, you’ll have to get Mortgage Protection. This is the policy that clears off your mortgage with your bank if you die and gets rid of a significant expense for your family.

Something you could consider is Dual Mortgage Protection. This bad lad pays out twice if both you and your partner die – so the bank gets one payment, and your kids get another. I know a double death is unlikely to happen but dual costs less than the joint life cover the banks will try to flog so you might as well buy the best.

You should also consider Income Protection, the replacement of income insurance.

Lion.ie recommends Life Insurance, Mortgage Protection, and Income Protection. Yes, that’s a long list but having a family comes with more responsibilities.

You and your partner share everything. Cooties. Wet towels on the floor. A growing hatred for that one couple who live nearby who just seem really annoying.

The mortgage or your rent. Expenses. Bills. Any debts.

All that good stuff.

Having kids is the real marker for whether or not you really need Life Insurance. But, if one of you earns more, you should look at protecting your partner.

Lion.ie recommends:

This one is a bit more complicated so:

Again, this depends on the exact situation but being self-employed is trickier because an ENTIRE business rests on you. State Benefits are also pretty shite and are a tangled web for the self-employed. Basically, if you can’t work due to illness, your income will drop to zero as you’re not entitled to illness benefit.

Lion.ie recommends Income Protection. If you’re self-employed and you don’t have Income Protection, you’re a bit silly. Go sort it now. If you have or are planning on having kids, Life Insurance swings right back into play here too. As does our old pal Mortgage Protection if you have or are planning on buying a house.

You can read more about Life Insurance for the self-employed over here.

Life Insurance is most valuable when you’re younger and have dependents. It’s handy when you’re older if you want to leave an inheritance to your family to cover off inheritance tax.

And yes I know it’s mad that you have to spend money on insurance to get money to pay tax on the money you previously had already paid tax on.

I do not make the rules; I only try to help.

Lion.ie recommends Section 72 Life Insurance. This chap is particularly useful for settling tax bills.

You’re probably fine without Life Insurance. I would consider Income Protection, and of course, our dear pal Mortgage Protection kicks in too if you’re planning on getting a mortgage.

Or if you’re young, healthy and think you’ll need cover eventually, lock away €1m cover – it’ll NEVER be cheaper. Your future self will thank you.

Now you know which way is up with the different types of insurance, your next step is to figure out how much cover you need.

It really does vary from person to person, and there are some tricks of the trade that can change the type of policy you end up with, so why not give me a call on or complete this questionnaire and I’ll do the hard work for you and email you a recommendation.

Chat soon

Nick

057 93 20836

Ask a question

As Ireland's leading life insurance broker, we specialise in comparing the rates and policies from the top five Irish life insurance providers and offering the very best value quotes to suit the individual needs of our clients. Our expertise lies in finding a suitable insurance plan for those with specific needs, be it a particular illness, occupation or claim history, we've got you covered in every sense!

Watch our video