Underwriting.

It sounds like something that happens to you when you’re dead.

Possibly performed by someone called The Underwriter, who may or may not also be a professional wrestler on WWE.

In the ever-expanding list of Life Insurance jargon, the question of ‘what the bleep is Life Insurance underwriting?’ comes up a lot.

In short: it’s a mix of science and maths that determines wheter you can get Life Insurance cover and how much you will pay for it.

It looks at factors like your health, your job, your age – all the stuff that would potentially make you more or less likely to claim within the term of your policy.

The more likely you are to claim, the more expensive your cover will be.

The thing you have to remember is that Life Insurance is a business. The insurers either:

It’s ghoulish, and a bit macabre but Life Insurance is also really, EXTRAORDINARILY vital if you die.

Truth: Life Insurance is most useful if you have a young family because they are totally reliant on you and your income to survive.

So how does life insurance underwriting work?

I like to think of underwriters as the dudes in the dungeons of fancy insurance buildings doing “the maths,” i.e. assessing the chances that you will claim.

Much like clampers, it’s natural to get mad at underwriters if it doesn’t go your way.

But remember, they are just regular people doing a job where maths meets mortality.

While the actual maths involved can get pretty complicated, the process itself isn’t that difficult.

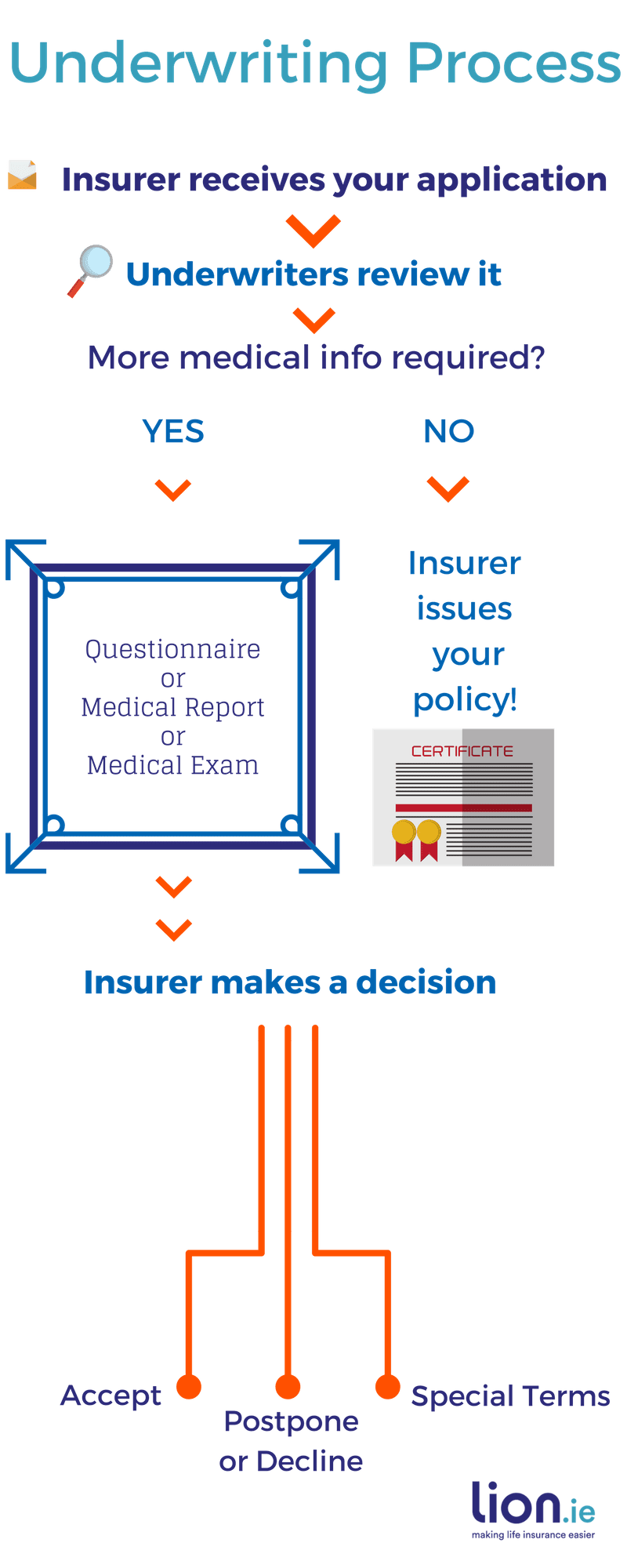

After the insurer receives your application, it goes to their underwriters who will either start doing “the maths” or request more medical info.

If your case is straightforward, they’ll offer you cover immediately.

Happy days 🙌

If your case is complicated (say you have a pre-existing condition), they may need more information in the form of a questionnaire or medical report 😩

Once the underwriters have all the necessary documents in the depths of their dungeon, they’ll either:

To make it really simple, I’ve put together this quick ‘choose your own adventure’ graphic:

It boils down to four steps:

Step 1:

You complete your application, we submit it to the most suitable insurer.

Step 2:

The underwriters review your application.

Step 3:

After assessing the risk of a claim (i.e. the chances of you dying, in any number of ways), they’ll offer cover or seek more info:

Step 4:

They’ll make a decision.

If the underwriters accept you at the standard price, you can skip happily to paying money to insure yourself should you drop dead.

Do you see what I mean about ghoulish?

If you’re accepted on special terms, you’ll be hit with a loading or an exclusion, or in some cases, both.

Exclusions appear on income protection and specified illness policies. There are no exclusions on life insurance (death cover). The underwriters either cover you for death due to any reason or they will decline your application.

Loadings and exclusions could be for any number of reasons from having a high BMI to having a health issue or a family history of illness. This history means that you may be more at risk of developing a specific condition.

e.g. if your mother had breast cancer before a certain age, it’s likely that claiming for breast cancer will be excluded from your serious illness cover.

Now, if you are loaded or get an exclusion, you may be tempted to fall to your knees and scream “why meeeee?” into the night.

You can do that if you want.

Go right ahead. I can wait.

It’s frustrating and can feel unfair; I get it.

However, it’s not about you.

Remember the dudes in the dungeon doing the maths.

You are a bunch of numbers to them.

You and your family history are the risks, however unfair that may seem.

If you’re postponed, it’s a bit like receiving a ‘please try again later’ message. In the case of postponement, the insurer might want to see if your medication or treatment is working. Or if there are changes you can make (for example, losing some weight or getting your blood sugars under control).

Down the line, you can reapply and see if they’ll accept you then.

If the insurers decline, it’s usually because you’re high risk – generally for medical reasons.

This is the part where you absolutely are allowed to scream into the night. If you have a medical issue, you’re more likely to need Life Insurance, but that also means the insurers will be more cautious.

It’s like in the first Shrek fil-um when the villagers are too scared to go into his swamp.

In this metaphor, I may or may not have compared you to a troll. A hero troll, to be fair.

So if you’re declined, you do actually still have some options. You’re going to be really bleepin’ annoyed, of course, but one insurer turning you down doesn’t mean they all will. Life insurance underwriting isn’t an exact science, and different underwriters treat illnesses or factors differently.

For example, one insurer may be more sympathetic towards people with heart issues than another. The trick is in getting a broker who’s in the know to help. 👋

Or go to all the insurers and wade through it all yourself.

A no from one insurer is not a no from all of them.

Bear that in mind!

Also, if the insurer declines you, make sure you get their reasons behind the decline. Ask the insurer to write to your GP with their reasons for the decision. If your GP doesn’t agree, you can always appeal. The success rate is low, but we have had declines overturned, usually where information on your medical report is out of date/inaccurate.

If you’re declined for mortgage protection, you can request a waiver from your bank.

Also much like clampers (and life insurance brokers TBF), no one grows up dreaming of being an underwriter.

Presumably. Unless you did, in which case, fair play to you and your financial nous as a four-year-old.

Underwriters usually have a professional diploma in insurance or a BA in Insurance Practice.

As with lots of jobs in the financial/insurance stream, wages are fairly decent, and it’s an office job, so there are worse ways to make your cheese.

And like I said earlier, underwriters are just people. There is no single mathematical equation deployed by the insurance companies to determine if you’re insurable or how much you should pay.

What I’m saying here is this: it pays to shop around.

Don’t just go to one insurer.

Arm yourself to the teeth with information and get as many quotes as you can.

But remember, the quotes you get online don’t take your medical history into account.

If you’re concerned about how a medical condition may affect your cover, you’ll need to run it by a broker first.

Look into the additional benefits as well as the amount of protection and the cost of your premium. Shop smart, and you can get cover at a reasonable price without too much hassle.

For example, years of working as a broker has taught me that if you’re overweight, one particular insurer is far more likely to offer you a better rate.

Likewise, some of the insurers will crucify you for your family history – so I can tell you who to avoid or who to go with.

Do you need help understanding the life insurance underwriting process, sorting out your application or have you been hit with a loading, or postponed or declined?

I love helping people with pre-existing medical conditions or what insurers might consider ‘difficult cases’.

If you’d like me to run a condition past the dudes in the dungeon, fill in this form or call me on 05793 20836. I’ll recommend the best insurer for you based on their responses.

We’re all different, so different insurers cater to different people with different health issues. I’ll find your best match.

Remember, our discussions will be in complete confidence.

Chat soon.

Nick

lion.ie | Protection Broker of the Year 🏆

Editor’s Note: We first published this blog in May 2018 and have regularly updated it since.

057 93 20836

Ask a question

As Ireland's leading life insurance broker, we specialise in comparing the rates and policies from the top five Irish life insurance providers and offering the very best value quotes to suit the individual needs of our clients. Our expertise lies in finding a suitable insurance plan for those with specific needs, be it a particular illness, occupation or claim history, we've got you covered in every sense!

Watch our video